Income Tax Department has provided User Friendly utilities in Excel format, called the Return Preparation Software, to make it easier for Income tax payers to fill his returns. In this article we shall explain how to fill ITR form in excel for Personal Information and Filing Status.

Table of Contents

Using Excel Utility for Income Tax Return

Steps in using excel file are given below. Our article E-filing : Excel File of Income Tax Return explains the excel file and process to use it in detail.

- Choose the excel file for correct Assessment Year, and Correct Form for example Excel file for ITR1 for FY 2012-13 Assessment Year 2013-14 is named ITR1_2013.zip.

- Excel utility that can be downloaded is a zip file from income tax website, incometaxefiling.gov.in.

- Extract the excel file , with extension .xls, from the zip file.

- Enable Macros : You may be asked to Enable Macros, click on messages when you open the file.

Look and feel of excel file

- It has buttons on the right hand side like Validate,Next, Help etc. Buttons may differ based on the sheet.

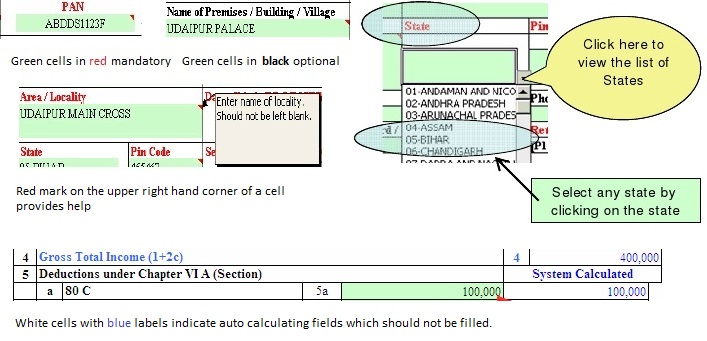

- Area to fill information is colourful with green cells , red marks in corner, white cells with blue labels etc as shown in picture below. You can use TAB key to move between cells

- Green cells indicate data entry fields where one can enter information ex: First Name, PAN etc

- Label of cells which is in red colour indicates mandatory fields for example : Last Name,PAN, Date of Birth

- Label of cell which is in black colour indicates optional fields for example : First Name, Road,Phone

- Down arrow in cells can be used to select from a list of options for that field For example State, Employer Category. Selecting the State

- Red mark on the upper right hand corner of a cell provides help or more information about what needs to be filled

- White cells with blue labels indicate auto calculating fields which should not be filled. These are calculated automatically based on information entered in other cells.

- Hover your mouse over each field and the comments box will display specific instructions on filling information for each field

-

- Color codes in excel utility

- WorkSheets on the bottom as tabs such as Income Details, TDS, Taxes paid and Verification, Instructions, 80G. You can navigate to any of the tabs by

- clicking on the tab using mouse, or

- pressing Ctrl PgUp or Ctrl PgDn keys to navigate to the desired tabs.

- Clicking the Next/Previous button on the sheet

Tips:

- All fields in red are mandatory. You will not be able to complete the form if even one of these fields are left blank.

- DO NOT Copy and paste any of the information from anywhere. It may mess up the sheet.

Fill Excel

Click the Income Details tab to start preparing your return

Assessment Year and ITR Form

Please check the Assessment Year and the ITR Form.

For income earned from 1-Apr 2012 to 31-Mar-2013, called as Financial Year 2012-13, Assessment Year should be 2013-14.

ITR form depends on the type of tax payer(individual, Hindu Undivided Family, Firm) , type of income earned (Income from salary, House Property). Our article Which ITR Form to Fill? discusses it in detail

For example ITR1 form is for Individuals having income of following types

- Income from Salary or Pension

- Income from One House Property (excluding loss brought forward from previous years)

- Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)

Personal Information

Most of the details to be filled out in are self-explanatory. Fill Information for fill up your first name, middle name, last name as they appear in your PAN card. Last Name, Address, pin code, date of birth, sex and email address are compulsory (Green cells with Red color) If the person filing tax do not have a last name, Fill your first name in the Last Name box and leave the First Name box blank.

