When you go to buy a car or a two-wheeler at the showroom two prices would be quoted ex-showroom and on-road. The price you actually pay for the car is the on-road price, so you better look at that when making your decision. The on-road price exceeds the ex-showroom by around 10%, depending on the car model and the state in which you are buying it.

Prices associated with a car or motorbike

that the car prices in India vary from one state to another. The basic factors that contribute to car prices in any state are ex-showroom price, ex-factory rate, and ex-road rate.

Ex Factory Price of Car : is the price Car Dealer pays to Manufacturer to lift the car from them i.e it is the price at which a car manufacturer sells the car. Ex-Factory Price Terminology is not so common as it is between the Manufacturer, Dealer

Ex Showroom Price of Car : Ex-showroom Price of Car is the is the price at which a car dealer sells a car to Retail Customers which includes Dealer Margins, Transportation costs and applicable Excise, State Taxes and Octroi Charges. Ex-showroom Price is called the basic price of the asset exclusive of any registration, insurance or loadings.

On Road Price : On Road Price is the final Price payable by the customer to the car dealer and is also known as Invoice Value of the car it includes State Registration Charges, Life Time Road Tax Payment, Mandatory Insurance and the dealer handling charges (aka Logistics Charges). Also includes optional costs such as Accessories cost, additional optional warranty coverage. The discounts if any will also be shown and reduced while calculating the Net On Road Price. Ex-road price refers to the price at which the buyer drives away the car.

What is ex-showroom price?

Ex-showroom price is the cost that the dealer charges for procuring the car from the manufacturer and the tax that it pays to the state government on procurement. The state government charges excise duty on cars. It is also known as the supply price of a car. In some states and cities, ex-showroom price may also include octroi tax. This is the tax collected by the local authority for bringing articles from outside the region for consumption in that region. Ex showroom prices differ from state to state. For instance, ex-showroom prices are higher in Mumbai or Bangalore than in Delhi.

- Registration charges : Registration is mandatory of every new vehicle. It is a unique identity of vehicle

- Life Time Road Tax : Road tax, known by various names around the world, is a tax which has to be paid on a vehicle before using it on a public road.

- Vehicle Insurance :also known as auto insurance, is insurance purchased for cars, trucks, motorcycles, and other road vehicles.

- Dealer Handling Charges or Logistics charges: Dealer claims handling charges in name of taking car from warehouse to showroom

