Opening an account is easy as bank accounts are opened online or the salary accounts are opened by the company itself or a parent opens it for you. But when it comes to a closing of bank accounts that is when the real inertia comes. But closing an account is important. This article talks about, Why should you close a bank account, Steps Involved in Closing Bank Account. Shows the sample account closure form.

Table of Contents

Steps of How to Close Bank Account Savings or Current

Different banks follow different processes but broadly the procedure to be followed is given below.

Before Closing the Account

- The bank account cannot be closed online. One needs to visit their home branch or at least the nearby branch for further procedure.

- If your account is dormant which means it has been inactive due to being non-operative for 2 years, then you will have to first activate the account in order to close it and thereby submit the account closure form.

- If you have a credit card, Demat & Trading account, FD, Loan, Locker linked with the saving account you need to think of what will you do to that credit card/Demat account, Fixed Deposit, Loan, Locker etc.

- Carry document proofs, hard copy to the bank, such Aadhar Card and Pan Card.

- For joint savings account both the account holders are expected to be present at the time of account closure. In some banks, a simple No Objection Certificate (NOC) of the non-present partner should work.

Steps to Close Bank Account

- Withdraw the balance amount from the account. Transfer it to another account. Or you can get the amount as Cash (if less than the amount ex: 20,000 for HDFC bank account) or Demand Draft or transfer to another account in the same bank.

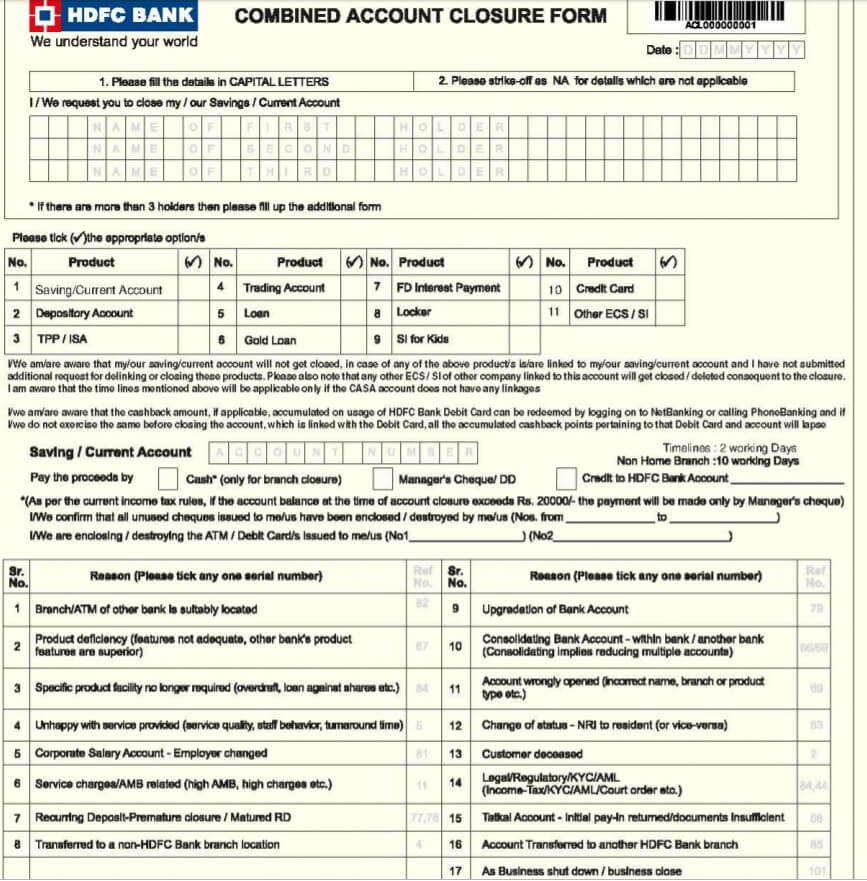

- Fill in the account closure form and submit to the respected bank employee. Account closure form can be obtained from the bank website online or from the bank. Sample closure form of HDFC is shown here.

