An individual has to pay tax on withdrawal of PF accumulations if the same has been withdrawn from a recognized PF account without rendering continuous services for five years or more with the employer. This article covers focuses on withdrawing EPF before 5 years, How to withdraw EPF before 5 years,Is EPF balance taxable, Why is my employer is asking to fill Form 15, what is Form 15G, Can I claim TDS? How to claim TDS, How to show PF withdrawal while filing income tax return.

Table of Contents

EPF Withdrawal before 5 Years

It is important to note that withdrawal of the EPF account by a salaried employee is illegal. Many employees withdraw their EPF account at the time of leaving the organisation. Legally right thing is to transfer the EPF account from old employer to new employer. Overview of EPF Withdrawl before 5 years is given below.

- After leaving your old job and being unemployed for 2 months you can withdraw EPF & EPS. Exceptions.

- A woman who quit their job for getting married, pregnancy or childbirth will not have to wait for two months to withdraw.

- if you are quitting due to health reasons.

- Who is going abroad for employment/settlement and don’t intend to return soon.

- Provident fund withdrawal before five years of completion of service will attract TDS(tax deducted at source) effective from 1 Jun 2015.

- TDS on EPF will be deducted if withdrawal is more than Rs 50,000. This is applicable from June 2016.Earlier this limit was Rs 30,000.

- TDS will be deducted at 10 % provided PAN is submitted. Otherwise, TDS is dedthe ratethe rate of 34.608 % if PAN is not submitted.

- If you withdraw offline you can submit form 15G/15H to avoid TDS.

- You can withdraw online or offline

- You can withdraw online using UAN member portal (if KYC is approved). Our article How to do Full or Partial EPF Withdrawal Online explains it in detail with images and video.

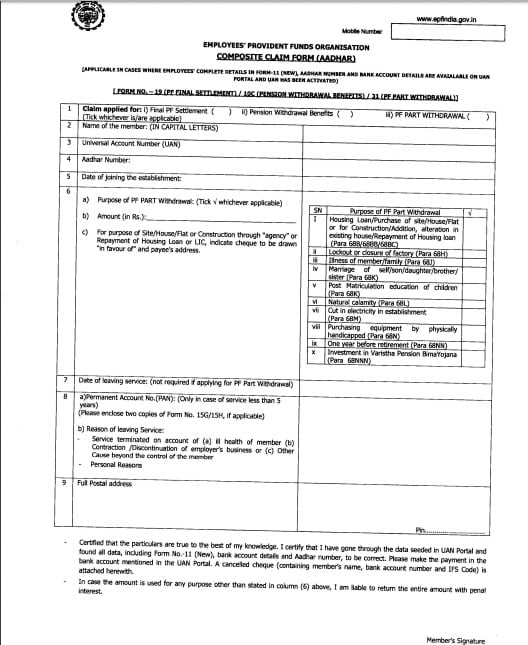

- To withdraw EPF offline through old employer If you have UAN then you have to submit Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaced forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN)

- To withdraw EPF offline through old employer If you don’t have UAN You have to submit Form 19, and Form 10C

- To withdraw EPF offline without going through old employer for un exempted organisations you can approach EPFO directly. Unexempted organisations are those where you are not contributing to EPF Private Trust.

- You can Track EPF Withdrawal

- You will get regular SMS updates

- You’ll receive two different amounts. One is for your EPF withdrawal and one is for Pension contribution.

- if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

- Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

- Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

- The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

When can one do EPF Withdrawal?

When can one withdraw from EPF?

The rules are that an employee should not be in employment for two months after resigning if he has to withdraw his Provident Fund amount. Earlier one could withdraw EPF from one job even after joining another job as EPFO could not track if one is working or had a PF account. But now with UAN number, EPFO can find out whether you are employed or not and hence EPFO can theoretically reject your application. Remember that EPF is a long term retirement investment product, and transfer of account will help you get the magic of compounding.Our article UAN or Universal Account Number and Registration of UAN explains the UAN number in detail.

Are two months waiting period for EPF withdrawal applicable in all cases?

No. In following cases, 2 month waiting period for applying for EPF withdrawal is waived off.

- Those employees who are going abroad for employment/settlement and they don’t intend to return soon, can Apply for immediate PF withdrawal.

- A woman can Withdraw money if she is leaving service for marriage. You have to provide proof of the marriage such as wedding card.

- These are after the retirement or death of the employee.

How are the 5 years calculated for EPF Withdrawal?

5 years mean 5 years of contribution to EPF. Say you worked in an organization for 3 years and then left it for higher studies. Then you have contributed to EPF for 3 years old. Just holding the PF account with the employer for five years will not make it 5 years and hence shall not take away the tax implications. But your EPF would earn interest. So If you intend to take job after some time(say after higher st a dies) you can leave your PF account and after joining transfer it to new employer.

What happens if I don’t withdraw from the EPF account after leaving the job?

When you leave the job, you stop contributing to EPF account and your EPF account becomes inactive. EPF accounts were deemed inoperative when there was no contribution for 36 months. Such accounts stopped earning interest from the financial year 2011-12. On 2 August 2016, labour minister Bandaru Dattatreya said in the Rajya Sabha that the government has decided to credit interest to these inoperative accounts, which will turn them into operative accounts. On 11 Nov 2016, notification was issued to this effect.

Now, the account will be considered inoperative only when the employees retire at the age of 55 years or move abroad permanently. According to the notification, if the account holder dies, then too, his/her account will be considered inoperative.

How much will I get on withdrawing from EPF?

You can check your EPF balance in various ways. If UAN registered then you can check EPF Balance by following methods Our article How to get information about EPF balance : Annual Statement, SMS, E-Passbook discusses it in detail

- UAN Passbook.

- Now Member passbook is available at http://www.epfindia.gov.in >> Our Services >> For Employees >> Member Passbook. You can use your UAN number and password to download the passbook.

- Check EPF Balance by sending SMS

- If your UAN is registered then from the mobile send SMS EPFOHO UAN ENG to 7738 299 899. You have option to specify 9 other languages like HINDI,Gujrati etc,

- Check EPF balance with EPF mobile App

- Download Mobile App m-epf from Google Play store. One can also view their monthly credits through the passbook as well view their details available with EPFO

- Get EPF Balance by Missed Call

- If you have a valid UAN, your mobile number too will be registered with the EPF department. A missed call to 011 229 01 406, at no cost, will ensure that you receive an SMS that lists down your PF number, age and name as per the EPF record.

For UAN not registered You can check EPF balance as follows.

- EPF through Member Balance website and get SMSFrom July 2011 one can check the EPF Account balance online. Note Often balance is old and not updated

- Go to http://www.epfindia.com/site_en/KYEPFB.php

- Select EPFO Office

- Enter PF Account Number which is in the format : EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit) (PF Account Number may not have Extension code, in that case leave it blank).

- Enter your Mobile and Name, Accept Terms and condition and Submit.

- You will get SMS alert from EPFO : EE amount : Rs XXXXX and ER amount Rs:XXXXX as on <Today’s Date>(Account updated upto Date).

You would get employer’s contribution, employee contribution and interest earned on it. To refresh Normally, both the employer and employee contribute 12% each of the basic salary of the employee plus DA (if any) to EPF. (Employee can contribute more towards EPF voluntarily which is called VPF)

-

- The entire 12% of employees contribution is added towards PF.

- 8.33% out of the total 12% of the employers contribution is diverted to the EPS or pension scheme and the balance 3.67% is invested in PF. However, if the basic pay of an employee exceeds Rs. 6,500 per month, the contribution towards pension scheme is restricted to 8.33% of Rs. 6,500 (i.e. Rs. 541 per month) or 8.33% of 15,000 ie 1250 pm after Oct 2014. The balance of employers contribution goes into EPF. EPFO has now raised the eligibility ceiling for EPS to Rs 15,000 a month.