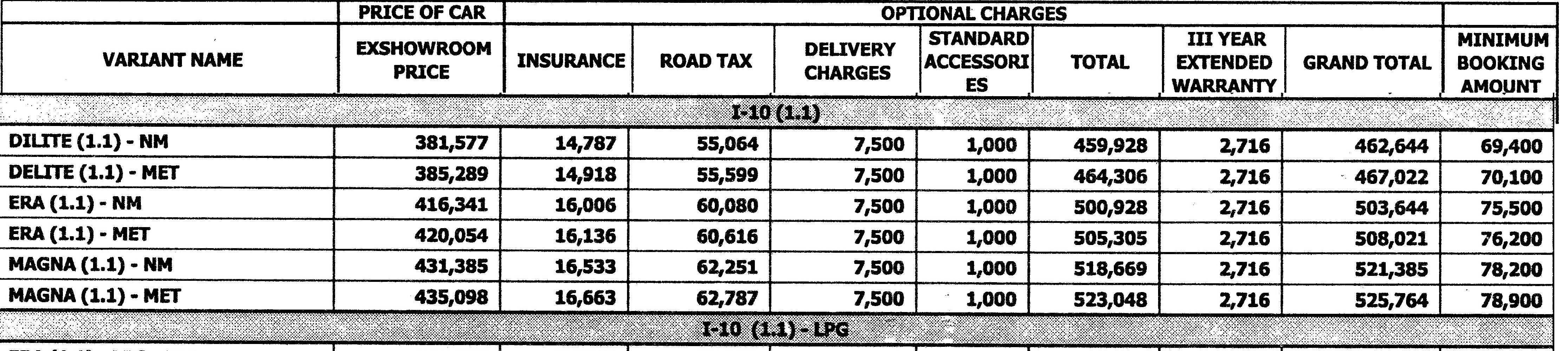

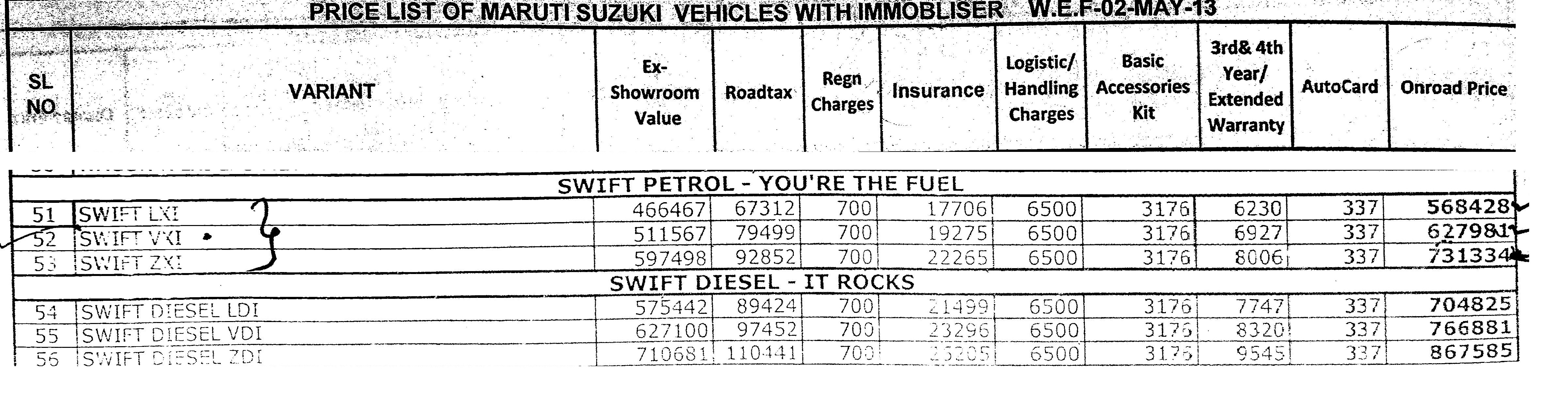

Difference between Onroad price and ex-showroom price for Hyundai as on Jun 2013 is shown below. Click on image to enlarge.

- All motorised road vehicles are tagged with a registration or licence number in India. The licence plate (commonly known as number plates) number is issued by the district-level Regional Transport Office (RTO) of respective states

- Plates for private car and two-wheeler owners have black lettering on a white background (e.g., TN 54 BB 0525). Commercial vehicles such as taxis and trucks have a yellow background and black text (e.g., KA 10 MA 8008). The current format of the registration index consists of 3 parts, They are

- The first two letters indicate the state to which the vehicle is registered.

- The next two digit numbers are the sequential number of a district. Due to heavy volume of vehicle registration, the numbers were given to the RTO offices of registration as well.

- The third part is a 4 digit number unique to each plate. A letter(s) is prefixed when the 4 digit number runs out and then two letters and so on.

| Place | Cost of Car | Registration charges |

| Delhi | Upto Rs. 6 Lac | Petrol Cars – 4%, Diesel Cars – 5% |

| Price between 6 Lac – 10 Lac | Petrol Cars – 7%, Diesel Cars – 8.75% | |

| Price > Rs. 10 Lac as Exshowroom Cost – | Petrol Cars – 10%, Diesel Cars – 12.5% | |

| + MCD Parking Charges | Rs. 2000 for cars priced under 4 LakhRs. 4000 for rest of the vehicle | |

| Karnataka (Bangalore, Mysore, Udupi) | Karnataka has highest vehicle registration charges withminimum slab starts @ 15% | |

| Price < 5 Lakh – · | 15% | |

| Price between 5 – 10 Lakh | 16% | |

| Price between 10 – 20 Lakh | 19% | |

| Price > 20 Lakh | 20% |

- The road tax imposed is subject to state government rules, traffic regulation etc. So it differs from state to state in India.Road tax in Delhi is lesser than in Bangalore and therefore the car you buy from Delhi is priced lower than that you buy in Bangalore.Even within the state it is based on type of vehicle, cost of vehicle etc. In any state Road Tax for Maruti Swift is different from Hyudai i10, road tax for Hyudai i10 is different from Hyundai Verna and road tax for Hyundai i10 with 1.1 metallic color is different from Hyundai i10 non metallic color.