- One has to specify Reason(s) for closing the account

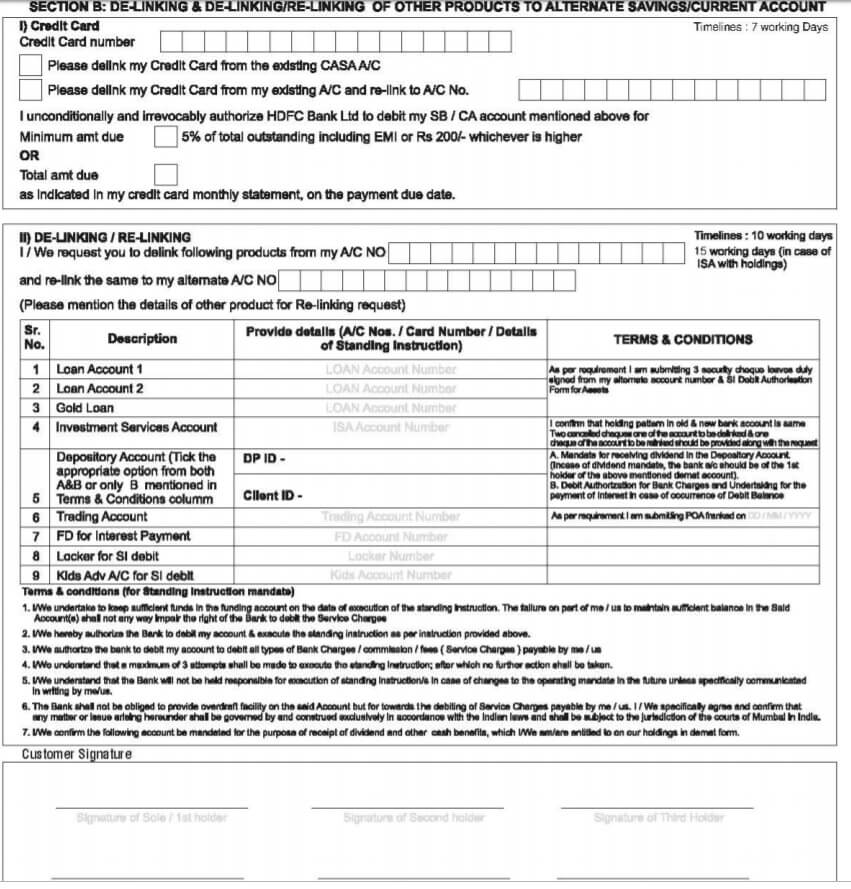

- If your bank account is linked to a credit card, Demat & Trading account, FD, Loan etc you need to delink that.

- The bank officer may ask you to submit a Self-attested signed letter or an application for closure of the account.

- Surrender the cheque book, a debit card issued to you. Some banks may ask the account holder to destroy the debit card once the account holder has applied for account closure procedure

- The officer will check for any kind of remaining/ pending charges tagged with the account. Any fine, dues or other value-added services will then be charged to the account holder.

- The bank may levy account closure charges. For example, SBI charges Rs 500 + GST if you close the account within a year. There are no fixed guidelines for account closure charges. Banks are free to levy any charges on account closure.

- The executive will then give you a copy of the acknowledgement and bank account will be closed within 10 working days

- You will get mail as well as SMS on your registered email id and mobile after account closure.

Why should one Close Bank Account?

Many individuals end up have multiple bank accounts and often they no longer operate them. Often when we change jobs we have to open a new account as companies have tie-ups with different banks and we get a salary account, which has many perks such as zero minimum balance. But when the salary stops crediting to a particular account bank converts into a savings account. Then it becomes a regular bank account.

It is advisable to close the bank account for the following reasons:

- Life becomes simple: Less number of accounts would mean less headache, less regular tracking of transactions.

