If you own a property, you have income from House Property. What will be Income from House Property for more than 1 house? How to Evaluate which house to choose when one has two houses and both houses are self occupied? How to Choose which one to show as Self Occupied in ITR? How to calculate Income from House Property when one is Self Occupied, One given on rent. When you have multiple Houses then how do you account for these multiple houses in ITR?

Table of Contents

Overview of Income from House Property

If you own a property, you have income from House Property. A house property could be your home, an office, a shop, a building or some land attached to the building say a parking lot. The Income Tax Act does not differentiate between a commercial and a residential property. All types of properties are taxed under the head Income from house property in the income tax return.

But if you occupy your house property to carry on a business or profession or your freelancing work– any income or expenses with respect to this property shall be covered under the head ‘Profits & Gains of Business & Profession’. You will be allowed to deduct expenses that you may incur towards maintenance and repairs from your business income. Any rent receipts will be added to your income.

Income From House Property and ITR

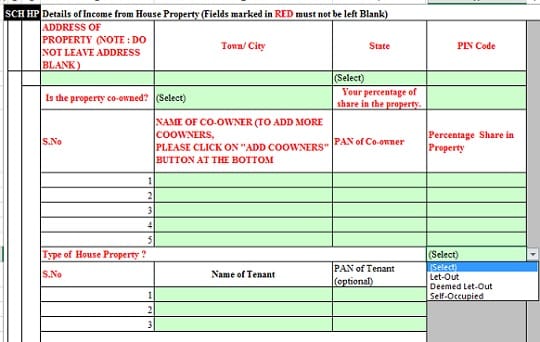

In Income Tax Returns (ITRs) section called Schedule-HP (HP for House Property) needs to be filled for details about percentage of co-owned property, loan, Annual Value,deductions etc. Information about the House needs to be filled in as shown in picture below. Income from house property can be divided between the co-owners which can reduce overall tax liability. Our article Income from House Property and Income Tax Return explains Income from House Property in Detail

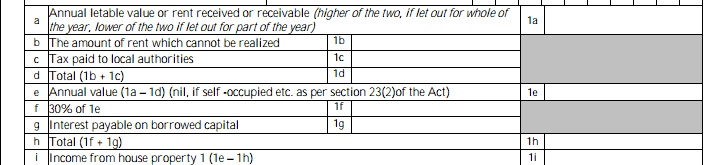

Calculation of Income from House Property is as follows

Rules for Calculation of Income tax on Income from House Property

If you look at the information for calculating Income from house property, information needed is Annual Value, Rent, taxes paid, Interest on borrowed capital. Annual Value is the amount for which the property might be let out on a yearly basis. You can also say that it is the estimated rent that you could get if the property was rented out.

Rules for Calculation of Income tax on Income from House Property vary based on whether house is

- Self occupied property, A self-occupied house property is used for one’s own residential purposes. This may be occupied by the taxpayer’s family, parents, spouse and children. The gross annual value of a self-occupied house is zero. There is no income from your house property.

- Let out : A house property which is rented for the whole or a part of the year is considered a let out house property, according to the I-T Department. For a rented house, gross annual value of the property is the annual rent collected. If one has take home loan for property that is let out, the entire interest on the home loan can be claimed as a deduction.

- Vacant or Deemed to be Let Out : If the house is vacant it is considered as Deemed to be Let out . It is expected to generate income for you and you need to pay tax on what you could have earned.

Note: The deduction to claim principal repayment on Home Loan is available for up to Rs. 1,50,000 within the overall limit of Section 80C

Gross Annual Value of House

Gross Annual Value (GAV) of property will be required to determine the annual value, which is higher of:

(a) The sum for which the property might reasonably be expected to let from year to year. In cases of properties where Standard Rent has been fixed, such sum cannot exceed this value. However, where property was vacant during the whole or part of the previous year and rent actually received or receivable is less than expected rent, then rent actually received or receivable is taken as GAV.

(b) Where property is actually let out and the rent received or receivable is more than the amount determined in (a) above, the annual value would be the actual rent received.

Net Annual Value is arrived at after deducting the municipal taxes and the unrealized rent (subject to certain conditions). However, receipt of any unrealized rent shall be chargeable to tax in the year of receipt.

