One of the greatest scams in Indian stock market occurred in 1992, by a man known as ‘The Big Bull’, Harshad Mehta. He was convicted by the Bombay High Court and the Supreme Court of India for his part in this financial scandal valued at Rs 5000 crore, (USD $ 740 million). The scam exposed the loopholes in the Indian banking system and the Bombay Stock Exchange transaction system. Let’s look at Harshad Mehta scam in detail, How he did the scam, how was Harshad Mehta caught, What happened to him? What were the results of the scam?

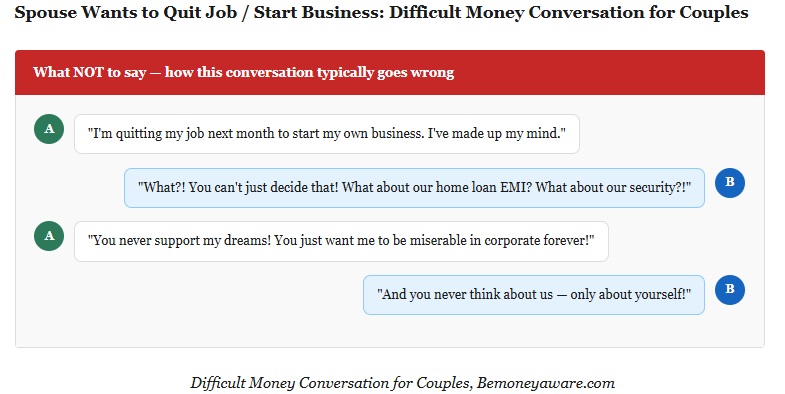

Scam 1992 is a 10 part web series on Sony Liv, which is directed by Hansal Mehta on the 1992 Indian Stock Market Scam by Harshad Mehta. Some famous dialogues from the movie

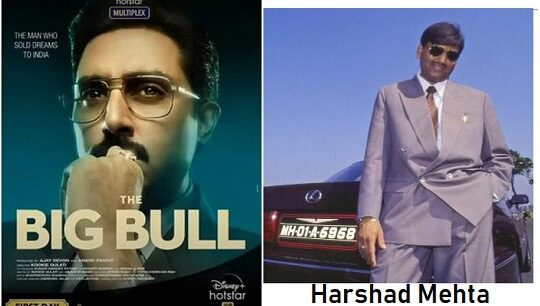

Abhishek Bachchan starter, The Big Bull, The man who sold dreams to India, is inspired by the Harshad Mehta securities scam of 1992. The film is set for digital release on Disney Hotstar+. The film also stars Ileana D’Cruz and Nikita Dutta

2006 Movie, Gafla, was based on Harshad Mehta scam.

Table of Contents

What was the Harshad Mehta scam?

The securities scam of 1991-92 refers to a diversion of bank funds worth Rs 3500 crore to stockbrokers, the kingpin being Bombay-based broker Harshad Mehta. Harshad Mehta and a few other brokers siphoned off funds from interbank transactions and bought shares. As he pumped in money, the markets continued to achieve new highs. Retail investors took cues from what Harshad Mehta was buying and followed in the footsteps of the ‘Big Bull’. Harshad Mehta was also called as ‘The Amitabh Bachchan of the Stock Market.’

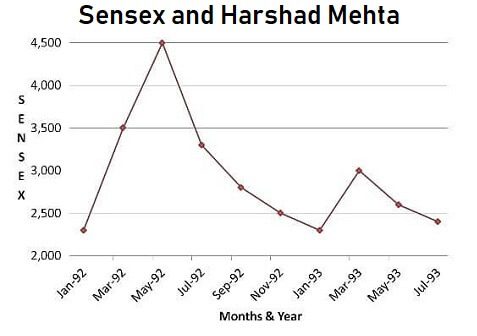

This resulted in a stupendous rise in Sensex. In the period between April 1991 and April 1992, the Sensex returned 274 per cent, moving from 1,194 points to 4,467. That is the highest annual return for the index. Stocks like ACC, Sterlite Industries and Videocon surged. ACC surged from about Rs 200 per share to about Rs 9000.

