Whether you are looking for a home loan, car loan or a personal loan, an EMI calculator is an effective and efficient tool that helps you calculate the equated monthly instalments (EMIs) that need to be paid to the lender each month until the loan is fully repaid.

Table of Contents

Why do you need to calculate your EMI?

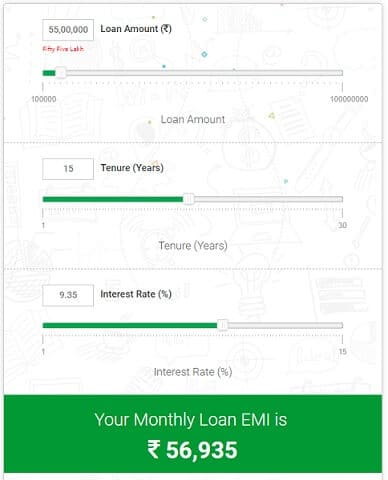

In this day and age, where expenses are rife, it would be prudent to pre-plan your monthly outgoings in EMIs. An EMI calculator predominantly helps you determine the amount that needs to be paid each month. All you need to do is enter your loan amount, interest rate and tenure, and it instantly provides you with the resultant EMI amount. With this all-important figure in hand, you can then chalk out a relative budget for your monthly expenses. Needless to say, an EMI calculator is essential for sound financial planning.

What all can an EMI calculator tell you?

Besides helping you figure out your EMI amount, the calculator also helps assess your loan amount eligibility – thereby, letting you know how much of your required loan amount can be financed. In fact, more sophisticated EMI calculators also consider local and state taxes, insurance, and your running loan EMI, if any.

The calculator also shows your amortisation schedule, which is basically the progressive payoff of your loan along with the break-up of each payment that gets attributed to principal and interest.

To give you an important example, let’s discuss how a home loan EMI calculator works, and how it can help you save money in the overall scheme of things.

Today, there is no denying the fact that purchasing a home is on every person’s bucket list. With some steady financial planning, you can turn this distant dream into a much-desired reality. Here, a home loan calculator can prove to be really handy. What’s more, it can also help save you a good amount of money. Once you determine your EMI amount using the calculator, here’s what you can do:

Go for a Higher Down Payment

Down payment is the amount that you pay upfront at the time of purchase. Opting for a higher down payment inherently reduces the principal amount, thereby resulting in lower interest payouts, which translates to lower EMI payments.

Keep the Prepayment Option Open

It would be wise to opt for a loan that permits you to pay a part of the home loan amount before the end of the loan term. This can help reduce the total interest outgo on your loan. However, some financial institutions and banks charge a penalty on prepayment, so be sure to check the terms before taking the loan.

Increase Your EMI

With an increase in net income every year, a salaried individual can look to increase his/her EMI to save money on the overall interest outgo.

Boost Your EMI

If you receive an annual bonus or a promotion, you can use the money to pay for an extra EMI, which not only saves interest but also helps repay the loan quicker.

Make the Switch to MCLR

If you’ve taken a home loan before April 2016, you can switch to the Marginal Cost of Funds Based Lending Rate (MCLR) facility, which allows you to benefit from the change in interest rates. This switch, however, may be subject to tax and a conversion fee. Therefore, before making the switch, conduct a cost evaluation to see if it is finally beneficial. On the other hand, if you’ve taken the loan after April 2016, you’re already entitled to the MCLR facility and benefits.

With a home loan in hand, you can use all the salient features of an EMI calculator to help determine your EMI amount and the money you can save to ultimately own your own dream home.

Our article Home Loan Transfer: Should I Switch My Home Loan? covers it in detail.