Mutual Funds Sahi Hain is what Indians are starting to believe in. Mutual Funds differ on the basis of what they invest in. Such as equity funds invest in stocks while Debt funds invest in capital bonds and gold funds in gold. But many mutual funds invest in a mix of equity, bonds, gold. Such funds are called Hybrid funds. Mutual funds provide income in two forms – dividends and capital gains. Dividends on mutual funds attract dividend distribution tax to be paid on behalf of investors by the asset management company. Whereas, capital gains are taxable in the hands of the investors depending on the period of holding.

Thus, taxation can have an impact on the income you earn from your investments. It then becomes crucial to understand the tax rates and how it is calculated.

If you are an experienced investor and know what are equity funds, what are debt funds and how to invest in equity funds or debt funds, you can invest in mutual funds on your own. If you are a new investor, it is advisable to take the services of a fee-based financial advisor who charge a fee to provide advise.

In this article, let us look at equity-oriented debt mutual funds, the taxes applicable to them and how they are calculated.

What are equity-oriented debt funds?

Equity-oriented debt funds are types of mutual funds which invest at least 65% of its portfolio in equities and the remaining in debt instruments. Conversely, if a fund invests over 65% in debt securities and the rest in equity instruments, it is known as a debt-oriented hybrid fund. Equity oriented debt funds were also called as the Balanced funds before the recategorization of the mutual fund schemes by SEBI.

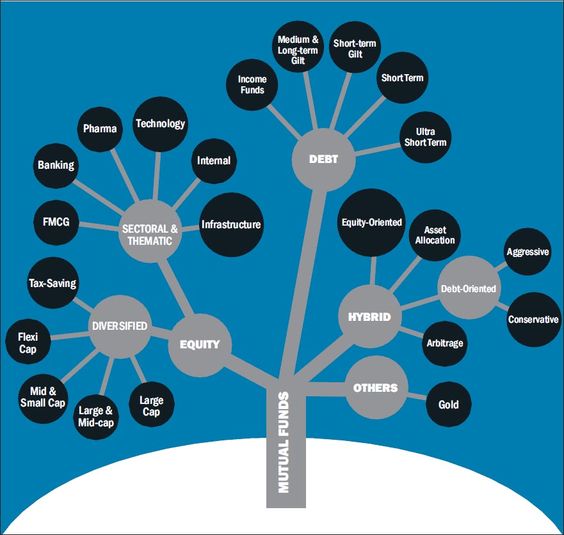

Asset management companies usually invest in shares of listed companies in technology, engineering, FMCG, finance, healthcare, etc. for equity exposure. In the case of debt exposure, investments are made in securities such as government bonds, debentures, guaranteed loans, corporate bonds, structured debts, treasury bills and other money-market instruments. The image below shows the various types of mutual funds.

What are the advantages of equity-oriented debt funds?

It can be challenging to strike the ideal balance between different asset classes while investing. Balanced funds offer the benefits of asset allocation and diversity within a single structure. While the debt component of the fund can add stability to your portfolio, the equity component can help in delivering long-term returns. This diversification can also cushion against market risks if either debt or equity enters a bear phase.

So, you can sell equity to maintain the levels when the markets are high. Or, when the markets are low, you can buy equities to sustain equity levels. This gives you better chances of a good return in the long run. Thus, investors with moderate risk profiles prefer to invest in equity-oriented debt funds.

How are equity-oriented funds taxed?

For taxation purpose, all mutual funds that have an equity exposure of 65% or more on an average are treated as an equity asset class.

Dividends from equity-oriented mutual funds are tax-free but liable for a dividend distribution tax of 10%, which becomes 11.648% with surcharge and cess.

If the funds are held for less than one year, the short-term capital gains are taxed at 15%.

If these funds are held longer than one year, long-term capital gains (LTCGs) are taxed at 10% for gains exceeding Rs. 1,00,000 and made after 31st January 2018. For example, if your LTCG in F.Y. 2018-2019 is Rs. 2,00,000, only Rs. 1,00,000 will be taxable.

However, if you invested in such equity mutual funds on or before 31st January 2018, gains will be grandfathered.

Conclusion

Thus, equity-oriented debt funds can serve as a viable avenue in the long-term. This is because the tax on long-term is much lesser than the tax on short-term capital gains. It is imperative to make the right decision so as not to lose out on the returns on investment due to taxation.