This article talks about joint home loan, terms associated with joint home loan, tax benefits, tax savings and some FAQ.

Table of Contents

Terms associated with Joint home loan

A joint home loan is a loan which is taken by more than one person.

Coowner: means a person who has a share in the property.

CoBorrower: A co-borrower is a person with whom you take the home loan jointly. In India, a home loan can have upto 6 co-borrowers. Usually a joint home loan is taken by spouses, or parent and child. You cannot take a home loan jointly with your friend or colleague or an unmarried partner. Usually banks insist co-owners to be co-borrowers of the loan. However, the reverse is not necessary.

Tenure of the loan: Period for which loan is taken

Documentation: A joint home loan requires both the applicants to furnish the necessary Know Your Customer documents. This includes address proof, ID proof, income proof and the bank statements of both the applicants, as well as the proof of co-ownership of the property.

Repayment: Although the loan is taken by more than one person, the EMI payment can be made from only one bank account which can be single or joint account of one of the borrowers. The borrowers can choose to share the number of EMIs between them in the whole year.

Who can be the coborrower?

The rules says any six persons can take home loan jointly, but the banks and institutions have more restrictions co-applicants. The restrictions are as follows:

- A Joint Home Loan can be taken by Husband and Wife or Parent and Child.

- Friends cannot take Joint Home Loans.

- In some case brothers are allowed to take the Joint Home Loans.

Tenure of loan depends on the co-borrowers.

- If the co-applicants of the joint home loan are spouses, then the maximum loan tenure can be upto 20 years or 25 years, depending on the housing finance institution.

- However, in case the co-applicants share a parent-child relationship or are siblings, then the maximum term is restricted to 10 years in most cases. In case of a joint loan taken by a parent and child, if the repayment is linked to the parent’s income, then the maximum loan tenure is restricted to the retirement age of the parent.

Banks insist that co-owners must be co-borrowers for the Home Loans. It is not necessary that all the co-borrowers must be the co-owners of the house.

What are the liabilities of taking joint home loan?

All co-borrowers are jointly and severally liable to repay the loan. It does not matter whether the payment is made in the normal course by only one of the joint borrowers as long as the full EMI is paid as per schedule. So if one of the borrowers refuses to pay the loan, has to file for insolvency or passes away, it becomes the co-applicant’s responsibility to settle the loan in full.

And do note that the repayment record on joint loans counts for your CIBIL score. The Credit Information Bureau (India) Ltd maintains information of all individuals’ payments relating to loans. It gives scores to individuals based on their credit history. Irregularity in payment by a partner or co-applicant can impact your eligibility in the future for a loan.

The co borrowers taking the loan should ideally take separate term life covers to reduce the financial burden on the other person(s) in case of their demise.

Also, if you are a co-borrower, you could perhaps draw up and sign an agreement with other co-borrowers (including your spouse) on splitting the liability. This will avoid any clashes in future

What does Tax benefits of Home Loan depend on?

Tax benefits on home loan can be be availed based on following :

- For constructed house i.e house should NOT be in pre-construction stage. You can seek Tax Benefits only from the financial year in which the construction is complete.

- Whether loan is taken for first house or house other than first house

- Whether the house is self-occupied (means you are living in it) or not i.e. given on rent or vacant?

- You can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question. A co-owner, who is not a co-borrower, is not entitled to tax benefits. Similarly, a co-borrower, who is not a co-owner, cannot claim benefits. Before you sign as a co-applicant in a home loan, make sure that you get a right to the property as well. Registering the house in joint names will get you additional tax benefits as mentioned earlier and your share in the property also becomes indisputable.

- The tax benefit is shared by each joint owner in proportion to his share in the home loan. It’s important to establish the share for each co-borrower to claim tax benefits.

What are the Tax Benefits on taking home loan?

For claiming income tax deduction, the EMI amount is divided into the principal and interest components. The Indian Income Tax Act allows both Principal repayment as well as Interest repayment as eligible deductions from your income. Our article Tax : Income From House Property discusses it in detail. For An individual

- Principal can be claimed :

- Up to the maximum of Rs. 100,000 under Section 80C. This is subject to the maximum limit of Rs 100,000 across all 80C investments such as EPF,PPF,Insurance Premiums etc.

- Principal Repayment can be considered as a valid investment under section 80C only if it is made for a self occupied house or you are not living in the house due to work

- Interest can be claimed:

- As a deduction under Section 24 under the head Income from house property.

- You can claim up to Rs 150,000 or the actual interest repaid whichever is lower.

