When it comes to your personal finances, surprises aren’t usually good. Often, surprises can very easily lead to emergencies. In addition, emergencies are how the real trouble starts. Emergencies are often difficult at best to plan. In addition, there is certainly no way to account for every potential scenario and situation. However, that doesn’t mean you can’t still prepare yourself to handle most emergencies. Having an emergency fund is a great way to help mitigate any potential losses or damages caused by an emergency. Keep reading to discover how to set up your fund and what emergencies it can help with.

Table of Contents

What Kinds of Emergencies Are We Talking About?

There are many reasons to have an emergency fund or savings account. But not every scenario is an emergency. Emergencies can include events like loss of job, demotion, medical emergencies, and car accidents. Keep in mind these are real emergencies.

Emergency funds should not be treated like a savings account. It should only be used for emergencies. Use your regular savings account for the dream vacation, yacht, or a new BMW.

To a great extent, credit cards have done away with the need to have emergency funds. You can use them to tide over the emergency until you are able to arrange funds. But credit cards should not be seen as a replacement for setting up an emergency fund

Likewise, you may have a savings account for emergencies, but still, need extra funds for to tide you over. In these cases, it might be a good idea to look into installment loans. If you’re concerned about credit or waiting times, there are installment loans for bad credit available.

How Big Should the Emergency Fund Be?

Everybody’s emergency fund will be different depending upon income, financial situation, and spending habits. Ideally, a person should have access to anywhere between three to eight months’ worth of your monthly expenses saved up.

The exact number of months of expenses to save varies from expert to expert. Nevertheless, don’t worry; you won’t have to try and save up several months’ worth of income overnight.

Starting out small is often the best way to go, and even an emergency fund as little as $500 is better than nothing. While that $500 won’t help much when it comes to handling emergency medical expenses over a long period of time, it could be the difference between a late payment or not.

Budgeting for an Emergency Fund

Again, your emergency fund doesn’t need to be built overnight, nor does creating your emergency fund need to bankrupt you. That would be rather counterintuitive.

Instead, redo your budget and account for deposits into your emergency fund. Set your goal and determine how much money you can reasonably afford to put into the fund.

This would also be a prime time to cut some of your expenses if necessary. The emergency fund should be one of the top priorities within your budget. But that doesn’t mean you should give up your Netflix or Prime subscriptions.

Instead, go through your monthly expenses and find those ones that you don’t really need anymore. I bet you will find an old subscription to something you forgot to cancel before the trial ran out. You’d be surprised at how much a month you’ll be able to save.

No matter what, any and every little bit helps when it comes to contributing to your emergency fund. Even as little as Rs 50/$5 a week is a good start.

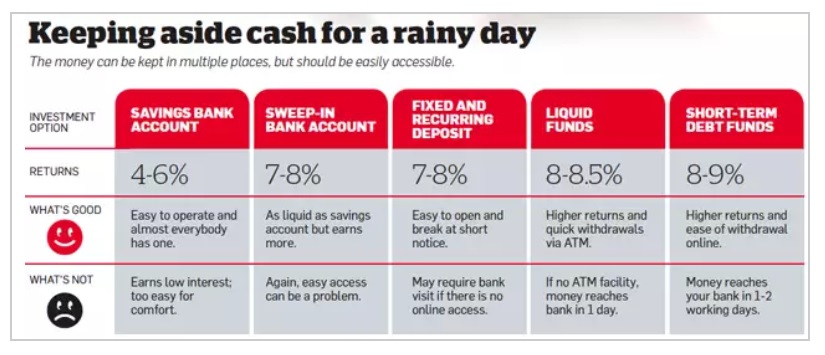

The image below shows where can you save the money to build an emergency fund. You need to choose an appropriate investment option for the fund. Remember, returns are not important here. What is more critical is that the money should be easily accessible at short notice.

Alternatives to Emergency Fund

As mentioned, emergencies are impossible to plan for. They happen at any time and always without warning. Moreover, even though you may have established an emergency fund, an emergency can still come along that makes your emergency fund useless.

Thankfully, there are options for those scenarios. Personal installment loans are a great way to handle many of life’s financial emergencies. Even if your credit is less than desirable.

Installment loans for bad credit can often help with a variety of life’s surprises. Everything from covering monthly expenses to consolidating debt, installment loans can help get you back on track.

When it comes to installment loans to help weather the storm of an emergency, be sure to do your research. Interest rates will leave you high and dry, but there are lenders with reasonable rates if you’re willing to look.

Relying on a personal loan in this fashion is always a bad idea but being aware of their existence and knowing they are an option, if need be, can be enough to ease the stress of any emergency.

Weathering the Storm

When it comes to weathering the storm of financial emergencies, there is no way to predict what will come and how it will all turn out. However, you can mitigate the damage done by an emergency by having an emergency fund.

An emergency fund is a great way to lessen the blow of an emergency while providing you comfort and security at the same time. The size of your fund should be around three to eight months of your monthly expenses saved up, but even one as small as $500 is better than nothing.

Don’t get caught by surprise in an emergency, set up your emergency fund today, and be prepared to weather any storm.

Company Name SLV Manpower soulations site name myntra Jabong Pvt LTD pls help me to ge my pf amount

Sir I m working 4 years 4 month they not paid properly my Pf amount