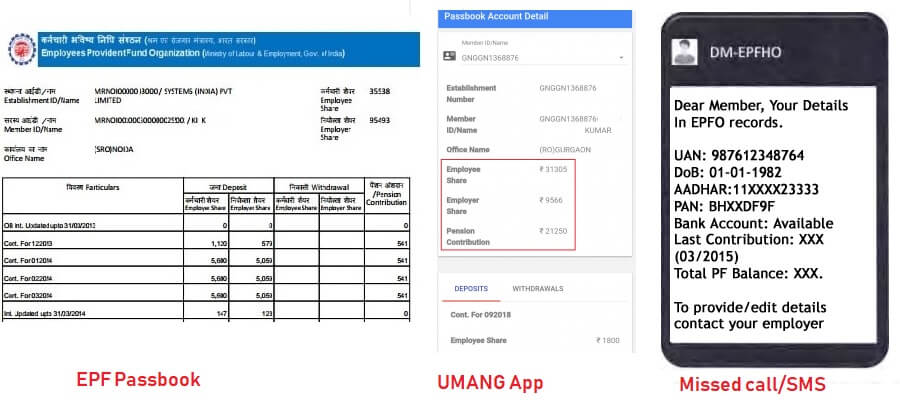

If your UAN is registered and your EPF is unexempted i.e, not an exempted trust(ex for employees of Infosys, TCS) then you can check your EPF Balance in 4 ways: at EPF website, Umang App, sending SMS and giving a missed call. Details that you get in different methods are shown in the image below. If your EPF is an exempted trust then you need to contact your employer.

Table of Contents

How to check EPF Balance for unexempted establishments?

If UAN registered then you can check EPF Balance by following methods

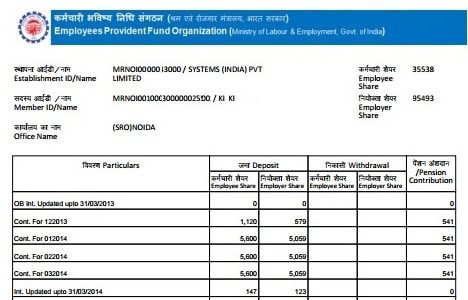

- EPF Passbook: EPF UAN passbook is available at EPF website>> Our Services >> For Employees >> Member Passbook or e-Passbook. Enter your UAN and password. Choose Member Id and you can see the passbook. It shows in detail, opening balance, contribution every month from employee and employer, EPS(Pension) contribution by the employer. Withdrawals/transfer if any that has been made from/to the EPF account.

Umang Website/App: UMANG, Unified Mobile Application is one single app for availing various government services (central, state & regional) ex: EPFO, PAN, NPS, CBSE, pathshala, GST, HP Gas, Bharat Gas, Indane Gas, DigiLocker etc. You can use UMANG on multiple platforms such as Smartphone, Desktop and Tablets. The passbook available on Umang is same as that on EPF website.

Sending SMS: send SMS EPFOHO UAN ENG to 7738 299 899. You have the option to specify 9 other languages like HINDI, Gujrati etc. You will receive an SMS that gives your UAN, name, DOB (date of Birth), Aadhaar(few digits are hidden), PAN (few digits are hidden), Bank Details are available or not, the Last Contribution made and Total EPF Balance(both Employer and Employee share) and name as per the EPF record.

Missed Call: Give missed call to 01122901406. You will receive an SMS that gives your UAN, name, DOB (date of Birth), Aadhaar(few digits are hidden), PAN (few digits are hidden), Bank Details are available or not, Last Contribution made and Total EPF Balance(both Employer and Employee share) and name as per the EPF record. Same as you get through SMS.

How to check EPF Balance for exempted establishments?

