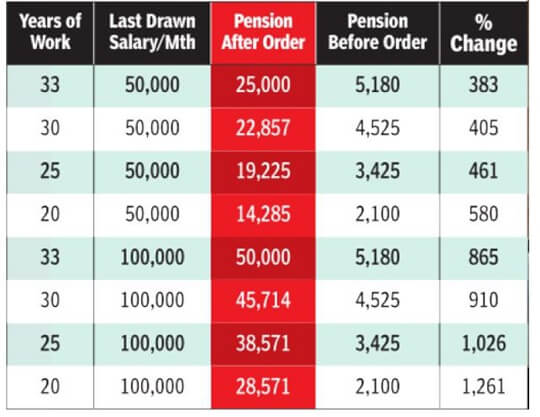

Will now the pension that one can withdraw from EPS after retirement be more than 7,500 Rs.? Will now the EPS contribution be more than Rs 1,250 per month or Rs 15,000 Rs per year? The Supreme Court on 1 Apr 2019, dismissed Special Leave Petition filed by the Employee Provident Fund Organization (EPFO) against the Kerala High Court order. The Kerala High Court Order says that the retirement fund body is required to give pension to the retiring employees based on their full salary, instead of the capping of Rs 15000. Your pension will now depend on your last drawn pensionable (basic salary plus dearness allowance) salary. The only catch is that while pension will increase, the provident fund corpus will be reduced as the extra contribution will now go to EPS rather than PF. Let’s understand this in more details. The example image below shows the difference in Pension that one can get.

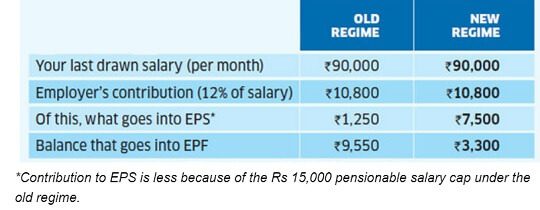

- An employer puts 12% of the employee’s salary in the Provident Fund. Of this 8.33% goes into EPS. But EPFO capped this contribution, which kept the pension low.

- If an individual’s salary (basic + DA) was Rs 10,000 per month in 1999-2000 and rose by 10% every year, his salary would be Rs 61,159 today.

- If he retires in 2019 and there is no cap on the contribution to EPS, the monthly pension would be Rs 17,474 instead of Rs 4,285.

Table of Contents

What is EPS?

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 came into effect on 4 March 1952. Presently, the following three schemes are in operation under the Act:

- Employees’ Provident Fund Scheme, 1952

- Employees’ Deposit Linked Insurance Scheme, 1976

- Employees’ Pension Scheme, 1995 (replaced the Employees’ Family Pension Scheme, 1971) and it was framed through paragraph 6(A).

How much does one contribute to EPS?

- All employees in the organised sector currently contribute 12% of their salary (basic salary+dearness allowance) to the EPF or Employee Provident Fund.

- The employer makes a matching contribution, of which 8.33% goes to the EPS, until now subject to a salary cap of Rs 15,000 (which before 1 Sep 2014 was Rs 6500)

- The monthly pension that one can get on retirement is based on the number of years put in by the employee multiplied by his last drawn salary and the total gets divided by 70.

In March 1996, the EPFO said that the individuals can contribute to their full wages instead of contributing to the ceiling amount of Rs 6,500

Later EPFO realised that the pension would increase and that can impact EPFO finances. So EPFO came up with an amendment, GSR 609(E), to give consent before the cutoff date of 1/12/2004 later extended to 1/09/2014.

What is GSR 609(E)?

Under the GSR 609(E),

- the wage ceiling/pf wage ceiling was increased from Rs. 6,500 to Rs. 15,000.

- If anyone wants to have a pension at higher wages then after September 1, 2014, the existing members could give a fresh consent within 6 months, otherwise, the additional money in their pension fund would be transferred to their pf fund and they will not be eligible for the higher pension.

- It was also said that those who want to have a higher pension would have to give an additional amount of 1.16%.

- Lastly, it was said that the pension would be calculated on the basis of the average of the last 60 months.

All these rules are now dismissed and GSR 609(E) is no longer valid.

Court vs EPFO

As this information was not easily known, many employees filed cases against the Supreme court. People went to court against EPFO because of the following reasons:

- The presence of the ceiling over the wages.

- The presence of Cut-off date of September 1, 2014, for those contributing at full wages.

- Calculation of pension on 60 months average salary which was 12 months earlier.

1 Sep 2014 Order by EPFO

On September 1, 2014, the EPFO amended the act to increase the contribution to 8.33% of a maximum of Rs 15,000 (or Rs 1,250). The amendment also stipulated that in case of those who availed the benefit of pension on full salary, their pensionable salary would be calculated as the average of the last five years’ monthly salary, and not of the last one year of average salary, as per earlier norms. This reduced the pension of many employees.

The department, however, added a new amendment of GSR 609(E) to the act which is as follows.