PAN: Verify that the same PAN number is reported inForm 16, form 16A. Make sure you enter your PAN correctly.

Employer category:For individual, Government category will include Central Government/ State Governments employees. PSU category will include public sector companies of Central Government and State Government. If not employed in Government or PSU use OTH.

Filing Status

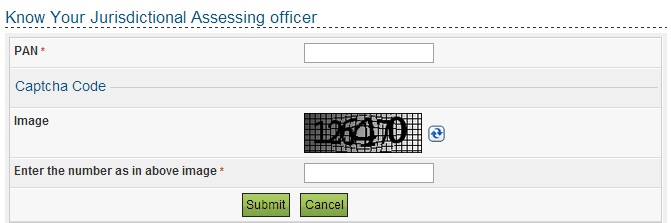

To fill the Designation of Assessing Officer (Ward/Circle), look up your previous years returns. If this is the first time you are filing your returns, you can look up the IT website using your PAN number as shown in picture below. Or just leave it empty (it’s in black so not compulsory)

Return filed under section : Depends on whether you are filing for first time in the assessment year before or after the due date or whether you are revising your return or you have been served notice by Income Tax Department and you are filing returns in reply to that. Due Date for filing of returns for individuals is 31-Jul of the Assessment Year, for ex for AY 2013-14 it is 31-Jul-2013.

- On or before the due date : section 139(1)

- After the due date under section 139(1) but before the expiry of one year from the end of relevant assessment year: section 139(4)

- Revised Return: section 139(5)

- In response to notice under section 139(9) for removal of defects.

- In response to notice under section 142(1).

- In response to notice under section 148

- In response to notice under section 153A/ 153C

Our article After filing Income Tax Return explains it in detail.

When you file the return for the first time for an assessment year before due-date section 139(1) is applicable. Due date is the last date, you need not wait till last date to file your returns, you can file early also. Infact many people have started filing their Income Tax returns in May end.

If an individual has already filed the income tax return and subsequently discover any omission or wrong statement therein, he can re-file the return with necessary modification. This re-filing of the income tax return is referred to as Revised Return. Revised return can be filed for any previous year at any time before the expiry of 1 year from the end of the relevant assessment year or before completion of the assessment whichever is earlier. For this financial year (2012-13), you can file the revised return till March 31st, 2014

Are you Governed by Portugese Civil Code under Section 5A? Section 5A of the Income Tax Act, 1961, provides for the apportionment of non-salary income between the spouses governed by the system of community of property which is applicable for income between Goan spouses covered under the Portuguese Civil Code. If you select Yes here you need to provide information in Schedule 5A of the Form.

Whether original or revised return? Select from list provided. If you are filing the return for first time for this assessment year then select Original. if you have already filed your return for this year and would like to make changes then select Revised .

- If Revised is selected : you need to fill acknowledgement number or date of filing of the original return

Notice number: If you filing return in reply to notice by income tax then you need to fill in the details.

Residential Status : Select from Resident, Non-Resident, Resident but Not Ordinarily Resident

A person is a resident Indian in a particular year if he fulfils either of these two conditions: –

- He/she has been in India in that year for 182 days or more or

- He/she has been in India for 60 days or more in that year and 365 days or more in the 4 years preceding that year

A person who does not fulfill the above conditions is considered to be a non-resident.

Resident but Not Ordinarily Resident(RONR) are those who have recently moved back to India after spending many years overseas. To be RONR one must fulfil either of the conditions

- He/she has been non-resident in India, that is, an NRI, in nine out of the ten previous years preceding that year, OR

- He/she has, during the seven previous years preceding that year, been in India for a period of 729 days or less

Related Articles:

- Income Tax for Beginner, Income Tax For Beginner – Part II

- E-Filing of Income Tax Return

- E-filing : Excel File of Income Tax Return

- Registering on Income Tax efiling Website,

- Which ITR Form to Fill?

