If you do not know where you want to be, you would not know how to get there . This article explains about what is goal based financial planning? why should we go for it?

Table of Contents

How are we investing?

How are we saving and investing? Is there a plan of action that guides our investments? Or Are we randomly putting money into different products, mostly at the advice of some friends or colleagues or on the basis of the market performance, without considering what we are putting away the money for? Most people invest into products as and when they become hot property, gold is going high, let’s buy it, real estate will always appreciate let’s buy it. This makes our investment portfolio like a complex web of financial products hoarded without any thought. Worse, most people don’t track their investments regularly or restructure or rebalance the portfolios accordingly. Don’t we require a more disciplined, planned approach to investment ?

Why Planning is important?

Planning is the key to successfully achieve what you set out to do, whether it is game, leisure, life or investing. Even activities as simple as going out to watch a movie become simpler with planning. Of course, there are things that you simply cannot plan for. But our financial future should definitely not be one of them. As Benjamin Franklin said “If you fail to plan, you are planning to fail!”

What to Plan in Finance?

When we talk about planning in finance, what exactly does it mean? Are we talking about setting aside how much money every month? Or is it buying a car or a house ? Putting aside money for children’s education or retirement funds? Planning encompasses all of this but it first it is looking at the big picture. What are we planning for?

It means identifying our financial goals,choosing the time horizon for achieving each one of them, and choosing how to reach those goals. Then It means making an roadmap so that we can reach our financial goals. It is easier to work towards specific, quantifiable financial goals rather than saving towards a vague goal of a ‘comfortable’ or ‘happy’ future. Please note Goal setting is more than just scribbling down some ideas on a piece of paper.We need to set goals that are realistic and rooted in pragmatism and are in line with our capacity to invest.

Goals can be:

- Increasing income

- Reducing expenses

- Clearing credit card debt

- Repaying Loan

- Funding higher education

- Buying car

- Buy high value item like laptop

- Funding travel/holiday

- Buying/repairing the hous

- Starting a business

- Getting married

- Becoming a parent

- Planning for children education

- Planning for children’s marriage

- Planning for a secure old age

Some common financial goals are purchasing a house, children’s education and marriage and retirement planning in Our article Insights into Financial Goals of Indians! covers the survey done into financial goals of Indians.

Goals are not wishes or dreams!

- All of us have an endless wishlist, dreams. However, given our limited resources, it is difficult to provide equally for all our dreams, wishes. We have to understand the difference between our needs and wants—it is crucial to determine which dreams are important and which ones can wait.

- Goals are realistic and attainable For instance, a Rolls Royce worth several crore of rupees may be our object of desire, but at a salary of Rs 6 lakh per annum, it may not be a feasible idea

- Goals have timeline. Some goals can be met within a short span of time, such as buying a car or going on a vacation . Others can only be achieved over years of saving and investing, such as funding children’s foreign education or marriage, or our own retirement.

- Setting goals is not a one-time exercise. With time, changes will occur that affect our lifestyle, the way we think, what we consider important, the state of our health etc. These changes, in turn, affect our goals in life. As goals are achieved new ones need to be set up.

- Goals, way to achieve those goals are personal, our own, as unique as we are.

Goals are fundamental to achieving financial peace-of-mind, especially goals that are SMART.

- Specific ex: I want to buy Bajaj Pulsar bike within a year rather than I want to own some vehicle some day.

- Measurable ex: I want to set aside Rs 1000 every month instead of wanting to save a lot of money.

- Attainable ex: If my net earning is Rs 10,000 a month then saving Rs 1000 a month is an achieving and energizing goal then a Rs 100 or Rs 8000 saving a month

- Realistic ex: If my net earning is Rs 10,000 a month then saving Rs 1,00,000 a year.

- Timely ex: I want to save Rs 15,000 by the end of this year.

What is the Goal setting process?

Goal Based Investment means saving for specific goals. Following are the steps to be followed :

- Think of major events in your life which would have a significant financial implication, and for which you would like to save.

- Find out the cost of achieving these goals today.

- Determine how far away these goals are from today (in years).

- Determine the cost of achieving these goals at the target time using an approximate but conservative rate of inflation.

- Determine the after-tax rate of return you can achieve when you invest today.

- Arrive at the per-year and per-month investment necessary for each goal,

- Choose the investments that would take us closer to our goals.

- Start investing as per the plan today, specifically for these goals!

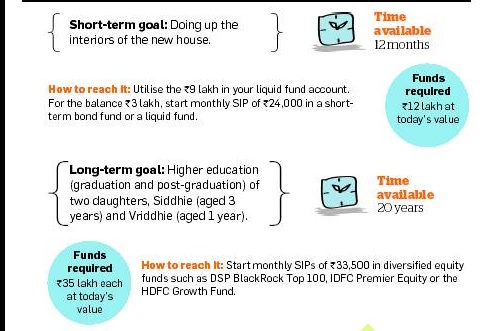

Example of Goals setting from EconomicTimes How to match your investments with financial goals

Why Goal based investing?

It connects with our goals : When investments are linked to our goals, it makes us a focused investor. The concept of goal-based investment stresses on having a planned and disciplined approach to saving money for the important goals of life. By having an investment plan defined around our goals, we can allocate our finances to the right asset class, so that we are readily available to meet the big expenses of life. Our dreams, our wishes become achievable

It prevents us from digressing: We have planned to accomplish many important things in our life – buying a house, an early retirement, good education for our kids . Suppose now we get some extra money a bonus or refund or large cash gift. And then we see an advertisement promising a discount on the Smart TV which our neighbour has bought. So we go ahead and buy the TV and promise ourselves to invest next time. We get the TV which was not goal. But if we have goals we know how using this extra push we can get closer to our goals. When we don’t have goals or targets, it’s easy to digress.

Getting carried away:For example, we may face a situation where a fixed deposit with a bank is offering better returns than a diversified equity fund over the last one year. Should we hit the sell button on equity investments and transfer all money into fixed deposits? Or the gold price has come down should we buy more? If yes how much? or should we remember that these products have different role to play in our overall portfolio and are not comparable. With goals one is mentally prepared to deal with volatility so that abrupt decisions based on prevailing market conditions can be controlled. We know what we are doing and why we are doing so we relook at the situation, understand how it affects and make conscious decisions.

Related Articles :

- Insights into Financial Goals of Indians!

- Beginner to Investing

- Beginner to Investing – Approaches, Plan, Psychology

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

In this article we have explained what is goal based financial planning, why we should do it? In our coming article we shall cover process of goal based investing in detail. How do you do your financial planning? Do you invest according to some goals or do you do it randomly? How do you choose your goals? Do you think goal based investing is useful?

Nice information . A small summary of what is learnt in CFP certification .

Thanks Vishal. Have you done CFP certification? (I haven’t)

Nice information . A small summary of what is learnt in CFP certification .

Thanks Vishal. Have you done CFP certification? (I haven’t)

One of the best articles and must read for every one. This article puts a complete stop the way you are looking at investments and does it for good.

Thanks a lot for the wonderful article.

Thanks for wonderful comment.

One of the best articles and must read for every one. This article puts a complete stop the way you are looking at investments and does it for good.

Thanks a lot for the wonderful article.

Thanks for wonderful comment.