The journey to wealth is a marathon and not a sprint. It is about the kind of endurance that the tortoise showed than the speed of the hare. Money needs time to grow and the power of compounding is seen only if there is enough time. The earlier that one can start on building the wealth, the better it would be. This article highlights the importance of starting early for Time is Money.

Table of Contents

Show me the Advantage of Starting Early

Let’s take the case of two brothers Ram and Shyam, 25 years old.

- Ram sets aside Rs 1,000 a month and puts it in an investment that earns 10% per annum.

- After 5 years, Shyam begins investing Rs 2,000 a month in same investment .

At the end of 10 years, value of their investment is as follows :

| Ram’s | Shyam | |||

| Year | Amount Invested | Value of Investment | Amount Invested | Value of Investment |

| 1 | 12,000 | 13,200 | 0 | 0 |

| 2 | 12,000 | 27,720 | 0 | 0 |

| 3 | 12,000 | 43,692 | 0 | 0 |

| 4 | 12,000 | 61,261.20 | 0 | 0 |

| 5 | 12,000 | 80,587.32 | 0 | 0 |

| 6 | 12,000 | 101,846.05 | 24,000 | 26400 |

| 7 | 12,000 | 125,230.66 | 24,000 | 55440 |

| 8 | 12,000 | 150,953.72 | 24,000 | 87384 |

| 9 | 12,000 | 179,249.10 | 24,000 | 122522 |

| 10 | 12,000 | 210,374.00 | 24,000 | 161174.64 |

By year 10, both Ram and Shaym have invested the same amount, but the value of Ram’s investment is more than that of Shyam’s.

Let’s take another example of Sita and Gita.

- Sita invests Rs 1,000 a month in an investment that earns 10% per annum. She stops after 4 years.

- At that point, Gita begins investing Rs 1,000 a month on the same investment and continues to do it for the next 6 years.

At the end of 10 years, value of their investment is as follows :

| Sita | Gita | |||

| Year | Amount Invested | Value of Investment | Amount Invested | Value of Investment |

| 1 | 12,000 | 13,200 | 0 | 0 |

| 2 | 12,000 | 27,720 | 0 | 0 |

| 3 | 12,000 | 43,692 | 0 | 0 |

| 4 | 12,000 | 61,261.20 | 0 | 0 |

| 5 | 0 | 67,387.32 | 12,000 | 13,200 |

| 6 | 0 | 74,126.05 | 12,000 | 27,720 |

| 7 | 0 | 81,538.66 | 12,000 | 43,692 |

| 8 | 0 | 89,692.52 | 12,000 | 61,261.20 |

| 9 | 0 | 98,661.78 | 12,000 | 80,587.32 |

| 10 | 0 | 1,08,527.95 | 12,000 | 101,846.05 |

Despite the fact that Gita invested more money (6 * 12,000 = 72,000) that Sita (12,000 * 4=48,000), Sita still has a larger investment value than her. And think how much more Sita would have if she didn’t stop investing.

Why does money grow on Starting Early : Compound Interest

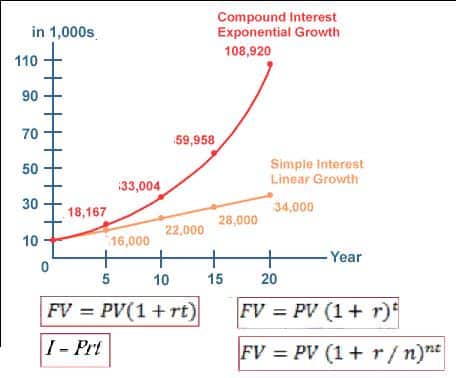

Why does money grow on starting early because of eight wonder of the world called Compound Interest. Yes the same one that you read in your 7 or 8th standard class. Compound interest refers to the situation in which interest is calculated on the original principal and the accumulated interest unlike Simple Interest where interest is calculated only on principal or the amount invested. Though the quote is attributed to Albert Einstein, as Prof Pattu of FreeFinCal in his article Einstein and Personal Finance showed Albert Einstein never said it.

Rule of 72 : Rule of 72 is a shortcut formula to find out approximately in how many years amount will double? Divide 72 by rate of return you will get the number of years in which your money will double. For example, if you want to know how long it will take to double your money at eight percent interest, divide 72 by 8 and get 9 years. If you expect a rate of return of 12% you money will double in 6 years (72/12=6).

This can also be used in reverse order at what rate your money should be invested to will double say in 5 years = 72/5=14.4%. Our post First Lesson in Financial education:Compound Interest discusses this and Simple and Compound Interest in detail. Time Value of Money shows various tables to easily calculate.