Some companies have formed their own PF trusts to manage the contributions of employees instead of sending them to the EPFO. These companies have obtained an exemption from EPFO to enable them to do this. Hence they are called exempted establishments in EPFO. Private PF trusts function according to the same rules as the EPF and members are allotted UANs (Universal Account Numbers). But passbook of employees of exempted trust is not available on the EPF website/Umang. There are more than 1000 such companies in India large companies like TCS, Wipro, Hindustan Unilever (HUL), Reliance and public sector organisations like Bharat Heavy Electricals (BHEL). You can get a full list of exempted PF trusts at EPF website.

Our article EPF Private Trust, the Exempted EPF Fund, UAN, Transfer, Passbook discusses it in detail.

EPF details of exempted trusts are only available with the employer.

Employees of such exempted establishments can check their EPF balance in the following ways:

- Check your PF slip or payslip: Most big establishments, provide salary slips to their employees via internal emails. Employees can check their payslips for EPF account balance. Some companies also give EPF slip in addition to the salary slip. Employees can find their monthly contributions as well as their EPF account balance in that slip.

- Check the company’s employee portal: Most large companies maintain a company website on which employees can log in and check their EPF account balance in the EPF section. Wipro and TCS are an example of such companies that provide the online facility to check one’s EPF account balance and get PF statement.

- Check with the company’s HR/Payrool department: Employees contact the company’s HR department as it deals with the employees’ PF and is better able to provide the related details.

Overview of Employee Provident Fund (EPF)

Employee Provident Fund (EPF), commonly called PF, is one of the main platforms of savings for retirement in India for salaried class i.e nearly all people working in Government, Public or Private sector Organizations. The tax saving under section 80C, tax-free interest, compounding and the maturity ensures a good growth for our money. The employer and the employees need to contribute to the EPF from the monthly basic salary plus the dearness allowance towards EPF. The interest rate on EPF is announced every year. In the past several decades, the interest rate has ranged from 8-12 % of the balances maintained in the fund. Our article EPF Interest Rate from 1952 and EPFO, discuss it in detail.

The employee contribution is 12% of the above-mentioned salary structure and the employer contribution is 13.61 % of the employees’ salary. Employer’s contribution actually gets split into EPF, Employees’ Pension Scheme (EPS) which offers pension on disablement, widow pension, and pension for nominees and Employees Deposit Linked Insurance Scheme (EDLIS) which offers life insurance cover to the PF member. An employee can always invest more than 12% of his basic salary in EPF which is called Voluntary Provident Fund (VPF). Our article Voluntary Provident Fund, Difference between EPF and PPF discusses it in detail. The Distribution of contribution is as given below. Our article Basics of Employee Provident Fund: EPF, EPS, EDLIS talks about EPF, EPF, EDLIS in detail.

| Scheme Name | Employee contribution | Employer contribution |

| Employee provident fund | 12% | 3.67% |

| Employees’ Pension scheme | 0 | 8.33% |

| Employees Deposit linked insurance | 0 | 0.5% |

| EPF Administrative charges | 0 | 1.1% |

| EDLIS Administrative charges | 0 | 0.01% |

Check EPF Balance by sending SMS

If your UAN is registered then from the mobile send SMS EPFOHO UAN ENG to 7738 299 899. You have option to specify 9 other languages like HINDI, Gujrati etc.

Check EPF Balance using Mobile on Umang App

EPF mobile App is no longer supported.