- No Pension if Salary above 15,000 Rs

- Existing member must give fresh consent within 6 months

Our article What are EPF, Pension and Insurance Changes from1 Sep 2014 covers it in detail

Oct 2016 Supreme Court decision

Supreme Court on EPF Basic Pay, Special Allowance, Supreme court Feb 2019

Kerala High Court Decision on 12 Oct 2018

Cases were filed and on 12 Oct 2018, The division bench comprising Justice K. Surendra Mohan and Justice A.M. Babu allowed the writ petitions filed by various employees against the amendment.

- The Kerala High Court set aside GSR 609(E), Employee’s Pension (Amendment) Scheme, 2014 that capped maximum pensionable salary to Rs.15, 000 per month, observing that it is absolutely unrealistic and would deprive most of the employees of a decent pension in their old age.

- A monthly salary of ₹15,000 then worked out only to about ₹500. Since the pension scheme was intended to provide succour to the retired employees, this objective would be defeated by capping the salary.

- The amendment calculated pension on an average of 60 months’ pay instead of 12 months. The High Court held that this stipulation would deprive employees of a substantial portion of their pension

- The HC added that the PF authority had no right to deny pension legitimately due to the employees on the ground that the fund would get depleted.

- Besides, the High Court had also held the requirement of additional contribution at 1.6% in the case of existing employees as legally untenable.

- The High Court set aside the orders of the Employees Provident Fund Organisation declining to grant opportunities to petitioners to exercise a joint option to remit contributions to the Employees Pension Scheme on the basis of actual salaries drawn by them.

Supreme Court and EPFO Special Leave Petition (SLP)

EPFO challenged the High Court Order through Special Leave Petition (SLP) which they filed in the Supreme Court.

What did the Supreme Court Say?

We find no merit in the special leave petition. The same is, accordingly, dismissed,” a Bench led by Chief Justice of India Ranjan Gogoi said, rejecting the appeal filed by the Employees Provident Fund Organisation in short order on April 1, 2019.

A number of high courts like Kerala, Rajasthan, Andhra Pradesh and Madras, among others, ruled in favour of employees and asked EPFO to allow them to contribute. This decision of the Supreme Court is expected to settle the issue once and for all. Employees who have begun working after September 1, 2014, will also be able to avail the benefit of pension on full salary

The Supreme Court’s order, in this case, would have an impact on a pending petition filed by retirees and members of the Employees Pension Scheme (EPS) 1995, against the government and the Employees Provident Fund Organisation (EPFO). In that plea, the petitioners have claimed that a 2014 amendment and 2017 circular exclude thousands from receiving their rightful benefits under EPS 95.

- Arbitrary restriction of Rs 15,000 on pensionable salary has been removed. Now, you can opt for a higher pension, if your pensionable salary more than Rs 15,000.

- Average pensionable salary will be based on 12 months’ pay and not 60 months’ pay as was the case earlier.

- Employees from organisations with PF trusts can also opt for higher EPS contribution for higher pensions.

- Recently retired people can also opt for higher pension. But they will have to return proportionate amount of EPF money.

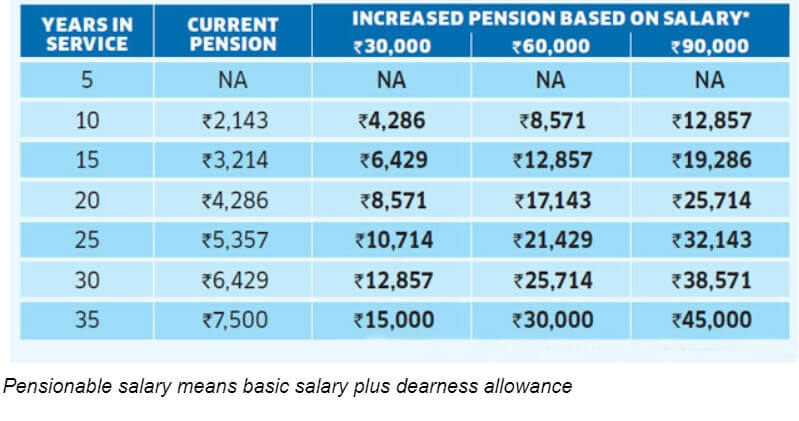

How will it affect your pension?

You can calculate your new pension using the formula:

New Pension = ((Pensionable Service + 2)/70)*Last Pensionable Salary

For example, if you have worked in a company for 10 years and your last drawn salary from the company is 30,000. Then

- your old pension would be ((10)/70)*15000 = 2,143 Rs

- your new pension would be ((10)/70)*30000 = 4,286 Rs.

In a similar manner, you can calculate your new pension as per the recent amendments by the Supreme Court.

For Full Pension How much does employee need to pay

To get this full pension employee will need to contribute for the years he did not pay.

For example, if you are 58 and about to retire after 35 years of service, and want a full pension, you will have to shift the entire 8.33% of the employers’ contribution from EPF to EPS from the date you started working. So, if your salary grew at 7% per annum and is currently Rs 90,000, the additional contribution for the last 35 years will be to the tune of Rs 10.35 lakh, plus interest.

Interest is what makes the real difference. When you add the interest, the additional contribution comes close to Rs 45.15 lakh. You will have to shift this amount from the EPF to the EPS to be eligible for your full pension— Rs 45,000 per month.