- Road tax for vehicles that cost less than Rs 4 lakh (two-wheelers and small cars) is around 4%-6% whereas it is between 7% and 9% in case of vehicles valued over Rs 20 lakh, Centre is likely to decide uniform lifetime road tax for cars, taxis and two-wheelers. The state governments have agreed to fix the tax at floor rate of 6% of the sale price before the value added tax (VAT).

- It is usually paid once in life time of the vehicle in a state hence it is called as Life Time Road Tax. But If one shifts or relocates vehicle from one state to another state in one has to re-register vehicle and pay lifetime tax again, based upon the depreciated value as assessed by RTO of the new state. The value of vehicle diminishes year after year. Once the residual value of lifetime tax is paid, it is possible of life-time tax paid in the earlier state on pro-rata basis, by writing to the earlier State’s RTO for the same. However, this is a manual process and therefore, it takes a lot of time before you actually get the refund

Dealer Handling Charges or Logistics charges: Dealer claims handling charges in name of taking car from warehouse to showroom , basic fuel,the number plate charge, cleaning of car, sundry expenses as delivery charges. The amount is quiet high and ranges from Rs. 6000 for a hatchback car to upto Rs. 25,000 for Luxury Segment Cars. The Amount is much dubious considering the high price paid for. However, the charges are not claimed by dealers in India, but across most of the countries in the world as Handling Fees, Documentary Fees or even Vehicle Preparation Fees

- Understanding Car : Box,Segment,Specifications

- An Interview: 20s and Money

- Our website bemoneyaware.com which organises information on money for different groups like kids,in 20s-30s,Women etc

When you are searching for car online, you would find mostly ex-showroom price. Make sure you also check car ex-showroom prices in your state because car prices in India differ from one state to another. And find out the on-road price of the car. Some car based websites provide this information once you give your email,mobile number details. Do you think charges like Dealer Handling charges does not make sense.

76 responses to “Understanding Ex Showroom Price and On Road Price of Vehicle”

Thanks for sharing this..

Great words. Thanks for sharing. Always need to check the price of the car through valuation tool.

Reliant Institute Of Logistics

has already proven its mettle with world class logistics training activities. Well established in the international logistics training sector, we are in the forefront in providing quality training with international exposure. The list of international companies involved with us helps to bring modern international practices involved in the logistics industry.

Hallo and compliments for the detailed information..

Could you / anybody please give the information regarding the tentative extra charges to issue the new vehicle’s registration charges, if any..?

Thanks you sir

it is very detailed and well explaned post because one by one clarity information and good specialties

Hello Respecly sir.

I had listened that in your showroom there is a bike name BMW vision next 100. So I just want to confirm that you have or not. Please sir reply kindly. I am waiting for a reply

[…] Understanding Ex Showroom Price and On Road Price of Vehicle – Sep 25, 2013. Registration charges,Life Time Road Tax, Insurance is added to. In some states and cities, ex-showroom price may also include octroi tax. Road tax in Delhi is lesser than in Bangalore and therefore the car. Different insurance companies provide different rates and types of insurance in different states. […]

Autoshed is the best Cars and bikes Wash services centers in Hyderabad over all 90 Locations in hyderabad Leading Car and Bike services in Hyderabad and free pickup and drop off services Over 90 locations,expert technicians and best customer support. We provide affordable, convenient and transparent services.We work 24*7, 365 days an year. With Free pick and drop services, managing your car and bike is now easy and time saving with a price difference of atleast 30% compared to others.

Read More : https://goo.gl/wCQCN5

Is it legal for showrooms/dealers to ask for handling/logistic charges.

No its not legal.

It has become a standard practice of dealers of many vehicle brands sold in the country to charge customers anywhere between Rs 5,000 and Rs 30,000 in case of passenger cars and Rs 2,000 to Rs 5,000 in case of two-wheelers, as handling, logistics and incidental charges.

“But these charges are not a part of the price of the vehicle. They are neither authorised by the manufacturer nor by the Transport department. This collection is not sanctioned by any law even. These charges are illegally collected by the dealers to enrich themselves at the cost of gullible customers,” says Waseem Menon, the founder of Drive Without Borders, an NGO that is fighting against the levy of handling and logistics charges.

Drive Without Borders then launched a petition on change.org urging the Union Transport Minister and Transport Ministers of all states to stop dealers from levying handling and logistics charges. Memon, the force behind the movement, says they are seeking legal recourse and would knock the doors of the High Court soon.