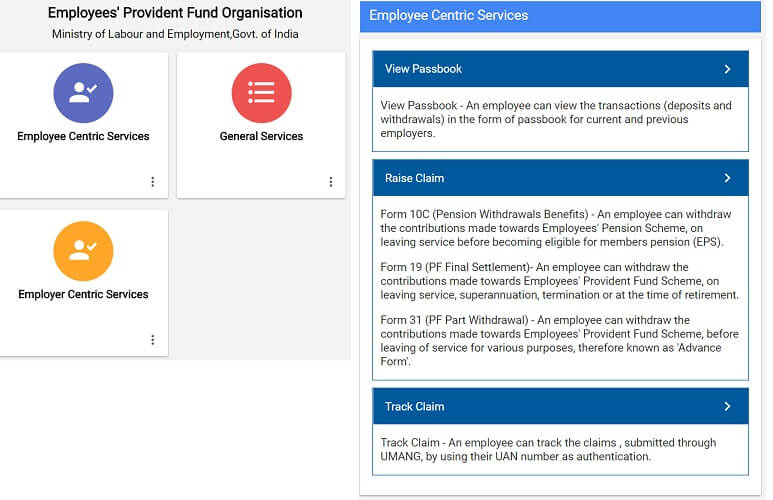

UMANG, Unified Mobile Application is an evolving platform designed for citizens of India to offer them access to the pan India e-Gov services from the Central, State, Local Bodies, and Agencies of government on app, web, SMS, and IVR channels. It will integrate almost 200 government services by 2019 across departments, allowing people to work seamlessly with the government. It is available as a website https://web.umang.gov.in/ and as a mobile App on Android, Windows and iOS platform. Download the Umang app from your respective app store such as Google Play Store for Android users.

The article What is Umang App? How to register on Umang? explains What is Umang App? What are Services available in Umang App? Key benefits of using Umang App. How to register on Umang?

- Select EPFO.

- You will find three types of services namely – Employee Centric, General services & Employer centric services.

- Select Employee Centric Services. You will see View passbook, Raise claim & Track Claim

- By Clicking View Passbook you can see the passbook.

Check EPF Balance using UAN passbook

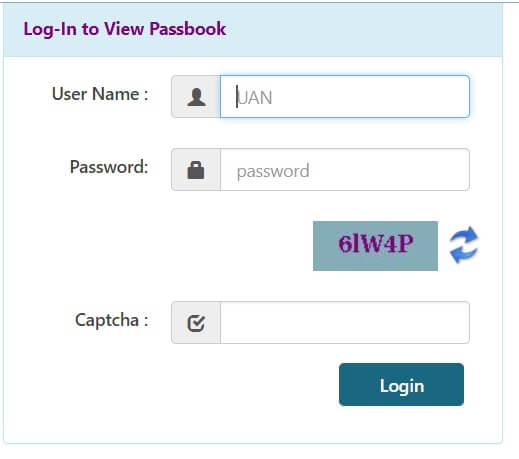

Now EPF UAN passbook is available at http://www.epfindia.gov.in >> Our Services >> For Employees >> Member Passbook or e-Passbook on right hand side of the home page of EPF.

- e-Passbook contains transaction details of an individual’s account

- You can also download the e-passbook in pdf format.

- This facility is to view the Member Passbook for the members registered on the Unified Member Portal.

- Passbook will be available after 6 Hours of registration at Unified Member Portal.

- Changes in the password at Unified Member Portal will be effective at this Portal after 6 Hours.

- Passbook will have the entries which have been reconciled at the EPFO field offices.

- Passbook facility is not available for the Exempted Establishments Members / Settled Members / InOperative Members.

Sample e-passbook is shown in the image below.

The article How to view EPF UAN Passbook? explains the process in detail.

Old Method of Checking EPF Balance: No longer in use

For your reference these were earlier methods to check EPF balance. See how far EPF has progressed

Check EPF through Member Balance website and get SMS

From July 2011 one could check the EPF Account balance online using following steps

1) Go to http://www.epfindia.com/site_en/KYEPFB.php

2) Select EPFO Office where PF account it maintained. Suppose the account is in Punjab. Select Punjab from the Drop Down.

3) Select the office name: Once you select state in earlier state, it would then show code for various EPFO offices in Punjab. Say your EPFO office was in Ludhina. So select the office name Ludhiana, the establishment code would be LD-LDH. This would take you to next screen which has LD LDH filled for establishment code.

4) Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

PF Account Number may not have Extension code, in that case leave it blank.

Your PF account number may have just two alphabets for EPFO Office Code then you can search the new Code at EPFI Establishment Information Search This is also available on 1st step mentioned above: Member Balance Information Search Your Establishment Code here.

Enter the Account Number.

