The Income Tax Department is sending email/SMS to identified taxpayers to verify their high value transactions. You can receive the SMS/Email even after processing of your ITR & intimation already received u/s.143(1) Don’t ignore any message/mail such as High Value Transaction message from Income Tax Department. What is this high value transactions notice from Income Tax Department? How to reply to it on the Compliance Portal.

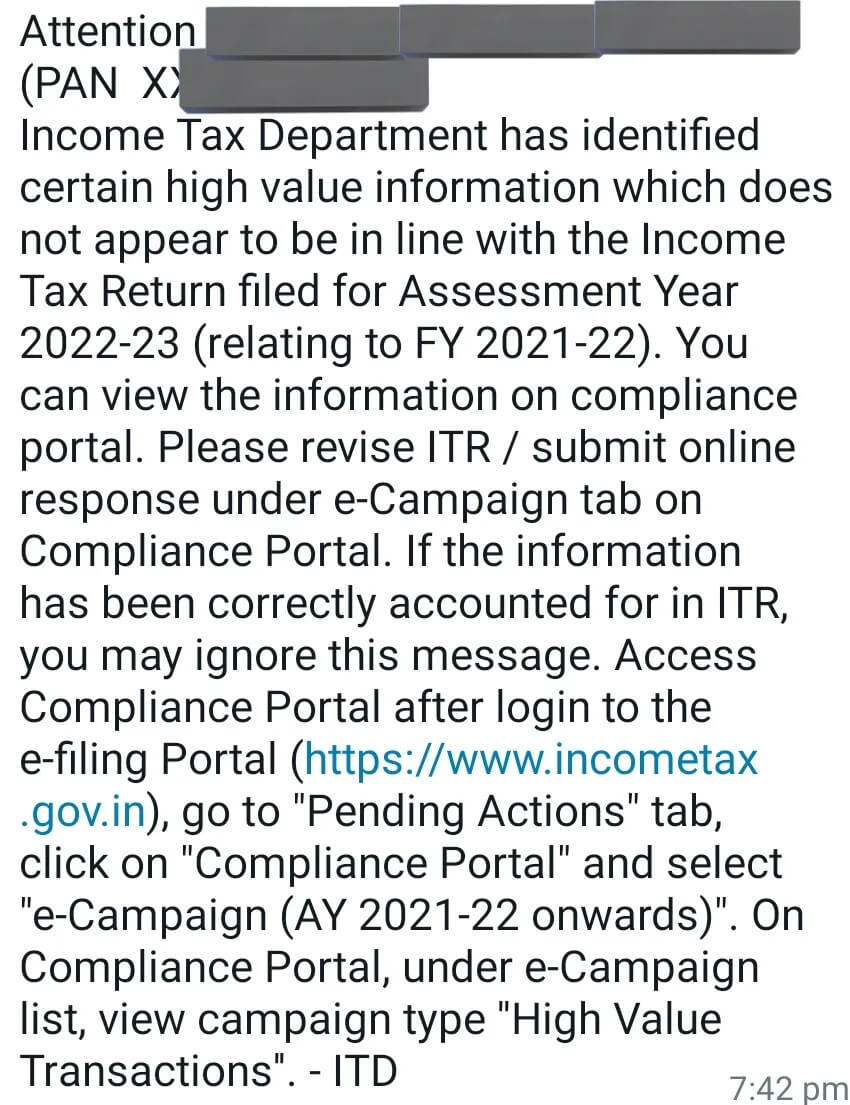

Attention (XXXXX1111X), the Income Tax Department has identified high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2022-23 (relating to FY 2021-22). Please submit online response under e-Campaign tab on Compliance Portal (CP). Access CP by logging into e-filing portal (My Account) – ITD

Check out our course on Income Tax here.

Check out the Workbook on Income Tax here.

Table of Contents

How will you come to know about pending e-verification?

Email and SMS will be sent to the taxpayer informing that information has been received in the case and response may be submitted on the Compliance Portal. Please verify and update the email address and mobile number on the e-filing portal (at https://incometaxindiaefiling.gov.in ) to receive electronic communication. Mostly people are getting emails of following types

You can receive SMS/Email even after processing of your ITR & intimation already received u/s.143(1)

- Non filing of Return: A taxpayer who is having total income above the prescribed limit or fulfils any other condition mentioned in section 139 of the Income Tax Act 1961, is required to file return of income Transactions of the taxpayer who have not filed return of income for a specific assessment year and have potential tax liability or who are under obligation to file return of income, are displayed for feedback.