- If the house is given on rent, there is no restriction on the interest amount.

- There is no restriction of Self Occupied Property for claiming the tax break on interest paid under sec 24.

- Co-owners and Co Borrowers can claim deductions in the ratio of ownership.

- The certificate issued by the housing loan company, showing the split between principal and interest for the EMI paid, is required for claiming tax benefits.

What are other deductions available on your taking home?

While buying a house you have to pay stamp duty and registration charges. You can claim deduction on these expenses under Section 80C of income tax in the respective year

For self-occupied house you cannot claim deduction on municipal taxes, but for let-out property you can claim deduction for the municipal taxes also on your income from house property.

What are Tax benefits of Joint Home loan For One House?

The repayment of principal amount of the loan can be claimed as a deduction under section 80C up to a maximum amount of Rs.1 lakh individually by each co-owner.

Each co-owner shall be entitled to the deduction individually on account of interest on borrowed money up to a maximum amount of Rs. 1.5 lakh.

If the house is given on rent, there is no restriction on the interest amount.

The tax benefits are according to the proportion of a loan.That is, if the ratio of the loan is 70:30, then a loan of, say, Rs. 50 lakh will be split into Rs. 35 lakh and Rs. 15 lakh and tax benefits on the interest/principal repaid will also be calculated based on this ratio.

Can you explain it with example?

Suppose Abhi Sharma(income of 6 lakh) and Nita Sharma (income of 4 lakh) have taken a home loan of 20 lakh with 10% interest Rate for 20 years for which EMI is Rs 19,300. For the first year Principal payment is 33,905 and interest payment is Rs 1,98,510. Tax Calculation for the three different scenarios is given below.

| Tax Calculation for Abhi | ||||

| Particulars | With individual loan | Without home loan | 70% year 1 Split(Joint home loan) | |

| Gross Income | 6 lakh | 6 lakh | 6 lakh | |

| Less: Housing Loan interest | Sec 24 | -1.5 lakh | Nil | -1.39 lakh |

| Total income | 4.5L | 6 lakh | 4.6L | |

| Less: Principal repayment | -33, 095 | Nil | -23, 167 | |

| Taxable Income | 4.2 lakh | 6 lakh | 4.4 lakh | |

Tax calculation for Mrs Sharma

| Tax Calculation for Nita | ||||

| Particulars | With individual loan | Without home loan | 30% split(Joint home loan) | |

| Gross Income | 4 lakh | 4 lakh | 4 lakh | |

| Less: Housing Loan interest | Sec 24 | -1.5 lakh | Nil | -59, 553 |

| 2.5 lakh | 4 lakh | 3.4 lakh | ||

| Less: Principal repayment | -33, 095 | Nil | -9, 929 | |

| Taxable Income | 2.17 lakh | 4 lakh | 3.3 lakh | |

To get the best out of the tax savings as seen with the above example, it is good to let the partner with the higher pay make a higher contribution towards the home loan resulting in a better tax benefit collectively.

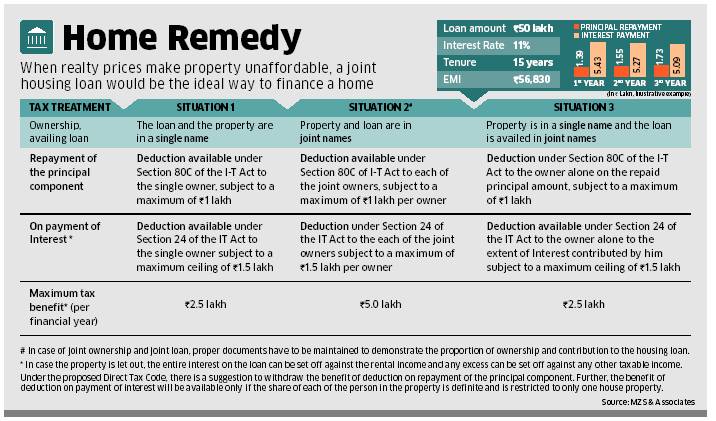

The image from Economic Times Joint Home loan helps raise more finance, brings extra tax benefits also shows various situations (Click to enlarge).

FAQ on Joint Home Loan

If I buy a house jointly with my wife and take a joint home loan, Can we both claim income tax deduction?

Yes, if your wife is working and has a separate source of income, both of you can claim separate deductions in your income tax returns.The repayment of principal amount of the loan can be claimed as a deduction under section 80C up to a maximum amount of Rs.1 lakh individually by each co-owner.