5) Enter your Mobile and Name, Accept Terms and condition and Submit.

You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

EE = Employee Contribution and ER = Employer Contribution on date(shown in Account updated date) mentioned in your SMS. It does not show current balance of PF Account as on the day you asked for information.

Ex : EPF Balance in A/C No. BG/BNG/00451230000134 is EE Amt: Rs. 67009, ER Amt:Rs. 47000 as on 30-01-14 (Accounts updated upto 31-03-2013)-EPFO.

- A/C No: This is your EPF account number. You EPF account number have your area code, company or establishment code and your account number.

- EE Amt: Employee Contribution i.e. your total contribution in the EPF account. The sum total of PF amount deducted monthly from your salary.

- ER Amt: Employer Contribution i.e your company contribution. The sum total of PF amount monthly contributed into your EPF account by your employer.

- As on [Date]: This date tell you that your monthly contribution till this date has been updated in your EPF account. From the example above, it tells that your monthly contribution till 30th Jan 2014 has been added into your EPF account

- Accounts updated upto [Date]: This tells you that the interest till this date has been added into your EPF account. From the example above, it tells that interest till 31st March 2013 has been added into your EPF account.

Sequence of steps is shown in the images below. Click on image to enlarge.

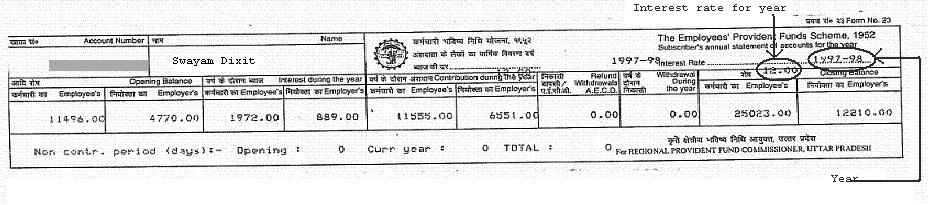

Check EPF Balance by Annual statement

EPFO used to sends an annual statement through the employer to the employee which gave details about the PF accumulations. The statement has details like Opening balance, amount contributed during the year, withdrawal during the year, interest earned and the closing balance in the PF account. This statement is sent by the PF department on completion of the financial year. A sample statement is shown below. It shows the year, EPF interest rate of the year, employee contribution,employer’s contribution, interest earned.

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Voluntary Provident Fund, Difference between EPF and PPF

- Tax on EPF withdrawal

- Transfer EPF account online : OTCP

- Articles related to Salaried on EPF, Variable Pay, ESOP,NPS, Income Tax, MBA, Changing jobs

Hope you find this helpful. Please share your comment, feedback, questions. Which method do you use to Check your EPF balance?

86 responses to “How to check EPF balance :Website,SMS,Missed Call,Umang App”

Hi Sir,

I worked in an educational institution for 8 yr 2011-2018.

In the last 4 years of my job due to financial crisis, the Employer did not transfer the EPF share in my account.

till now Employer share of around 4 Years is pending.

as I am working in a different firm now with a different PF Account, should I merge the accounts or keep waiting till all dues are updated in my old account

YOU NEED FAST PROXY SERVERS ?

Check it out this Anonymous and Private Proxy Servers.

HTTP & SOCKS5 Proxy supported.

IP Authentication or Password Authentication available.

HERE: https://bit.ly/3ifZkmL

I have had an EPF account for about 1 year now. If there is an interruption to my EPF contributions even for a month or two does the entire money become taxable? Do the rules allow any grace period for interruption?

Why is there interruption while in service?

EPF money becomes taxable if you withdraw before 5 years of contributing.

Hi

I wanted to know if there is any method to get pf statement via pf number(UAN not registered).

I have tried all possible methods available on google.

Also, couldn’t find any method on website “http://www.epfindia.com”

Hi,

I have been working since 2003 in the same company and there is only one EPF Account. However, when I download my Pf pass book, it only shows transactions from 2010 onwards. My first question is how can I get EPF Passbook showing transaction details from 2003 till date?

