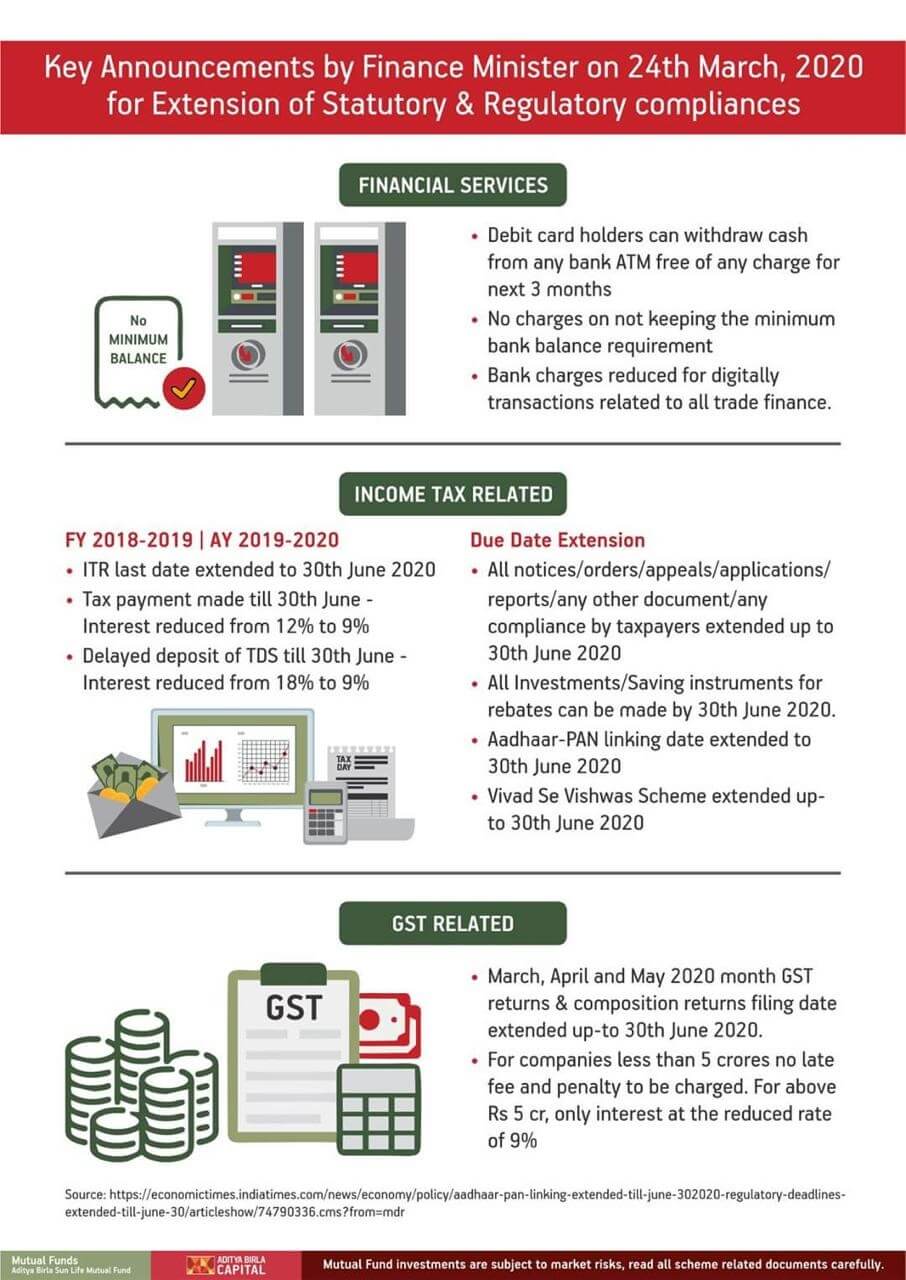

The government on 24 March 2020 announced that taxpayers have time until 30 June 2020 to complete their tax-saving exercise for FY2019-20. The earlier deadline was March 31, 2020. This article digs deeper into the headline and clarifies what can be done until 30 Jun 2020. What about RBI shift in Financial Year?