In cases where the house is owned by more than one person and is also self-occupied by each co-owner, each co-owner shall be entitled to the deduction individually on account of interest on borrowed money up to a maximum amount of Rs. 1.5 lakh. If the house is given on rent, there is no restriction on this amount. Both co-owners can claim deductions in the ratio of ownership.

My husband and I have jointly taken a home loan. He pays 75 percent of the EMI. What will be our individual tax benefits?

As you have taken a joint home loan, both of you are eligible for tax exemption for your share of the EMI paid. In case you are living in the house for which home loan is taken, both of you shall be entitled to deduction in the ratio (3:1) on account of principal upto 1.5 lakhs and interest on borrowed money up to a maximum of Rs. 2 lakh individually.

My wife and I had jointly purchased a flat. Until recently, both of us were paying the EMIs together and claiming tax benefits in equal proportion. Now, my wife is no longer working and I alone am paying the EMIs. Can I claim the entire tax benefit?

No, you won’t be able to claim tax deduction for the entire amount. As you are the partial owner of the flat, despite bearing the entire burden now, you would be eligible for tax benefit only in the proportion of your ownership of the flat.

I have a home loan in which I am a co-applicant. However, the total EMI amount is paid by me. What is the total income tax exemption that I can avail of ?

Yes, you can claim income tax exemption if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question. If you are only person repaying the loan, you can claim the entire tax benefit for yourself. You should enter into a simple agreement with the other borrowers stating that you will be repaying the entire loan. If you are paying part of the EMI, you will get tax benefits in the proportion to your share in the loan.

Related Articles :

- Tax : Income From House Property

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

- Capital Loss on Sale of House

- On Selling a house

22 responses to “Joint Home Loan and Tax”

Sir,

I have taken a joint home loan with my wife (50:50 ratio). Currently, we are paying EMI on home loan in 50:50 ratio also. I am in 30% tax bracket of Income Tax however my wife is in 10% tax bracket of Income Tax.

In order to take maximum benefit, can i take the amount as tax savings in 70:30 ratio since I am in the higher tax slab but I am paying EMI in 50:50 ratio. Or I have to make EMI in 70:30 ratio then I can avail tax benefit.

Kindly advise and mention list of documents required (agreement etc) for availing it.

I have taken a loan in 2010. The flat construction is complete only in March 2017.

So it has taken more than 5 years.

The rule and all discussions and examples are for cases where the construction is complete in 2 or 3 years.

What happens if it is more then 5 years?

Is there any different manner of deduction of the pre-construction interest as it is more than 5 years? Whixh rule applies?

After completion the house is let out.

Since in your case, the construction period is more than 5 years, total interest that can be claimed u/s 24(b) shall be restricted to Rs. 30,000 only and not Rs. 2,00,000, which is the limit u/s 24(b) under normal circumstances.

Joint Home loan is really useful, Recently My husband and me took a house loan with best interest. Thanks for sharing the post.

[…] Joint Home Loan and Tax – Be Money Aware Blog – If the co-applicants of the joint home loan are spouses, then the maximum loan tenure can be upto 20 years or 25 years, depending on the housing finance institution. […]

I think that you hit the nail on the head. There is no such thing as a get rich scheme or free lunch.If you want to build a solid online business, it would take hard work, dedication and lots of time.At the end of the day, it will be all worth, if its financial freedom you after. I look forward to checking out your site and learning more.RegardsRoopesh

me and my wife both are salaried.. have bought the 2 houses jointly… one is self occupied and other is let out…we do not have any other income.

please let me know the following

1. which form should I need to fill

2. can I claim the 100% of the principle and interest component for both the houses… (our EMI goes out of the joint accounts) and my wife will claim nil..

3. if no, how to arrive on the % to be claimed since it is not even on the agreement

4. if yes, can my wife also claim later date in case she required to do the same in future

I have taken a loan of 12,50,000/ for construction of first and second floor in our house. The ownership of the property is joint between me, my sister and my mother equally ( both my mother and sister are senior citizens and do not file IT).However, the co borrowers are me and my mother, also the entire loan repayment is done by me and I pay the taxes, the rent as of now is divided between my and my mother. can I take exemtion of both the principal and the interest on the loan.

Hi,

Thank you for your informative posts above.

I have purchased an under-construction Flat in Pune – expected to get possession in Dec 2016. I am the primary applicant and my mother is a co-applicant for the property and the Home Loan from AXIS Bank.

I am currently paying the Pre-EMI interest for the flat as my mother is a homemaker.