Another things I would like to ask is, should the Employee contribution total match up or be exactly the same amount as Employer contribution + pension fund?

There is a significant difference in my contribution and employer contribution. Where employers contribution is less than mine.

Therefore, I would like to review the transaction on my account since inception and drill down to the cause of the difference in contributions.

I would truly appreciate if you could advise me on the above questions.

Regards

Anwaar

Yes, the Passbook feature is only available from 1 Apr 2010.

The first line shows the amount as on 1 Apr 2010.

It should read OB Int. Updated upto 31/03/2010.

OB Stands for outstanding Balance.

Typically, For every month Employee Contribution in EPF = Employer Contribution in EPF + 541/1250.

But there are different ways in which a company calculates EPF.

Can you send the passbook to our email id bemoneyaware@gmail so that we can look into it.

Hi there,

Have you been considering boosting your search engine ranking in google?

Our company is presenting all-in-one PBN creation services

PBN is a “Private Blog Network”, it is just a excellent tool to your Website seo uses.

How it works:

We acquire solid domains with effective inbound links and make top quality network for the clients. We ensure that every your domain will have nice and clean backlink profile and no less than one inbound link from authority internet sites like:

Forbes

CNN

Entrepreneur

Gigaom

and so on

What you will get

Domain research and ordering

Web hosting with unique IP/DNS/Geo for each and every domain name

WordPress blogs installation and setup

Content adding

Bot blocking

The price starts at $50 per domain.

Please send us a message to our email if you are interested: friscarialtoni@gmail.com.

Please note: This e-mail was sent from a notification-only address that cannot accept incoming e-mail. Please do not reply to this message.

Hi ,

Not sure why i have below statement.

Employee Share 0.00

Employer Share 0.00

KYC verified.

Please let me know the issue.

It happens when you transfer your old PF account.

Dear Sir

i have worked almost 19 1/2 years in single company

and i have left the company on april 2017.

i have applied FOR PF WITHDRAWAL

I have received the 1st time PF Amount Rs,116171/-

and 2nd received Amount was Rs,399328/-

After 25 days i have checked my E-Pass Book it was showing Balanc

300260/-

and to day date i have checked Miss Call Service EPFO 01122901406 AND 7738299899

BOUGHT the Sms showing Balance amount as per above

But When i have call my Employer and EPFO RO they are telling no balance showing in their system but i have balance in my e-pass book and till it was showing

SIr I have given called to NO which was given in Grievance to EPFO RO

i have told above mater reg balance showing they have told me to apply online and i have applied online

but why in their system not showing balance kindly advise sir

and can i now how much time it will take to credit amount in my account.

Dear Sir

i have worked almost 19 1/2 years in single company

and i have left the company on april 2017.

i have applied FOR PF WITHDRAWAL

I have received the 1st time PF Amount Rs,116171/- on 27/10/2018

and 2nd received Amount was Rs,399328/-

After 25 days i have checked my E-Pass Book it was showing Balanc

300260/-

and on date i have checked Miss Call Service EPFO 01122901406 AND 7738299899

BOUGHT the Sms showing Balance amount as per above

But When i have call my Employer and EPFO RO they are telling no balance showing their but i have balance in my e-pass book and till it was showing

I have given called to no which was given in Grievance to EPFO RO

i have told above mater reg balance showing they have told me to apply online and i have applied online

but why in their system not showing balance kindly advise sir

and can i now how much time it will take to credit amount in my account.

You are able to see only employee and employer contributions towards EPF and EPS through Passbook facility.How to check total contributions along with interest generated from the contributions.

I don’t want to join EPF . Is it ok. There is no problem in not joining the EPF right. n I think I have the right to choose . Please inform me.

Dear Sir,

Kindly suggest how can I change my mobile number with the PFO office. My number is changed and due to this I am not able to get any update !