Building Wealth is Like Running a Marathon

From JagoInvestor book, 16 Personal Finance Principles Every Investor Should Know (earlier known as Change your relationship with money), which we reviewed here

Suppose you and your friend decide to race for 20 km. Your friend decides to pace himself by running at a steady rate of 4 km per hour. Accordingly, he will complete the distance in 5 hours. However, you are more relaxed at the start and decide to run at a pace of 2 km/hour, thinking that you will cover up for this slow start later. You keep running at a pace of 2km/hour for 3 hours and cover a total of 6 km. Now you decide to increase your pace. But imagine the situation. You have just 2 hour left and 14 km to cover. It’s a situation where you have to run at a speed of 7 km/hour. It might not be impossible, but it’s certainly not easy. It’s challenging! Your chances of winning come down considerably. Many things can prevent you from achieving that pace in the last 2 hours – you may get a cramp, you could meet with a small accident while running so fast, you could get exhausted… Overall, your task is rather challenging! What could you have done? If you had decided to run faster than your friend at the start, at say 5 km/hour (while your friend ran at 4 km/hour), you could have completed 15 km in the first 3 hours. Then even if you jogged at a speed of 2.5 km/hour for the next 2 hours, you could easily have won. It becomes much simpler than the previous situation. Even if you wanted to rest for 30 minutes, you could afford to do so and still complete the rest of the race at a speed of 3.4 km/hour. Or you could alternate between jogging and walking towards the end. This leisurely pace would be possible only because of the effort you made at the start. Your financial life is no different.

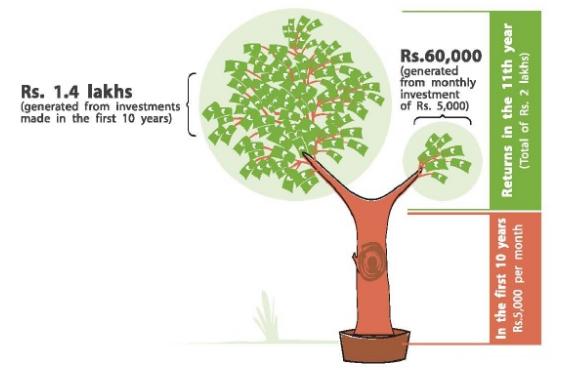

Building Wealth is like Growing a Tree

Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later

Imagine your wealth as a Money-Tree. When you plant a tree it is small seed, you need to look after it,water it,removed the weeds etc during earlier years when it is growing. You continue to nurture it, feed it, water it. And with each passing year, your tender young sapling will grow bigger,stronger,branches starts coming and as it ages, you and your children start enjoying fruits of the labour for many many years and your tree can defend itself even harsh weather. Growing your wealth is similar to growing the new tree. Given lots of tender care, your small baby steps will become your Mighty Money Tree. Your investments in first 5 yrs out of a 30 yrs period makes the 50% final corpus and rest another 25 yrs makes another 50% corpus. That means the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus Money might not actually grow on trees, Unless you plant your own Mighty Money Tree, and early!

Building Wealth is Test Cricket not a T20 match

Cricket format of T20 is so exciting, lots of action and drama,runs galore, flamboyant ambience and quick results. While Test cricket is about patience, fitness, grit and determination and boring there is hardly any turnout for Test Matches these days. We all want to make lots of money,have excitement in our daily lives, we get ecstatic about high return investments like stocks etc, and we want to make all this money very quick. But the reality of making money is different. Wealth creation is like Test cricket where a whirlwind fifty or hundred may not always win you a game. You need the solidity of a Rahul Dravid or a Laxman more often than the flamboyance of a Gayle to be able to emerge victorious over the five days. .All successful investment pundits have believed and practiced the principles of patience, consistency, fitness and variety (read asset allocation) akin to the virtues of being a good Test cricket player. Read more about it at EconomicTimes Cultivate qualities of a test cricketer for a rewarding financial innings. As Rahul Dravid,the wall, said Test matches are cricket’s life source

“Test cricket, an older, larger entity is the trunk of a tree and the shorter game – be it T20 or ODIs – is its branches, its offshoots,” he said. “Now to be fair, it is the branches that carry the fruit, earn the benefits of the larger garden in which they stand and so catch the eye. The trunk, though, is the old, massive, larger thing which took a very long time to reach height and bulk. But it is actually a life source: chip away at the trunk or cut it down and the branches will fall off, the fruit will dry up.”

Moral of the Story

Start investing when you’re young. The more time you have to let your investments grow, the bigger the fortune you’ll end up with. For each year that you delay, the amount to be invested every month to achieve the same target just keeps growing. If one starts saving at the age of 25 instead of 30, the financial corpus can be 17 per cent higher when one retires at 60 assuming a compounded rate of return at 9% per annum. When you start earning, you are generally single, you have less responsibilities and are in a position to save a part of our income. Don’t waste it thinking that you can always start saving later, when you have more money or when you get a job that pays better. Start small, it is suggested that you should save atleast 10% of your income. When you’re twenty or thirty, it’s hard to imagine the day will come when you’ll turn sixty-five, but if you get in the habit of saving and investing, by then your money will have been working in your favor for fifty years. Fifty years of putting money away will produce astonishing results, even if you only put away a small amount at a time. Waiting doesn’t help for Time is Money.