- The employer contribution is exempt from tax and employee’s contribution is taxable but eligible for deduction under section 80C of Income tax Act.

How can one withdraw from EPF online?

On 1 May 2017, EPFO announced that all EPF Member’s who have activated their UAN and seeded their KYC (Aadhaar) with EPFO will be able to apply for PF Final Settlement (Form19), Pension Withdrawal Benefit (Form10-C) and PF Part Withdrawal (Form31) from the UAN Interface directly. If you meet these requirements then you can withdraw online.

Our article How to do Full or Partial EPF Withdrawal Online explains it in detail with images and video.

Note: If you withdraw online then there is no way to fill Form 15G/15H. They

- Log on to the UAN portal and enter your details.

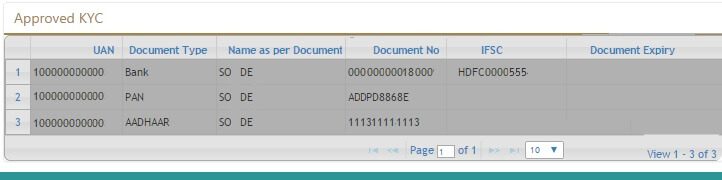

- Check whether the KYC details seeded are correct and verified or not. Click on Manage->KYC in Approved KYC section you should see your PAN, Aadhaar, and Bank Details as shown in the image below. All your KYC should be approved by your employer.

- Select Online Services.

- Select the claim(Form 31, 19 & 10C).

- If you are withdrawing EPF then submit both the Forms, Form 19 and 10C.(You would have to repeat the process twice)

- verify the online PF claim using One Time Password (OTP) that you will receive on your mobile number linked with your UAN.

- EPFO will obtain your KYC i.e. Aadhaar details from UIDAI and your online PF claim will be processed and your bank account will be credited with the amount of the claim.

- Track your claim status from UAN Member portal itself.

How can one withdraw from EPF offline?

You need the following information for withdrawing.

-

- PF account number

- Date of joining

- Date of leaving

- Bank Account number , IFSC code where the money will be deposited.

- A copy of blank cheque for account number verification.

- Form 15G/15H so that TDS before 5 years is deducted at the rate of 10 percent. This is done if you have less than 5 years of service.

On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) has introduced Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaces existing Forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). This is to simply the form for claiming the partial and full withdrawal from the EPF. Now you can submit the form to your previous employer or to your EPFO.

How to withdraw If you don’t have UAN

You have to submit Form 19, instructions to fill form 19 from the EPFO website.

- Employer will attest the form and send it to the regional PF office.

- The regional PF office takes about one month to process your application.

- EPFO deposits PF amount directly to the employee’s bank account.

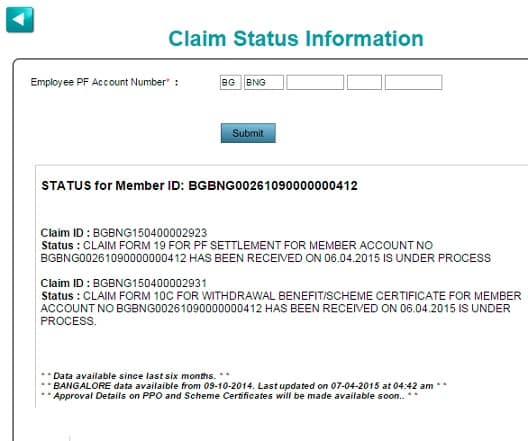

You can track your application status through http://www.epfindia.com/site_en/KYCS.php .Know you can also give SMS number in the application form and receive updates.

What is Form 15G or 15H? Why do I have to fill it?

Form No. 15G or 15H are self-declaration forms that can be furnished by individuals to state that their income is below the taxable limit and hence no TDS should be deducted.

- Provident fund withdrawal is before five years of completion of service attracts tax deducted at source (TDS) at 10 per cent from Jun 1 2015.

- TDS will be deducted at 34 per cent if one does not submit PAN.

- Exemption from TDS has been given to subscribers with no taxable income, provided they submit 15G/15H form. To avoid the levy of TDS, 15H (for senior citizens) or Form No. 15G (other than senior citizens) can be submitted, provided the provident fund amount payable is up to basic exemption limit which for AY 2016-17 is 2,50,000 and Rs 3,00,000 for senior citizens respectively.

- Our article How to Fill Form 15G? How to Fill Form 15H? explains how to fill the form 15G/15H in detail.

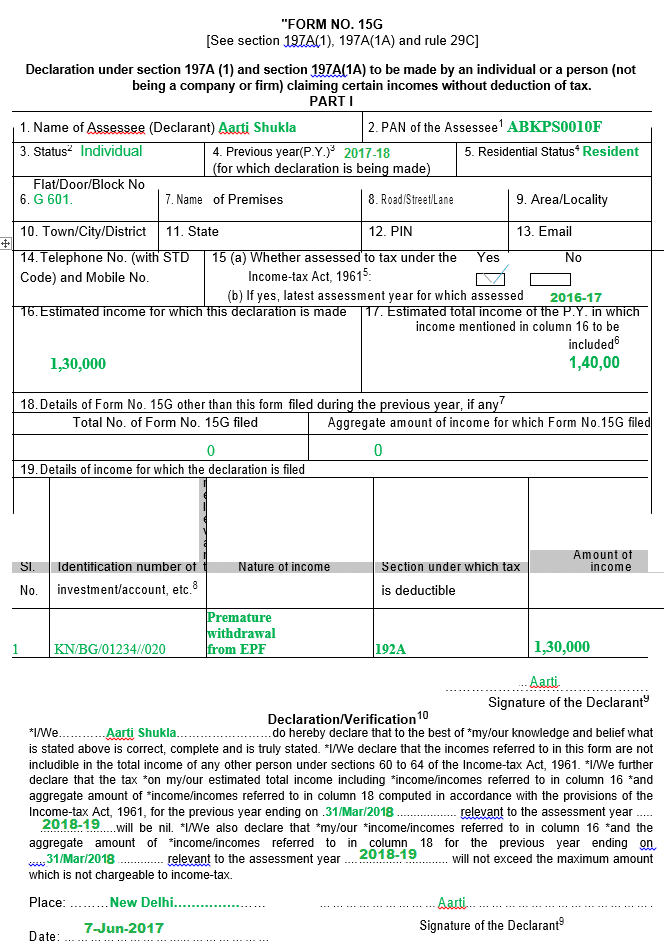

Sample Filled Form 15H for EPF Withdrawal

Sample filled form 15HG for Aarti Shukla, who is withdrawing on 7 Jun 2017, her EPF of Rs 1,30,00 and has 10,000 other income. If you withdraw between 1 Apr 2017 to 31 Mar 2018

- then Previous Year or PY( Pt 4 in the Form) is 2017-18 and Assessment AY would be 2018-19.

- For 15(a) Mention latest Assessment Year for which Income Tax Return has been submitted and processed.

- If you have filed return for FY 2016-17 or AY 2017-18 last date for which is 31 Jul 2017 mention AY 2017-18.

- Else mention the last Assessment Year in which your ITR was submitted. For example if You filed return for FY 2015-16 or AY 2016-17 then mention AY 2016-17.

- In the declaration part Assessment Year would be 2018-19

Can my employer say no to withdrawing my EPF application?

An employer cannot deny signing your EPF withdrawal form, and he should not, because PF is your money and no one has any right on it. If he does not cooperate you can submit the application to Regional EPFO office. You have to attest your application form by any of these authorities: Manager of a bank or any gazetted officer or Member of the Central Board of Trustees./ committee/ Regional Committee (Employees’ Provident Fund Organization) or Magistrate/ Post/ Sub Post Master/ President of Village Panchayat/ Notary Public. Note that you have to take signature and stamp in every page of the application. Attach service proof such as copies of payslip, ID card, Form 16 or appointment letter from employer to substantiate. Also attach copy of your identity proof as well as Address proof.

