Financial technology (FinTech) has gained substantial attention in the finance industry. Numerous banks and Non-Banking Financial Companies (NBFCs) offering commercial loans are revising their existing policies and business models so as to create a dynamic environment amidst the FinTech ecosystem.

In simple terms, FinTech refers to the scope of financial services offered through digital means. With the wave of technology, loan seekers are turning to digital platforms to avail of finance. Customers may apply for a loan, make loan repayments, and much more through the Internet.

With the emergence of FinTech companies, the business loan sector is receiving an impetus. Following is the positive impact of the rise of FinTech companies in India.

- Competitive interest rates

FinTech companies do not involve physical transactions as everything is done through the internet. Therefore, they make significant savings, the benefit of which is then passed to the customers through attractive interest rates. FinTech companies also charge interest based on numerous factors like credentials of the borrower, creditworthiness of the business, and current market rates, among many other aspects. Businesses may, therefore, borrow a commercial loan through FinTech companies and take advantage of reduced rates of interest.

- Digitalization of loan processes

FinTech companies are deploying numerous digital methods to create a competitive advantage. Some financial institutions use social, mobile, analytics and cloud (SMAC) in order to bring about business innovation and improve operations. This, in turn, results in digitalization of all loan-related aspects. Banks and NBFCs, therefore, set up their portals online. Potential loan borrowers may obtain loan details online and even avail of a business loan online. This enables them to obtain credit anytime, anywhere.

- Quick loan processing

Some businesses may face a cash crunch and require immediate funds. Through traditional means of loan application funds were not disbursed quickly. Besides, loan seekers had to make repeated physical visits to the lender’s branch. In comparison, availing of a commercial loan through a FinTech company helps to save time and also ensures faster processing. Loan applicants have to upload all the necessary documents through the lender’s website. Thereafter, the application is sent for processing and the amount is then disbursed to the specified account. Due to quicker disbursal of loans, numerous businesses are opting to borrow from FinTech companies. This, in turn, results in the increase in the demand for loans.

With the launch of Unified Payments Interface (UPI), the digital platform is receiving an additional boost. If lending institutions partner with such digital platforms, the business loan sector will further grow in the years to come. Besides, demonetization has also encouraged digitalization. Through such reforms, it is expected that the business lending sector will bring about innovation and new trends.

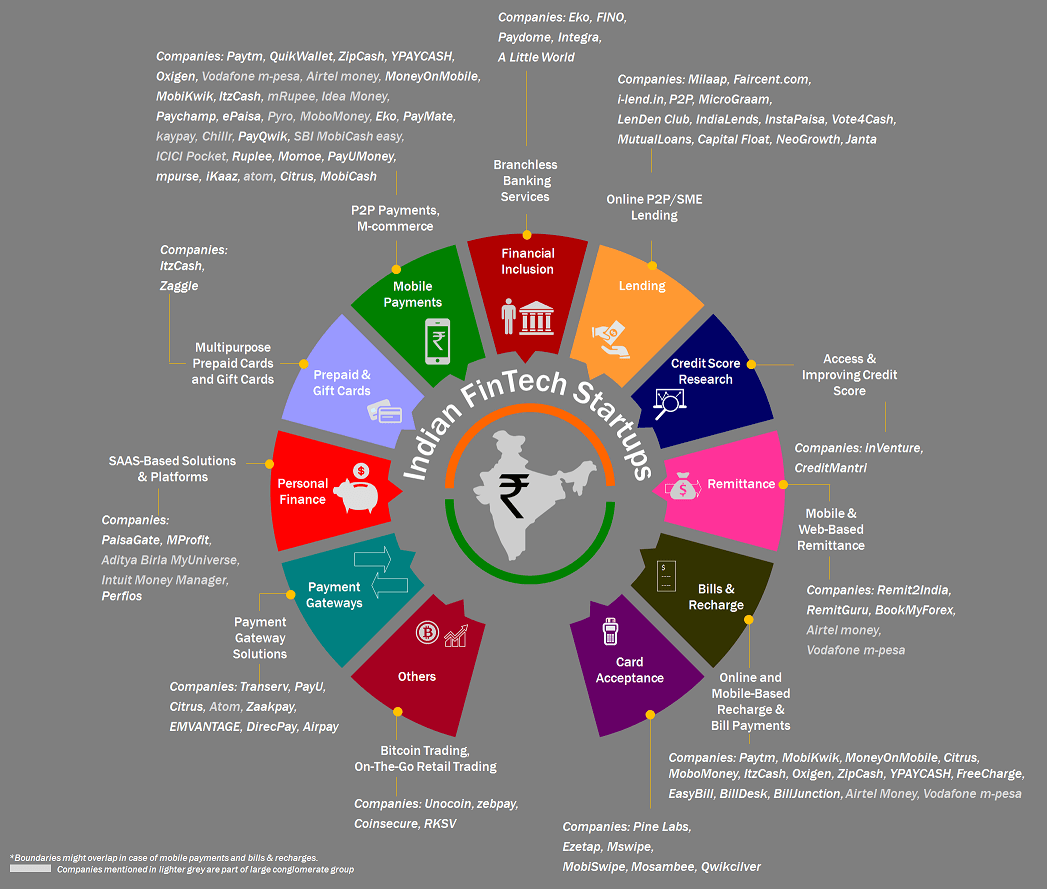

The following image shows Fintech startups in India (Courtsey LetsTalkPayment)

good article