This 10 minute video explains steps in filing ITR, ways to file ITR : Excel Utility, Java Utility or Online, Documents required and Form 26 AS. This video is based on our article E-Filing of Income Tax Return,

Table of Contents

Video on Ways to File ITR , Steps to File ITR

Bemoneyaware’s video on Youtube is at https://www.youtube.com/watch?v=6uPW-iavZPc

Summary of Video is given below

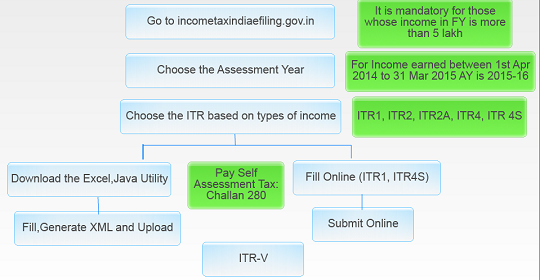

Steps In Filing Income Tax returns

To file on incometax department efiling website incometaxindiaefiling.gov.in steps are ”

- Fill the form for which there are two options

- File return offline : means you can download the form, fill it without being connected to internet and submit the form online.

- File return online (which currently shows for filing only ITR 1,ITR4S) : means that you need to be connected to internet for filling the form as well as submitting it.

- Choose whether you want to use digital signature while filing. A digital signature authenticates electronic documents in a similar manner a handwritten signature authenticates printed documents. This signature cannot be forged.

- If you do not use digital signature the Income Tax receipt, called as ITR-V, needs to be printed and sent to Central Processing Unit (CPC) Banaglore within 120 days of filing return.

When does one need to e file returns

E-Filing Returns is compulsory for:

- Individuals earning over Rs 5 lakh a year. They are required to file their tax returns in the electronic format from AY 2013-14 (FY 2012-13) and subsequent assessment years.

- Individual/HUF, having total Income of Rupees 10 lakhs. It was made mandatory from AY 2012-2013((FY 2011-12) and subsequent assessment years.

- Individual/HUF /Firm auditable under section 44B of the IT Act, 1961. It was made mandatory for AY 2012-2013 and subsequent assessment years.

- All Companies

How to file returns using Excel or Java Utility

Which utility to choose depends on your familiarity and your ease of use with software such as Excel, Java or form based. Information to be filled is same in all. As Amitabh Bachchan says famous lines from his father’s Harivansh Rai Bachchan, raah pakaD tu ek chalaa-chal paa jaayega madhushaala .

Steps to file returns offline are :

- Download the applicable ITR form which is zip file with Microsoft excel file or Java Utility also called as Return Preparation Software

- Fill it offline

- Generate a XML file and save it to your computer.

- Logon to incometaxindiaefiling.gov.in (If you don’t have the Login you need to register )

- Go to e-File->Income Tax Return and Upload your XML file (saved in step 3)

- Choose whether you want to use Digital Signature or not

- On successful upload acknowledgement details would be displayed.

- If you did not use digital signature and you did not meet requirements for Electronic Verification code ex : did not fill the Aadhaar the Income Tax receipt, ITR-V, needs to be printed out and sent to Central Processing Unit (CPC) Banaglore within 120 days of filing return.