Tax Deductions on Home Loan Interest under section 24

| Serial No | Particulars | Amount or Percentage Deduction |

| 1 | Standard deduction | 30% of Net Annual Value |

| 2 | Property acquired/constructed after 1st April, 1999 with borrowed capital (deduction is allowed only where such acquisition or construction is completed within 3 years from the end of the financial year in which capital was borrowed) | Rs. 2.00,000 per owner |

| 3 | In all other cases except in point 2. | Rs. 30,000 |

| 4 | In case of let out property | Full deduction of interest on borrowed capital. |

- The construction of the property should be completed by 31st March 2019. This period has been extended to 5 years in Budget 2016 which is applicable from financial year 2016-17.

- The deduction can only be claimed starting in the financial year in which the construction of the property is completed.

- Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished.Interest paid during this time can be claimed as tax deduction in five equal installments starting from the year in which the construction of the property is completed. Our article Pre-Construction Home Loan Interest and ITR explains it in detail.

Calculate Income From House Property for One Self Occupied House Property on Home Loan

Rajan has borrowed money from the bank to fund his home purchase. He made an interest payment of Rs.1,76,000 this year and spent Rs.10,000 on repairs. He paid the municipality Rs 8,000 in property taxes. He is living with his family in the house, so he has one Self Occupied House Property. His income from house property is zero because he has been living in this house throughout the year. He has a loss from Income from House Property, This loss can be deducted from Suresh’s income from other heads for the year.Let’s see how income from property is calculated. Our article Tax and Income From One Self Occupied property explains it in detail.

| Gross Annual Value | 0 |

|---|---|

| Less: Property Taxes | 0 |

| Net annual value | 0 |

| Less: Interest on money borrowed | -1,76,000 |

| (Loss) on house property | -1,76,000 |

Income from House Property for ONE Self Occupied House Property No Home Loan

If one has self Occupied House Property with no Home Loan. Net Income from House Property is Zero(0)

Income from House Property given on Rent

Shalini has let out her apartment for Rs. 35,000 per month. She paid Rs 25,000 in property taxes and spent Rs 6,000 in repairs and Rs 25000 in electricity bills. She is also paying an interest of Rs.2,20,000 on the money borrowed to build the house. For a rented house, gross annual value of the property is the annual rent collected. In her case the municipality has determined the reasonable rent to be Rs. 32,000. Therefore, the gross annual value is Rs. 4,20,000. This is how his income from house property is calculated.Note that her expenses on repairs and electricity are not allowed to be deducted. Our article Tax and Income from Let out House Property explains it in detail.

| Gross Annual Value | 4,20,000(35,000 *12) |

|---|---|

| Less: Property Taxes | -25,000 |

| Net annual value | 3,95,000 |

| Less: standard deduction at 30% | -1,18,500 |

| Less: Interest on money borrowed | -2,20,000 |

| Income from house property | 56,500 |

If one gets rental income from more than one house property, one would have to calculate for each one of them individually in the same manner as above.

Income from House Property for more than 1 house

If you own more than one house property,

- The I-T Department only counts one property as a self-occupied house.

- It treats all other houses as rented properties even if they are not rented at all.

- Rental income calculation is based on what rent a similar property in the area would earn.

So if you own more than one property, then only one house of your choice will be considered as self-occupied and others will be considered as let out or Deemed to be let out (if not let out). Therefore, you should carefully evaluate and choose a property with less tax liability.

Multiple Houses and ITR

- If you have more than 1 property you cannot file ITR1. You can file any other ITR based on your type of Income. Use our article to find Which ITR Form to Fill?

- For Every Property add the details to calculate the Income From House Property. Click on Add Properties in Excel and Add in Java

Evaluating which House to be Self Occupied from many Self Occupied Properties

Example 1 Shiva owns two houses both Self Occupied. He can choose one which will minimize his tax liability.

| Particulars (If Deemed Let out) | House 1 | House 2 |

| Annual Value | 3,60,000 | 7,00,000 |

| Less: (Municipal Taxes) | (40,000) | (54,000) |

| Net Annual Value (NAV) | 3,20,000 | 6,46,000 |

| Deductions u/s 24 | ||

| (a) 30% of NAV |

(96,000) | (1,93,800) |

| (b) Interest on borrowed capital |

(1,75,000) | (2,50,000) |

| Income from House Property | 49000 | 2,02,200 |

Income from House Property Option 1: House 1 Self Occupied, House 2 Deemed to be Let Out.

