Table of Contents

Overview of International Usage of Indian Credit Cards or Debit Cards

Every Indian bank cards which use Visa, MasterCard or Amex gateway can be used at international websites. Nowadays most of the Indian Credit card and Debit cards are eligible for International purchases. Just confirm with your bank regarding the international purchase. Alternatively, you can check on the internet about your credit card type and facilities like international payments. Personally, I have used HDFC Visa card without any issues.

When you use a credit card or debit card in India physically i.e it is swiped at the merchant’s machine, you have to provide a PIN or personal identification number. PINs usually contain four digits. Even cash withdrawals from ATMs invariably require PIN. PINs should be known only to the users and never disclosed to anyone else.

If you use a credit card or debit card in India online you have either use a password or provide one-time password or OTP which is sent to your registered mobile number.

- Make sure your card is activated for international transactions.

- One can do an international transaction without OTP or PIN. All you need are your card details such as Card number, Date of Expiry and CVV. If you are using a Payment Gateway outside India they are not bound by the RBI mandate hence they may not require OTP authentication. You would still get the SMS about your card being used.

- Reserve Bank of India has mandated that each and every Credit Card issuer give a liberty to the Customer to either Enable or Disable International Spending.

- if International Spending is enabled, the Consumer must have a choice to set his own Credit Limit.

- If you disable your credit card then you cannot use it at International location merchant outlets, International ATMs and International shopping websites.

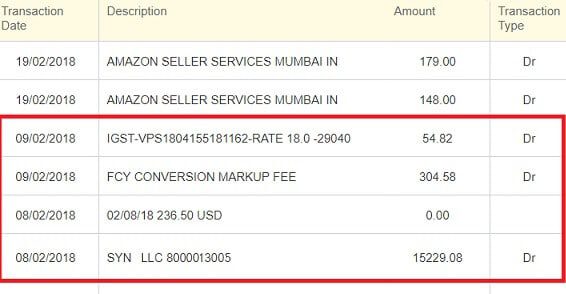

- When you use Credit Cards or Debit cards internationally, you pay in the currency other than Indian Rupee hence Extra Charges are involved such as Foreign Transaction Charge, Foreign Currency Conversion fee along with GST. Consolidated FCY Markup fee is consolidated foreign currency markup fees. When a customer pays in foreign currency through his credit card/debit card, he has to pay the consolidated FCY markup fees to his credit card company.

Why is OTP/PIN required for using Credit or Debit Cards? What is Two Factor Authentication?

OTP or PIN is a mandate given by RBI and it is required for all domestic transactions. This is called as Two-factor authentication. Two Factor Authentication, also known as 2FA, two-step verification or TFA , is an extra layer of security that is known as multi factor authentication that requires not only a password and username but also something that only, and only, that user has on them, i.e. a piece of information only they should know or have immediately to hand – such as a PIN or OTP One Time Password. Biometric scanners for fingerprints and retinas or faces are on the upswing thanks to innovations such as the iPhone X’s Face ID and Windows Hello, but we are still far from ubiquity. In most cases, including 2FA for your Google account and other popular services, the extra authentication is simply a numeric code; a few digits sent to your phone, which can only be used once. In India, RBI gave the mandate for 2-factor authentication in 2011 which came into effect in 2014.

PC MAG article Two-Factor Authentication: Who Has It and How to Set It Up explains how to set up two-factor for Google and Gmail, for Twitter, for Facebook

But One can do an international transaction without OTP or PIN. All you need are your card details such as Card number, Date of Expiry and CVV. You would still get the SMS about your card being used. If you are using a Payment Gateway outside India they are not bound by the RBI mandate hence they may not require OTP authentication. The USA does not have two-level security. They have fraud insurance to protect the customer. In the European Union (EU) two-factor authentication (2FA) is mandatory for online payments. It does increase the risk of fraudulent transactions. Often we hear cases of the credit card being used outside India. Every Credit Card Issuer allows you to dispute a transaction if it looks like fraud though it takes time.