In this article we have explained how to fill ITR form in excel for Personal Information and Filing Status. In forthcoming article we shall explain more on how to fill ITR in excel with pictures.

28 responses to “Fill Excel ITR form : Personal Information,Filing Status”

If we not mention payment of one month from last employer and filled the ITR with new employer can we get the notice?

As there is no entry of income from both employer

Note :-

1- As both income are non taxable

2- 26AS has no entry of payment from employer

3- even after clubbing both income it does not cross the 2.5 lakh limit

Still we get the notice???

If I am central govt pensioner who is my employer to be filled in the income tax return

i am retired , not getting any pension. having rental income and fixed deposit interest income. what should i write in employer category in ITR 2A . is it mandatory to tick on OTHERS for retired people also or shall we leave it empty?

please reply soon.

thanks in advance

You have:

Interest from FD which comes under Income from Other Sources

Rental Income : which comes under Income from House property.

As you do not have Income from Salary you leave that blank.

If you have rental income from 1 house only you can also use ITR1

Hi, i need to know that what salary amount i need to put in my excel in column Salary in sheet-PartB-TI-TTI. do i need to mention my gross salary or Total income which is calculated after deducting my savings under section 80 c. Please assist

Pooja cells in excel have color coding for ex:

Green cells indicate data entry fields where one can enter information ex: First Name, PAN etc

Label of cells which is in red colour indicates mandatory fields for example : Last Name,PAN, Date of Birth

White cells with blue labels indicate auto calculating fields which should not be filled. These are calculated automatically based on information entered in other cells.

As instruction in Part B TI says Computation of total income . PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The income figures below will get filled up when the Schedules linked to the Income are filled.

Total Income from PartB-TI-TTI is automatically filled from the information entered in Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank).

To fill Salary Income in Schedule S you can check our article HRA Exemption,Calculation,Tax and Income Tax Return which shows it with pictures

Hi, i need to know that what salary amount i need to put in my excel in column Salary in sheet-PartB-TI-TTI. do i need to mention my gross salary or Total income which is calculated after deducting my savings under section 80 c. Please assist

Pooja cells in excel have color coding for ex:

Green cells indicate data entry fields where one can enter information ex: First Name, PAN etc

Label of cells which is in red colour indicates mandatory fields for example : Last Name,PAN, Date of Birth

White cells with blue labels indicate auto calculating fields which should not be filled. These are calculated automatically based on information entered in other cells.

As instruction in Part B TI says Computation of total income . PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The income figures below will get filled up when the Schedules linked to the Income are filled.

Total Income from PartB-TI-TTI is automatically filled from the information entered in Schedule S Details of Income from Salary (Fields marked in RED should not be left Blank).

To fill Salary Income in Schedule S you can check our article HRA Exemption,Calculation,Tax and Income Tax Return which shows it with pictures

Im having a problem, i have availed of a home loan in my native place and am staying and working in a different state. I have been given form 16 from my employer which shows my

income chargeable under head salaries say 600000

loss from house property as -150000

gross total income is 450000

deducting 80c,80ccc and 80ccd 100000

deducting 80e 5000

tot income 345000

tax payable 19753

i have filled these into the ITR1 supplied which shows refund of INR 19750 in the taxes paid section

Is this right? if so will i get this refund? I have a citibank account that shows only 10 digits which

the form refuses to accept what to do?

Also i do not know where to fill the amount of loss of property as it shows income from house property

as only self-occupied and let out which is neither the right option

Hansel if your taxable income is 345000 then your tax liability should be

Exempt Income 200000 0

Income chargeable at 10% 145000 14500

Total 14500

Education Cess @ 3% of Income Tax Payable 435

Gross Income Tax liability 14935

So Tax payable should be 14935 which would have been paid by company. As you have reported these to your employer and are in Form 16 all tax liability should have been taken care of.