- Charges: Savings account have paid services such as debit card usage fees, SMS alert fees, ATM usage fees(beyond free transactions). Charges by SBI account are given below and for details, one can read our article Do you know Bank Charges on Saving Accounts, QAB, MAB

- Minimum Account balance. You will also have to maintain a monthly average balance to avoid penalties. Non-maintenance of sufficient funds can lead to MAB charges. For SBI it is shown below.

- Less Interest Rate: Savings accounts offer less interest rates offered(3.5% to 6%). If you invest that amount in a Fixed Deposit, or a Mutual Fund or in a Demat Account, your money will work for you.

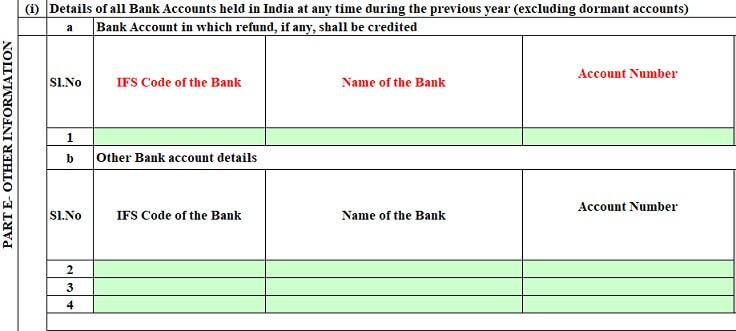

- Income Tax Return: Need to declare your non-dormant accounts in Income Tax Return, as shown in the image below

Sample Account Closing Form

Sample Closure form of HDFC is shown below. Other bank account closing forms are similar.

The image below shows part of the account form which shows how to transfer the balance in the account and Reasons for closing the account.

The image below shows the delinking/relinking of the credit card, loan account, Locker, FD from the bank account to be closed.

