In India, personal income tax is based on the concept of “pay as you earn” wherein there is a mandatory deduction of tax at source(TDS) from the salary paid to each employee. From Jan employer asks for tax saving Proofs. This article talks about the steps to claim tax benefits on Home Loan Interest, Why Submit the Tax Saving Proofs to your Employer on time, PAN number of the bank or institution from where you have taken loan, Provisional home loan interest certificate.

Table of Contents

Steps to claim Interest on Home Loan Deduction

- An employee can claim home loan interest deduction under section 24C by submitting details to his employer in Form 12BB with proofs such as Ownership details of the property, provisional home loan certificate. you submit your interest on home loan deduction documents to your employer, your employer will adjust your TDS deductions accordingly.

- If you are a Freelancer or you are self-employed – you don’t need to submit these documents anywhere. You use it to estimate your Advance Tax liability for each quarter. You can claim it while filing ITR.

- An employee can also claim the tax deduction on the principal amount under section 80C by submitting details to the employer in Form 12BB along with other tax savings proofs such as PPF, Life Insurance Premium.

- Form 16 will show the tax saving proofs considered by the employer.

- Show Home loan interest as income from House Property while filing ITR. You are not required to submit these documents to the Income Tax Department.

If you don’t submit the proof to your employer, you can claim the Principal and Interest on Home loan while filing ITR and ask for the refund. But that’s delaying the process by at least 6 months. We recommend you to provide the tax saving proofs on time to your employer as stitch in time saves nine and taxes too1

To claim tax exemption on home loan one is required to quote PAN number of the bank or institution from where the loan was taken. The loan providers have now modified their home loan payment certificate which quotes their PAN Number. PAN numbers of some of the popular home loan providers are given below. The entire list banks and NBFCs with their PAN Numbers are here.

- SBI PAN Number – AAACS8577K

- HDFC PAN Number – AAACH0997E

- ICICI Bank PAN – AAACI1195H

Why Submit the Tax Saving Proofs to your Employer

In India, personal income tax is based on the concept of “pay as you earn” wherein there is a mandatory deduction of tax at source(TDS) from the salary paid to each employee. The taxes deducted at source (TDS) are covered under Section 192 of the Income-tax Act, 1961 making it the obligation of the employer to withhold taxes at the time of payment of salaries.

The employer asks for the declaration of tax saving proofs in the beginning of financial year i.e Apr. Since the beginning of the financial year, from 1 Apr, your employer would have been computing taxes on your salary based on the proposed investment declaration submitted by you earlier and deducting Tax.

Usually, from Jan employer asks you to furnish the documentary evidence of having actually made the investments as per the investment declaration made earlier. Once the actual proof is submitted, the accounts department will compute the taxes based on the proofs of the actual investments made by you.You can make tax-saving investments different from those declared by you earlier but the deduction from taxable income will be given only on the basis of the actuals submitted and not on the basis of the proposed declaration made earlier. This will also enable the employee to finalize tax adjustments, if any, in the balance months of the current financial year (2016-17).If taxes have been deducted in excess or less, accordingly, they will get deducted in the last 3 months of the FY. The documents need not be attached or sent to Income-tax Department at the time of tax filing. Instead, it’s the employer who has to receive them from employees and deduct tax accordingly. Our article Income Tax Proof Submission to the Employer discusses tax saving investment/expenditure proofs in detail.

Do not wait till March for saving tax as one could see a huge tax burden in that month and less of take-home pay.

Income Tax Benefits on a Home Loan

Income Tax Benefits on a Home Loan for FY 2016-17 are given in table below

| Particulars | Deduction on | Amount | Conditions |

| Section 24

Self-occupied property Rented property |

Interest on home loan Interest on home loan |

Upto Rs.2,00,000

No Limit |

Home has been purchased/constructed within 5 years |

| Section 80C | Principal repayment, stamp duty & registration charges | Upto Rs.1,50,000 | Deduction is allowed in the year in which actual principal payment is paid |

| Section 80EE | Interest on home loan | Upto Rs.50,000 ( in addition to Rs 2lakhs) | Loan must be taken between 1st April 2016 to 31st March 2017