Autoshed is the best Cars and bikes Wash services centers in Hyderabad over all 90 Locations in hyderabad Leading Car and Bike services in Hyderabad and free pickup and drop off services Over 90 locations,expert technicians and best customer support. We provide affordable, convenient and transparent services.We work 24*7, 365 days an year. With Free pick and drop services, managing your car and bike is now easy and time saving with a price difference of atleast 30% compared to others.

Find new cars, compare cars, sell & buy used cars. Check Used Car Valuation. See upcoming cars in India in 2016. Check On Road Car Prices, specs, mileage. Car photo galleries along with TCO & Reviews.

Thanks for the Understanding Ex Showroom Price and On Road Price entry, bemoneyaware.com webmaster!. For more information on shipping a car refer to Braxton website or email me at mgl029@yahoo.co.in and get more information.

Sir,

I have purchased tata tiago on road price, from oberai motors dehradun. When i am asking my car number plate dealer ask me more money for registration fee rs 1800/-

Please suggest ne in this regard.

Thnks

You should always be aware and get some knowledge about these topics before buying a vehicle. Thanks for sharing this, it was very useful for me. Appreciate your efforts for such informative post.

I just want to know how much percent excise duty is on all car manufacturers in India. and if i buy t permit (Tourist) vehicle from any dealer in Mumbai, excise duty for two same dealer is different different. actual excise duty charged on ex. showroom price of the car. then what is the actual excise duty percent on t permit vehicle.

Yes, the Ex-Showroom must be somewhat same in the city for different dealers. But the On Road Price differs a lot for every dealer in the same city.

Is it possible to buy a new car for shipment to another country?

Which country do you want to ship and why?

is the country you are shipping to ha LHS traffic as same as ours and the cars RHD, same as ours?

Very nice article and easy to understand.We are an online lead aggregator for all the major banks and NBFCs. Logon to our portal http://www.letzbank.com to avail any loan at easy way and you can compare different banks interest rate and apply for that particular bank which suits you.

thank you but on road price is different each show room another in same city.

i have checked few.

how to know the exact ex-showroom price in a city?For an Example : ‘maruti suzuki dzire tour LDi’ model. In all websites there is some prices abour ‘maruti suzuki swift dzire’ model but not for the required model.When I asked a dealer they gave me the price of ‘maruti suzuki Dzire tour basic model’ but not the LDi version.I came to know after comparing the features of those model.

in official website there is no information about the prices for this model.

‘Maruti Suzuki Dzire tour’ & ‘maruti Suzuki swift dzire’ are different model.

Did you try carwale.com at http://www.carwale.com/new/prices.aspx

It allows one to change version also.

For example for Maruti Suzuki Swift Dzire LXI version at (South Delhi)

Ex-Showroom Price 5,16,073

RTO 21,256

Insurance 18,705

Registration Charges 4,000

On-Road Price 5,60,034

For ZXI Version

Ex-Showroom Price 7,90,743

RTO 69,803

Insurance 27,602

Registration Charges 4,000

On-Road Price (South Delhi) 8,92,148

The Central Motor Vehicle Rules insist the dealerregister and deliver the vehicle. The ex-show room price covers the vehicle cost, insurance, road tax, cess, and registration fee. The manufacturer also takes care of the initial fuel cost and pre-delivery inspection.

http://www.thehindu.com/todays-paper/tp-national/tp-kerala/vehicle-dealers-under-the-lens/article7994486.ece

Thanks for the input. Raids happened in Kerala, I hope other states also learn from it.

The Central Motor Vehicle Rules insist the dealerregister and deliver the vehicle. The ex-show room price covers the vehicle cost, insurance, road tax, cess, and registration fee. The manufacturer also takes care of the initial fuel cost and pre-delivery inspection.

how a cars or bikes handiling charges calculated..is there a rule for that..a certain % ..

kindly reply me …

Dealer Handling Charges : Dealer claims handling charges in name of taking car from stockyard to showroom cost, basic fuel, stock maintenance, cleaning of car and as delivery charges.

The amount is quiet high and ranges from Rs. 6000 for a hatchback car to upto Rs. 35,000 for Luxury Segment Cars. The Amount is much dubious considering the high price paid for as Ex-showroom Price in itself means Price Paid for bring Car to Showroom. Still Dealers claim this amount over and above the exshowroom Price.

However, its something which is not unique to Indian Automotive market, but happens across most of the countries in the world – where dealer claims the amount as Handling Fees, Documentary Fees or even Vehicle Preparation Fees.