Since this is bypass route, EPFO does not encourage this process. Also, there is more chance of fraud as well. Hence It asks for a letter which should state the reason of direct application for EPF withdrawal.

How do I know the status of my withdrawal application?

You can go and check your EPF Claim Status by going to EPF Webpage for EPF Claim Status .Select the EPFO Office where your account was maintained and furnish your PF Account number. You would get the status as shown in the image below. Document Know Your Claim Status (pdf format) lists the steps in detail with images at each step. Please be aware of the tax implications of withdrawal.

How long will it take for EPF Withdrawal?

EPFO handles EPF withdrawal within 20 days. It is planning to bring it down to few hours.

Alternatives to EPF Withdrawal : Transfer of EPF

How to transfer EPF?

Ideally, you should initiate the process of transferring your EPF balance as soon as you join your new organization and are allotted a new PF account number. Currently all the online EPF Transfer claims are through http://epfindia.com/Employee_OTCP.html . Our article Transfer EPF account online : OTCP explains it in detail.

If you need money you can partially withdraw from your EPF account, while in service.

You can withdraw from your EPF account upon emergency subject to few conditions and situations mostly after serving at least 5 years of contribution. Earlier it was one of the popular method shown in Hindi movies like Ferrai Ki Sawwari.

-

- Education or marriage: Withdrawal is allowed for the purpose of self, a sibling’s or children’s marriage or for self/children’s education. You need to complete at least 7 years of service to be eligible for this. Relevant proofs are required. You need to submit Form 31 to your employer. Withdrawal amount is up to 50 per cent of the corpus accumulated till date.

- Medical treatment: Withdrawal is allowed for medical treatment of self, spouse, children or parents. For this, no restrictions are imposed on years of service. You can withdraw up to six times your monthly salary or the total corpus accumulated till date, whichever is lesser. Relevant proofs are to be submitted along with Form 31. There is no limit on the number of withdrawals.

- Purchase of plot: The plot needs to be registered in your name , your spouse’s name or jointly. You can withdraw up to 24 times the monthly salary. However, withdrawal here is allowed only once.

- Construction/purchase of flat or house: You need to have completed at least 5 years of service. Withdrawal is allowed up to 36 times your monthly salary.

- Repayment of home loan: You need to have at least 10 years of employment.

- Renovation of house: You need to have completed at least 5 years of service. You can withdraw up to 12 times your monthly salary.

- Pre-retirement: Minimum age is 54 years. You can withdraw only once and up to 90 per cent of the corpus accumulated.

Tax and EPF Withdrawal

Is there TDS on EPF withdrawal?

TDS is not applicable:

- If the withdrawal is after five years or more of service, no TDS would be applicable.

- TDS shall not be deducted in case of transfer of provident fund from one account to another.

- TDS will not be applicable in case of termination of service due to ill health of member, discontinuation / contraction of business by employer or other cause beyond the control of the member,

- For computing the period of continuous service, the period of previous employment can also be included, if the accumulated balance while at previous employer is transferred to provident fund of the new employer.

- If the service period is less than 5 years.If the accumulated provident fund balance is less than Rs 50,000, TDS would not be applicable.

TDS is applicable when

- Provident fund withdrawal before five years of completion of service will attract tax deducted at source (TDS) at 10 per cent from Jun 1 2015.

- TDS will be deducted at 34 per cent if one does not submit PAN.

- Exemption from TDS has been given to subscribers with no taxable income, provided they submit 15G/15H form. To avoid the levy of TDS, 15H (for senior citizens) or Form No. 15G (other than senior citizens) can be submitted, provided the provident fund amount payable is up to basic exemption limit which for AY 2016-17 is 2,50,000 and Rs 3,00,000 for senior citizens respectively. Form No. 15G or 15H are self-declaration forms that can be furnished by individuals to state that their income is below the taxable limit.

TDS or No TDS amount EPF withdrawal before 5 years is taxable

What are taxes on EPF withdrawal before 5 years of service?

Do note that, if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

-

- Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

- Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

- The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

While filling the income tax form please add income under the appropriate section.

If PF withdrawal is after 5 years then it is exempt from tax. You can still show it Income Tax Form under exempt income section like we show PPF Interest (as shown in our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details)

If TDS is deducted and income is less than basic exemption limit then?

If TDS is deducted and income is less than the basic exemption limit then one can claim TDS while filing ITR form and ask for refund.

Example of Tax on EPF withdrawal before 5 years

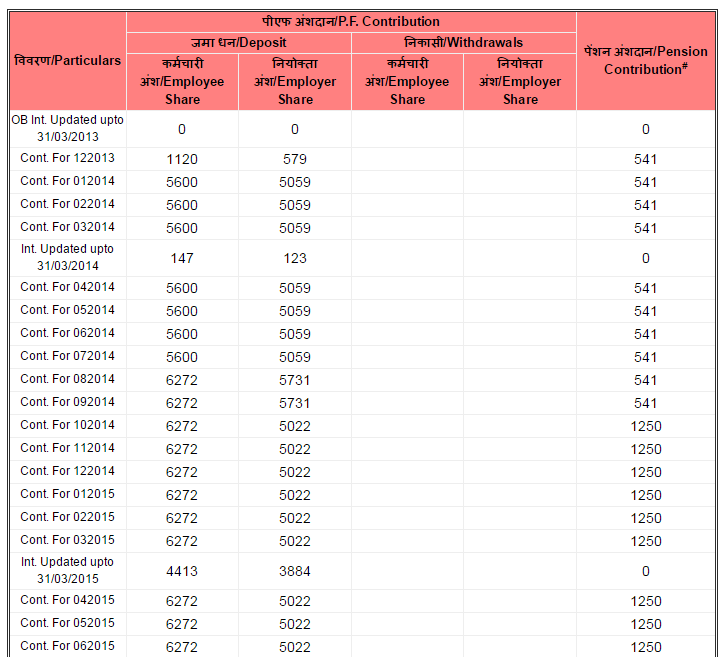

Let’s say Rahul joined an organization in Dec 2013 and quit on 30 Jun 2015. His employer and employee contribution as per UAN passbook is given below. Click on Image to enlarge. Thanks to our reader for sharing his UAN passbook.

- For AY 2014-15 (FY 2013-14) Employee Share 17,920 Employer Share in EPF 15,756

- Interest earned on Employee Share 147 Employer Share 123

- For AY 2015-16 (FY 2014-15) Employee Share 72,576 Employer Share in EPF 61,830

- Interest earned on Employee Share 4,413 Employer Share 3,884

- For AY 2016-17 (FY 2015-16) Employee Share 18,816 Employer Share in EPF 15,066

- So he has to add Employer Share in EPF 15,756 for AY 2014-15, AY 2015-16 and AY 2016-17 109,312(17,920 + 72,576 +18,816 ) . Interest on Employer’s share 123+3884. He can reduce tax outgo on the employer share and interest using section 89.

- Interest accumulated on employee’s contribution will be taxed as Income from Other sources: 147 + 4,413

- If he has claimed 17,920 as the deduction under 80C then he has to reverse that. By using the 17920 as 80C deduction his taxable income would have reduced hence his tax. So the tax he saved will now have to be shown. This reversal has to be taken in for every year. For example, his income in AY 2015-16 was 8.25 lakh and he had claimed 80C deduction of 1 lakh which included 72,576. Unless has made other investments where he can claim 72,576 he would not have to calculate the tax without the deduction.

- So on 8.5 lakh due to 1 lakh tax deduction, his tax liability was Rs 77,250. Now without 72,576 his 80C deduction is reduced to 27,424(1,00,000 – 72,576) so his tax liability became 89,515 that is increase of 16,939. He has to pay tax on this income.

What is relief under section 89?

