Group life insurance is a type of life insurance in which a single policy covers an entire group of people, usually employees of the same company or members of the same association and their dependents. The members covered under the single insurance policy are collectively referred to as a ‘Group’. Group life insurance is often provided as part of a complete employee benefit package. Group Insurance may offer life cover, health cover, and/or other types of personal insurance. In most cases, the cost of group coverage is far less than what the employees or members would pay for a similar amount of individual protection. Employers or association groups often limit the total amount of coverage available to employees or members based on a variety of factors, such as time in service (or membership), annual salary or number of dependents. Amounts are limited because insurance companies do not collect health risk data from each individual under the policy.

Group Health Insurance: Example of Group Insurance

A group health insurance plan is meant to offer heath care coverage to a group of people. Whereas, an individual health insurance plan is designed to offer coverage to an individual or his family.Under an individual insurance plan, every individual has a separate renewal date, whereas under a group plan, there is no need to remember various renewal dates, as there is only a single renewal date.

Advantages of Group Health Insurance

- Lower Premium: The premium amount for a group health insurance plan is lower as compared to an individual health insurance plan. According to a study, a group health insurance plan is 30% cheaper than an individual health plan.

- Maternity Cover: A group health insurance plan offers an individual with complete maternity benefits from the day one, whenever the person is enrolled in the policy.

- Waiting-period: A group health insurance plan has no waiting period in order to avail full benefits of a health care plan as there exists in an individual health plan.

- No Medical Check-up required: When it comes to group health insurance, it is not necessary for an individual to submit his or her medical checkup reports in order to get enrolled under the group health plan, as the case is with individual health insurance.

Disadvantages of Group Health Insurance

- Leaving the Job: One of the major disadvantages of a group health plan from your employer is that, what if you leave your job and shift to some other company. Not only will your health cover cease to exist, but you will have no health cover in case your next company does not offer any health insurance to its employees.

- Policy Discontinuity: Once you leave your job and are no longer associated with the company, the policy you were enrolled under will come to an end and so will its benefits. This is yet another disadvantage of a group health insurance plan. However, in some cases, an employee has the choice to buy the very same policy with similar benefits. And, if such is the case, he or she should definitely opt for it.

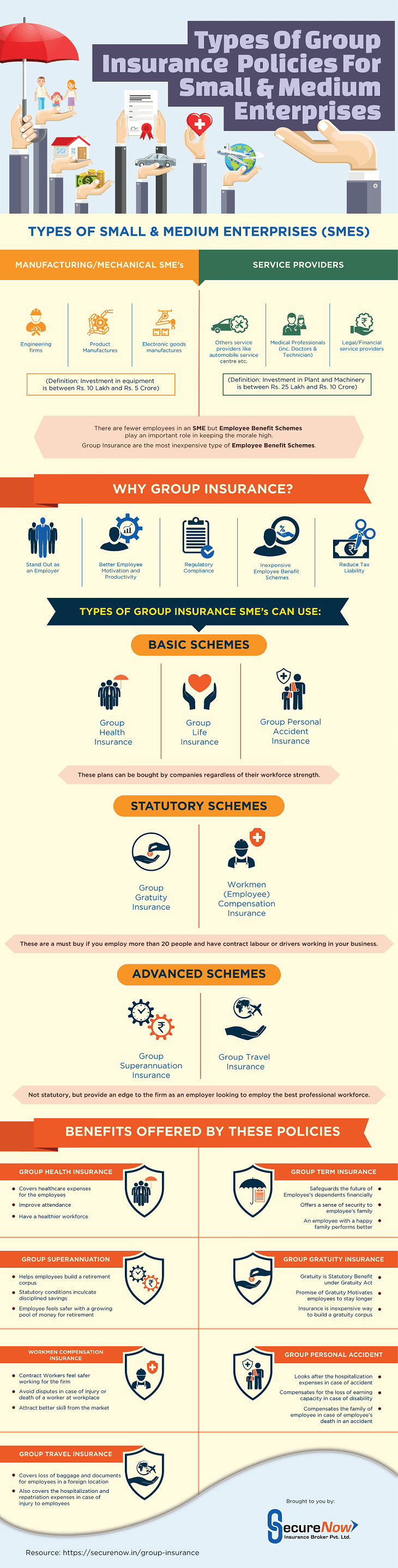

We found this interesting Infographic Created By Secure Now on Group Insurance.

Which are the Group Insurance policies offered by your employer? Which Group Insurance would you like to have?