How to Enable Credit Card or Debit Card for International transactions

How to enable HDFC Bank Credit Card or Debit Card for International transactions

To enable international transactions on your Debit or Credit Card,

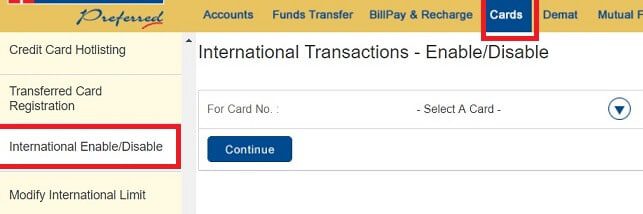

- Login to Netbanking > Cards > Credit/Debit Cards > Request > International Enable/Disable as shown in the image below.

- Or Call PhoneBanking

How to enable ICICI Bank Credit Card or Debit Card for International transactions

To enable your Debit or Credit Card for International transactions,

- SMS INTL to 5676766 from your registered mobile number

- Call ICICI Bank Customer Care

- Login to iMobile App > Services > Cards Services > Modify Debit Card limit > Choose to activate International transactions

How to enable Kotak Bank to Enable Credit Card or Debit Card for International transactions

Please contact the customer support centre number: 1860-266-2666

How to enable Citi Bank Credit Card or Debit Card for International transactions

Credit Cards / Citibanking 1860 210 2484 (Local call charges apply)

Use +91 22 4955 2484 for calling us from outside of India.

How to enable SBI Credit Card or Debit Card for International transactions

To enable international usage on your SBI Credit Card instantly,

- Visit link, enter your user id and password when prompted and select the ‘activate’ option OR

- Visit sbicard.com or the SBI Card Mobile app, login to your account by entering your user name or password and select ‘Request > Activate International Usage’ from the left menu.

How to enable Axis Bank Credit Card or Debit Card for International transactions

To enable your Axis Bank Debit or Credit Card for International transactions,

Login to Axis Bank Internet banking or Mobile Banking >> Accounts >> Select Credit Card or Debit Card >> Select the specific card >> Replace/ Upgrade Card >> Change Usage Preference

How to Disable Credit Card or Debit Card for International transactions

If you disable your credit card will be disabled for usage at International location merchant outlets, International ATMs and International shopping websites. The process is similar to Enabling the Credit Card for International transactions.

How to Set Credit Limits for International Usage on credit cards? ?

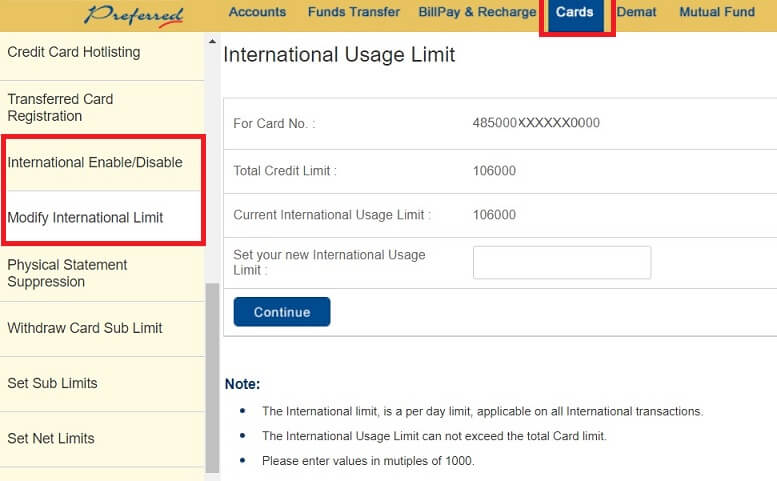

You can secure your card for international usage by setting limit which is well within your limits. Do Note that The International Usage Limit cannot exceed the total Card limit.