- High Value Transactions: Certain transactions of the taxpayer reported in their ITR which have been found to be inconsistent with the information received from the third party for a specified Assessment Year are displayed to the taxpayer for feedback.

What if I don’t Respond to Compliance Alert ?

Non or Wrong compliance with communication from Income Tax Department, may lead you to face Notice from income Tax Department regarding assessment/Penalty/Prosecution etc.

What action is required from me if I receive a communication?

If you receive such communication, you should log into the Compliance Portal and check the details of issues generated and submit adequate response for the same. There is no need to visit any Income Tax office, as the response has to be submitted online.

Compliance portal is the dedicated portal to enable e-verification (i.e. capture of response on specific compliance related issues in a structured manner) for effective compliance monitoring and evaluation. The Compliance portal also enables a seamless, secured two way structured communication to enhance the transparency and functional efficiency of the department.

- If you have not filed the ITR, then you may be required to file ITR.

- If you have filed ITR without certain incomes, then you may be required to file Revised ITR. Last date for filing (Belated) as well as revising the ITR for AY 2022-23 is 31st March 2023. Yes, ITR can be revised u/s.139(5) even after Processing of ITR!

- (i) Information is correct,

- (ii) Information is not fully correct,

- (iii) Information related to other person/year,

- (iv) Information is duplicate/included in other displayed information, and

- (v) Information is denied.Provide feedback in AIS and If you have missed to report same in ITR then file revised ITR. You have to select from the following options:

Yes, ITR can be revised u/s.139(5) even after Processing of ITR!

What happens after submission of online response?

The responses submitted online by the taxpayers will be verified by the Income tax department. If the response is found to be satisfactory, the case will be closed. Otherwise, further queries may be raised or suitable proceedings may be initiated.

How can taxpayer view the submitted response on each Information?

Step 1: Visit Compliance Portal at https://compliance.insight.gov.in or Login to the e-filing portal by using the URL https://incometaxindiaefiling.gov.in and Click on ‘Compliance Portal’ link available in “My Account” or “Compliance” tab.

How to respond to e-campaign notice on High Value Transactions online?

The I-T Department keeps a watch on high-value cash transactions, including bank deposits, mutual fund investments, property-related transactions and share trading. As part of its e-campaign to promote voluntary compliance and avoid issuing the notice and the scrutiny of taxpayers, the tax department sends e-mail and SMS alerts about the non-disclosure of high-value transactions linked to a permanent account number (PAN).

Under the e-campaign the taxpayers will be able to access details of their high value transaction related information on the designated portal.

If you have received an email or SMS for high-value transactions or non-filing of returns, you can respond to the income tax department by following the below steps:

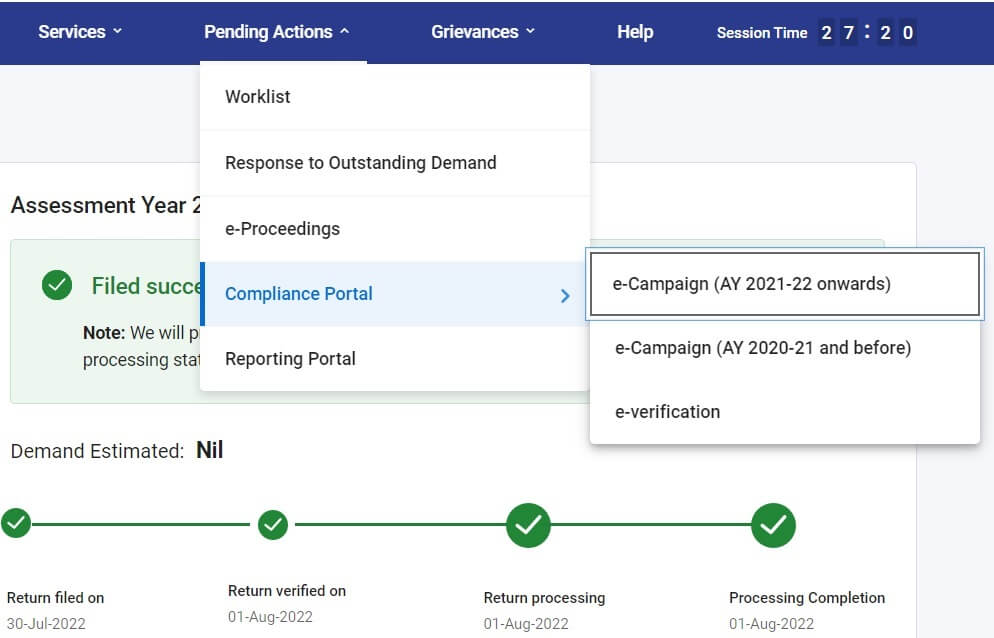

Step 1: Log in to your income tax e-filing account.