When salary or other income arrears are received in any particular year, one’s tax liability for that year increases. Simply because one’s total income for that year has increased. But having to pay a higher tax on account of arrears is unfair to the taxpayer. Our Income tax law has taken the same into consideration and allows a tax deduction under Section 89(1) for this additional tax burden on the taxpayer. It involves ascertaining the two amounts of tax, the first is the amount of tax applicable to the total income, including the extra amount in the year of receipt. The second is calculating the amount of tax by adding the arrears to the total income of the years to which they relate. The difference between the two amounts is the deduction allowed.

Say, you earn Rs.10 lakh a year in the financial year (FY) 2014 and receive an arrear of Rs.4 lakh for FY13. Your total salary in FY13 was Rs.8 lakh.

For FY14, without the arrears, your tax liability will be Rs 1.34 lakh, and with arrears (total salary of Rs.14 lakh), it will become Rs.2.57 lakh. This is a difference of Rs.1.23 lakh.

Now, we have to calculate the tax incidence for FY13, on your salary of Rs. 8 lakh. Without the arrears, you paid a tax of Rs.92,700, and with the arrears (total salary of Rs.12 lakh) you would have paid Rs.1.95 lakh as the tax. This is a difference of Rs.1.03 lakh. So, the relief that you can get under section 89 is Rs.20,600 (Rs.1.23 lakh – Rs.1.03 lakh).

You will have to fill up Form10E with these details and then submit it to your current employer to claim the relief. Keep your salary slips handy to provide as proof of receipt of the arrears. But do keep in mind that only if the tax paid is higher will you be able to claim this relief. If you do not have to pay excess tax due to the arrears, then you do not get the relief.

Summary:

- An employee should not be in employment for two months after resigning if he has to withdraw his Provident Fund amount.

- Provident fund withdrawal before five years of completion of service will attract tax deducted at source (TDS) at 10 per cent from Jun 1 2015.

- TDS will be deducted at 34 percent if one does not submit PAN.

- Exemption from TDS has been given to subscribers with no taxable income, provided they submit 15G/15H form.

- TDS or No TDS amount EPF withdrawal before 5 years is taxable

- if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Related Articles:

All About EPF, EPS, EDLIS, Employee Provident Fund

- How to Fill Form 15G? How to Fill Form 15H?

- Basics of Employee Provident Fund: EPF, EPS, EDLIS, EPF Calculator : Method I 3.67%

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Withdrawal or Transfer of Employee Provident Fund

- UAN Problems, Password,Mobile Number,Incorrect Details and Help Desk

If you have withdrawn from EPF before 5 years, please do share yoryouru experience and tax calculation to benefit other readers.

Hi,

I quit my earlier job in Jul 2019 and joined another company immediately. I did not transfer my PF from earlier company to the new PF account with my current employer.

In Apr 2021 I received an email from my previous employer regarding the PF amount transfer or withdrawal pending from my side. I chose to withdraw the same and the amount was credited to my account within a couple of days.

Now I’m in a fix as the requirement regarding not being employed for 2 months immediately preceding the date of application of withdrawal was overlooked my me.

Please guide me on the way forward.

Also I would need to include the same in my ITR filings for next year.

Regards,

Rahul

What is done is done.

And you are not alone many others also have done it.

You have missed out on the compounding aspect of EPF.

So you withdrew in Apr 2021.

So you are right you have to report it in ITR for FY 2021-22 by Jul 2022.

if you have withdrawn PF before 5 years it is taxable.

Please go through our article http://bemoneyaware.com/epf-withdrawal-before-5-years-tds-form-15g-tax-itr/ for more details.

Can an employee withdrawing PF in current year (service less than 5 Years) and offer tax in Current year without apportioning the withdrawn amount for past years? Is it an option not to apportion but offer tax as per current year slab?

Hi sir,

Thank you for this information. Kudos to you!

I have a doubt. I recently quit my job on 2 march 2020 and the total number of service was around 4.8 years. I was earning around 60k in hand or you can say a package of 10lakhs p.a.

Now while applying for the pf withdrawal, my pan is verified and as the service was less then 5 years, tds of 10% would be deducted.

I wanted to know if

1. If i am eligible to fill 15G or should i anyways submit it online.

2. If yes, then what should i fill for point 17.

My pf amount is close to 7.37 lakhs and 20 k for the pension.

Kindly clear my doubts. Would be a great help. Thanks in advance sir

Warm regards

Technically, As your EPF withdrawal is above exemption limit of 2.5 lakhs you are not eligible for Form 15G

But many times EPF rejects the withdrawal if Form 15G is not submitted.

So, submit Form 15G and put 7.57 lakh as income.

And if required show this in your ITR.

Are you planning to take a new job?

Then we would recommend that you transfer your EPF and make compounding work in your favour.

Hi Sir,

Thank you for your swift reply.

Also, i am planning to shift abroad after the COVID situation and that was the reason i wanted to withdraw my PF amount.

Thanks a lot for your help!!

warm regards

Hello,

I worked with a MNC for 4 years and moved out from the company. After which i have moved abroad and wont be returning back anytime soon. I had filed for PF withdrawal claim under – not employed for more than 2 months and my claim was satisfied from the employee share. Now i still have the employer’s share and my pension share in the PF account. How can i claim this full amount without any deduction?

When you withdraw from EPF you withdraw both employee and employer contribution.

You can apply for withdrawal from the pension account.

Please check your passbook. If you have confusion you can read our article How to view EPF Passbook and track Contributions,Interest,Transfer,Withdrawal for more information

If you still have doubts you can send your EPF passbook to our email id bemoneyaware@gmail.com

Taxability of EPF before 5 years of withdrawal is explained in the article.

Is there any part you did not understand?

dear sir

i worked in a company for 3 months only now need to withdraw PF money what should i do form 15 is difficult for me as the company HR are not responding properly the 2nd part should be filled by the company HR which is must kindly guide me.

with regards

Dr G Ramesh

Hi,

I am foreigner and 58 yrs old now. I worked in India for a short period on a posting from my company in my home country. During this period I was employed by our subsidiary company in India and contributed to EPF for 4 years. I left India after I was repatriated back to my home country. After I turned 58 yrs old, I submitted PF withdrawal application online and received the funds. I noticed that there was a 10% TDS deduction. I submitted PAN but not Form 15G as I was not aware that I should submit this. I have a couple of questions:

1) I understand that 10% TDS will be deducted if withdrawal is made before 5 years of continuous contribution to PF. However, since I have no taxable income in India, would the 10% TDS be deducted if I had submitted Form 15G? If it would not have been deducted, how can I now claim a refund of the TDS?

2) I understand that PF funds received are taxable if withdrawal is made before 5 years of continuous contribution to PF. I also understand there is an exception to this rule if the “reason for discontinuation of service is beyond the control of the employee” and in this case it shall be treated as if it was withdrawn after 5 years i.e. it shall not be taxable. Is this rule applicable in my case as the reason for my discontinuation of service is due to my repatriation back to my home country? If yes, what documents are needed to show this?

Appreciate your advice. Thanks.

Hi, thanks for the amazing article. I have query, I am jobless for month two months now. I ant to withdraw both epf and eps which comes around 18k. My Pan is not attached to my account since there was a slight name difference in aadhar and pan but my aadhar is verified. So while applying online I can see only for form 19 . And do I need to fill form 15G and my total service is less than 5years?

Sir. I left my job in 12-12-2015. I applied for PF on 26-10-2019. And today is 12-11-2019. When salary will be credited in account while all credentials covered and approved….bank..adhar…pan. ??????? Still waiting ….

Hello Sir,

While applied for pension withdrawal two months after my resignation from private concern, my claim has been rejected due to : 1) SUBMIT PHYSICAL 10C FOR SCHEME CERTIFICATE OR 10D PENSION THROUGH EMPLOYER WITH SUPPORTING DOCUMENTS 2) NOT ELIGIBLE FOR WITHDRAWAL BENEFIT

Please clarify me about the above reasons.