Please note The government also announced waiving off ATM withdrawal charges for using another bank ATM. No minimum balance maintenance fee to be charged by banks.

Table of Contents

FY 2019-20 and 30 Jun 2020

Let’s remember these Simple guidelines

- FY 2019-20 is ending on 31 March 2020 as scheduled.

- Next FY, Fy 2020-21, starts from 1st April 2020. No change in this.

- For the purpose of tax savings (80C, 80D), one had a complete investment in ELSS, Life Insurance etc till 31 March 2020. This date is extended to 30 June 2020. The video below explains the various tax saving options.

- RBI Financial year is different from Govt Financial Year, it followed 1 Jul to 30 June. On 23 Mar 2020, Reserve Bank of India (RBI) has finalised that the fiscal year 2021-22 for the central bank will start from April 1. Fiscal 2019-20 will end on 30 June while the fiscal year 2020-21 will be beginning on 1 July 2020 but will end on March 31, 2021. Thereafter, all fiscal year will begin on April 01 every year. The alignment with the Government will bring a change in the way the Central bank does it bookkeeping. Besides, it may not need them to announce the interim dividend

- While filing your Income Tax Return for FY 2019-20, income from the period from 1st April 2019 to 31st March 2020 will be considered. Income from 1st April 2020 to 31st March 2021 should be reported in the ITR of FY 2020-21.

What all can be done till 30 Jun 2020

- The last date also extended for filing Income Tax Returns for the financial year 2018-19. The interest rate on delayed payment of returns has also been cut to 9 to 12%. Our article ITR for FY 2018-19 or AY 2019-20: Changes, How to file talks ITR in detail.

- Aadhaar-PAN linking date. Our article Link PAN with Aadhaar: How to link, How to check status talks about it in detail.

- Vivaad Se Vishwas scheme, tax dispute resolution scheme. Those availing the scheme by the extended deadline will not have to pay 10 per cent interest on the principal amount.

- Extension of Due date for Investments made for Capital Gain Exemptions under section 54, 54EC, 54F. Example Arvind sold his house property on 23rd September 2019 and to save Capital Gain Tax by investing in REC Bonds he had to invest on or before 22nd March 2020. If he hadn’t done, then As the due date has been extended to 30th June 2020, so Arvind can claim an exemption under section 54EC even if he invests in REC Bonds before 30th June 2020.

- Filing GST of March, April, May 2020

Filing of Belated Returns of FY 2018-19

For Financial Year 2018-19 (the period from 1st April 2018 to 31st March 2019), the last date of filing of Belated Income Tax Return was 31st March 2020 earlier. Now the date has been extended up to 30th June 2020. It means, now a taxpayer who has not filed his Income Tax Return for FY 2018-19 till date, can file his return up to 30th June 2020.

- No relaxation for Late filing Fees under section 234F. If a taxpayer fails to file his income tax return on or before the due date, he shall pay late filing fees ranging between Rs. 5,000 to Rs. 10,000. That fee is still applicable.

- Interest on Late Filing of Income Tax Return is reduced to 9% p.a. (w.e.f. 1st April 2020 to 30th June 2020)

- If a taxpayer files Income Tax Return after the due date, the taxpayer is liable to pay simple interest @ 1% p.m. i.e. (12% p.a.) under 234A. Interest on late filing of return has been reduced from 1% p.m. to 0.75% p.m. This amendment is applicable only for the period from 1st April 2020 to 30th June 2020.

Example Shyam has missed the due date for filing of IT return of FY 2018-19. His tax payable is Rs. 50,000. His interest under section 234A shall be applicable from 1st August 2019 till the date of filing. Let us understand interest calculation in different conditions.

| Particulars | Case I | Case II |

| Tax Payable | Rs. 50,000 | Rs. 50,000 |

| Due date for filing of return | 31st July 2019 | 31st July 2019 |

| Actual date of filing | 31 March 2020 | 10th June 2020 |

| No. of months of delay up to 31st March 2020 | 8 months | 8 months |

| No. of months of delay after 31st March 2020 | Nil | 3 months (even a part of month shall be considered as full month) |

| Interest Rate applicable | 1% p.m. x 8 months = 8% | (1% p.m. x 8 months) + (0.75% p.m. x 3 months) = 8% + 2.25% = 10.25% |

| Amount of Interest | Rs. 50,000 x 8% = Rs 4,000 | Rs. 50,000 x 10.25% = Rs 5,125 |

Clarifications on what can be done till 30 Jun 2020

Next FY for the same shall start from 1 April or from Jul 1 2020?

