In our earlier articles on Filling ITR Form in excel, we covered Fill Excel ITR form : Personal Information,Filing Status and Fill Excel ITR1 Form : Income, TDS, Advance Tax. This article covers filling of information for 80G, bank details, exempt income,verification,bank details, computation of tax, submitting the return.

Table of Contents

80G

If you have you donated money for charity, social or philanthropic purposes, or, have made contributions towards a National Relief Fund, then you could use these donations to reduce your tax outgo by using tax benefits under Section 80Gof Income Tax Act. Qualifying amount is the maximum amount you can claim as deduction. For example for Section 80C you can invest in EPF,PPF, Life Insurance Policies etc but the Qualifying amount or maximum amount that you can claim is Rs 1,00,000. In section 80G how much amount can one claim depends on the institution to which one donates.

- 80GA : Donations entitled for 100% deduction without qualifying limit such as National defense fund , Prime minister relief fund etc.

- 80GB : Donations entitled for 50% deduction without qualifying limit such as National Children’s Fund,Indira Gandhi Memorial Trust

- 80GC : Donations entitled for 100% deduction subject to qualifying limit

- 80GD : Donations entitled for 50% deduction subject to qualifying limit

Some features of Section 80G are :

- Only donations in cash or cheque are eligible for the tax deduction.

- All donations are not eligible for tax benefits. Tax benefits can be claimed only on specific donations i.e. those made to prescribed funds and institutions.

- For claiming deduction under Section 80G, a receipt issued by the recipient trust,called as donee, is a must. The receipt must contain the name , address & PAN of the Trust, the name of the donor, the amount donated .

- In case of donation which are eligible for 100% deduction recipient should also insist on Form 58 from trust.

- In case of certain funds or institutions, donations above 10% of your Adjusted Gross Total Income (GTI) are allowed for deduction only upto 10% of your adjusted GTI. For example:

- You have an income of Rs. 7 Lakhs in a year.

- You have invested Rs. 1 Lakh under Section 80C .

- You also make a donation of Rs. 1.5 Lakhs to a charitable institution having an 80G certificate from the income tax department.

- If the allowable deduction is 50% of the amount donated, subject to an upper limit of 10% of the adjusted GTI then amount that can be claimed for deduction is as follows :

- Adjusted GTI = Rs. 7,00,000 – Rs. 1,00,000 = Rs. 6,00,000

- Qualifying amount(10% of GTI) = Rs. 60,000.

- Amount eligible to be claimed as deduction under section 80G is: 50% of qualifying amount = 50% of Rs. 60,000 = Rs. 30,000

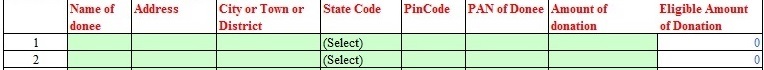

Information that needs to be filled in is shown in picture below :

Bank Details and Exempt Income

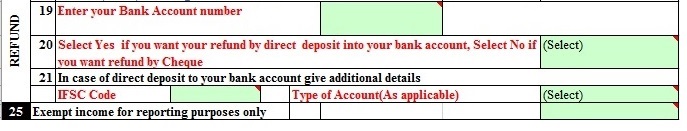

On the Tab Taxes Paid and Verification enter the bank details whether you have a refund or not. Fill in the following details (marked in red) as shown in picture below

- Bank account number (minimum 11 digits as per Core Banking Solution (CBS) system of the Bank).

- Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque

- Quote the IFSC code of the bank if you desire to receive the refund through electronic clearing system (ECS).

- Fill in the Type of Account : Savings,Current etc.

Certain types or amounts of income are not taxed i.e are exempted from income tax. It falls under Section 10 of Income tax Act. Some income which is exempted from tax are given below. TaxFaq’s List of Income that is Exempt from Income Tax gives the full list . It is better to report such income.