Step 2: In the home page, go to ‘Pending Actions’> Compliance Portal > ‘e-Campaign (AY 2021-22 Onwards)’.

Step 3: Select the relevant e-campaign.

After redirecting from the e-filing portal, the landing page of the e-campaign view will be displayed. Select the relevant e-campaign and click on ‘provide feedback in AIS’.

If you don’t have active e-campaigns or e-verifications, you will get the message – “No Compliance Record has been generated for you”.

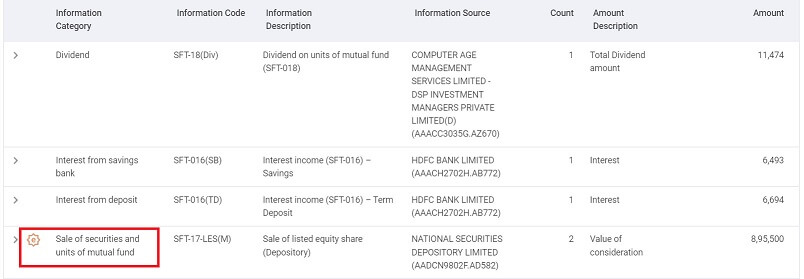

Step 4: Select the information category

Expand relevant section(s) under the ‘SFT Information’ tab

‘e’ would be marked against the information category for which you have received the communication.

Step 5: Select the Transaction

The information on which feedback is required would be marked as ‘Expected’.

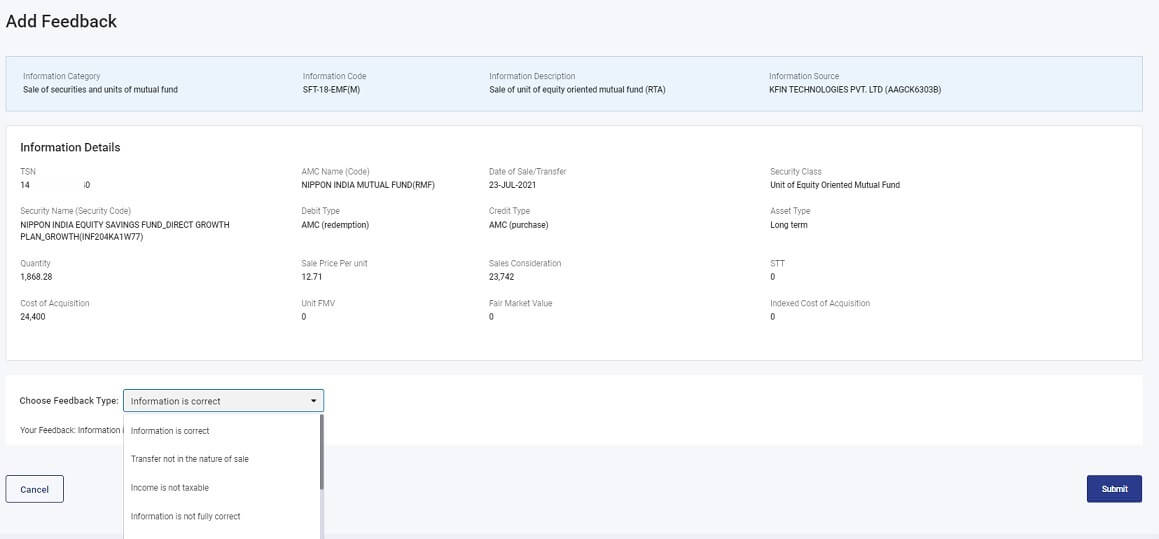

Step 6: Submit response

You must provide feedback on the information, which is marked as ‘Expected’ as shown in the below screenshot.

Following are the categories where the response is expected from the taxpayer under e-campaign:

They will also be able to submit online response by selecting among any of these options:

- (i) Information is correct,

- (ii) Information is not fully correct,

- (iii) Information related to other person/year,

- (iv) Information is duplicate/included in other displayed information, and

- (v) Information is denied.

