Income Tax Slabs ,Rates,Forms for Assessment Year 2014-15, or Financial Year (FY) 2013-14, applicable on income earned during 01.04.2013 to 31.03.2014) for various categories of Indian Income Tax payers are given in the article

Table of Contents

Income Tax Slab rates for FY 2013-14 or Assessment Year 2014-15

For Financial year 2013-14 or Assessment Year 2014-15 for individual resident aged below 60 years or NRI / HUF / AOP / BOI / AJP

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 200000 | 250000 | 500000 |

| 10% tax | 200001 to 500000 | 250001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Rebate or Tax Credit | 2000 deducted from net tax | ||

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

Income Tax Table for Individual resident Individual or NRI / HUF / AOP / BOI / AJP with Calculations

| Income Slabs | Tax Rates | |

|---|---|---|

| i. | Where the total income does not exceed Rs. 2,00,000/-. | NIL |

| ii. | Where the total income exceeds Rs. 2,00,000/- but does not exceed Rs. 5,00,000/-. | 10% of amount by which the total income exceeds Rs. 2,00,000 Less : Tax Credit Rs 2000. |

| iii. | Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-. | Rs. 30,000/- + 20% of the amount by which the total income exceeds Rs. 5,00,000/-. |

| iv. | Where the total income exceeds Rs. 10,00,000/-. | Rs. 130,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-. |

Financial Year,Assessment Year

A Financial Year (FY) runs from April 1 to March 31. Income earned in, say, FY 2013-14 is assessed for tax in FY 2014-15. Financial Year is also called Previous Year (PY)

FY 2013-14 is called Previous Year and FY 2014-15 is called Assessment Year.

Resident Individual

The person who is in India for 182 days or more during the relevant previous year is called Resident. Other categories are NRI – Non Resident Individual; HUF – Hindu Undivided Family; AOP – Association of Persons; BOI – Body of Individuals; AJP – Artificial Judicial Person

Surcharge

A surcharge is an additional levy on the tax that an individual pays. It is levied on the income tax and not on the income.

- For FY 2013-14 there is no surcharge for income less than 1 crore.

- For income more than 1 crore there is a surcharge at the rate of 10% of the Income Tax, Marginal Relief in Surcharge, if applicable explained later.

Education Cess

Education cess 3% of the total of Income Tax and Surcharge. 2% is education cess and 1% is a higher education cess . The cesses are earmarked taxes collected to finance education and higher education. Tax was brought in effect from April 1st, 2004

Tax rebate

For taxable income up to Rs.5 lakh, you will get a rebate of Rs.2,000

Income Tax Return Forms, ITR for AY 2014-15 or FY 2013-14

The Income Tax Department has released the Income Tax Return Forms for Assessment Year 2014-15 (Financial Year 2013-14). These are the forms you need to file your Income Tax Returns for the Income earned between April 1st 2013 and March 31st 2014.31st July 2015 is the last date Submission of return of income for individuals for PV 2013-14. Our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details explains filling ITR1 in detail.

Paper forms have been released for

- ITR1

- ITR2

- ITR-4S

E filing

e-Filing of Returns/Forms is mandatory for:

- Any assessee having total income of Rs. 5 Lakhs and above from AY 2013-14 and subsequent Assessment Years.

- Individual/ HUF, being resident, having assets located outside India from AY 2012-13 and subsequent Assessment Years.

- An assessee required to furnish a report of audit specified under sections 10(23C)(iv), 10(23C)(v),10(23C)(vi) ,10(23C)(via) , 10A, 12A(1)(b), 44AB, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E or 115JB of the Act, shall furnish the said report of audit and the return of Income electronically from AY 2013-14 and subsequent Assessment Years.

ITR1 (Sahaj) and ITR-4S(Sugum) are available in online and offline utility for efiling at https://incometaxindiaefiling.gov.in/e-Filing/

Offline utilities are ITR Forms are developed using the latest in JAVA technology and effort has been made to make it user friendly, simpler and faster preparation of tax returns. This utility can be run on operating systems like Windows 7.0 or above and latest Linux, where Java Runtime Environment Version 7 . Update 13 (jre 1.7 is also known as jre version 7) or above is installed.