Who was Harshad Mehta?

Harshad Mehta was born on 29 July 1954 at Rajkot, Gujarat to a lower-middle-class Gujarati family. He was an average student in school.

He completed his B.Com in 1976 from Lajpatrai college Bombay and worked a number of odd jobs for the next eight-years. at companies like New India Assurance, a jobber on BSE for stockbroker P.D. Shukla, the one who used to bring clients to brokers for stock trading. In 1981 he became a sub-broker for stockbrokers J.L. Shah and Nandalal Sheth

Pump and Dump/Operator driven stocks

In 1984, Harshad Mehta along with his brothers started his own company named “Grow More Research and Asset Management”. He started manipulating the stock to increase the prices tremendously.

Harshad Mehta became the pied piper of the stock market, he created artificial scarcity in stocks by mopping up their marketable liquidity, thus increasing the prices to unjustified levels. He lured the gullible investors into believing his self propagated theories of Asset Replacement Value & Water & Gold. His argument was that the replacement cost of the assets of ACC was much higher than the market capitalisation of ACC. Water is a very easily available resource and is very cheap even though it is life-supporting. The same water if sold in the middle of the Sahara Dessert would be valuable due to scarcity. Gold has no real value but is valuable as it is in short supply.

Harshad Mehta circulated a message with help of different agencies that stock XYZ is a buy at the price of Rs. 1000 and the target price is Rs. 2200. Harshad then invested huge funds into this XYZ Company and created an artificial demand for this particular stock. The prices start increasing from Rs. 1000 to Rs. 1500, 1700. Then he would sell and the price would fall.

He also got into competition with the Bear Cartels operated by brokers Hiten Dalal, A. D. Narottam and others. The Bear Cartels would aim at driving the prices low in the market which eventually undervalued various securities. The Bear Cartels would then purchase these securities at a cheap price and make huge profits once the prices normalized.

He invested in different companies such as Associated Cement Company (ACC), Apollo Tyres, Reliance, Hero Honda, Tata Iron and Steel Co (TISCO), BPL, Sterlite, and Videocon. The ACC, cement firm, was Mehta’s favourite. He pumped money into its shares so aggressively that its stocks rose from Rs 200 a share to Rs 9,000 a share in three years, a 4,400 percent rise!

He became a sensation in the world of finance in India. In the year 1990-1991 Harshad made it to the cover of the Magazines like Business Today. He had a luxurious lifestyle with cars such as Toyota Corolla, Lexus Starlet, and Toyota Sera which were rarities and a dream even for the rich in India during the 1990s.

He lived a lavish lifestyle. Bought 12,000 sq ft sea-facing Worli penthouse, which had a mini-golf course and swimming pool. He had a fleet of two dozen luxury cars, as Toyota Corolla, Lexus Starlet, and Toyota Sera which were rarities and a dream even for the rich in India during 1990. He even paid the Income Tax Department an advance tax of Rs 26 crore just weeks before the scandal broke. This eventually led to his downfall.

The question is how did Harshad Mehta get so much money to put in the stock market?

Harshad Mehta and securities scam

Harshad Mehta used the loopholes in Banking system of 1990s consisting of Ready Forward and Fake Bank Receipts to get money from banks which he pumped into the stock market.

In the early 1990s, the banks were required to have a minimum of 38.5% of government fixed interest bonds, called the Statutory Liquidity Ratio(SLR). And the banks also had to maintain profitability. Banks were, however, barred from participating in the stock market.

Banks had to give a detailed account of their holdings of government securities to the RBI every Friday. But during the week banks bought and sold government securities. at the beginning of the week and bought them back before Friday.