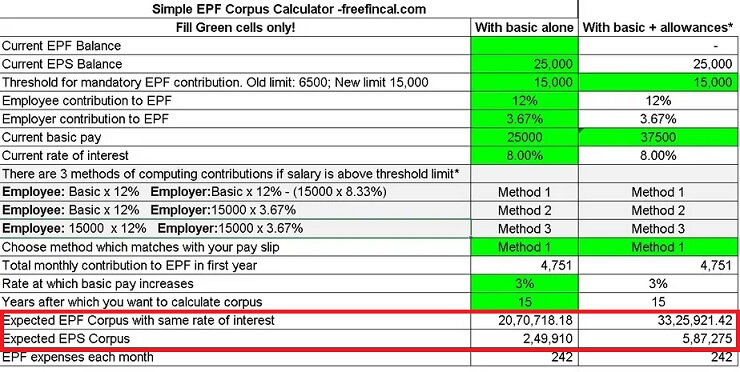

Your EPF Contribution will go down

Now 8.33% of your actual pensionable salary will go towards EPS. Earlier, the pensionable salary was capped at Rs 15,000

Who will be benefitted?

Not clear. Only those individuals who were contributing to their full wages would get the benefit of the scheme. For example, if your income is above Rs 15,000 and you are contributing PF on your full wage then your pension may increase. However, if you are contributing only up to the ceiling then, in that case, your pension will not increase.

How to avail the benefit of increased Pension?

To avail the benefit, both the employee and the employer are required to give a fresh option. To get the form, you must go to your nearest PF office, connect with the account officer, and ask for the relevant document that is required. After completing that and having a ceil from the employer you will submit that to the PF department who will then do a calculation.

If you have taken out your PF money then you would have to transfer it to the pension fund or return to the PF department. Once you are done with that you will get increased pension along with an arrear and interest over that.

Adverse Impact over the Pension fund

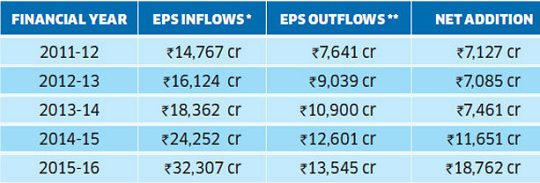

EPS has a huge corpus and is controlled by the Ministry of Labour, most people assume that it is totally risk-free. Also, as inflows in the EPS are far higher than outflows, currently it appears a safe product.

During 2015-16, the total inflows into the pension fund were Rs 32,307 crore and the payments it made totalled Rs 13,545, leaving a net surplus of Rs 18,762 crore. More importantly, the pension fund’s huge corpus also generated interest income of Rs 21,662 crore during 2015-16, and it has been growing regularly. Actuarial studies have said that EPS may face shortfall as demographics change in future

The PF department believed that it would result in a negative impact on the Pension Fund. This is because:

- Its viability would not be there in the EPF pension fund because the pension was not taken at that time. However, in this case, the department would have to give an interest of over 30-35+ years.

- It would result in more deficit which would increase year after year, as a result, the future stake pensioners would have to face big trouble.

Video on Supreme Court Decision on PF Pension Increase

16-minute video on Supreme Court Decision on PF Pension Increase. The case for higher pension was going on for years in Kerela High court, and now the supreme court has finally set aside the GSR 609(E) of the EPFO that bars pensioners to get a higher pension. Know all about the supreme court decision on EPF pension increase and whether you’re eligible or not.

Further Discussion over the Pension Scheme

We still cannot say that the matter is closed because the Supreme Court’s decision had raised a number of questions for the PF department. They can take different measures in this regard like:

- The EPFO can ask the Supreme Court for reviewing the case.

- The EPFO, in this case, has filed the SLP on March 13, 2019, which was verified on March 27, 2019, and was dismissed on April 1, 2019. However, the Ministry of Labor filed a similar SLP on March 26, 2019, for the High Court’s decision which is currently under the objection status as for why the Ministry of Labor has filed the SLP when one was already done by the EPFO. This case is expected to be heard on May 2, 2019.

Reference: Factors you should consider before opting for higher pension under EPS scheme

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

- What are EPF, Pension and Insurance Changes

- Higher EPS pension: Supreme court order and how it affects those who joined before 1 Sep 2014

- Understanding Employee Pension Scheme or EPS

- Pensioner’s Life Certificate and Jeevan Pramaan Certificate

- EPF Private Trust

- How EPFO earns to pay Interest

- How much pension will one get under EPS

Therefore, nothing can be said as of now. Let’s wait for the hearing of the case of the Ministry of Labor and we will keep you updated with the same.

I am retired in october 2008. I have not given higher option. My pensionable salary was pegged at Rs.6500/- and I am getting a pension of Rs.1836/- now. Am I eligible for full pension if I pay the difference of PF to EPS contribution from the date of my pensionable salary crossing Rs. 15000/-.

Please register my email for new notification in this regard.

Thanks for best information

Uan active mobile no change 9348351905

Good development.Well reported

Watch for final outcome