- Agricultural income [Sec. 10(1)]

- Leave travel concession(LTC) provided by as employer to his Indian citizen employee [Sec. 10(5)]

- Any amount from provident fund paid to retiring employee [Sec. 10(11)]

- Dividend on or after April, 2003 from domestic companies [Section 10(34)]

- Income on units of Mutual Funds on or after April 1, 2003 [Section 10(35)]

- Long-term capital gains arising on transfer of equity shares or units of equity oriented mutual fund if securities transaction tax is paid. [Section 10(38)]

- Income of a minor child up to Rs. 1,500 in respect of each minor child whose income is to be included under section 64(1A) [Section 10(32) ]

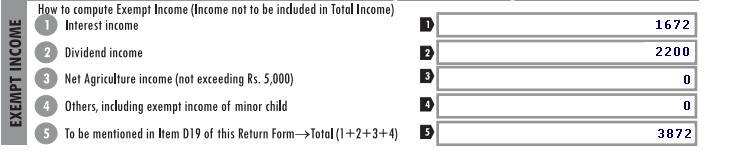

For example if one has interest on PPF and dividend (from stocks or mutual funds),calculation is as follows:

Computation of Tax

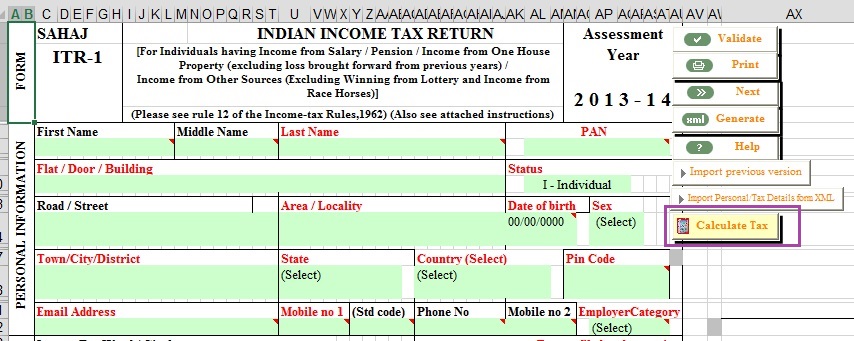

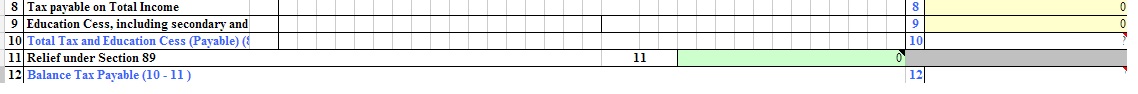

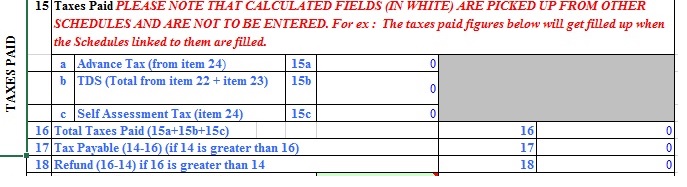

Click on tab Income Details. Click on Calculate Tax to calculate the tax that you should be paying for the income and deductions you have declared and compare it with the tax you have paid as shown in figure below.

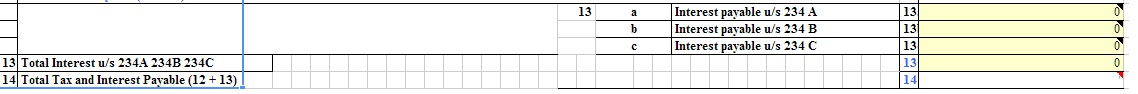

If you have paid less tax, it would show the difference in the Balance tax payable row as shown below and also in the rows 15-18 of tab Taxes Paid and Verification. If you have paid more tax, it would show the amount in the tax refund row 18 of tab Taxes Paid and Verification

If Balance tax payable amount is more than Rs 10,000, a penalty under section 234 will be levied, as you would have been expected to pay Advance Tax. Calculate Tax would update those fields also.