Ready Forward Deal

Banks used ‘Ready Forward Deal’(RFD) to lend and borrow government securities. An RFD is a secured short term 15-day-loan from one bank to another against government securities or G-secs. The borrowing bank sells the securities to the lending bank and buys them back at tenure, at a slightly higher price. The normal settlement process in G-Secs was that the transacting banks make payments to each other and then later collect securities. Deliveries of securities and payments were made through the broker i.e. the seller handed over the securities to the broker, who passed them to the buyer, while the buyer gave the cheque to the broker, who then made the payment to the seller. And broker earned commission.

Harshad Mehta asked for time to give the securities and also asked banks to transfer the money into his personal account. He promised the banks higher rates of interest. This is where Harshad got the money and used this money to trade and drive up the prices of stocks in the stock market.

In a normal RF deal, there would be only 2 banks involved. Securities would be taken from a bank in exchange for cash. What Harshad Mehta did here was that when a bank would request its securities or cash he would rope in a third bank. And eventually a fourth bank so on and so forth. Instead of having just two banks involved, there were now multiple banks all connected by a web of RF deals.

Bank Receipt(BR)

In the ‘Ready Forward’ deal, securities were not moved back and forth in actuality. Instead, the borrower, i.e. the seller of securities, gave the buyer of the securities a Bank Receipt(BR) which confirmed the sale of securities. A BR promised to deliver the securities to the buyer and also states that, in the meantime, the seller holds the securities in trust of the buyer.

Harshad Mehta got fake BRs i.e BRs not backed by any government securities using the Bank of Karad (BOK) and the Metorpolitan Co-operative Bank (MCB), two small and not very well known banks. Once these fake BRs were issued, they were passed on to other banks and the banks, in turn, gave money to Mehta, assuming that they were lending against government securities even though this was not really the case.

How was Harshad Mehta caught?

Sucheta Dalal and Harshad Mehta Scam

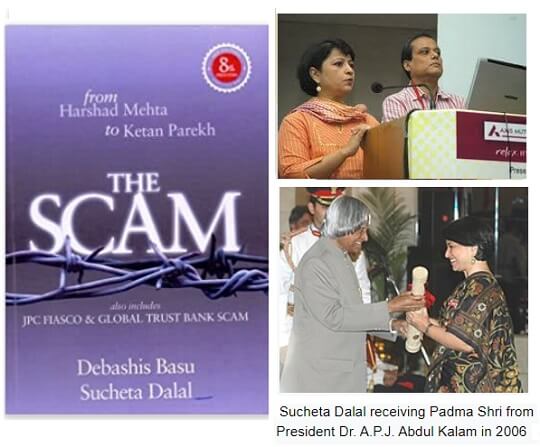

On 23 April 1992, journalist Sucheta Dalal exposed Mehta’s illegal methods in a column in The Times of India about how Mehta was illegally dipping into the banking system to finance his buying. She got interested after she saw him drive up at the State Bank of India offices in a brand new Toyota Lexus, which had just been released internationally and costed more than Rs 40 lakh at the time. She started researching how can a broker afford such an expensive car. She also wrote a book, The Scam, The: Who Won, Who Lost, Who Got Away, covering various scams. In 2006, she began to write for Moneylife, a fortnightly magazine on investment started by her husband Debashis Basu.

It has been alleged that the Bear Cartel ganged up on Mehta and blew the whistle on him to get rid of him and the bullish run altogether

What happened after the exposure

State Bank of India realised it was holding onto worthless bank receipts and was Harshad owed Rs 500 crore to SBI. Once the scam was exposed, several banks found they were holding BRs of no value at all. Mehta had, by then, swindled the banks of Rs 4,000 crore.

The immediate impact of the scam was a sharp fall in the share prices. The index fell from 4500 to 2500 representing a loss of Rs. 100,000 crores in market capitalization. The scam resulted in the loss of money of lots of families who had invested in the stock market,

The scam’s exposure led to the suicide of the Chairman of Vijaya Bank, who issued cheques to Mehta.