Java Utility

Online

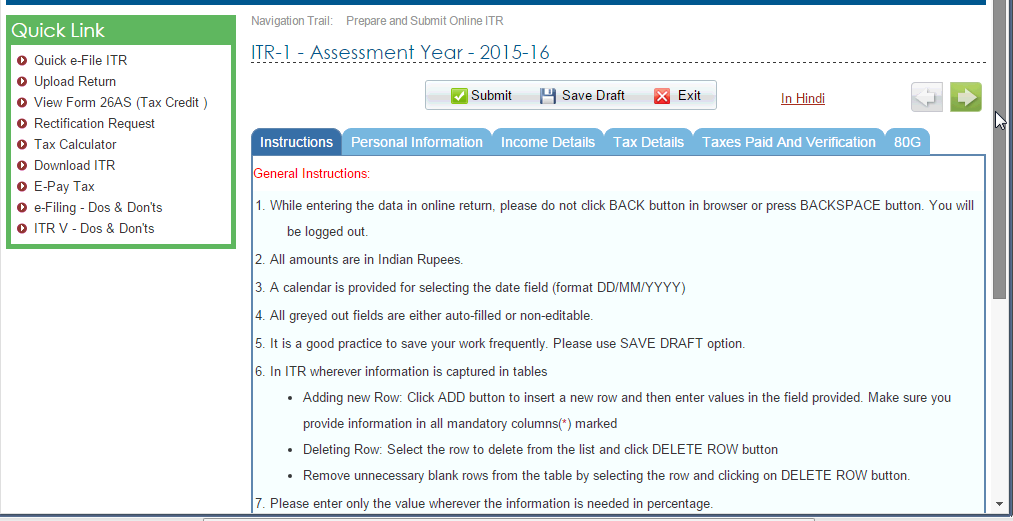

Those filing ITR1 or ITR 4S can file online after logging in to incometaxefiling.gov,in and selecting Quick e-File ITR ,as shown in image below (Click on image to enlarge)

Documents required while filing ITR

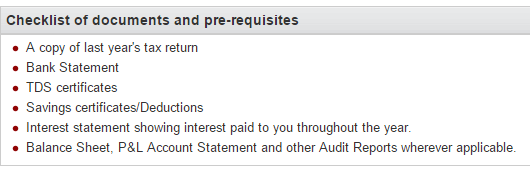

As per income tax department documents required for filing ITR are shown in image below

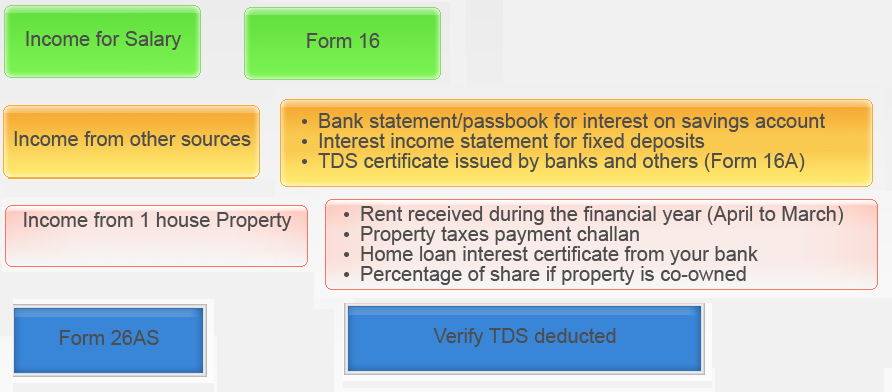

Various documents depending on Types of Income are shown below (Click on image to enlarge) and articles to help you understand