Taxpayer should not own any property Loan from a financial institution Value of the house must be less than Rs 50 lakhs Loan must be for less than Rs 35 lakhs. |

Documents to claim Income Tax Benefits on a Home Loan

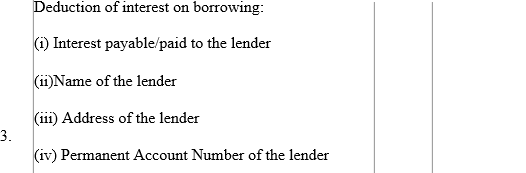

Following documents need to be submitted for claiming the Income Tax benefits on Home loan in form 12BB. Our article Form 12BB for claiming Income Tax Deductions by Employees explaining Form 12BB in detail. Many employers have their own websites to upload the information.

- Provisional Interest certificate from Bank/Financial Institution specifying the break-up of interest and the principal amount. The certificate should also have the loan sanction date and PAN number

- Possession Certificate copy.

- Sale Deed Copy (In case possession letter in not available)

- Lease deed copy, in case of let out property

- In case of Joint Home Loan, self-declaration of the ownership proportion needs to be furnished

- Form 12C

PAN Number of the lender for Home Loan

To claim tax exemption on home loan one is required to quote PAN number of the bank or institution from where they have taken the loan. The loan providers have now modified their home loan payment certificate which quotes their PAN Number. But in case you are not able to find it, here is an alphabetic list of banks or finance institutions with their PAN Numbers.

If you want to check if the PAN Number of the lender is correct, you can do so at Income Tax website for PAN Verification.