Ans: Next FY starts from 1st April 2020. No change in this.

The Table shows the various Financial and Assessment Year. Ex: The income earned between 1 Apr 2018 to 31 Mar 2019 will be assessed after 1 Apr 2019. So FY becomes 2018–19 while Assessment Year(AY) is 2019–20. The due date for filing ITR for FY 2018-19 or AY 2019-20 is 31 Jul 2019 and one can file belated returns for FY 2018-19 or AY 2019-20 with penalty till 31 Mar 2020 which now is extended till 30 Jun 2020. Our article Difference between Assessment Year and Financial Year, Previous Year, Fiscal Year in World discusses it in detail.

| Income Earned Between | FY | AY | Due Date for filing ITR | Last date for filing ITR | Notes |

| 1 Apr 2020 to 31 Mar 2021 | FY 2020-21 | AY 2021-22 | 31 Jul 2021 | 31 Mar 2022 | |

| 1 Apr 2019 to 31 Mar 2020 | FY 2019-20 | AY 2020-21 | 31 Jul 2020 | 31 Mar 2021 | Current Financial Year. Advance Tax to be paid

Tax saving Extended due to Corona Virus lockdown |

| 1 Apr 2018 to 31 Mar 2019 | FY 2018-19 | AY 2019-20 | 31 Aug 2019 | 30 Jun 2020 | Tax saving and ITR filing Extended due to Corona Virus lockdown |

| 1 Apr 2017 to 31 Mar 2018 | FY 2017-28 | AY 2018-29 | 31 Aug 2018 | 31 Mar 2019 | Cannot file ITR.File Condonation request and pay Tax Liability |

| Earlier Years | Cannot file ITR.File Condonation request and pay Tax Liability

|

How do I calculate income tax if this year the financial year is ending on the 30th of June 2020?

No effect on your income tax calculation. Your income will be considered from 1 Apr 2019 to 31 Mar 2020. ITR ie Income Tax Returns will have to be filed by 31 Jul 2020.

Effect of EPF contribution / Home loan EMI (Int. + Principal) paid from 01/04/2020 to 30/06/2020. Will, it combined with a current year or eligible for next year?

Ans: Only voluntary savings for rebates and exemptions(80C,80D) made in Apr-June 20 can be used for FY 1920. All else like EPF will be for FY 20-21. Our article All About Income Tax Savings: sections 80C,80D, claim in ITR talks about it in detail.

Does it mean people who want to invest for FY 20-21 can not invest from Apr to June-2020?