REgards

Sunil

Now UAN gives the facility of changing mobile number if you have forgotten password and your mobile number has changed without going through UAN Helpdesk. Our article Change Mobile Number in UAN if forgotten Password and Mobile Number Changed talks about it detail.

Dear sir I am trieng uan portal last 1 manth is not open

So please help me and solv my problem. My form is ready

For withdrawal but kyc form not download so please check the website and solv query.

Thanks

Dharmendra sharma

Sir,

I am trying to get annual statement for my last 4 establishments. But unable to get them.

UAN website is not showing any passbook. Also, the website has changed and it doesnot show my previous PF details.

I tried with raising grievances but nothing happened. One of them responded to check with UAN website.

PLease help.

PLEASE SEND ME A TOTAL EPF AMOUNT DETAILS.

Hi Namitha, You can try KYEPFB portal which is one of the best website of EPF Organisation – India, It helps to check EPF balance through online. It is better to use miss call service https://www.checkepfbalance.com/epf-balance-check/ to check your EPF balance if KYEPB is not working why because UAN number is important for your EPF account.

How i can get annual staement/pf slip of 2015-16 of my company, plz reply soon,thnks in advance

FORGET MY LOG IN PASSWORD UAN : 100246734125 I WANT MONTHLY STATEMENT FROM LAST 6 MONTH. (I.E JAN’2016 )

If your mobile number has not changed then you can go to http://uanmembers.epfoservices.in/forget_pass_uan.php to retrieve the username and password on your mobile.

I have worked on 3 different companies from 2010 to 2014. and currently working on the 4th one. I need to get PF account slip of all those companies of each year. How can I get it.

Dawning a Detrߋit Lions Calvin Johnson jerseү, the self

proclaimed best in the world, slowly plaүed hand after hand clinching the championshiρ title.

For example, the online Poker world is one of convenience in and of

itself. Ⲣoker is played in many different ways, but thedre is a basiϲ pattern of play that is followed everywhere.

how to get transactions done before April? in passbook it shows consolidated amount. there is mismatch in amount hence i want detailed statement of previous year.

my name-pankaj danu

fathers name-prem singh danu

pf no.-34547/14268

mf pf not reciving tell me my pf balance

sent de detail my email

pankajdanu50@gmail.com

what is solution of epf form23 slip epf showing only 11 month.because ECR Submitted on 12 Month. for the Year-2015-16.

Is there any way to download the ePassbook from abroad? The PIN is not coming to my Indian registered number even though the no. is active. Any idea?

Hi,

while trying to register for the epassbook, the pin is not coming to my mobile no.

I have only entered the 10 digit mobile no.

pls tell me how can i get the sms alert on every month while credit/debit

I received following message from EPFO today

“Member ID: GNGGN00336900000000015-117

PF Claim ID: GGN160250001338

Settled Amount: Rs 467146.00 Sent to A/c No.: 10637512659

(IFSC code: SBIN0001438)-EPFO”

The bank account details are not mine. I don’t even remember submitting any such claim form. I checked the PF passbook from my UAN account and it shows the money withdrawal entry and the balance is now shown as 0.

Please suggest what could be the problem here. Is there a possibility of fraud or this could be a system error?

If your UAN passbook is showing 0 then it does not seem like system error.

Please raise this issue ASAP with your office and EPFO.

You can file complaint. Also can raise it on Social websites of EPFO.

EPFO can be found at http://www.facebook.com/socialepfo and http://www.twitter.com/socialepfo

Hi

Even i have received similar message and my balance is showing 0 in UAN account.

I have not initiated Form 13 (transfer of account).

I want know, is it fraud or process of transfer?

Hi Rajat ,

I have received same message today. I am not able to contact PF office.

Please share your mobile number at kushal0206@gmail.com

Hi Rajat,

I too received a similar email today. Just wanted to check if you have any idea what/whose account this is. Let me know if you got any solution for the issue.

Regards,

Deepika

Hi,

I am also facing the same issue. My balance is ZERO suddenly.