How to interpret the income tax slabs, surcharge?

Total taxable income, Deduction, TDS, Form 26As, Challan 280

Total taxable income is sum of income from all the categories minus all the deductions under 80C,80U,80TTA etc. Various categories of income are given below Our article Income Tax Overview explains computation in detail

- Income from Salary / Pension

- Income from Business / Profession

- Income / Loss from House Property

- Income / Loss from Capital Gains

- Income from Other Sources

Tax slabs and Income Tax Calculation:What does 20% income tax slab mean?

Income tax in India is charged based on one’s total income, more the income more the tax. India has four income slabs or groups given below. The income slab also varies with age(less than 60,between 60 – 80 years, more than 80), residence(india/non-resident India), gender(male/female). Tax slabs keep on changing from year to year. These are announced in budget by the Finance Minister every year. Our article Understanding Income Tax Slabs,Tax Slabs History explains it in detail.

- income not taxed at all,

- income taxed at 10%,

- income taxed at 20% and

- income taxed at 30%.

If someone has income of say 8 lakh , which is between 5 lakh to 10 lakh , hence as per above table he/she falls in 20% bracket. Calculation of tax on his income uses exemption for first 2 lakh, 10% of tax on income between 2 lakh to 5 lakh and 20% on income exceeding 5 lakh.

- So for first 2 lakh he pays nothing , on 3 lakh he pays 10% and remaining 3 lakh he pays 20% =30,000( 10% of 3,00,000) + 60,000(20% of 3,00,000) = 90,000

- Other way of calculating is = 30,000 + 20 % of his income exceeding 5 lakh . 30,000 tax for income of 3 lakh (between 2 lakh to 5 lakh) at rate of 10% + 20 % of income exceeding 5 lakh = 30,000 + 60,000(20% of 3,00,000)

- On tax he needs to pay surcharge (0%) and education cess (total 3%) = 3% of 90,000 = 2700

- Total tax he is liable to pay = 90,000 + 2700 =92,700

You can use Income Tax Calculator to calculate tax liability.

Rebate and Income tax calculation

Rebate is provided under Section 87A from Financial Year 2013-14 (AY 2014-15) onwards. The rebate is available if you satisfy both these conditions-

- a RESIDENT INDIVIDUAL.

- Total Income Less Deductions ( under section 80) is equal to or less than Rs 5,00,000

- The rebate is limited to Rs 2,000. Which means if the total tax payable is lower than Rs 2,000, such lower amount of tax will be the rebate under section 87A.

- This rebate is applied on total tax before adding Education Cess.

- This rebate is also available to Senior Citizens.

If total taxable income is less than 5 lakh one gets the rebate of maximum upto Rs. 2000 or tax due whichever is lower. So if one’s total income after applying all the deductions is Rs 5,00,000 then one will get Rs 2000 on total tax calculated. So after applying the calculation on income tax calculated 2000 Rs is subtracted.

Example :

Resident less than 60 years with total income as 6 lakh.

- So if one’s total income is 6 lakh.

- He claims all deductions so that one’s total taxable income is 5 lakh (5,00,000)

- then as per tax formula his income-tax should have been 10% of 3,00,000 which is 30,000.

- But as one gets a rebate of Rs 2000. So total tax payable is 30,000 – 2000 = 28,000.

For senior citizen (between 60 years to 80 years of age) with total income as 6 lakh

- as exemption limit is two and half lakh (2,50,000) the tax is 10% of 2.5 lakh (25,000) and

- due to rebate total tax comes out to be 23,000 (25,000- 2000)

Resident less than 60 years with total income as 3.15 (3,15,000) lakh.

-

- So if one’s total income is 3.15 lakh.

- He claims all deductions so that one’s total taxable income is 2.15 lakh (2,15,000)

- then as per tax formula his income-tax should be 10% of 15,000 which is 1500.

- But as one gets a rebate of lesser of Rs 2000 and 1500. So total tax payable is 1500 – 1500 = 0.

