Roti, Kapda, Makaan are our basic needs and we all want to have a house of our own. As Indiabulls Home Loans says Shehar mein apna ghar ho toh, shehar bhi apna lagta hai. (If you own a house in the city, the city also feels like your own). Indians want to have a house of their own. Choosing the home loan organization is as important as buying your own home. The most common ways to reduce interest rates is to either go for a balance transfer of the loan or talk to the bank that has provided you the loan to reduce it. This article talks about transferring the home loan, what is Home Loan Transfer, When should you do it? What is the process of Switching of Home Loan?

Table of Contents

How lower interest rate save money in Home Loan?

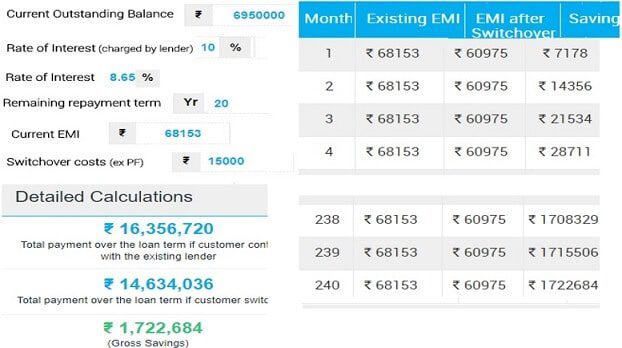

Suppose one has taken a loan of Rs 75 lakh for 25 years at the rate of 10% so EMI is Rs 68,153. After 5 years when the principal outstanding is Rs 69.5 lakhs he transfers his home loan to another bank with an interest rate of 8.65%, his EMI reduces to Rs 60,975. EMI savings per month is Rs 7178. Over the next 20 years period he would save Rs 17.22 lakh as shown in the image below:

What is Home Loan Balance Transfer?

In home loan balance transfer the full unpaid principal loan amount is transferred from one bank to another bank, typically for a lower rate of interest. The old bank that had originally sanctioned the loan and to which you were paying EMI gets the unpaid principal amount and you only have to pay your EMIs at the new rate to the bank that has taken up the loan. Home Loan Balance Transfer is when you transfer the home loan from one bank to another. This transfer of an existing loan is also called as refinancing and it can help you get lower interest rates and better terms of repayment.

Should you opt for Home Loan Transfer?

Before making the decision to transfer your home loan to another bank, you must first assess its advantages:

- The first thing to compare is the interest rate and the difference in the EMI. Lesser the EMI means more saving. The difference should at least be a minimum of 0.5% from the existing rate. For example, if Rs 50 lakh is outstanding at 10.9%, you will have EMI of Rs 49,919. If you do opt for home loan transfer at 10%, you save over 4 lakhs in 20 years and if the new interest rate is 9.85%, you will save 5.19 lakhs over 20 years.

- You also should consider processing fees and charges. If the other financial institution charges amount higher than your old rate, there is no point in making the switch.

- Prepayment penalty: Most banks these days don’t levy the prepayment penalty. But if your bank has it, then you can ask your new lending bank to take it into account. This will vary from bank to bank.

- If you opt for a lower interest rate, your interest liability goes down, thus reducing your overall tax benefits.

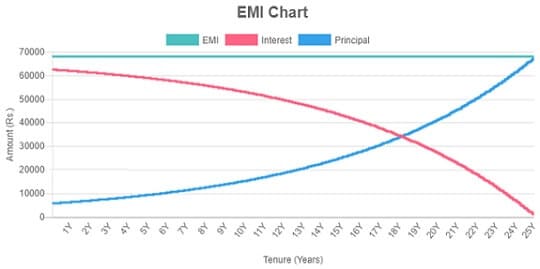

- Know when to make the switch: It is better to make this switch in the early part of loan tenure as EMI comprises a higher interest part, while the principal amount is less. If you are towards the end of your home loan tenure, then it may not save much and might not be worth the effort. The image below shows how interest and principal contribute to the EMI of the loan of above example, 75 lakhs for 25 years at 10% pa with EMI of Rs 68,153.

The thumb rule to validate productivity of a balance transfer is a reduction of 1% if tenure left is less than five years, 0.75% if around 10 years left and 0.25% – 0.5% if 15 – 20 years left.

You can approach an existing bank for reducing the rate. The existing bank may reduce their own rate to match the offer in case they do not want to lose a customer. However, if that doesn’t happen, you can feel free to move to another lender for your home loan.

The exact reduction in EMI varies based upon:

- Outstanding principal amount

- Existing rate of interest charged by your bank

- The rate of interest presently offered by the new bank

During the home loan transfer, one can also apply for a top-up on the home loan, if needed, but there may be processing and legal charges applicable. A top-up home loan allows you to borrow over and above your home loan.

Before transferring the loan check the features offered by new organizations during Home Loan Transfer. For example, You can choose to transfer your existing home loan balance to Indiabulls Home Loans to avail lower interest rates, save more with lower EMI’s or even top-up on your home loan amount. Key features of India Bulls Home Loan Transfer are:

- Low interest rates

- Additional top-up

- Customised repayment options

- Prepayment facility

- Doorstep service

- Online account access

- No hidden charges

- Special rate of interest for women applicants

What is the process of home loan transfer?

Transferring a home loan process is like taking a new home loan. The new bank or NBFC will do all due diligence on your home loan transfer request, will determine your eligibility for the home loan balance transfer. The bank or NBFC where you apply for home loan transfer will do a credit check and if they are not satisfied your home balance transfer request might be refused. Also, you will have to get the documents of your house released from the bank where your loan was originally sanctioned, and this involves some running around. It might take 15-30 days or more for the home loan to be transferred to the new bank. The loan term is determined based on various factors, including the customer’s profile, the customer’s age, and the property’s age at the time of loan maturity, etc.

As per Indiabulls Home Loans, the documents that are required to apply for a Home Loan Balance Transfer are –

Identity & Residency Proof:

- Aadhaar card

- Valid Driving License

- Valid passport

- Voter ID card

Proof of income for the Salaried:

- Last 3 months’ salary slips

- Last 6 months’ bank statements, showing salary credit

- Latest Form-16 & IT returns

Proof of income for the Self-Employed:

- Income Tax Returns with a computation of income for the last 3 Assessment Years

- Balance Sheet and Profit & Loss account statements of last 3 years along with the annexures and schedules

- Current account statements of the business entity for the last 6 years

- Savings account statements of the individual for the last 6 years

Property Papers:

- NOC from the builder

- Registered agreement for the sale

- Chain of all old Agreements for sale

- Certificate of occupancy

- Any maintenance bill, electricity bill, property tax receipt

Other Documents:

- List of all original documents held the existing bank

- Sanction Letter from the existing bank

Switching your home loan to a new lender make sense at a lower interest rate as it can save you a lot of money. However, you should just not look at the interest rate difference but also assess the overall cost before you make the final decision.

Great Blog! Thanks for sharing informative post with us.

This is very helpful information. The home loan transfer becomes very necessary when the other banks are offering a great interest rate. Thank you for sharing the great idea regarding the pros and cons.

Thank you for giving me useful information with the help, i understand the home loan process

http://www.fundmaker.in

The blog is very informative. Thanks author