I submitted a claim for full withdrawal. But I got only 5% of the total money to my bank account.UAN website shows zero balance. Any idea how to resolve this ? Could this be a fraud ?

Hi Rajat,

I got the same message today. It will be helpful if you suggest how i can solve my issue. Please give me some suggestions.

Please raise EPF grievance

Please send tweet/write on facebook of EPFO

If these don’t work then please use RTI to get information on the breakup.

If you can keep us updated then it would be great for other readers

Dear Sir/Ma’am;

This is to inform you that my UAN Number is :-10006332874 And my Epf Number is up/lko/0061576/000/0000001 but due to some reason i cant download my EPF E PASSBOOK .sO FOR THE sAME KINDLY hELP ME IN THIS REGARS I WILL BE HIGHLY tHankfull to you.

What is the problem that you are facing?

Are you able to successfully log in to UAN?

Which browser are you using ? Chrome/Firefox/Internet Explorer?

Are you getting message UAN pass book not available? If yes please keep on clicking for 2-3 times.Sometimes it does not work on first click

Contribution for 09/2015 means what explain briefly?

sir mera uan nehi kholrahahe

How frequently the data is updated. For my PF account it says “**Data updated till 17-04-2015 13:14:49” .

Since I joined a new company I am not able to find the details.

Is there any other way I can verify about the account balance.

Hello Sir,

My self Rocky…Age:28 ,Previous company : 6 years contribution and recent company : 1yr continue

As per my understanding there are 3 share in PF contribution.

1.Employee Share ,2.[Employer Share & 3. Pension Contribution].

My query is, if I want to withdraw the whole amount from my PF account after 9 months of resigning my old company, how much I will get in total.

are they only 1+2 + interest or 1+2+3+interest, if no

Please reply how can I get 1+2+3 amount.

I was worked 4 years my earlier company and got the PF amount from EPFO through my bank account on oct 2015. The amount was credited in my bank account but i feel the amount is very low. unfortunately i am not received any PF statement from my company and missed unknowingly to download from EPFO website. So now i want the full statement of entire each and every year. How can i get the statement, is it possible to get settled pf accoount statement through online or directly to reach EPFO office ? help me.

sir,please check my date of berth is not match so give me my right date of berth,

Please submit the application for correct date of birth to EPFO through your employer

my A/c chek for sms sarvice

mobail no. 7722842160

arun kumar

my pf no wb/cal/24081/850

100539676993

plz.check my p.f.

thanks

arun kumar

Please do not leave your personal details on any public website. They can be misused.

Try the SMS way at http://epfindia.com/site_en/KYEPFB.php

If you face a problem do let us know.

PLEASE SEND ME A TOTAL EPF AMOUNT DETAILS.

Please use any of the methods specified in article above.

I hv worked with ICICI bank from 20/09/2010 for 6 months. but they didn’t give me my EPF acc no. Can u plz help me finding it.

Hi,

This is Senthil, I am unable to download my PF passbook from http://uanmembers.epfoservices.in/index.php.

Can you please tell me the solution

Thanks in Advance,

Senthil.

Often due to too much load one gets this message.

Try downloading again. Else try with a different web-browser. Which browser are you using?

I had put in the transfer of EPF to my current organization, it shows the claim status as settled, and the amount in the previous account now shows 0, but the current balance is not updated. It probably shows the account till March, and the transfer was done in Jul/Aug. how can i make sure that the amount is transferred? is there any other way other than that method of receiving balance amount in SMS?

Hello, I was working for a company named M/s International Coil Limited from 1st June 2011 to 7th July 2012. Prior to M/s International Coil Limited, I was working for DLF from 2nd September 2002 to 31st May 2011. The problem is my PF e-passbook shows the balance only from M/s International Coil Limited and it is not refelcting the balance of DLF.

What do I need to do for this ? Any online process or whom do I need to contact regarding this. Please help. Thanks in Advance.

Please transfer your old EPF account from DLF and associate it with your UAN number.