Senior Citizen and Super Senior Citizen

Individual resident aged below 60 years (i.e. born on or after 1st April 1954)

A resident senior citizen is 60 years or more at any time during the Financial year but less than 80 years on the last day of the financial year, i.e., born during April 1, 1934 and March 31, 1954

A resident super senior citizen is 80 years or more at any time during the financial year, i.e., born before April 1, 1934

What is surcharge?Marginal Relief in Surcharge

A surcharge is an additional levy on the tax that an individual pays. As mentioned above For FY 2013-14 there is no surcharge for income less than 1 crore. For income there is a surcharge if income is more than 1 crore. Even for income above 1 crore the marginal tax relief is provided.

For example, if the tax on an income of Rs 1 crore is Rs 28.3 lakh (28,30,000) .

If income is 1000 rs more than 1 crore 100010001 then

- tax is 28,30,300

- Surcharge of 10 per cent is levied ,283030, the total tax liability on the taxpayer would be Rs 3113330 .

- But actually one’s tax liability is increased only by 700 due to marginal relief in surcharge.

Concept of mariginal relief is the additional amount of income-tax payable (together with surcharge) on the excess of income over 1 crore should not be more than the amount of income exceeding 1 crore. So income tax calculations become as follows

| 1 | Income Tax | Rs. 28,30,300 |

| 2. | Surcharge @10% of Income Tax | Rs. 2,83,030 |

| 3. | Income Tax on income of Rs. 1 crore | Rs. 28,30,000 |

| 4. | Maximum Surcharge payable (Income over Rs. 1 crore less income tax on income over Rs. 1 crore) |

Rs. 700 (1000 – 300) |

| 5. | Income Tax + Surcharge payable | Rs. 28,31,000 |

| 6. | Marginal Relief in Surcharge | Rs. 2,82,330 (2,83,030 – 700) |

Alternate Minimum Tax (AMT)

Alternate Minimum Tax (AMT) was introduced with effect from 01.04.2012 on Limited Liability Partnerships (LLP). Later on from 01.04.2013 this has been extended to all assesses other than companies. The AMT will apply only to those assesses who prefer claim of exemption under section 10AA and deductions under Chapter VIA- C in relation to certain incomes (except deduction u/s S.80P). In case of individual, HUF, AOP and BOI further relaxation from AMT is provided if the adjusted total income does not exceed Rs. 20 lakh

PAN, TAX Deduction, TDS, Challan 280,Computation of Income Tax

Permanent Account Number,PAN, is essential for processing the Return of Income and for giving credit for taxes paid.

- Every assessee is required to obtain 10 alpha numeric Permanent Account Number (PAN) and quote the same in his returns, challans & correspondence.

- If a person who is required to quote his Permanent Account Number fails to do so or intimates false number, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of Rs.10,000.

- PAN can be obtained by applying in new Form No.49A at the designated Service Centres of UTITSL OR NSDL.

Tax Deduction is a legal way to reduce the income hence the tax that one needs to pay. One can claim the reduction under different heads such as 80C,80D etc.

Tax deducted at Source or TDS is a certain percentage deducted at the time of payments of various kind such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account. This withheld amount can be adjusted against tax due. One can know his TDS details through online Form 26AS

If you have some tax to pay, Advance Tax, Self Assessment Tax , you can pay through Challan No. ITNS 280 is used for payment of Income tax

- Online deposit

- Nationalised banks

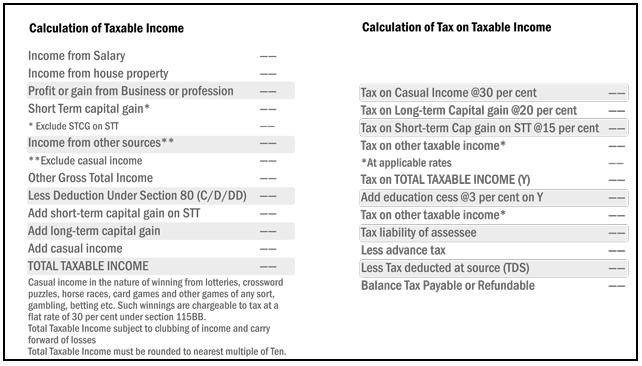

The image below recaps the process of calculating income tax.