You need to pay the tax payable amount using Challan 280. You should pay your all your tax due before submitting the income tax return form. If you pay less than what you should pay as per your computation of tax before filing Return , your return may be treated as defective return as per Section 139(9).

- For Assessment Year fill in appropriate Assessment Year For ex: Assessment Year is 2013-14. For filing returns for income earned in 1 Apr 2012 -31 Mar 2013

- For Tax applicable fill in Select 0021 : INCOME-TAX (OTHER THAN COMPANIES)

- For Type of payment Select 300 for SELF ASSESSMENT TAX

After paying it go to Tab TDS and mention the payment details(Seven digit BSR code of the bank branch, Date of Deposit (DD/MM/Year) of tax, Serial Number of Challan) in Advance Tax and Self Assessment Tax as explained earlier.

Again Validate and Compute the tax.

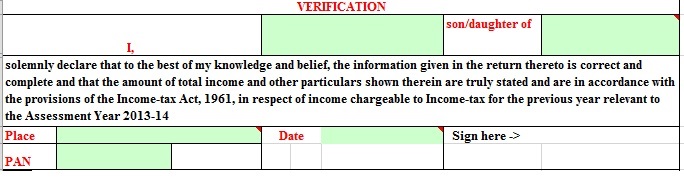

Verification

Fill in your name, your father’s name (women tax payer also needs to fill in father’s name only), place from where you are filing your returns, your PAN number and the date. Sign here ->should be left empty in excel ITR.

If the return has been prepared by a Tax Return Preparer (TRP) relevant details have to be filled (which would be filled by TRP himself)

Generation of XML

After validating, (no errors ,warnings) all the entries.

- Click Generate XML.

- Click the Save XML button. Make a note of where the file is located and then click the OK button

Submit your Return

Now that you have the XML file ready, all you need to do is upload it back to the IT website.

- Go to https://incometaxindiaefiling.gov.in

- Login with your PAN number and password.

- Under SUBMIT RETURN, point to Select Assessment Year and then click AY 13-14.

- Choose ITR-1 from the drop down, if you don’t have digital signature, choose No and then click the Next button.

- Use the Browse button to navigate to the saved xml file on your computer.

- Click the Upload button after the file has been located. Click the OK button

- Upload Digital Signature Certificate, if available and applicable.

- Click SUBMIT.

On successful upload, Acknowledgement details would be displayed. If you have not used digital signature you need to send it to the CPC in Bangalore.

- The acknowledgement number is confirmation of the successful submission of your e-returns.

- Click the link to view or generate a printout of Acknowledgement/ITR-V Form.

- ITR-V is also sent to your email id

Sending ITR-V

- Once you have the print out,Sign the form.

- Send the ITR-V form to the CPC within 120 days of uploading the XML. Use only normal post or SpeedPost.

- Address is: Income Tax Department – CPC, Post Bag No – 1,Electronic City Post Office, Bangalore 560100.

Confirmation mail: After IT department receive the duly signed ITR V and verify it, they will send you the acknowledgement mail to your mail-id.

After submitting Income Tax Return: CPC process the returns as per the rules set by Central Board of Direct Taxes. It determines the sum payable to or the amount of refund due to, the person after credit of such Tax collected at Source (TCS), Tax Deducted at Source (TDS) and tax payment claims which are validated with reference to data uploaded. An intimation is generated electronically and sent to the person by e-mail specifying the sum determined to be payable by, or the amount of the refund due to, the person or Nil demand. Our article After filing Income Tax Return explains what happens after submitting the returns.

Related Articles:

- Fill Excel ITR form : Personal Information,Filing Status

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- Paying Income Tax : Challan 280

Due to extra load on the e-filing website, several taxpayers could not file their returns. So the finance ministry has extended the due date for filing income tax (I-T) returns for assessment year 2013-14 (FY2012-13) from 31st July to 5th August 2013.