PAN number of Banks and Financial Institutions

| Bank/Home Loan Providers | PAN Number |

| Allahabad Bank | AACCA8464F |

| Andhra Bank | AABCA7375C |

| Axis Bank Limited | AAACU2414K |

| Bank of Baroda (BoB) | AAACB1534F |

| Bank of India (BoI) | AAACB0472C |

| Bank of Maharashtra (BoM) | AACCB0774B |

| BMW India Financial Services | AADCB8986G |

| Canara Bank | AAACC6106G |

| Canfin Homes Limited | AAACC7241A |

| Central Bank of India | AAACC2498P |

| City Union Bank Limited | AAACC1287E |

| Corporation Bank | AAACC7245E |

| DCB Bank Limited | AAACD1461F |

| Deutsche Bank | AAACD1390F |

| DHFL | AAACD1977A |

| GIC Housing Finance Limited | AAACG2755R |

| HDFC Bank Limited | AAACH2702H |

| HDFC | AAACH0997E |

| ICICI Bank Limited | AAACI1195H |

| IDBI Bank Limited | AABCI8842G |

| Indiabulls Housing Finance Limited | AABCI3612A |

| Indian Bank | AAACI1607G |

| Indian Overseas Bank (IOB) | AAACI1223J |

| Indusind Bank Limited | AAACI1314G |

| Kotak Mahindra Bank Limited | AAACK4409J |

| L&T FinCorp Limited | AAACI4598Q |

| L&T Infrastructure Finance Company | AABCL2283L |

| LIC Housing Finance Limited | AAACL1799C |

| Oriental Bank of Commerce | AAACO0191M |

| PNB Housing Finance Limited | AAACP3682N |

| Power Finance Corporation Limited | AAACP1570H |

| Punjab & Sind Bank | AAACP1206G |

| Punjab National Bank (PNB) | AAACP0165G |

| State Bank of Bikaner and Jaipur (SBJJ) | AADCS4750R |

| State Bank of Hyderabad (SBH) | AADCS4009H |

| State Bank of India (SBI) | AAACS8577K |

| State Bank of Mysore (SBM) | AACCS0155P |

| State Bank of Patiala | AACCS0143D |

| Syndicate Bank | AACCS4699E |

| TATA Motors Finance Limited | AACCT4644A |

| HSBC | AAACT2786P |

| The Karnataka Bank Limited | AABCT5589K |

| The South Indian Bank Limited | AABCT0022F |

| UCO Bank | AAACU3561B |

| Union Bank of India | AAACU0564G |

| United Bank of India | AAACU5624P |

| Vijaya Bank | AAACV4791J |

| YES Bank Limited |

Provisional Home Loan Interest Certificate

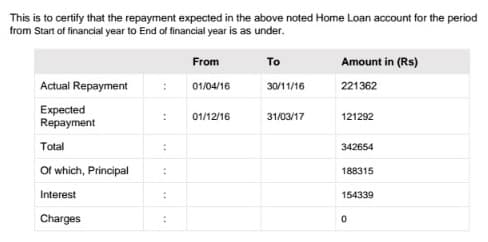

The interest certificate from the bank or financial institution, specifying the break-up of interest and the principal amount for a financial year is required. A sample provisional home loan certificate showing break-up is given below.

Actual repayment is one that is the amount paid by the person who has taken the loan, from Start of the financial year(ie Apr) to the time of generating the certificate.

Expected repayment is amount one is expected to pay from the day of generation of the certificate to the Mar 31 i.e end of financial year

Most of the banks now provide the provisional home loan certificate through net banking. For example, if one has taken home loan from SBI one can view/download Interest Certificate (Provisional) of their home loan account(s) by following the steps given below. The certificate can be viewed online, printed or downloaded in pdf.

- Logging to Internet Banking site with your credentials

- Select Enquires Tab

- Select the “Home Loan Int.Cert (Prov)” link under “Enquiries” tab. Then select the account for which you require a Home Loan Interest Certificate.

Related articles:

20 responses to “Submitting Home Loan Interest Proof to the Employer with PAN of Lender”

[…] salaried, you can submit details of Income from House Property to your employer. Our article Submitting Home Loan Interest Proof to the Employer with PAN of Lender explains it in […]

[…] Steps to claim Interest on Home Loan Deduction – An employee can claim home loan interest deduction under section 24C by submitting details to his employer in Form 12BB with proofs such as Ownership details of the property, provisional home loan certificate. you submit your interest on home loan deduction documents to your employer. […]

Hi,

I have taken the housing loan from a bank. Now I need the provisional certificate from bank for Income tax purpose and bank is saying that they can only provide me the document only for the interest paid as on date and not upto 31st March 2019. How can I get the provisional Income tax deduction certificate if the bank is not ready to provide the same. Please advise at the earliest.

Which bank have you taken the loan from?

Talk to your employer and explain it.

I have submitted home loan interest certificate as proof of my home loan but it got rejected saying form of verification and annexure of form of verification is required. Heavy tax got deducted what I can do now.

You have 2 options.

1. As you have 2 months you can Discuss with your friends/colleagues and then with the employer as to what more needs to be submitted and do needful.

2. You can claim it while filing ITR as explained in our article here.

hi jai,

Facing the same problem.

Did the employer tell what more document is required. ?

I took loan from Bank and claimed tax benefit accordingly .Last year i took Home-loan from my Mother(Joint Account) and closed Bank Home-loan.

I register paper document stating it is Home-loan from mother and all mentioned PAN details.

Can i apply for tax benefit on interest paid.I understand that only Interest component is eligible for tax exemption and loan amount is less then 20L

I have taken the home loan this year.Loan is on my name & my mother is co-applicant but in the property only my mother name is mentioned.

So can I avail the income tax benefit?

hello!,I love your writing very a lot! share we be in contact more about your

article on AOL? I need an expert in this area to resolve my problem.

May be that is you! Having a look forward to peer you.

We have a home loan with SBI. It is joint loan in the name of my wife and I am the co-owner. While I repay the loan, the PAN number updated on the loan account is that of my wife. Is this fine?

Please verify that the bank loan is in both names.

You should be co-applicant too

Hi Team,

1)I have taken home loan on 9 th march 2018

2)EMI on loan starts from april 2018

3)expected date of handover july/august 2018

Can i submit interest paid on loan as declaration to my employer?

Thank you.

No sorry you can’t as construction is still going on

Deduction on home loan interest cannot be claimed when the house is under construction. This pre-construction interest can be claimed only after the construction is finished.