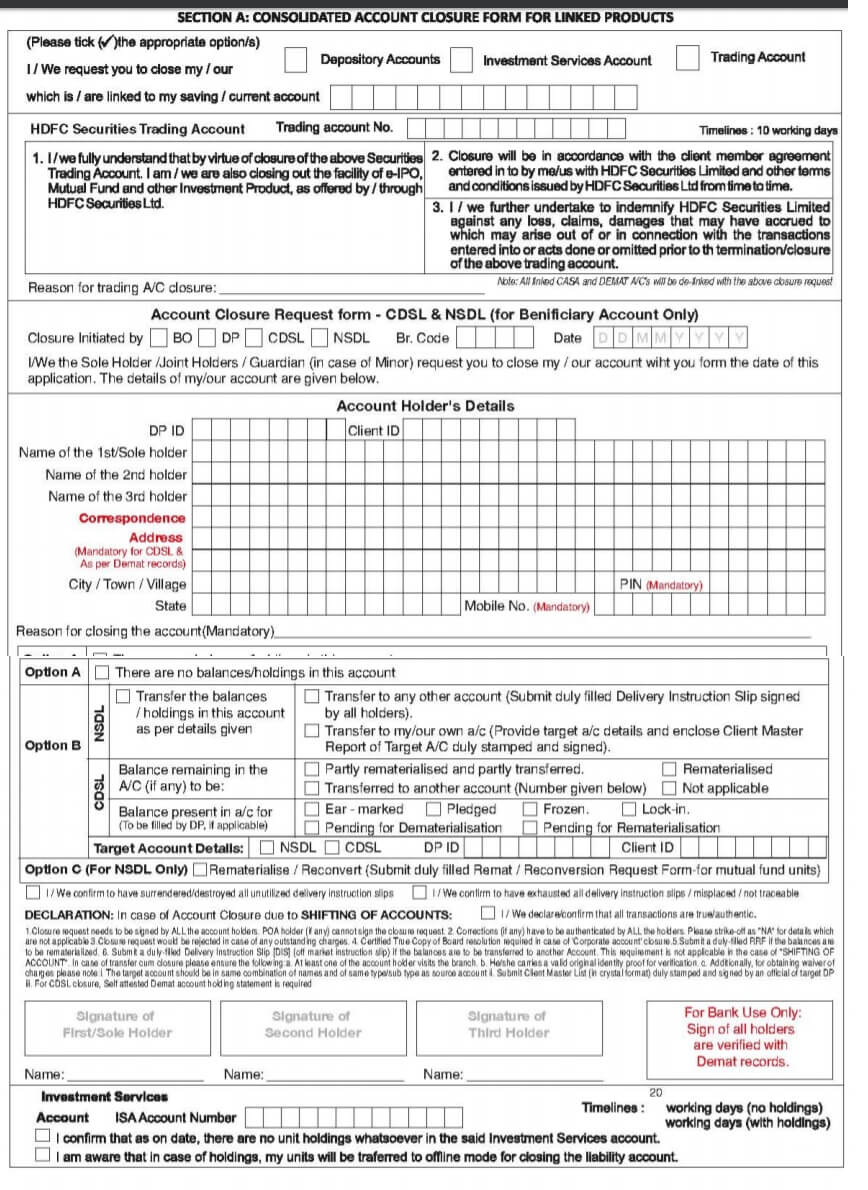

The image below shows the delinking of the demat/trading account associated with the bank account.

SBI Charges for Closure of Bank Account

SBI customer is charged following for closing a bank account.

| Period | Charges |

|---|---|

| Up to 14 days of opening – Free look period | NIL(As per BCSBI Code) |

| After 14 days up to 1 year of opening of account | Rs. 500+GST |

| Beyond 1 year of opening of account | NIL |

| Accounts closed on settlement of accounts of deceased depositors | NIL |

| Closure of Regular SB account by BSBD account holders | NIL |

| (Ref: sbi.co.in) | |

SBI Regular Charges

| Debit Card Annual Maintenance Charges (Recovered at the beginning of the second year onwards) | 125(Classic Debit Card) to

350(for Pride/Premium Business Debit Card |

| SMS Alert charges per quarter from Debit Card holders who maintain average quarterly balance of ₹ 25000/- & below during the quarter |

₹15 |

| ATM Charges (Transactions exceeding the permissible limit for free ATM Transactions). On our ATMs: | Per Transaction Rs.20 |

SBI Charges for Non-Maintenance of Minimum Balance

SBI charges a fee ranging from Rs 5 to Rs 15 (plus applicable GST) for non-maintenance of the required monthly average balance. The charges vary depending upon the branch location and degree of the shortfall.

| The shortfall from the required average monthly balance | Penalty for non-maintenance of average monthly balance (excluding GST) | |||

|---|---|---|---|---|

| Metro | Urban | Semi-urban | Rural | |

| Minimum Balance Requirement | 3000 | 3000 | 2000 | 1000 |

| Up to 50% | Rs 10 | Rs 10 | Rs 7.5 | Rs 5 |

| More than 50% but less than 75% | Rs 12 | Rs 12 | Rs 10 | Rs 7.5 |

| More than 75% | Rs 15 | Rs 15 | Rs 12 | Rs 10 |

| (Source: sbi.co.in) | ||||

Related Articles:

- Saving Bank Account:Do you know how interest is calculated

- Do you know Bank Charges on Saving Accounts, QAB, MAB

- How to open Saving Bank account with SBI the State Bank of India

- Why a Business should have a Current Account and not a Saving Bank Account?

- What is Auto Sweep Bank Account?

- Interest on Saving Bank Account : Tax, 80TTA,ITR

It is always better to limit your bank accounts and maintain only those which are necessary. It may seem painful going to the bank to close the account but it is necessary.

3 responses to “How to Close Bank Account Savings or Current”

Hi dear my canara bank account is blocked

Please immediately

contact your bank

Sir my DOB is 02/03/1957

I have joined the Bata India Ltd on 21/12/1980 and Retired on 02/03/2017 at the age of 60

My basic Salary at the Time of Retirement was Rs 10.000

What will be my Monthly Pension which is unreleased yet