Hope it helped you in understanding how to fill the income tax return. If there something wrong, or missing Please let us know. Which part of filling ITR you find difficult?

25 responses to “Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax”

The donation to chief ministers distress relief fund is not possible to be entered under 80G

I am not able to make entry under 80G (5) (vi) as the colum is grey

There are no examples to illustrate filing of IT return by gallantry awardees where the full pension is totally tax exempt under Sec 10(18) of IT Act. Say the Form 16 shows the pension of the gallantry awardee as Rs. 600000/- and tax deducted is nil. My query is which form should be used for the tax return and, how and where to reflect this. Should the salary be taken as zero and return filed or this needs to be shown elsewhere?. Kindly guide.

You are the backbone of our nation.

Those defense personnel who were retired from the service receive pension income which also be taxable under the head income from Salaries.

You have to show this as exempt income in ITR1.

Is it mandatory all donations under 80G get included in form no 16/16A for AY 2017-18.

Recd notice for the discrepancy 143(1).

I think this write-up on Sec 80G needs to be updated. The present sec 80G does not have 80GA, 80GB, etc.

While calculating the deductible limit available for 80G deduction (donations), one has to deduct from the gross taxable income (i.e. excluding exempt income), denoted by say X, items such as long/short term capital gains and all other deductions available in Chapter VIA excluding 80G, denoted by say Y. The figure X minus Y denoted by say Z will then be the basis for applying the maximum deductible amount for Sec 80G deduction. Only a maximum of 10% of Z will be allowed u/s 80G. The actual deduction to be claimed within this 10% ceiling will depend on the type of donation made.

It also needs to be clarified that the deduction u/s 80GGA (100% deduction of donations made to certain eligible institutions) which forms a part of Chapter VIA, should also be first deducted from the amount Y mentioned above. Sec 80GGA is not available for those in business or profession.

For a list of Chapter VIA deductions, please refer to the IT Return form that is available on the IT Dept. website.

This is my understanding of Sec 80G deductions. I request the learned authors to go into this section 80G as it now appears, and rewrite the article to reflect the current position. Thank you.

Incidentally, the reference to the taxguru article mentioned in your article relates to an article on income-tax rectification petition and not on Sec 80G.

Correction: Reference deduction u/s 80GGA in my earlier post. The deduction u/s 80GGA should be made from figure X and not from figure Y as mentioned. Regret the error.

Hi

Can you please tell me, under which section from 80G A,B,C,D does 80G(5) come?

Income Tax Act and under section 80G provides for a deduction in respect of donations to certain funds, charitable institutions etc subject to the conditions that such funds/ institutions are approved u/s 80G(5)(vi). Only a few government funds such as the Prime Minister’s Relief Fund, Nehru Children’s Fund etc. are registered under section 80G. All other organisations, NGOs in particular, are registered under section 80G(5)(VI) of the said Act.

Under this section 50% of your donation to our fund shall qualify for exemption from income tax. Moreover, the qualifying amount must not exceed 10% of your gross income. While computing the deductible amount under section 80G, first the aggregate of the sums donated has to be found out. Then 50% of the donated amount has to be found out and it should be limited to 10% of the gross total income. If such amount is more than 10% of the gross total income, the excess will be ignored.

For example: Suppose, your gross annual income for the current financial year is Rs. 4,00,000. You donate the sum of Rs. 1,00,000. In this case 50% of your donated amount, i.e. Rs. 50,000 will qualify for tax exemption. However, this qualifying amount must not be above 10% of your total income, i.e. Rs. 40,000. So, in this instance, the actual amount eligible for deduction from income will be Rs. 40,000.

So it should come under 80GD : Donations entitled for 50% deduction subject to qualifying limit

Taxguru article Deduction U/s. 80G of Income Tax Act, 1961 for donation explains calculation in detail.