The scam came under scathing criticism in the Indian Parliament and Harshad Mehta was arrested by the Central Bureau of Investigation (CBI) in November 1992, along with his brothers Ashwin and Sudhir, who masterminded and executed this scam together. The CBI charged Mehta with 72 criminal cases (bribery, cheating, forgery, criminal conspiracy and falsification of accounts) and over 600 civil action suits by banks and institutions for the money he owed them. Other brokers such as his brothers and AD Narottam, Bhupen Dalal, Hiten Dalal and Naresh Aggarwal, among others, were also charged for taking part in the scam, but for much smaller sums. This table illustrates the extent of money some banks lost.

| Name of Bank | ₹ in crores |

| National Housing Bank(NHB) | 1199.39 |

| State Bank Of Saurashtra | 175.04 |

| SBI Capital Markets Ltd(SBI Caps) | 121.23 |

| Standard Chartered Bank | 300.00 |

| Total | 1795.66 |

What happened to Harshad Mehta?

Mehta and his brothers were released on bail after three months in custody. He held a conference in a hotel along with his lawyer Ram Jethmalani and claimed that he had paid Rs 1 crore to then Prime Minister PV Narasimha Rao as a donation to the Congress to get him off the hook. He even displayed the suitcase in which he allegedly carried the cash. PV Narasimha Rao denied it, and later, a CBI probe also found no concrete evidence of this bribery claim.

A few years later, Mehta made a brief comeback as a stock market expert and started providing investment tips on his website and in a weekly newspaper column. He set up a whole network of entities called the Damayanti group to conduct his market operations; the group openly operated out of his Nariman Point office which was technically under the custodian.

In October 1997 the Special Court set up to hear the cases related to the securities scam approved 34 of the 72 charges brought forward by the CBI against him.

In September 1999, the Bombay High Court awarded five years rigorous imprisonment to Mehta and three others in the Rs 380.97 million Maruti Udyog Ltd fraud case (MUL), one of the many individual cases within the larger securities scam.

He secured bail in all cases, including the MUL, but was arrested again in 2001 for misappropriating Rs 2.5 billion from 2.7 million “missing shares” of 90 blue-chip companies. He was denied bail this time, and on 31 December 2001, at the age of 47, he passed away in Tihar jail after a heart attack.

The rest of the criminal cases were abated due to his passing away, but the civil suits for the recovery of crores of money remained.

The Mehta family, led by Ashwin Mehta, who also represents the family in court, is fighting the case at various levels, right from reducing their net liabilities to safeguarding family assets from recovery and liquidation.

The court-appointed a custodian to attach properties and receivables of Harshad Mehta and redistribute the same to creditors and other court-decreed parties. The court-appointed custodian has been at its job for over 20 years now. Periodically, the custodian files a confidential report valuing the property under its custody and liabilities to be paid off. According to a report released by the Office of the Custodian on 8 January 2016, the Harshad Mehta family owns assets worth Rs 1,723.84 crore and has total liabilities of Rs 16,044 crore.

Of these liabilities, Mehta’s family has to pay Rs 4,662 crore to various banks (mainly interest charged over the years) and Rs 11,174 crore to the I-T Department.

As of May 2017, the custodian had disbursed Rs 6,310 crore to banks and the I-T Department by selling off assets of the Mehta, his family members, and associates.

Lessons learned from Harshad Mehta scam

The government established Security Exchange Board of India (SEBI) to regulate the stock exchanges under “SEBI Act 1992”.

NSE was set up which introduced transparency to the system.

- Sensex fall from 4500 to 2500 loosing Rs. 1,00,000 crore in market capitalization (O/s shares *CMP).

- Liberalisation policies were put on hold by the GOI.

- BR were removed by RBI.

- Naked short sales (borrower and lender being unaware of each other) was banned in 2001.