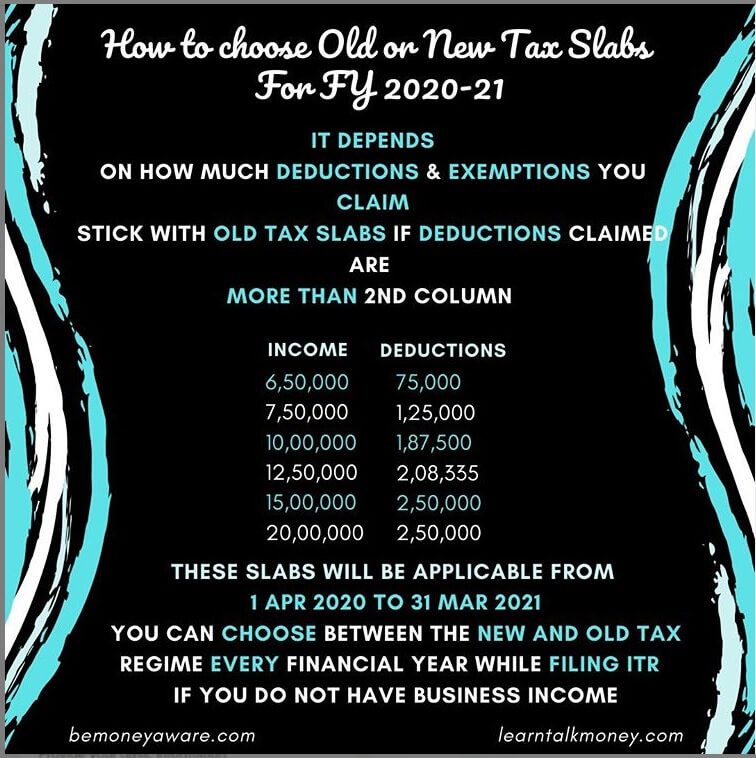

Ans. You can invest in Apr-June 20 for FY21 tax savings. No restriction on this. It is self-declaration. Remember that the new Tax slabs have been introduced for FY2020–21 where you can choose to go for tax savings or not. Our article Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21 covers it in detail.

If someone invests after April 1, 2020, will it be considered for FY19-20 or FY 20-21?

Ans. Yes, you can invest in tax-savings till 30 Jun 2020 for both FY19-20 & FY20-21. You will just need to ear-mark each. And give self-declaration. You cannot use the same investment for both the years.

Does that mean Dividend received till 30th Jun will be non-taxable in Individual’s hands and will be taxed at dividend distribution tax.

Ans: No. Dividend received till 31 Mar 2020 is tax-free.

Video on Various Tax saving options

This tell you about all the options available for you under Section 80c. This tells about each product’s features and also how should you go about picking the right product to save tax.

Overview of what has been extended till 30 Jun 2020

The image shows what has been extended to 30 Jun 2020.

Related Articles:

All about Income Tax has all our income tax-related posts in 1 place.

- Income Tax for FY 2019-20 or AY 2020-21

- Difference between Assessment Year and Financial Year, Previous Year, Fiscal Year in World

- All About Income Tax Savings: sections 80C,80D, claim in ITR

11 responses to “Financial Year 2019-20 extension 30 Jun 2020,What is it? How do do tax saving for FY 2019-20, FY 2020-21?”

1) I missed 30/6 for tax investment for fy 2019-20.Is chance of extendion?

2) What is last dste of ITR for fy 2019-2020 without fine?

3) For fy 2020-2021 what is last date for tax saving FD investment.

Usually we submit our 15G,H forms for non deduction of income tax for the interest earned from our investment in banks,companies fixed deposits.But now due to corona Vitus situation, we cannot move out and submit them. is there any change in deadline for this year as the special case?.. Jagadeesan.

Yes form 15g/h which is needed to submit 1st week of april for new financial year is extended till 30/06 that means your form 15g/h for f.y. 19-20 is valid till 30.06.20.

If I contribute in PPF in SBI between 2nd to 5th April 2020 for FY 2020- 21,

Will I get interest of PPF from april by the bank ?

Will this be considered for deduction U/s 80C for FY 2020- 21 ?

I have already made full contribution in PPF for FY 2019- 2020

sir.

i want to invest Rs1.5 lakh in PPF, for tax saving for Financial year 2020-2021. Hence sir can i invest now before 5th April for maximum interest earnings in PPF?

Yes you can and you should

thanks you very much for this valuable information . i am also planning to invest in the FY 2019-20 but missed the due date of 31 march, now happy to know that date is extended. also have a look at this

http://www.letsupdate.in/2020/04/missed-due-date-march-312020-for-tax.html

FY 20-21 very effective terms and conditions so very nice.,

For FY 20-21 You can invest only after 1 Apr 2020 just like earlier

Due date for investment for FY 19-20 is extended. Okay But if I want to invest for FY 20-21 , can I invest on or after 01-04-2020 ? Please reply

You can invest from 1 Apr 2020 for FY 2020-21. There is no change in the FY.

The Financial Year FY2020-21 starts from 1 Apr 2020.