Read this example to understand how it can be claimed.

Prakash took a loan of Rs.20 lakhs to start construction of his house property in Bhubaneshwar in July 2014. He has been paying EMI of Rs.18,000 ever since. The construction was completed in August 2016 and he received a completion certificate. This house has been on rent from September.

Prakash is not sure how he can claim a deduction on interest for the home loan in his income tax return.

Homeowners can claim the deduction on interest for the home loan only from the year in which the construction of the property is completed. In this case, Prakash can claim it from FY 2016-17.

Let’s start with his EMI payments this year:

Prakash pays a total EMI of Rs. 2,16,000 in FY 2014-15 (Rs.18,000 X 12), of which Rs.14,000 goes towards principal repayment

Total interest on home loan, therefore, is Rs.2,02,000. Since the property is rented out, he can claim the entire interest as deduction.

Prakash can claim a deduction for principal repayment of Rs.14,000 under Section 80C. He must remember not to sell this property in the next five years. The amount claimed under Section 80C will be added back to his income in the year of sale and he will be taxed accordingly if the property is sold within five years.

Now let’s look at interest paid when the house was under construction:

The period from borrowing money until the 31 March immediately preceding the year of completion of construction of the house is called pre-construction period.

Pre-construction interest deduction is allowed for interest payments made from the date of borrowing till March 31st before the financial year in which the construction is completed.

Here the pre-construction EMI payment will be calculated for 21 months between July 2012 to March 2014 as under:

FY 2014-15 – July 2014-March 2015 >> 18,000 X 9 = 1,62,000

FY 2015-16 – April 2015-March 2016 >> 18,000 X 12 = 2,16,000

This adds up to Rs.3,78,000.

The total EMI payment included principal repayment of Rs.24,000. Subtract this to arrive at pre-construction interest.

Rs.3,78,000 – Rs.24,000 = Rs.3,54,000 is the pre-construction interest that can be claimed in five equal installments of Rs.70,800 starting from FY 2016-17.

So Prakash can claim Rs.2,02,000 + Rs.70,800 = Rs.2,72,800 as deduction towards interest from home loan in FY 2016-17.

All said and done, one needs to bear in mind that from FY 2017-18, the loss from house property that can be set off against other heads of income has been restricted to Rs 2,00,000

Is registration of flat necessary to claim tax exception for principal and interest on housing loan. How can I submit this for past 2 years , I am abut to get possession in July .

As you have not taken the possession of the house

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1.5 lakh under Section 80 C towards the principal repayment for a Self-occupied property.However, you cannot seek these tax benefits in the pre-construction phase (i.e. no tax deductions available for an under construction house), even if you have started repaying the housing loan through EMIs.

The Section 24 of the Income Tax Act states that if a property is still to be constructed, there will not be any tax deduction on the interest payment for all of those years.

However, the interest for the pre-construction period can be availed for deduction in five equal installments from the year the construction is complete.

Step 1: Identify the date of borrowal of Home Loan

Step 2 : Identify the Date of completion / Acquisition (possession)

Step 3 : Identify the last date of the Financial Year immediately preceding the date of Completion / Acquisition

Step 4 : Calculate Prior Period. Prior Period = Period from Step 1 to Step 3

Step 5 : Calculate Prior Period Interest i.e., the total interest paid during the prior period.

Step 6 : Calculate Allowable prior period interest (APPI). APPI = Prior period interest as per Step 5 divided by 5.

[…] Submitting Home Loan Interest Proof to the Employer with … – To claim tax exemption on home loan one is required to quote PAN number of the bank or institution from where the loan was taken. The loan providers have now modified … […]

[…] Submitting Home Loan Interest Proof to the Employer with … – To claim tax exemption on home loan one is required to quote PAN number of the bank or institution from where the loan was taken. The loan providers have now modified … […]

[…] Submitting Home Loan Interest Proof to the Employer with … – To claim tax exemption on home loan one is required to quote PAN number of the bank or institution from where the loan was taken. The loan providers have now modified … […]

It is very helpful thank you soo much