Related Articles

- Income Tax Overview

- Income Tax Calculator

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax articles organized , example articles

[poll id=”57″]

This article gave overview of Income Tax for AY 2014-15. While filing income tax return is no rocket science, it takes a little bit of hard work. Even if you get your returns filed by your Chartered Account, other party please make sure you understand what has been filled in, if something is left out.

44 responses to “Income Tax for AY 2014-15:Tax slabs, ITR Forms”

I have joined my company on 27th july 2015. My gross salary is 30000. How much i have to pay as income tax. Kindly help me.

Your gross salary is 30,000 Rs per month or per year?

Is your company deducting TDS?

Typically when one becomes an employee and earns annual salary of more than 2.5 lakh (the basic exemption limit for Income Tax) then company deducts TDS every month.

This is also reflected in payslip and Form 16.

If that’s your only income then all your TDS will be paid by employer.

You just have to file ITR

Hi,

Can i file income tax for assessment year 2013-14 now. i missed it back then.. is there any way i can file it now ?

Regards,

Bharath

For FY12-13 the time available to file the belated return was till 31 March 2015. So you have missed it.

We are not aware of any other way.

Hi

I got a gold loan for 4% and I used that money to deposit in Fixed for 9% annual. Since FD interest is more and I have pan card they have done TDS at 10%. Now, while filing tax, can you show the interest paid for gold loan as expenses against the income from bank FD.

Thank you

Hello Abish

I have no information about it. Sorry

Abhish have you cleared your Gold loan? Why did you take Gold loan to invest to earn 5% more interest?

Hi Kirti,

Thanks for responding to my query.

Yes. I closed the loan. To gain 5% more interest and the gold is in safe custody.

From where did you get gold loan for 4%?

Hi

I got a gold loan for 4% and I used that money to deposit in Fixed for 9% annual. Since FD interest is more and I have pan card they have done TDS at 10%. Now, while filing tax, can you show the interest paid for gold loan as expenses against the income from bank FD.

Thank you

Hello Abish

I have no information about it. Sorry

Abhish have you cleared your Gold loan? Why did you take Gold loan to invest to earn 5% more interest?

Hi Kirti,

Thanks for responding to my query.

Yes. I closed the loan. To gain 5% more interest and the gold is in safe custody.

From where did you get gold loan for 4%?

Hi,

I have two Company form 16 in the financial year of 2013-2014. How to file the Income tax. from April to Feb in ‘X’ Company and from Feb to March in ‘Y’ Company. Which company TAN i need to give. The X company has detected and paid the tax. Where as the Y company has not detected any TAX Since it falls below 2 Lacks.

How to file the Returns in this case. Please suggest.

With Regards

Munuswamy

Hello Munuswamy

We have written an article on Changing Jobs and Tax liability. Did you fill Form 12B when you changed your job?

Hi,

Since i joined in Feb they are not asked me 12B, and again the first employer only detected tax the second employeer didn’t detected it. Now What i need to do?

Munuswamy don’t worry. Most of the new employers do not ask for Form 12B. You can show both incomes while filing ITR. We have written an article on it How to Fill ITR when you have multiple Form 16

If you have any question/doubt please don’t hesitate to ask.

If any extra tax can be paid by our self online, if we are filling the Returns online? or need to pay through any bank or other sources?

Please clarify.

You need to pay self assessment tax through Challan 280 at Bank or net banking.

Please go through. if you have questions/doubts please do ask.

How to file ITR when you have multiple Form 16

Challan 280: Payment of Income Tax

Hi,

I have two Company form 16 in the financial year of 2013-2014. How to file the Income tax. from April to Feb in ‘X’ Company and from Feb to March in ‘Y’ Company. Which company TAN i need to give. The X company has detected and paid the tax. Where as the Y company has not detected any TAX Since it falls below 2 Lacks.

How to file the Returns in this case. Please suggest.

With Regards

Munuswamy

Hello Munuswamy

We have written an article on Changing Jobs and Tax liability. Did you fill Form 12B when you changed your job?

Hi,

Since i joined in Feb they are not asked me 12B, and again the first employer only detected tax the second employeer didn’t detected it. Now What i need to do?