Can you explain

-how many years did you work in the organization

-did you work in any other company before this?

-how did you apply for withdrawal online/offline

-has your employer marked your date of exit?

Hello Sir,

I have completed more than 5 years of service from 1-AUG-2013 to 14-AUG-2019. Now I am jobless for more than 2 months. Should I need to submit form 15G for PF full withdrawal?. Also, Should I need to submit form 10C for EPS full withdrawal because I have 85,000 rupees in my pension contribution?. Please clarify me.

Hi ,

Kindly suggest me My PF amount is 40000 and Pension is 18000, will we need to fill Form 15G while applying full PF withdrawal?

After carefully looking at online form realised that it’s calculating my total employment related to last employement only. Where as I have been a continuous member since 2009.

Reason Of Leaving: CESSATION (SHORT SERVICE)

DoJ EPF 01-AUG-2016

DoE EPF 01-JUL-2018

Is there a way to fix this anomaly ?

Contact your old employer.

I worked in a concern for 3 years and after 3 years, I am jobless for 5 months now. My PAN is not linked to EPF/UAN due to slight variation. The PF office asked me to submit 15G along with PAN card copy. My income crosses the slab once I include the EPF claim. What will be the rate of tax if I submit form 15 G and PAN copy? I need to pay off my debts with that.

Hi,

Could you please help me know,if I am eligible to submit form 15G for below scenario?

I want to apply online PF withdrawal in Feb, 2019 itself and the PF income is supposedly less than the limit of 250000.

As I left job in December,2018, Will my income for the prior months of the year 2018-19 will be considered? If so, what about the TDS deducted by the employer and the ITR in this year?

If, I don’t submit the 15G, will there be an additional TDS deduction on the same income?

Please clarify.

Regards

Partha

Yes, Income of the Financial Year will include Income from your job.

TDS for income from the job would be deducted by the employer based on the number of months you worked.

Typically, the EPF office asks for Form 15G to avoid deducting TDS.

TDS or no TDS withdrawal before 5 years of EPF contribution is taxable.

A question, why are withdrawing your EPF? If you are planning to join a new job then transfer your EPF.

Hi,

I was with a MNC organization for 3 years till 2016 where I & my company were contributing to the PF account. I understand the company operated a private trust and not the government PF.

I moved to a new organization in 2016 and have been there since. My current company gave me an option to opt out of PF and hence currently they don’t deduct PF.

Its been almost 3 years since I left my past organization and I understand that my PF amount lying with them will stop accruing interest. I wish to withdraw the amount, but after going through your forums I understand that It will be liable to tax.

Kindly suggest if there is a way I can avoid tax on the withdrawal and if not, what do I need to do to ensure I can withdraw it tax free in future. Should I start contributing to PF in my current company and transfer the old PF amount to the current company? If so how long do I have to contribute to PF before I can withdraw the amount tax free?

Thanks

PF contribution after 5 years (including multiple jobs) is tax-free.

So 2 years more you need to contribute atleast for your withdrawal to be tax free.

Why do you want to withdraw your EPF? It is a very good saving vehicle for your retirement.

No one is giving 8% tax-free with 80C benefits

We would recommend you to transfer your old PF to new and continue it.

Hello,

I cannot check my PF balance using the link http://www.epfindia.com/site_en/KYEPFB.php . Neither can I find a menu option in the EPF India website. Could you provide the correct link, please. (I do not have a UAN)

A reply would be highly appreciated.

Regards…

Sir

My name is sanoop s v .i applied for withdrawl of pf in online mode but my pan card is unable to add in it.what is the solution for this.how i can withdraw the pf amount.if i choose offline mode what are the necessary things needed for that.i have no cheque book also.plz help me.i already submitted in offline mode in october 26 but no claim stztus been showed .what i do for the withdrawl plz help me.

Sir,

In my UAN portal all my KYC details (Aadhar, PAN, Bank account) are uploaded and approved by employer. But in approved section PAN status is Unverified. I left the job (below 5 yrs). My question is

(i) if i appy for claim they have consider my PAN or not

(ii) if i apply claim for epf & eps, how much tds will be deducted

Hi,

I resigned my previous organisation before completion of my 5 year service in that organisation (but i have more than 5 years record for continues service, but starting service is without PF benefit) and settled my PF amount which is more than 50K. and my current income is taxable. so is any TDS applicable for my PF settlement amount?

Please guide.

Regards,

Asmita P

Dear Sir,

Recently i applied for PF claim ( both form 19 and 10C).

(My basic was Rs.16000/-. ). Subsequently, the claim via Form 19

was approved and i got the settlement.

But, claim via 10C has been rejected with a reason

“Wages above 15000/- but pension also contributed” .

I am not able to get any information from PF office and at the the same

time my ex employer payrolls department is also not responding telling what they have done is correct.

Now, am in a hopeless situation. Request for your guidance

Sadly we know the problem but not the solution.

New EPF members enrolled on or after September 1, 2014, and having a salary of more than INR 15,000 month at the time of joining, will not become members of the EPS.

Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee.

Who is at fault for EPS contribution for Employee with Basic more than 15,000?

Both employer and EPFO.

But also the employee, because he faces the problem and misses out the interest also as some part of his salary, is diverted to EPS which does not earn interest.

And his transfer/withdrawal claim is not approved.

We have raised this issue with EPFO.

We are trying to find a solution.

We have covered this in our article Basic Salary More than 15000,EPS Contribution,Rejection of Transfer or EPF Claim

Hi, I have applied for PF online for partial withdrawal. Its been 15 days since I applied but status is still Under process. How long should I wait more?

Hi,

I worked for a software company from 1 April 2018 to 19 April 2018 in Bangalore. Now I completely moved to my hometown Gujarat. In Gujarat I am not working any private or public organisation. I am doing my own business. In my epf account Employee share is 63,887/- INR, Employer share is 29,788/- INR and Pension contribution is 30,713/- INR. I claimed withdraw pf(Form 19) through online on 10 Sept 2018. On 6 August 2018 I received 84,331/- INR to my bank. Why there is huge difference? Is tax deducted? Could please help me on this?

Thanks,

Ravi

You can get the only employer and employee shares amount, you can withdraw pension only after 60 years old… so total amount you get is Employee share+Employer share is 29,788.

If you withdraw pf before completing 5 years of service and amount is >50000 then there will be 10% tax deduction.

So (63,887+29,788) – 10% = 84,331

Hello,

My Gross Total Income is approx 115,000 (i was unemployed for major part of FY2017-2018). However, I was able to invest (well above the limit of 150,000) in 80C instruments ELSS Mutual Funds and PPF from –

(i) funds received from EPF withdrawal from my previous employer after 9 years of service.

(ii) funds in savings account.

(iii) mutual funds investments (held for 5 years) redeemed in Dec 2017.

My question is –

(1) Since my Gross Total Income 115,000 is non-taxable, should i show my 80C investments or not ?

(2) If yes, should i input the actual amount invested in 80C investments or simply inputting 150,000 (because this is the max deduction allowed) is enough ?

Thanks.

Hi,

I have tried to submit claim online for 2 yrs of service and no job at hand now.Aadhar,pan and bank details are linked but the claim gets rejected with reason ” has been rejected due to :- MEMBER NOT SUBMITTED FORM 15G/PAN CARD/K”……My questions are :

1) How do I submit form 15g online?

2) If I have to do offline withdrawl my regional office is in Chennai while I stay in Hyderabad.So can I submit the 15g and composite claim form offline in Hyderabad pf office?

Is your PAN attached to your UAN?

You can find the regional EPFO office email details and contact them on email and phone. Refer to our article how to find Regional office here

You can try submitting the Filled Form 15G online One using EPF grievance website.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

To find filled Form 15G refer to image here Please use the appropriate assessment YearsForm 15G for EPF Withdrawal

Hi,

Thanks for the quick reply.