List of High Value Transactions

List of transactions for which a taxpayer may receive a notice from the Income Tax Department is given below.

| Sr. No. | Transaction | Threshold (Rs) | Authority concerned |

| 1 | Cash deposits in the fixed deposit account | 10,00,000 | Banks need to disclose a transaction if the amount deposited exceeds the threshold to the Director of Income Tax by filing Form 61A, known as Statement of Financial Transactions(SFT). |

| 2 | Cash deposit or withdrawal in a savings bank account | 10,00,000 | Banks need to disclose a transaction if the amount deposited exceeds the threshold to the Director of Income Tax by filing Form 61A, known as Statement of Financial Transactions. |

| 3 | Cash deposit or withdrawal in a current account | 50,00,000 | Banks need to disclose a transaction if the amount deposited exceeds the threshold to the Director of Income Tax by filing Form 61A, known as Statement of Financial Transactions. |

| 4 | Sale or purchase of an immovable property | 30,00,000 | The Property Registrar/Sub-registrar must report a transaction exceeding the threshold via Form 61A. |

| 5 | Investments in shares, mutual funds, debentures and bonds in cash

*If the transaction is related to the sum transfer from one scheme to another, then reporting is not required. |

10,00,000 | Mutual Fund Trustee, Stock Exchange is required to report a transaction exceeding the threshold via Form 61A. |

| 6 | Payment of credit card bill in cash | 1,00,000 | Banks need to report transactions exceeding the threshold via Form 61A. |

| 7 | Payment of credit card by any mode other than cash such as NEFT, cheque etc. | 10,00,000 | Banks need to report transactions exceeding the threshold via Form 61A. |

| 8 | Sale of foreign currency | 10,00,000 | Banks need to report transactions exceeding the threshold via Form 61A. |

| 9 | Cash payment for purchasing bank draft or prepaid RBI instruments | 10,00,000 | Banks need to report transactions exceeding the threshold via Form 61A. |

How to responsd to Income Tax Notice on Non Filing of ITR

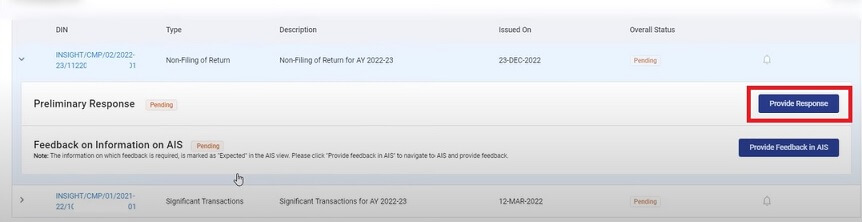

Preliminary Response

Under the ‘Preliminary Response’ section, the taxpayer is expected to respond to relevant questions. The queries under the Preliminary Response section are based on campaign type (non-filing of return/certain high-value transactions done by the taxpayer).

For example, for campaign type – ‘Non-Filing of Income Tax Return’, the taxpayer is expected to submit a response whether an income tax return has been filed or not.

Step 1: Click on the ‘Provide Response’ button provided against the ‘Preliminary Response’ section.

Step 2: On the next page, respond by selecting the relevant drop-down:

- ITR has been filed: If you select this option provide details of the ITR like acknowledgement number, date of filing, mode of filing etc.

– Acknowledgement Number: You will find the Acknowledgement Number in the Income Tax Return of that particular assessment year.

– Date: Select Date of Income Tax Return filing

– Mode: Select Mode of Income Tax Return filing (i.e., e-Filed return | Paper filed return)

– Circle/Ward and City: Enter Circle/Ward and City of the taxpayer

– Remarks: Enter remarks for Income Tax Return filing (Optional) - ITR has not been filed: If you select this option, you will have to:

– Select Reason: Select the Reason for not filing the ITR

– Add Remarks: Provide remarks for not filing the ITR - Step 4: After filling in all the relevant information, submit the response. You can download the preliminary response submitted from the ‘Activity History’ screen.

Related Articles:

- How to file Revised Income Tax Return ITR

- Income Tax Annual Information Statement (AIS), TIS, How to use it to File ITR

- How to file ITR Income Tax Return, Process, Income Tax Notices

Check out our course on Income Tax here.

Check out the Workbook on Income Tax here.

Don’t ignore any message/mail such as High Value Transaction message from Income Tax Department. Provide feedback in AIS and If you have missed to report same in ITR then kindly file revised ITR. The taxpayer must avail the opportunity to participate in the e-campaign for their own ease and benefit.