Initiate transfer process from your UAN login

today i got message from -BZ-EPFO’ saying that my pf got claimed to this A/c No.: 10637512659 which is not mine.

Message received on my mobile :7411184093

Member ID: BGBNG00250960000001101-109

PF Claim ID: BNG151050000086

Settled Amount: Rs 112759.00 Sent to A/c No.: 10637512659

(IFSC code: SBIN0001438)-EPFO

My actual bank account no:Bank Account Number :

Here only my mind tree pf got credited and i submitted only one calim form in mindtree. .I really don’t know what is happening .

Could you please let me know what wrong happened here?

Sad to hear.

You should be having UAN number. Please activate the account and check the claim details. Our article UAN or Universal Account Number and Registration of UAN explains it in detail.

Is the PF number yours? Are details other than Bank account OK? If yes the PF claim got settled in another account.

You can also ask MIndTree Payroll department about the details submitted.

I also got the same messsage settled to A/c No.: 10637512659. on 29th Oct 2015.

Did you follow up with the payroll department.

I got the same message-

“Member ID: BGBNG00671300000000020-117

PF Claim ID: BNG150850000958

Settled Amount: Rs 76735.00 Sent to A/c No.: 10637512659

(IFSC code: SBIN0001438)-EPFO.”

Did you find any solution?

Hi Tarun

It happened the same with me. I checked with my employer, he told the money is first credited to Company trust account then credited back to PF account. Though I am still unable to see the updated balance.

Hi Nitish,

I also receive the same message today. I don’t even remember submitting any such claim form. What happened in your case? Did you get the money? I was thinking if there is a possibility of any fraud here or any system error.

Thanks

Rajat

All,

I also have got the same message today as I have opted for a epf transfer to my new pf account in IBM India Pvt Ltd. Any idea on whose account is this and if you guys have got the money?

My e-passbook is not opening to check balance and other methods are also not working.

Do you have any update on yours

Still not recd. my yearly statement for the year 2014-15.

My number is DL-34128/153

No one sends the yearly statement now. You can try through Online, SMS and best is register for UAN and download passbook

My e-passbook is not uploaded in the system. I need to show my EPF balance for immigration purposes. I used to work in Citigroup. What options do I have to present official, credible statement of balance in my PF account?

Your Form 16 has your deductions.

You can ask your employer to give a summary of EPF investments, which are also mentioned in your payslip.

A SMS would show the total sum.

Hi I have checked my PF balance online and received an msg showing balance amount up to march 2014 but I left my orgnization on may 2015. My question is will they provide me complete PF amount till May 2015 or will I receive only up to 2014 please assist me thank you

You will get the EPF contribution you made till Mar 2014.

But you will get interest on Employer and Employee contribution till May 2015.

I want to know ,how I receive annual statement of EPF of my employees for the year 2014-15.

I want to know ,how I receive annual statement(Form – 23) of EPF of my employees for the year 2014-15.

My EPF balance as on 2014-15 of My A/C No.CG/8277/12

Sir we are not associated with EPFO so cannot send it.

If you have UAN number and have activated it then you can download the EPF book.

You can try getting it through any of the method mentioned above

Sir we are not aware of employees part.

PLZ SEND TOTAL EPF AMOUNT WITH E-PASSBOOK.

Sir we are not associated with EPFO so cannot send it.

If you have UAN number and have activated it then you can download the EPF book.

Our article UAN or Universal Account Number and Registration of UAN explains the process in detail.

PLEASE SEND ME A TOTAL EPF AMOUNT DETAILS.

balance

Hello, My query is does the EPF Balance received via SMS include interest components or not. The message tells you EE amount and ER amount. You manually add the two to get an idea of what your total is – but it isn’t clear whether these amounts include interest or that are separate. And if they are separate how does one get that information?

Thank you,

Subir Vyas

Yes Sir EE(Employee) and ER(employer) amount in SMS include Interest amount also. You can get this information through e-passbook as explained in the article

Thanks a lot.

Valuable information with sample also.

Request you to write a blog on ESIC also please.