Yes my pan,AAdhar,bank details are attached to my UAN.Also I am not getting response via phone or mail to respective regional EPFO.

When I did reach chennai regional office via phone they said to do offline withdrawal I need to send Composite claim form,pan,15g all attested by my employee.I have left job 2 yrs back.So is there any way to do offline withdrawal without employee attestation?

Get it attested by your bank manager.

You can also try reapplying online and raise a grievance and submit Form 15G online.

Our article How to register EPF complaint at EPF Grievance website online explains how to raise grievance

We have raised the issue with EPFO on twitter.

You can see the tweet here.

Refer to your reply on June 28, 2018 “If you haven’t claimed 80C deduction then it would be non-taxable.” Here, we are talking about Employee contribution.

So, when Employee contribution is non-taxable, is it necessary to show it in return as an exempted income OR No need to mention? If yes, in which worksheet of ITR2?

Please show it as exempted income.

In ITR1 as Sec 10(12)-Recognised Provident Fund received in

Tab Taxes Paid and Verification

Section Exempt Income

Other entering as Sec 10(12)-Recognised Provident Fund received

In ITR2 in EI tab and 5 (others)

Thank you for your quick response. In ITR-2, Salary tab, 7 “Allowances exempt under section 10” -> iv. Other allowances, in “Nature of income” column, “Sec10(12)-Recognised provident fund received” is available in drop-down menu.

Is it OK if we show it here instead of EI tab and 5 (others) ?

Hi Sir,

I have made my previous company PF withdrawal in January 2018 and amount is 80,170 and TDS is 8258. Now i am submitting returns for current year.

Here my questions is, should i mention this income in my filling ? if i mention then i need to pay 20% instead of 10% because my overall income for current year crossed 5 lakhs.

Please replay me with your suggestions.

Thanks in advance.

Mahi

As you worked less than 5 years TDS has been deducted.

You have to mention it in your ITR because this amount and TDS would show up in Form 26AS.

Do note that, if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary. However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Hi Sir,

In your above reply to Mahi, it is clear that releis u/s 89(1) can avail on employer’s contribution along with interest. To claim relief u/s 89 one should submit form 10e. In form 10e there are four annexure’s. Which annexure should use?

Please reply with your suggestions.

I made a premature PF withdrawal (say within 14 months), and while I understand that employers contribution (plus interest) will be fully taxable in the year of withdrawal (profits in lieu of salary), however on the employee contribution part while the accrued interest is taxable (income from other sources); my question is on roll back of 80 C benefits in light of employee PF contribution being counted as one of the 80C permitted deductibles (in Form 16) whereas I had several other investments (Life Insurance policy premium, tution fee for kid etc. etc.) which would had exhausted the 80 C limit (150,000) even before taking PF contribution as one of the components ?

Can you advise if roll back of 80C will still happen just because my employer chose to put PF as 80C permitted limit and ignored to consider other 80C permitted options instead ?

You can avoid roll back of 80C. As you have other 80C deductibles provided you have proof for it.

Hello Sir,

I withdrew my PF amount in FY 2017-18 . It has only two time components corresponding to FY 2016-17 and FY 2017-18.

Since the amount was less than 50000, No TDS was deducted . The amount i received is not mentioned anywhere, Neither in Form 16 provided by my employer nor in Form 26AS downloaded from TRACES. I am not sure if I should offer it in ITR of current FY. If I do so, Won’t I be receiving system generated mismatch notice ?

Let’s say I am offering the amount. Instead of filing the full PF amount in FY 2017-18 ITR and Increasing my tax liabilities , I am planning to change my FY 2016-17 ITR and offer it year wise. Is this the correct way ?

Sir, Correct me if I am wrong. There is no need to consider EPS Component ( Pension Contribution ) as far as filing my Income tax is concerned. Right ?

Thanks & Regards

Mihir

EPF Withdrawal is taxed in the year it was withdrawn.

SO you cannot claim it in FY 2016-17

Govt verifies ITR with income/TDS appearing in Form 26AS.

So don’t change your FY 2016-17.

If you want to avoid mentioning it , it would be calculated risk what if it comes up in Form 26AS?

Do note that, if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

While filling the income tax form please add income under the appropriate section.

Thank you very much for your suggestions.

I have downloaded my form 26AS for the FY 207-18 and PF Amount is still not getting reflected there at all ( Maybe because there was no TDS ).

Is it possible that it can still make its way to 26AS ?

Regards,

Mihir

Theoretically, it can, but the probability is less.

Hi,

i need some help here, trying to reach PF office through email and phone but to no avail.

I am trying to claim my PF withdrawal online, wherein I have updated my PAN card details also.

Now when i submitted my claim, they rejected it after 20 days stating that I have to SUBMIT FORM 15G AND PAN OTHERWISE TDS WILL BE DEDUCTED/OK.

My question is if i have updated my PAN details online, is it necessary to send form 15G to pf office? also do i need to attach the print out of PDF acknowledgement of form 19 and 10C.

Please help.

Thanks in advance

Best would be to either claim again online and be ok with TDS deduction

or

you can visit Regional office personally.

Can you send the rejection information to our email id bemoneyaware@gmail.com

Hi,

I have withdrawn my EPF in the year 2017-18 and that too before completing 5 years of service. So as per this blog I understand that Employer’s contribution + Interest thereon is taxed under head “profits in lieu of salary” and Interest on Employee’s (my) contribution is taxed under the head “Income from other sources”. About Employee’s (my)contribution in PF, I have never claimed its deduction under Sec 80 in any of the previous years. So, in that case, from total PF withdrawal amount, will my contribution (i.e. Employee’s contribution) portion be taxable or non-taxable?

Please guide me.

If you haven’t claimed 80C deduction then it would be non-taxable.

Thanks for the reply. I have one more question w.r.to your reply.

Do I need to mention non-taxable Employee’s contribution in Schedule S of ITR2? If yes, where exactly I need to mention?

Hello Sir,

I withdrew my PF in FY 2017-18 . It has only two components corresponding to FY 2016-17 and FY 2017-18.

Instead of using Section 89, Can i simply change my FY 2016-17 ITR and Offer the PF Component ( Corresponding to FY 2016-17 ) there only ? I will also offer PF Component ( Corresponding to FY 2017-18 ) in the current return ? Is this one of the correct way ?

By PF Component above, I mean to include all parts namely Employee contribution, Employer contribution and Interest accrued on them.

if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Hi,

Date of Joining 01/11/2012 to Date of Leaving 01/11/2017. Totally 5 years Service competed. The person withdraw the PF Amount. PAN Number needed or not.

Regards

Saravanan P

First of all, I would like to thank you for all the effort you put into running this blog.

I have withdrawn my PF last October after working for about 3 years. I had applied for online withdrawal and a TDS of 10% was deducted from the amount. Apart from the PF money, I had very little salary and the total amount (April 2017-March 2018) did not cross 2.5 Lakh. It is my understanding that I will get a full refund of this TDS amount. Please correct me if I am wrong.

My question is how do I go about doing this? I already have my Form 16 and 26A.

Are there any specific heads under which the withdrawn amount needs to be declared? (Like, for example, 80TTA for bank interest)

Thanks again.

-MH

@bemoneyaware

Could you please clarify my doubt above?

Thanks

-MH.

Sir will it be possible for you to send your Form 16 and Form 26AS to bemoneyaware@gmail.com so that we can reply specifically

Hi had same situation plz help if you got the solution

Hi

I applied pf through online as company denied offline form.there is no option to submit 15g through online.my employer is saying raise rti to save 10% tds..my amount will be above 50000 and service was 2 years. Is it worth to register rti and request not to deduct tds.

Don’t raise RTI.

EPFO offices are asking for Form 15G as to avoid paying TDS.

As you rightly pointed out the TDS should be deducted.

But then common sense is not so common in India.