Handling charges varies from dealer to dealer

Govt had told dealers to Waive handling charge but nothing happened

Can someone explain why Insurance for a new vehicle is done on the ex-showroom price and not the on-road price? Would be great if you can share any resource viz. IRDA or GIC or court judgments to justify…thanks

Thank you sir for the elaborate article, actually i am from Bhutan so i am unsure of what price should i be paying for a vehicle(gixxer blue color) if i am buying it from Siliguri, West Bengal i.e ex-showroom or on road price considering Bhutan is another country and i will get it registered in Bhutan

If you are a Bhutan citizen, you may not be able to purchase a car in India. You would need a Indian citizenship to purchase car.

Hi,

Thanks, a really well written article. Makes all the concepts easy to understand.

Cheers !

Hi,

Thanks, a really well written article. Makes all the concenpts easy to understand.

Cheers !

As a prospective buyer, i have been checking various websites for more information on the taxes and the approximate amount i had to pay for a car. Do one need to give the RTO at the time of buying? I have seen a big difference in RTO of different cities. Dimapur have RTO of 8k on Renault Duster whereas for Jaipur its 1.2 lacs.

I intend to buy the duster at Dimapur and register it for Manipur. Please help.

Superb,Very Useful for Irrational Custtomers

what are the comman % for LBT and ROAD TAX. in up and uttrakhand, suggest me plz.

very usefull

Thank You

Which is the best site online to show up the on road prices for new cars without an enquiry. I think https://mynewcar.in is good. Have any suggestion?

I find this article devised in a way easily understandable and throws all that needed to consider while purchasing a new vehicle. In 2012 I purchased my Chevrolet beat diesel optional model and I paid what they asked as I was a novice to the area. In future purchases this knowledge definitely could lend me a hand in avoiding exploited bills. Thank you!

Thanks for encouraging words. We appreciate you taking time to write such a wonderful comment

I m in Bangalore, HYUNDAI dealer gave free insurance quoting worth 25k for i20 car. But premium paid to insurance company was only 13,583. Also they mentioned 25k in debit note. On asking about differential amount they are saying that they charge for service they wud provide for claims. This looks unfair to me.

Also is it not a malpractice to reduce insurance amount(25k) from ex showroom price and then putting in debit note? In fact they are bringing down the value of the car.

Can you please suggest

Thanks

Rish

This is unfair. Yes many has noticed this. But in excitement of buying the car people do not bother about the things.

if you plan to buy a car, you don’t have to necessarily pick up motor insurance from the dealer. You could approach insurance companies directly and negotiate a lower premium and secure up to 50% discount on what your dealer offers. According to Delhi-based consumer expert Bejon Misra and former General Insurance Council secretary general K N Bhandari, dealers are known to mark up premium.

While insurance companies TOI spoke to deny knowledge of such a practice, Bhandari says, “Higher the premium, higher the commission. There is a need for consumers to assert themselves even to the regulator to enforce greater surveillance and more stringent implementation of insurance guidelines.’’

Checkout the team bhp

Hi,

Thanks for the detailed yet simple to understand article on cost associated with a vehilcle purchase.

Am planning to buy Hyundai i10Grand Sportz 1.2 Kappa VTVT in Thane. While i understand that it makes sense to have few dealers details on car costings and take a call on the cheaper buy, what/how are the other aspects that we can negotiate with dealer on for cost reduction (eg; flat discount, adding accessories for free, etc)

Also can you provide the tax % break-up on costings for this car in Thane?

Thanks & Regards,

Karthik Iyer

I say in Dombivli, planning to buy 4 wheeler. I heard that LBT will be scraped from 1-August-2015. Does it means from now on no need to pay LBT on vehicle purchase? If not, from when it will be done.

Local Body Tax, popularly known by its abbreviation as LBT, is the tax imposed by the local civic bodies of India on the entry of goods into a local area for consumption, use or sale therein

The LBT is now partially abolished as of August 1, 2015.

You can check for more details

very easy to understand that what is exshowroom n on rood prices n what charges are included in it …………thanks to who wrote this blog ,,,

Great article.

Thank you for sharing such a valuable information.

I am purchasing a honda bike. Showroom has quoted 70k as ex-showroom price and 80k as on road price.

I am confused about two components in bill:

Others – 450/-

Less Purchase value (If exchange) – 1000/-

Please provide me some info about above two charges. Are they valid or salesperson is misguiding me?