| Description | Amount |

| House 1 Self Occupied | 0 |

| House 1 Interest | -1,75,000 |

| House 2 Deemed to be Let Out | 2,00,200 |

| Income from House Property | 27,200 |

Income from House Property Option 2: House 1 Deemed to Let Out, House 2 Self Occupied

| Description | Amount |

| House 1 Deemed to be Let Out | 49000 |

| House 2 Self Occupied | 0 |

| House 2 Interest | -2,50,000 |

| House 2 Interest that can be claimed | -2,00,000 |

| Income from House Property | -1,51,000 |

If Shiva considers House 1 as Self-occupied and House 2 as deemed to be let-out then his income from house property will be Rs. 27,200

If Shiva considers House 1 as Let out and House 2 as Self occupied then his income from house property will be Rs. -1,51,000.

Therefore, he should consider House 1 as deemed let out and House 2 as self occupied

Income from House Property when there 1 House is Self Occupied and Other house is given on rent

ABC is a marketing officer at Lucknow. He owns two residential houses. The first is in Delhi and was constructed on 31.12.1991. This has been let out on a rent of Rs. 3,000 p.m. to a company for its office. The second house is in Lucknow which was constructed on 21.5.2015 and has been occupied by him as his own residence since then. He took a loan of on 1.5.2013 . Total Interest on pre-construction home loan amount is 4800, 1/5 installment is 960. His interest for FY 2015-16 is 7200.ABC was transferred to Mumbai on 1.12.2015 where he resides in a house at a monthly rent of Rs. 4,000 and his house at Lucknow was let out on the same day on rent of Rs. 2,000 per month Other relevant particulars in respect of these houses are given below:

| Particulars | House 1 | House 2 |

| Municipal Valuation | 24,000 | 18,000 |

| Less: (Municipal Taxes) | 10% of Municipal Value | 8% of Municipal Value |

| Expenses on repairs | 2,000 | 6,000 |

| Interest on Loan | 7200 |

Income from 2 House, which is on rent

| Particulars (Let out) | House 2 |

| Annual Value (Rent received) | 36000 |

| Less: (Municipal Taxes) | -2400 |

| Net Annual Value (NAV) | 33,600 |

| Deductions u/s 24 | |

| (a) 30% of NAV |

10.080 |

| Income from House Property | 23,520 |

Income from House which was given on rent from Dec

| Particulars (e (Part of the year let out and part Of the year self occupied)) | House 2 |

| Gross Annual Value higher of the following two: | 36000 |

| a) Municipal value or Fair rent, whichever is more, i.e., Rs 18,000 or Rs. 24,000 | 24,000 |

| Actual rent received or receivable 2,000 *4 | 8000 |

| Net Annual Value whichever is more, i.e., Rs 18,000 or Rs. 24,000 | 24,000 |

| Less:- Deduction u/s 24 | -2400 |

| a) Statutory Deduction @30% | 24,000 |

| Deductions u/s 24 | |

| (a) 30% of NAV |

-7,200 |

| b) Interest on Loan (7,200+960) | -8,160 |

| Total Deduction 7200 + 8160 | -15,360 |

| Income from House Property (24,000-15,360) | 8,640 |

Total Income from House Property = 23,520 + 8640=32,160

Related Articles:

- How to fill ITR1 for Income from Salary,House Property,TDS

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

- Pre-Construction Home Loan Interest and ITR

- Joint Home Loan and Tax

I have to say that you have shared a commendable blog, it is very useful for those who want to enjoy together and work together. For more inf :- https://www.helsbyconstructiongroup.co.nz/

I have 3 house properties h1,h2, h3 then i was self occupied in h3 having 4 floors then 3 are letout and having actuals rent 35000, 30000, 34000 how can i calculate GAV

If there are 3 properties ( houses ) owned jointly by husband and wife . One is self occupied .

The other two are earning rentals . How is the taxation done ? Can husband and wife have one rental property each , since one house is self occupied by both .

If I have only one flat which is vacant.Is it comes under self occupied or let out? Do i need to consider it as a deemed to let out and consider minimum rent and calculate income for house?

For Ex: There is interest of 1.64L for the flat.Its vacant and i am staying in rent. It’s come under self occupied and i would consider whole interest -1.64L as income for house and deduct for total taxable income?

Or

I need to consider minimum rent say 10K. No munciple taxe. 30% deduction = 70K and total deemed rent out = 1.2L- 30K = 90K

Income for house = 90-1.64L = -74K which is deduct from total taxable income?

Which one is correct?

Thanks

Satya