Can you go through our article Fill Excel ITR1 Form : Income, TDS, Advance Tax and Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax and check whether your TDS details from Form 16 have been filled correctly.http://bemoneyaware.com/wp-admin/edit-comments.php#comments-form

Im having a problem, i have availed of a home loan in my native place and am staying and working in a different state. I have been given form 16 from my employer which shows my

income chargeable under head salaries say 600000

loss from house property as -150000

gross total income is 450000

deducting 80c,80ccc and 80ccd 100000

deducting 80e 5000

tot income 345000

tax payable 19753

i have filled these into the ITR1 supplied which shows refund of INR 19750 in the taxes paid section

Is this right? if so will i get this refund? I have a citibank account that shows only 10 digits which

the form refuses to accept what to do?

Also i do not know where to fill the amount of loss of property as it shows income from house property

as only self-occupied and let out which is neither the right option

Hansel if your taxable income is 345000 then your tax liability should be

Exempt Income 200000 0

Income chargeable at 10% 145000 14500

Total 14500

Education Cess @ 3% of Income Tax Payable 435

Gross Income Tax liability 14935

So Tax payable should be 14935 which would have been paid by company. As you have reported these to your employer and are in Form 16 all tax liability should have been taken care of.

Can you go through our article Fill Excel ITR1 Form : Income, TDS, Advance Tax and Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax and check whether your TDS details from Form 16 have been filled correctly.http://bemoneyaware.com/wp-admin/edit-comments.php#comments-form

Regarding Employer category-

What should be filled if employer if a private company ? So neither Gov, Nor PSU.

You mentioned ” If not employed use OTH” .

So is it NA?

Thanks for pointing out Vineet. It should be OTH. If employed and not in Govt or Public Sector Unit one should use OTH.

Correction made in the article.

Still there is an issue Kirti.

The Excep sheet downloaded from https://incometaxindiaefiling.gov.in/ says –

” If not employed use OTH”

What do you suggest, is it a typo in the sheet ?

Yes,(it’s a bug after all it’s written by humans)

If employed and not in Govt or PSU use OTH.

Still there is an issue Kirti.

The Excel sheet downloaded from https://incometaxindiaefiling.gov.in/ says –

” If not employed use OTH”

What do you suggest, is it a typo in the sheet ?

Regarding Employer category-

What should be filled if employer if a private company ? So neither Gov, Nor PSU.

You mentioned ” If not employed use OTH” .

So is it NA?

Thanks for pointing out Vineet. It should be OTH. If employed and not in Govt or Public Sector Unit one should use OTH.

Correction made in the article.

Still there is an issue Kirti.

The Excep sheet downloaded from https://incometaxindiaefiling.gov.in/ says –

” If not employed use OTH”

What do you suggest, is it a typo in the sheet ?

Yes,(it’s a bug after all it’s written by humans)

If employed and not in Govt or PSU use OTH.

Still there is an issue Kirti.

The Excel sheet downloaded from https://incometaxindiaefiling.gov.in/ says –

” If not employed use OTH”

What do you suggest, is it a typo in the sheet ?

Dear Kirti

If I am a pensioner retired from Government service what do I choose?

Sir your pension will be considered as Income from Salary.

ITR1 is usually for Individuals having income of following types

Income from Salary or Pension

Income from One House Property (excluding loss brought forward from previous years)

Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)

ITR-2 is for Individual/HUF 1. Income from salary/pension 2. Income from house property(s) 3. Income from other sources( excluding winnings from lottery and income from races horses)

4.Income from Capital Gains. 5. Income from foreign assets.

They should not have Income from Business or Profession.

Our article Which ITR Form to Fill? explains it in detail.

Another very informative and important post….. Thanks for the share……

Thanks Debopam, please share it with your friends

Another very informative and important post….. Thanks for the share……

Thanks Debopam, please share it with your friends