Hi,

Mostly others includes the mandatory accessories such as Saree Guard, Side Mirrors and Initial Fuel. It varies between Dealer to dealer. After receiving the bill, check each and every bill component and get clarified. We noticed some dealers puting non mandatory accessories also in others such as handle grip, which you may not willing to buy.

Dear Sir,

I stay in Thane and I’m trying to purchase a Bike, Ex-showroom cost is 90,000/- and the on-road is 1,20,000/- (can’t understand their calculation)

can I negotiate with the dealer to sell the bike adding up only Registration and Road Tax (7%). I shall arrange to pay the LBT(it is being considered to be cancelled ?) and do a Pvt Insurance (Insurance charged by the dealer is comparatively high)

Please suggest.

Maharashtra is likely to scrap the Local Body Tax (LBT). This levy is likely to be replaced with a surcharge on value-added tax (VAT) from the new financial year.

Don’t be afraid to visit two or more dealers selling the same product.

Question the total amount, including destination charges and assembly charges. Ask to have those waived or reduced.

With very few exceptions, it’s usually best to avoid optional aftermarket warranty coverage for a new motorcycle. Dealers make a considerable profit on those policies. If you want one, you can often buy them yourself after the sale from various competing companies on line.

Thank you very much for sharing valuable information! 🙂

while buying a car, specially look at other component of cost sheet, specially registration, octoroi, LBT & other form of tax. % age is fixed Statewise, region wise but the dealers are charging you over & above the fixed rate.

I have esquire it, lets say in Thane, Mumbai, the registration charges is 9% of ex-showroom & LBT is 5% of ex-showroom. But in the cost sheet, the charges mentioned was more than 9% & 5%. When i asked, why it is so?? The executive told, it is dealer’s margin!!! The dealers put a margin is tax also, actually it must only go to government account only. In the cost sheet, every component, dealers have a margin, whether it is ex-showroom, registration charges,LBT or any insurance premium. I have inquire almost all brands, Hyundai, Maruti,Chevrolet,Honda,Nissan or Renaults, everywhere it is there.

so friends, while buying car, look at those pts, & negotiate with the dealers for their wrong practices!!!!

Rightly said Angan we don’t have information on rates which dealers take advantage of.

One must visit different dealers of the model you are interested in to see where does one get cheaper.

while buying a car, specially look at other component of cost sheet, specially registration, octoroi, LBT & other form of tax. % age is fixed Statewise, region wise but the dealers are charging you over & above the fixed rate.

I have esquire it, lets say in Thane, Mumbai, the registration charges is 9% of ex-showroom & LBT is 5% of ex-showroom. But in the cost sheet, the charges mentioned was more than 9% & 5%. When i asked, why it is so?? The executive told, it is dealer’s margin!!! The dealers put a margin is tax also, actually it must only go to government account only. In the cost sheet, every component, dealers have a margin, whether it is ex-showroom, registration charges,LBT or any insurance premium. I have inquire almost all brands, Hyundai, Maruti,Chevrolet,Honda,Nissan or Renaults, everywhere it is there.

so friends, while buying car, look at those pts, & negotiate with the dealers for their wrong practices!!!!

Rightly said Angan we don’t have information on rates which dealers take advantage of.

One must visit different dealers of the model you are interested in to see where does one get cheaper.

This is the information that was looking for.. a very good explanation with simple words and in short.

This is the kind of comment that we are looking for…thanks a lot for acknowledging it

This is the information that was looking for.. a very good explanation with simple words and in short.

This is the kind of comment that we are looking for…thanks a lot for acknowledging it

THanks.

It was very detailed and well explained post

THanks.

It was very detailed and well explained post

It was a good read.I guess it was the first article that I have read on this topic.Thank you for sharing.

Thanks Paresh.

It was a good read.I guess it was the first article that I have read on this topic.Thank you for sharing.

Thanks Paresh.

Very Very Useful Post..Thanks for sharing this.. 🙂

Thanks Harsha

Very Very Useful Post..Thanks for sharing this.. 🙂

Thanks Harsha

What a comprehensive explanation about Ex showroom price and On road Price .. appreciate the effort put in !

Thanks a lot Aziz for your kind comment.

What a comprehensive explanation about Ex showroom price and On road Price .. appreciate the effort put in !

Thanks a lot Aziz for your kind comment.