1. Hence based on the above posts, I will be able to avail the tax benefits only after the possession in 5 yearly equal portions. Right?

2. My wife is working and has no loan in her name. Now, I wish to add my wife as a co-owner and a co-applicant for the flat so that we both can avail tax benefit on the EMI that we will pay after possession. How can I do that?

What government formalities/deeds/contracts will need to be made? Can this be done before possession or after possession? Approximately what would be the cost for this transaction?

3. I understand the 1.5L on Principle payment and 2L on the interest can be availed for tax benefit. Can me and my wife (after adding as co-owner and co-applicant) avail the tax benefit of 1.5L on Principal payment and 2L on the interest SEPARATELY. Cumulative 3 L on Principle and 4 L on Interest?

Property in my father name we are applying home loan by my father as a co applicant if I only the loan repayer can I get tax benefit and interest subsidy on houe loan as I am working in PSU.

Property in my father name we are applying home loan by my father as a co applicant if I only the loan repayer can I get tax benefit and interest subsidy on houe loan as I am working in PSU.I am not a owner or co owner if the property.

Hi

My husband and I are looking to buy a house together. Both of us are working. While he’s in India, I’ve recently moved to the UK. I plan to be here for the next 6 months. I will be giving him POA to sign the agreement on my behalf, but when it comes to the home loan, can he take an individual loan and then convert it to a joint loan when I return? If that is not possible, what are the documents required from my side given that I am not in India? Will this affect the timeline for the bank to approve the loan? If so, is there a provision that the builder should wait for the approval from the bank before setting a grace period for payment?

I have taken home loan with my brother as co-borrower,he is also a co-applicant it the purchased flat.He transfer’s his share of EMI into my bank account and the entire EMI is deducted from my account.Can he availt the benefit in tax exemption?

I have taken a joint home loan with my brother .Both of us are co-borrower in the purchased home.He transfer’s his share of EMI in my account and the entire EMI is payed via my account.Can he get the benefit of ta exemption?

Hi Kirti,

Nice detailed blog. Was very useful. I have another question

I’m going for a home loan with SBI for an under-construction apt. The builder told me that they have got a tie-up with SBI for ADF (Advance Disbursement of Funds) in which abt 80-90% of the total loan amount would be disbursed initially itself to the builder. The builder is trying to sell this to me saying this would be beneficial both for them & me. According to this scheme, the builder would be paying abt 50% of the pre-EMI amount while I would pay the other 50%. My questions –

1. I was planning on beginning my EMI payment straightaway (as opposed to pre-EMI). Can this ADF scheme be clubbed with normal EMI payment as opposed to pre-EMI?

2. Assuming I go in for the ADF scheme, how can I calculate in exact numbers how this would be beneficial for me?

I tried googling abt ADF, but there dont appear to be too many articles on this, as this seems to be a new scheme that is picking pace now. Any advice/suggestions on this would be much appreciated.

Thanks!

Sorry Karthick my financial expertise does not extend till there. I searched google and like you hit dirt.

Maybe ask Deepak Shenoy of Capital mind as there was mention on the page about it Pay Pre-EMI or Full EMI? The Facts Revealed

Hi Kirti,

Nice detailed blog. Was very useful. I have another question

I’m going for a home loan with SBI for an under-construction apt. The builder told me that they have got a tie-up with SBI for ADF (Advance Disbursement of Funds) in which abt 80-90% of the total loan amount would be disbursed initially itself to the builder. The builder is trying to sell this to me saying this would be beneficial both for them & me. According to this scheme, the builder would be paying abt 50% of the pre-EMI amount while I would pay the other 50%. My questions –

1. I was planning on beginning my EMI payment straightaway (as opposed to pre-EMI). Can this ADF scheme be clubbed with normal EMI payment as opposed to pre-EMI?

2. Assuming I go in for the ADF scheme, how can I calculate in exact numbers how this would be beneficial for me?

I tried googling abt ADF, but there dont appear to be too many articles on this, as this seems to be a new scheme that is picking pace now. Any advice/suggestions on this would be much appreciated.

Thanks!

Sorry Karthick my financial expertise does not extend till there. I searched google and like you hit dirt.

Maybe ask Deepak Shenoy of Capital mind as there was mention on the page about it Pay Pre-EMI or Full EMI? The Facts Revealed

That’s very useful info. Thanks for sharing.

Thanks a lot Easwar.

That’s very useful info. Thanks for sharing.

Thanks a lot Easwar.