Submit the form offline through your employer.

I had applied for final settlement of pf through online process. But it rejected by saying form 15G/15h not submitted.but in online application there is no way to submit 15g please help

Grr…the EPF site. You need to apply again or go the offline way.

Did you work for less than 5 years?

Which regional EPFO office was it?

Can you tweet/write on facebook about it.(you can tag us bemoneyaware is our twitter handle)

If you have the rejection letter can you mail it to bemoneyaware@gmail.com

Hi,

First of all, thank you for sharing lot of information to public. I really appreciate it. I have few queries below and I will explain my situation.

Now, I am leaving abroad and I have EPF balance of Apprx.6.5lakhs. I want to withdraw epf before 5 years. I don’t have other income in India for this year. My question is regarding filling form 15G.

– What should I fill on Column 5. Residential Status….. ( I stayed in India last year less than 182 days). I presume that I will be considered as Non Resident for tax purposes.

– What should I fill on Cloumn -16 & 17. Estimated income & total income…

Also, I checked my recent epf passbook, and found that interest for last year ending 31/03/2018 has not been updated. When normally, then update. DO I need to wait to reflect that interest or can I submit form now to withdraw EPF.

Thanks for your help.

Why are you not doing Online withdrawal?

Yes interest for year ending on 31/03/2018 has not been credited as Finance ministry has not approved interest rate suggested by EPFO.

So we would recommend you to wait for 2 weeks atleast

I have completed 5Y+ & left India for job overseas over 6M ago. Trying to apply for withdrawal online, but it’s asking for 15G. Could you please help explain ? Many thanks in advance!

After carefully looking at online form realised that it’s calculating my total employment related to last employement only. Where as I have been a continuous member since 2009.

Reason Of Leaving: CESSATION (SHORT SERVICE)

DoJ EPF 01-AUG-2016

DoE EPF 01-JUL-2018

Is there a way to fix this anomaly ?

Please read our article Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G for more details

Sir I previously worked for an organisation during July 2014 to Jan 2016 & my total epf contribution is approx 95000.i resign my previous job and joined new organisation in 2017.now my total income is above 6 Lakh.now I have applied for claim. But the epfo is asking to submit 15g.

Sir now my income is above tax limit. How can I submit 15g.

Regards

We would not recommend you withdrawing your EPF but transferring it.

Legally you cannot withdraw EPF if you are employed.

Yes EPFO is wrong on asking you to submit the 15G but they don’t want to deduct TDS hence they are asking Form 15G with EPF Withdrawal.

Sadly that is the way it works.

If you want to claim then you need to deposit Form 15G.

Do note that, if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Hi I am Sampat kumar.

I have worked from 1-jan-2015 to 1-sep-2017 then after i quit the job.currently i donot have a job in my hand.

I have applied the PF.

Adhar is verified in my portal.

Getting PAN is unverified in my portal as Name is mismatch in Adhar and PAN.

Please suggest me how can i correct it.

PF is very needful for me now please guide me to withdraw of PF amount without deductions.

Regards,

Sampat

Sir while verifying my pan n Aadhar card I cannot able to verify my pan as its showing unverify so plz help. All my details are correct n I’m trying to summit online so plz help me .

Hi,

I have withdrawn my PF in the year 2015 – January by submitting Form 15-G.How does it impact my IT Returns.

Do we need to pay anything while filing IT Returns

Did u summited ur other form sir by online ??

When did you file returns for the year 2015? It should have been mentioned then.

if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Sir,I worked for a company from 2011 sep to 2015 oct.after that I quit the company and withdraw pf.my company deducted 10% tds.my total salary income in fy2015-16 is Rs 340000.I got 1 lakh as pf settlement.can I get a refund of tds on pf,since of amount is less than exemption limit.otherwise do I need to add pf income with total salary earned in 2015 to arrive at tax liability?

Sir,I worked for a company from 2011 sep to 2015 oct.after that I quit the company and withdraw pf.my company deducted 10% tds.my total salary income in fy2015-16 is Rs 340000.I got 1 lakh as pf settlement.can I get a refund of tds on pf,since pf amount is less than exemption limit.otherwise do I need to add pf income with total salary earned in 2015 to arrive at tax liability?

[Mom, 16-06-10 03:34:57

I worked in a company from jan 2014 to jan 2016. Pf balanve is 90000. Currently i m not working, have savings bank ac with 7000 annual interest and dont have any other source of income .

What should be filled in following columns of form 15 g

4 .?

16 ?

17 ?

19. ?

It would be of great help if you could answer these questions

If you withdraw between 1 Apr 2017 to 31 Mar 2018

4. then Previous Year or PY( Pt 4 in the Form) is 2017-18 and Assessment AY would be 2018-19.

16. Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For EPF in your case is 90,000.

17. Estimated total income of the P.Y. in which income mentioned in column 16 to be included is 90,000+7000=97000

19. Identification Num is your PF number,

Nature of income is premature withdraw

Section 192A

Amount 90,000

For 15(a) Mention latest Assessment Year for which Income Tax Return has been submitted and processed. If you have filed return for FY 2016-17 or AY 2017-18 last date for which is 31 Jul 2017 mention AY 2017-18.

Else mention the last Assessment Year in which your ITR was submitted. For example if You filed return for FY 2015-16 or AY 2016-17 then mention AY 2016-17.

In declaration part Assessment Year would be 2018-19.

I quit job after 4 years of service in May, 2011 from my previous employer. Now I am working in another employer. I tried to online transfer the old PF to new EPF A/C. But unable to transfer.

Showing Message “Details of previous account are different than present account. Hence claim request cannot be processed.”

When I am checking the balance under http://www.epfguide.com/check-pf-balance-chandigarh-epf-office/ below message is showing.

STATUS for Member ID: PB/CHD/000XXXX/000/0000XXX

Your Account has been marked as In-operative Account. For details please contact respective EPF Office.

**Data updated till 23-04-2015 13:30:06

Total requests served: 6368499 (updated – 07-02-2018 02:45:01)

I am trying to contact with that office but no one receiving the call. Even I sent mail to regional office but no reply from them.

Can I transfer the amount of this inoperative A/C to my new account?

Hello, Need help with EPF withdrawal after rule changes. I was in one firm for four years and another for about four and a half years until 2015. I did not join any other firm after that and am self employed. From the first firm, I withdrew my PF in 2015 and after that the rules have changed. Now, I need to withdraw the second firm PF. Please help with the following queries,

– full amount can be withdrawn without any conditions since I am not employed with any firm ? – how will it be taxed ? – can some amount be withdrawn and some transferred to NPS or PPF ? – can there be multiple withdrawals like partial withdrawal this year and rest in next 1-2 years ? Thanks for the help. SD

Hi,

I worked in my previous company for4years and left in 2011. I have not withdrawn/transffered my PF. Now have submitted for withdrawal and it is under process. I dont have a UAN for that.

How can I know the amount I will be getting and the details like employee contribution, employer contribuution and interest for these years. Also, I will be getting the amount after tax deduction or I have to pay the tax from my side? While filing ITR for this finacial year what all things I have to do?

Thanks

John

Hi,

My PF started in 2013 and it will end this month because of my resignation with my employer. As per my PF statement, including interests, the Employee share is Rs. 53,471/-, the Employer share is Rs. 18,096/- and the Pension contribution is Rs. 33,179/-. I will close my PF account and for that I have to fill up 15G Form. I have 2 queries:

1) Once my PF account is closed, will I receive the full amount after submission of necessary documents i.e. Rs. 1,04,746/-?

2) In 15G form, what amount should I write in section 16 (Estimated income for which this declaration is made)?

Please help me out as I am confused which amount should I give in 15G.

Yes you would get almost full Employee share of 53,471, the Employer share is Rs. 18,096 and the Pension contribution is Rs. 33,179.