Please verify it by calling

For Income tax related queries :1800 180 1961

e-Filing : 1800 4250 0025

Hi

Can you please tell me, under which section from 80G A,B,C,D does 80G(5) come?

Income Tax Act and under section 80G provides for a deduction in respect of donations to certain funds, charitable institutions etc subject to the conditions that such funds/ institutions are approved u/s 80G(5)(vi). Only a few government funds such as the Prime Minister’s Relief Fund, Nehru Children’s Fund etc. are registered under section 80G. All other organisations, NGOs in particular, are registered under section 80G(5)(VI) of the said Act.

Under this section 50% of your donation to our fund shall qualify for exemption from income tax. Moreover, the qualifying amount must not exceed 10% of your gross income. While computing the deductible amount under section 80G, first the aggregate of the sums donated has to be found out. Then 50% of the donated amount has to be found out and it should be limited to 10% of the gross total income. If such amount is more than 10% of the gross total income, the excess will be ignored.

For example: Suppose, your gross annual income for the current financial year is Rs. 4,00,000. You donate the sum of Rs. 1,00,000. In this case 50% of your donated amount, i.e. Rs. 50,000 will qualify for tax exemption. However, this qualifying amount must not be above 10% of your total income, i.e. Rs. 40,000. So, in this instance, the actual amount eligible for deduction from income will be Rs. 40,000.

So it should come under 80GD : Donations entitled for 50% deduction subject to qualifying limit

Taxguru article Deduction U/s. 80G of Income Tax Act, 1961 for donation explains calculation in detail.

Please verify it by calling

For Income tax related queries :1800 180 1961

e-Filing : 1800 4250 0025

Hi team,

Excellent information provided.

Query – HOW CTC is calculated & what all components are considered ?

Hi team,

Excellent information provided.

Query – HOW CTC is calculated & what all components are considered ?

Nice Information. Thanks for sharing a useful information about Income Tax Calculator. Please share some more information about IT Calculator.Keep it Up.

Thanks for sharing the calculators on taxsmile. You have great collection of calcualators

Nice Information. Thanks for sharing a useful information about Income Tax Calculator. Please share some more information about IT Calculator.Keep it Up.

Thanks for sharing the calculators on taxsmile. You have great collection of calcualators

Thanks for the efforts.Till the year most of the tax payers were filling the returns lightly (means they were not much careful) but as Govt have become as much strict…peoples need such posts for guidance.

Paresh thanks for encouragement. The reason I wrote article was because people say e-file the return it’s so easy but I have struggled to fill return. It’s like writing the essay when you don’t even know the alphabets properly

Thanks for the efforts.Till the year most of the tax payers were filling the returns lightly (means they were not much careful) but as Govt have become as much strict…peoples need such posts for guidance.

Paresh thanks for encouragement. The reason I wrote article was because people say e-file the return it’s so easy but I have struggled to fill return. It’s like writing the essay when you don’t even know the alphabets properly

very informative. thanks for sharing.

very informative. thanks for sharing.

Hi Kirti,

In TDS page, I filled details in row 22 and 23 also. I think I’ve to fill only row 22 because it is asking for “Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)]”

But I filled the same details in row 23 (“Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)]”)

which are mentioned above in row 22.

That is why the reason I’m getting TDS as

b TDS (Total from item 22 + item 23) 15b 45,524

I’ve already generated XML and filed the return. Please let me know what is the process to modify now.

Thank you

Kishore

Hi Kirti,

In TDS page, I filled details in row 22 and 23 also. I think I’ve to fill only row 22 because it is asking for “Details of Tax Deducted at Source from SALARY

[As per FORM 16 issued by Employer(s)]”

But I filled the same details in row 23 (“Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)]”)

which are mentioned above in row 22.

That is why the reason I’m getting TDS as

b TDS (Total from item 22 + item 23) 15b 45,524

I’ve already generated XML and filed the return. Please let me know what is the process to modify now.

Thank you

Kishore