Munuswamy don’t worry. Most of the new employers do not ask for Form 12B. You can show both incomes while filing ITR. We have written an article on it How to Fill ITR when you have multiple Form 16

If you have any question/doubt please don’t hesitate to ask.

If any extra tax can be paid by our self online, if we are filling the Returns online? or need to pay through any bank or other sources?

Please clarify.

You need to pay self assessment tax through Challan 280 at Bank or net banking.

Please go through. if you have questions/doubts please do ask.

How to file ITR when you have multiple Form 16

Challan 280: Payment of Income Tax

Again the time has come when you have to assess your total income and file the income tax return.

The last date for filing the income tax return is 31.7.2014. Please file it before the due date so as to avoid penalty and interest.

Please contact us below to file your income tax return:

Need Help?

(Company India Advisors)

Again the time has come when you have to assess your total income and file the income tax return.

The last date for filing the income tax return is 31.7.2014. Please file it before the due date so as to avoid penalty and interest.

Please contact us below to file your income tax return:

Need Help?

(Company India Advisors)

Thanks, it helps.

Thanks a lot for encouraging comment. It helps.

Thanks, it helps.

Thanks a lot for encouraging comment. It helps.

Nice post Kirti!

I hav a question…..U’ve written:

Resident less than 60 years with total income as 6 lakh.

So if one’s total income is 6 lakh.

He claims all deductions so that one’s total taxable income is 5 lakh (5,00,000)

then as per tax formula his income-tax should have been 10% of 3,00,000 which is 30,000.

I think in last line above as per given tax slabs as his total income is 6 lakhs so he shd come under the 20% tax slab! Plz chk & confirm! 🙂

Thanks Amrita for question. And Good observation.

Income slab of 20% starts from 500001 and goes till 1000000.

A person with total taxable income after deductions is Rs 5 lakh then his tax would be 10% of 3,00,000 which is 30,000 and then a rebate of 2000 so 28000

But if one has income of 5,00,001

Income tax becomes 30,000 (10% of 5 lakh due to rounding) but no rebate

If one has income of 5,00,100 then tax becomes 10% of 3,00,000 which is 30,000 and 20% of 100 which is 20.

So total tax is 30020 (and no rebate)

You can verify using Income tax calculator or finotax

This is my understanding.

Is there other way to interpret the tax slabs Amrita?

Nice post Kirti!

I hav a question…..U’ve written:

Resident less than 60 years with total income as 6 lakh.

So if one’s total income is 6 lakh.

He claims all deductions so that one’s total taxable income is 5 lakh (5,00,000)

then as per tax formula his income-tax should have been 10% of 3,00,000 which is 30,000.

I think in last line above as per given tax slabs as his total income is 6 lakhs so he shd come under the 20% tax slab! Plz chk & confirm! 🙂

Thanks Amrita for question. And Good observation.

Income slab of 20% starts from 500001 and goes till 1000000.

A person with total taxable income after deductions is Rs 5 lakh then his tax would be 10% of 3,00,000 which is 30,000 and then a rebate of 2000 so 28000

But if one has income of 5,00,001

Income tax becomes 30,000 (10% of 5 lakh due to rounding) but no rebate

If one has income of 5,00,100 then tax becomes 10% of 3,00,000 which is 30,000 and 20% of 100 which is 20.

So total tax is 30020 (and no rebate)

You can verify using Income tax calculator or finotax

This is my understanding.

Is there other way to interpret the tax slabs Amrita?

is it true that this year form 16 must be gotten from TRACES? otherwise it will be considered invalid?

Dipak that’s a good observation.

you will get the form from your employer only and it should have TDS logo and TRACES written on top.

I shall add information about it soon. Thanks for the question.

is it true that this year form 16 must be gotten from TRACES? otherwise it will be considered invalid?

Dipak that’s a good observation.

you will get the form from your employer only and it should have TDS logo and TRACES written on top.

I shall add information about it soon. Thanks for the question.

Nice post 🙂 All basic information about slabs and taxation under one post.

Thanks a lot for encouraging comment Deepa

Nice post 🙂 All basic information about slabs and taxation under one post.

Thanks a lot for encouraging comment Deepa