(The employee won’t get the entire contribution (Rs 541/Rs 1,250 a month) back after applying through Form 10C. The amount received will be subject to Table D which for 4 years is 3.99

in 15G form you have to mention your taxable income after 80C deduction.

We have also updated the article with sample 15G form. You can go through it

Hi,

i was contributing to PF from Aug 2014 to Jan 2017, i found new job and i tried claiming my PF online, but they rejected due to no 15G form.

now, i m confused where can i upload 15 G form in EPFO portal?

should 15G be filled in bank account through netbanking or income tax portal?

if i submit all documents to PF office verified by my current employer, shall they be asking for 15G?

I was contributing to the PF from Sep 2010 to Sep 2014.Then my contract got over and I got another job for 6 months vacancy from March 2015 to August 2015.After that I am unable to get any Job as I completed 60 Years in Mar 2016.

To qualify for having contributed to PF for 5 years for deduction of tax is ruled out as I am 60 years and no one will give me an employment.

Now I got my PF settlement and a TDS amount reflected in 26As of my PAN account.

How should this PF TDS be treated for filing my returns for this year.

Plz send me filled form no.15G

Please check the image in the article

Hi ..

I have withdrawal my EPF this year ( i.e. early 2016) . I had epf of around 2.8 years and didn’t submit the 15G form. And TDS is deducted from the total amount. How can I get return of TDS deducted through ITR.

Thanks .

You can claim it while filing ITR.

First verify that TDS deducted shows up in form 26AS.

Then check if you have your total tax calculation, check how much tax you owe. If your TDS is more than tax due you will get it through refund.

Remember EPF withdrawal before 5 years is taxable as per following:

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

Thanks .

Hi,

I left my first company after a service of 2years and 6 months in 2011 from where i have not withdrawn/transffered my PF. My salary in that company was 1.8 lakhs only however now my salary is around 5 lakhs. So, now if i withdraw the salary from my previous company, will the tax calculation be based on my salary in that company or on my current savings/salry as am requesting to credit the amount to my current account. Do i have to submit 15G or form 16.

If you withdraw your EPF now , income in year of withdrawal is used.

If after 80C deductions etc from your this year salary you are able to bring it below 2.5 lakh , the exemption limit, you can file Form 15G which means no TDS will be deducted on your EPF withdrawal.

We suggest you transfer your EPF to current job and take loan from EPF if required.

Hi,

I worked with the Tatas for 4 years and 6 months. With Tatas the PF was held with a trust. I then shifted to work in a start up for 19 months. The transfer of the PF from Tata was in the last month of my service with the start up. Can I withdraw my PF without tax in this case. I am not sure how the calculation is done and whether the Trust and EPF contributions are treated differently.

Thanks

i worked for 4yrs and 9 months in a company which was not continuous in EPF and while applying for the PF they have deducted TDS and for the FY 2015-16 i didn’t work anywhere and doesn’t have taxable income whereas there is home loan repayment. Can i claim the TDS deducted and what is the procedure? i am unable to see tax credit in IT website for the amount deducted. Kindly advice

Sir,

My epf depisited for 2 years..after resigned from job i.applied for epf withdrawal and also filled 15G form. But i get amount which is less than actual depostied amount.

I am giving you detail

Total emoloyee contribution – 23487

Employeer share – 7186

Amount deposited in pension – 16261

Total – 46934

But my account is credited with 10489 and 31505 (total 10489+31505- 41994). There is difference of 4940. Sir can you eleborate these how i got less amount credited in my account.

Thankx in advance

Your epf amount seems to be fine. 31505 for 23487+7186

But eps amount is less you should get full EPS amount of 16261.

Did you try to talk to your ex employer?

Did you check your Form 26AS to verify if TDS was deducted /not?

Sir i dont know how to check form 26. Can u plz help me or guide me from where i can check tds deduction.

Two easy way to view Form 26AS. It is explained in our article Viewing Form 26AS on TRACES with pictures.

1. View Tax Credit from incometaxindiaefiling.gov.in

Taxpayers who are registered at the portal incometaxindiaefiling.gov.in for e-filing of income tax returns can view 26AS by clicking on ‘View Tax Credit Statement (From 26AS)’ in “My Account”. The facility is available free of cost. Earlier it used to TIN-NSDL website, now it takes to TRACES.

2. View Tax Credit (Form 26AS) through banks using net banking facility

The facility is available to a PAN holder having net banking account with any of authorized banks. View of Tax Credit Statement (Form 26AS) is available only if the PAN is mapped to that particular account. The facility is available for free of cost.

Banks Site showing tax credit through TRACES (Earlier it was taking to TIN-NSDL site)

can you please provide Form 15G. i am trying to download the same but i am not able to get it.

I have already withdrawn & closed my EPF account after 3 years of service in Nov 2015 with also submitting form 15G. Amount was transferred to my account directly & last statement that I was able to see online was very different (showing less amount) from actual amount received.

Now could you please suggest how can I obtain the last statement & form 16 of 10% TDS deduction so as to claim for TDS refund for my EPF withdrawl?

Neha did you EPF withdrawal amount in one deposit or two ?

On EPF withdrawal you get Employer Share of EPF + Employee Share + Interest of this financial year till date of withdrawal + EPS amount.

So does the (Employer Share of EPF + Employee Share + Interest of this financial year till date of withdrawal + EPS amount) match the amount your received.

if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew.

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

While filling the income tax form please add income under appropriate section.

When you submitted Form 15G then your no TDS should have been deducted. So please verify your Form 26AS to see if no TDS was deducted under section 15G.

Income tax office looks at Form 26AS to see the tax paid or deducted on your PAN number.

Our article What to Verify in Form 26AS? talks about it in detail.

If your income in financial year is less than 2.5 lakh you can claim TDS deducted by asking for refund while filing ITR.

You would get Form 16 from your company for this year after end of Financial year.

15327393

I quit job after 4 years of service in Feb 2015, I got EPF dues on April 2015 of 4.4Lakhs, total taxable income is 4,7 Lakh, Tax deducted by company on crediting PF was Rs 55000.

Do I have to pay any income tax or dues , I have 80C investments of 1.5lakh,

Regards

Hrishi

Sir as you got your dues in Apr 2015 PF income would be considered as Income in FY 2015-16.

So for FY 2014-15 or AY 2015-16 your income was 4.7 Lakh – 80 C deductions of 1.5 lakh.

For the year FY 2015-16 or AY 2016-17 for which you would file income tax return in Jul 2016 you need to account for EPF.

1. EPF is taxable if withdrawn before 5 years.

2. As TDS is deducted you can claim the TDS i.e part of tax paid while filing income tax return.

3. Tax on EPF withdrawal before 5 years is as follows:

Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary.However, relief under Section 89 will be available.

Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

every employer will make a new PF account now called as member ID. you have to link new member ID to UAN and transfer you old PF account .

As you said EPF account will be dormant after 3 years of no contribution, But after the concept of UAN, I have created new EPF account with my new employer. So still my 1st EPF account will be dormant after 3 years?

We have written an article FAQ on UAN number and Change of Job This article answers frequently asked questions like What is UAN number , What is Member Id and how does it differ from UAN number, What is registration of UAN number, How is UAN number allotted, What happens to UAN number when one changes job, Change of Job and UAN number,Request for this Member ID is already under process, What if two UAN numbers were allotted to someone, Mismatch in UAN and Member ID.

PF is with pvt establishment and thus not able to download the passbook from UAN website. Any option to access it?

5 years means 5 years of contribution to EPF irrespective of days or months or years between the jobs

Hi,

“How are the 5 years calculated?”

Does 5 years include cumulative contribution to PF account assuming that PF corpus from earlier account (with earlier employer) is transferred to new employer?

If there is a break taken between two jobs say couple of days or months but total contribution across the two jobs is more than 5 years, will it be considered as 5 years of service and applicable for EPF withdrawal without any TAX at all?

Regards

Praveen