Scam 1992: Web Series

Adapted from journalists Sucheta Dalal and Debashish Basu’s book The Scam: Who Won, who Lost, who Got Away, Scam 1992 is being hailed as one of the best web series of 2020. Some dialogues from the movie

Video About Harshad Mehta scam

This 8 minute video explains the Harshad Mehta scam,

Stock Market and Bank Scams in India

Ketan Parekh Scam: 1999 – 2001, 2001, Rs 120 crores

KP was a chartered accountant by profession and managed a family business, NH Securities started by his father. Ketan Parekh procured funds from the banks and inflated the stock prices artificially. He operated in Bombay Stock Exchange, Calcutta Stock Exchange and the Allahabad Stock Exchange. Coincidently, Ketan used to work as a trainee under Harshad Mehta earlier. He was known as the ‘Bombay Bull’

Parekh traded in ten stocks, came to be known as the K-10 or the KP pack. They were the ACCs of the Harshad Mehta era. The K-10 pack included the following stocks: Amitabh Bachchan Corp, Himachal Futuristic Communication, Mukta Arts, Tips, Pritish Nandy Communications, Global Telesystems (GTL), Zee Telefilms, PentaMedia Graphics, Crest Communications and Aftek Infosys.

HFCL soared by 57% while Global increased by 200%. As a result, brokers and fund managers started investing heavily in K-10 stocks. By January 2000, K-10 stocks regularly featured in the top five traded stocks in the exchanges. Mutual funds like Alliance Capital, ICICI Prudential Fund and UTI also invested in K-10 stocks and saw their net asset value soaring.

A small Ahmedabad-based bank, Madhavapura Mercantile Cooperative Bank (MMCB) was KP’s main ally in the scam. In December 2000, when KP faced liquidity problems in settlements he used MMCB. KP issued cheques drawn on Bol to MMCB, against which MMCB issued pay orders. The pay orders were discounted at Bol.

A bear cartel started disrupting Parekh’s party by hammering prices of the K-10 stocks, precipitating a payment crisis in Kolkata. In December 2000, the NASDAQ crashed. The stock market started falling across the world. In India, mutual funds and brokers began selling them and that led to a liquidity crisis for Ketan Parekh and finally he was exposed.

Ketan Parekh was charged with defrauding Bank of India (Bol) of about $30 million among other charges. He was charged, banned from trading for 14 years and jailed

Satyam Scam: 2003-2008, 2009, Rs 7000 crores

Satyam Scam came to light in the year 2009, when founder-chairman of Satyam Computers, Ramalinga Raju, confessed to manipulating accounts to show increased sales, profits and margins from 2003 to 2008. The INR 7,000 Crore accounting fraud was disclosed in the balance sheets. On April 9th, 2015, a court found Ramalinga Raju along with nine others guilty and they were sentenced to seven years of imprisonment. Our article Satyam Scam : Ramalinga Raju covers it in detail.

Nirav Modi Scam, 2018, Rs 11,000 crores

The Nirav Modi Scam is India’s biggest bank fraud. This fraud took place between 2011 and 2017 and was detected in the third week of January 2018. Nirav Modi, the 48-year-old diamond trader, defrauded Punjab National Bank to the tune of Rs 11, 000 crores. Using fraudulent Letters of Undertaking (LoU), his company Firestar Diamond took loans and failed to repay them. Nirav Modi has left India and is in the UK, PNB employees who helped Nirav Modi carry out the fraud are now behind bars.

Related articles:

- Satyam Scam : Ramalinga Raju

- Cricket:BCCI , BCCI Finances and Lodha Committee

- What is IL&FS Crisis? Why Government had to rescue IL&FS

- Online Fraud : UPI Scam, AnyDesk, Matrimonial Site, Lottery, Fake Job Offer etc

Was Harshad Mehta a criminal or was he a smart stockbroker, who knew the loopholes in banking system and exploited the loopholes. Was His whole intension to make SENSEX rise? Did his recklessness led to his downfall through his ambitious schemes?

Did you see Scam 1992? Did you enjoy it? Did you like it?