Related Articles :

- Beginner to Investing

- Money Awareness for Beginners

- Price of Cool

- Personal Finance and Scott Adams,Dilbert

- Personal Finance Books For Adults

- Review of movie One Idiot by IDFC

[poll id=”44″]

START NOW! Compound interest works over time and the rate of return will make a difference in how large your investment grows. Remember Ram and Shyam, Sita and Gita. The secret of Sound Financial Planning is Early Investing . If you can take little pain and invest more money now , then better do it , It will give you a BIG money tree. For learning about money and investing in 20s and 30s check out our revamped website bemoneyaware.com

Do you believe in Starting early? Or you are waiting for big amount to start your financial journey. When did you start your financial journey? What do you think is secret of building wealth?

26 responses to “Journey to Wealth : Start Early”

Crystal Clear Article. Thanks. I forwarded this information to one of my friend. He came back with questions like how do i calculate returns for FD and RD. Thanks, you made a difference here.

Thanks for kind words. How to calculate returns on FD, RD..We have arranged the articles on our website Learn Investing which has articles on FD , RD and links to calculator. Drop in and give us your feedback!

Thanks will check the Link on Learn Investing.

Thanks a lot. Please share what you learnt

Crystal Clear Article. Thanks. I forwarded this information to one of my friend. He came back with questions like how do i calculate returns for FD and RD. Thanks, you made a difference here.

Thanks for kind words. How to calculate returns on FD, RD..We have arranged the articles on our website Learn Investing which has articles on FD , RD and links to calculator. Drop in and give us your feedback!

Thanks will check the Link on Learn Investing.

Thanks a lot. Please share what you learnt

Nice blog loved it

Nice blog loved it

Hello, as usual very helpful and interesting post, Can u please share with us the exact investment source which gives 10% per year, I don’t believe in private investments (you know what happened to me), and mostly they have a lock in period and the funds cannot be broken in case of any emergency also.

Ajeeth If I would have known it I would be enjoying my holiday in Istanbul, or maybe appearing in the CNBC.

Frank answer I don’t know. I have also burnt my hands okay money in Equities, Mutual funds, debts, gold.

Everyone has made a mistake that’s part and parcel of life.

What I have felt was something which experts call as Asset Allocation or Diversification

I have PPF account, I have invested in Post Office, I invest in Gold ETF, I invest in Mutual Funds and Stocks too.

I have stopping chasing the return and have started focusing on risk and how much can I loose, keeping time frame in mind.

For assured income I invest in PPF, Post Office, Fixed Deposit, Recurring Deposit

For money which I need 8 years from now I invest in Mutual Funds and Stocks. I do SIP

I have life insurance

I keep a month’s expenses amount in Saving Bank Account, when I am not sure what to do with money after SIP etc, I move to Debt funds (short term) and when I figure out I make the investment.

Thanks for your honest reply… Its hard to find people who disclose their investments like this publically for others to learn… Thanks again…

Hello, as usual very helpful and interesting post, Can u please share with us the exact investment source which gives 10% per year, I don’t believe in private investments (you know what happened to me), and mostly they have a lock in period and the funds cannot be broken in case of any emergency also.

Ajeeth If I would have known it I would be enjoying my holiday in Istanbul, or maybe appearing in the CNBC.

Frank answer I don’t know. I have also burnt my hands okay money in Equities, Mutual funds, debts, gold.

Everyone has made a mistake that’s part and parcel of life.

What I have felt was something which experts call as Asset Allocation or Diversification

I have PPF account, I have invested in Post Office, I invest in Gold ETF, I invest in Mutual Funds and Stocks too.

I have stopping chasing the return and have started focusing on risk and how much can I loose, keeping time frame in mind.

For assured income I invest in PPF, Post Office, Fixed Deposit, Recurring Deposit

For money which I need 8 years from now I invest in Mutual Funds and Stocks. I do SIP

I have life insurance

I keep a month’s expenses amount in Saving Bank Account, when I am not sure what to do with money after SIP etc, I move to Debt funds (short term) and when I figure out I make the investment.

Thanks for your honest reply… Its hard to find people who disclose their investments like this publically for others to learn… Thanks again…

like this article very much,very simple way of understanding ,keep it up,thanks

Thanks for encouraging words. Glad to know you liked it. So when did you start your financial journey to wealth?

like this article very much,very simple way of understanding ,keep it up,thanks

Thanks for encouraging words. Glad to know you liked it. So when did you start your financial journey to wealth?

Loved this post, simple to understand and mighty useful 🙂 Thank You

Loved this post, simple to understand and mighty useful 🙂 Thank You

Nice article !! enjoyed reading it..

Nice article !! enjoyed reading it..