- For HDFC Bank: You can login on to the Net banking and set the new limit as shown in the image below. We received a One Time Password on our Mobile and enter this on the online Banking interface to authenticate. Upon successful completion we got the following message – The Credit Limit of Your Card Has Been Updated Successfully.

- Login to ICICI Bank Internet banking >> Customer service >> Service requests >> Increase/Decrease debit card limit

Charges involved in using Credit Cards internationally

There are basically three types of charges involved:

- Foreign Transaction Charge– A foreign transaction fee is charged on credit card transactions outside the country where the card was issued. Since you own an Indian Credit Card, your balance is automatically in Indian Rupees. So when you buy something while travelling abroad, or by placing an order with a foreign merchant a Foreign Transaction Charge is charged. Not all cards charge this fee, but for those that do, it’s usually around 3% of the purchase price.

- Foreign Currency Conversion fee: Currency conversion fees are the result of Dynamic Currency Conversion or DCC. This fee is charged by an overseas merchant to convert transactions into dollars (or whatever your home country’s currency is). Say you’re an Indian citizen visiting Hong Kong, and you want to buy some souvenirs. The merchant may give you the option of seeing the bill in Hong Kong Dollars rather than Indian Rupees, so you don’t have to try to do the conversion math in your own head.

- Cash Advance Fee: Cash advances are expensive even within the country. If you are using your Credit Card overseas, withdrawing cash will increase the fees even more. You can incur a 1-4% additional fee every time you carry out an overseas cash withdrawal. You will also be charged the standard cash withdrawal rate for your Credit Card, together with the international cash withdrawal fee.

The following image shows FCY or foreign currency markup fees along with GST when we used the card on the website in US.

If you do not use your Card for any International Transactions [Online or while Visiting other Countries], then we Strongly Advise you to Disable International Usage

Before you leave, get in touch with your bank and inform them about your foreign trip, along with your travel dates. Ask them for a number you can call, in case something happens to your card. This will also prevent your Credit Card issuer from getting confused between genuine and suspicious transactions.

Related Articles:

ATM card fraud: What it is ? How to avoid ATM Card fraud?

Hey there!

thank you for this amazing information.

I got a question, is there a limit to how much they can make an international online transcation?

Hi,

I was able to use my canara bank credit card on PayPal for making some payments. Suddenly the bank started rejecting the payments. Is there a possible solution to my problem ?

Thank you

Best to get in touch with your bank.

In March RBI had said all cards (physical and virtual) shall be enabled for use only at contact-based points of usage [viz. ATMs and Point of Sale (PoS) devices] within India.

Maybe because of that your bank disabled your card

Do websites like dmarket.com and neonet.pl actually need OTP for processing transaction. I am having a fraud dispute with a bank which is saying since OTP was triggered you are liable. But, in my view these are international transaction which do not need OTP for payment

Please help how to fight this dispute

Was OTP triggered?

Did you enter OTP at the site?

Do you proof that you did not make the transaction?

You can talk to bank about it and ask what can you do to prove it is a fraud.

“Overview of International Usage of Indian Credit Cards or Debit Cards”- It has covered all the basic information regarding the different Credit cards available in india and their respective uses and importance in our day today life. Other than this, if you wish to add further knowledge in your knowledge list then visit us at AntworksMoney or click here : https://www.antworksmoney.com/blog/essentials-to-consider-while-applying-for-credit-card-online/

Hello sir,

Finally a helpful blog on the international transaction for Indian cardholders. First of all, thank you or this info.

And I have a question. I’m using SBI global international debit card to pay for facebook ads. but they have online transaction limits on all their debit cards. They have per month limit of foreign currency equivalent of Rs. 50,000/ on online transaction. I can’t pay more than 700 USD in one month.

Could you please suggest me which Indian debit card is best for the international online transaction which has really high limits.

Thank you.

Many clients are having trouble while activating Capital One card and they are facing an error saying capitalone com activate.

The Capital One Financial Corporation is a unique bank corporation. Which also had some expertise in credits cards and the provision of various saving and banking services.

good job