Steps in Filing an ITR

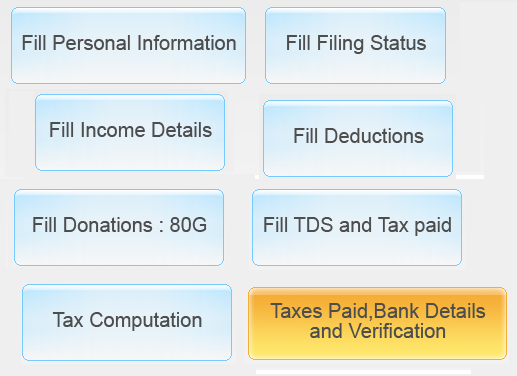

Steps in filling an ITR are explained in articles and shown in image given below

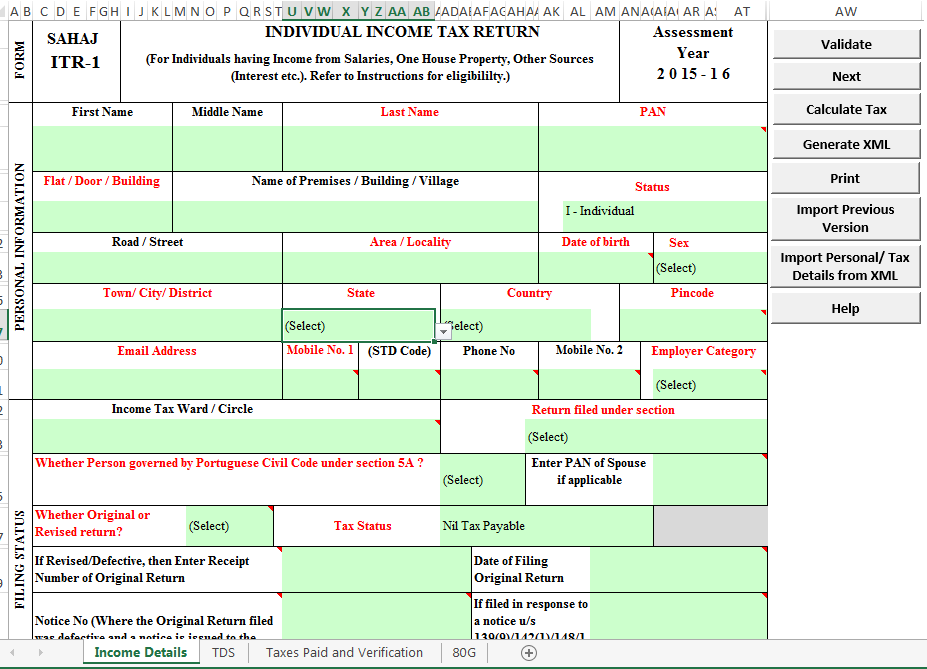

- Fill Excel ITR form : Personal Information,Filing Status or Filling Individual ITR Form: Fields A1 to A22

- How To Fill Salary Details in ITR2, ITR1

- HRA Exemption,Calculation,Tax and Income Tax Return

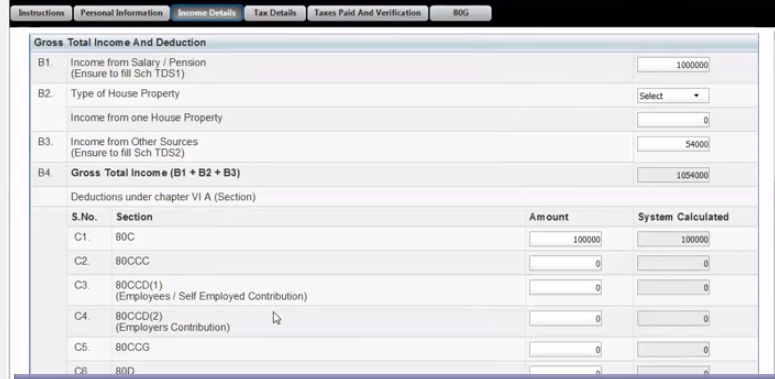

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Tax Exempt Allowances in Salary Schedule S in ITR2

- Paying Income Tax Online, epayment: Challan 280

Please let us know your feedback on how are the videos? Are videos helpful? What kind of information you prefer to see on bemoneyaware – text or video or both

9 responses to “Filing ITR : Video on Steps to File ITR, Ways to File,Documents required”

I have discovered a web site that has the most affordable costs on name brand flashlights. This website claims it has fast delivering in a safeguarded online order environment. If you are trying to find flashlights for camping or emergency situation scenarios this is a web site you must have a look at.

Hi Kirti,

I have filed ITR 4 with the help of CA.

He syas you need not send ITR V to CPC, Banglaore.

Instead You can e-verify it on Income Tax Portal.

Is that sufficient?

Gagan

Very much so Gagan. Income tax department realised that many people are not sending their ITR-V so from this year they have come up with E-verification of ITR.

There are various ways to do so. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking gives details about it.

Hi Kirti,

I have filed ITR 4 with the help of CA.

He syas you need not send ITR V to CPC, Banglaore.

Instead You can e-verify it on Income Tax Portal.

Is that sufficient?

Gagan

Very much so Gagan. Income tax department realised that many people are not sending their ITR-V so from this year they have come up with E-verification of ITR.

There are various ways to do so. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking gives details about it.

i am salary employee and i have housing loan. paying interest and principle are dedected in my it calculation. how can i fill IT form for this and where can i show detections for this in the tax form.

u have should file to itr1

i am salary employee and i have housing loan. paying interest and principle are dedected in my it calculation. how can i fill IT form for this and where can i show detections for this in the tax form.

u have should file to itr1