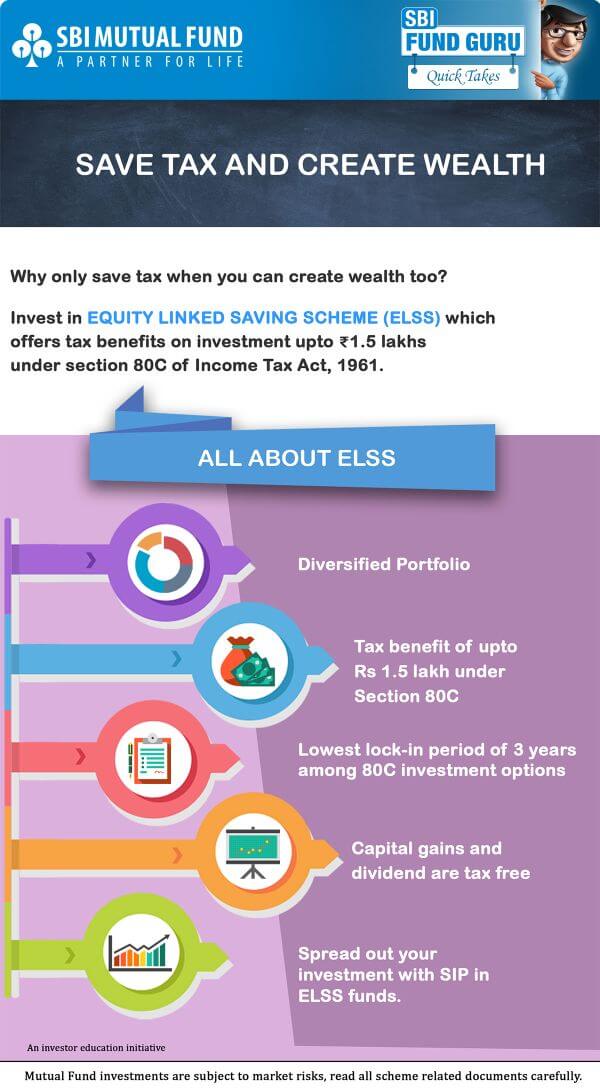

The tax fever is back to haunt investors. While most Indians prefer traditional instruments that offer fixed returns, Equity Linked Savings Scheme (ELSS) ability to create wealth over the long run; giving tax advantage. Most importantly, irrespective of the asset class investor choose, they should comprehend that taxation plays an integral role in overall financial planning; hence, the activity should be carried throughout the year, and not towards the end of the fiscal. Thus one can start looking at investing in ELSS scheme through SIP and avail tax benefit up to Rs.1.5 lakhs for a year as per the current tax laws.

Mutual funds, offering ELSS, predominantly invest in a diversified portfolio of stocks. Investors, choosing the dividend option, enjoy tax-free dividends and need not pay the long-term capital gains tax when they sell units. The minimum lock-in period of three years is the only caveat for investors to claim the tax rebate.

The infographic below talks about ELSS funds.

*Disclaimer: Please note that the Union Budget 2018 has introduced Long Term Capital Gains (LTCG) on equity oriented mutual fund schemes. LTCG from sale of equity shares and equity mutual fund schemes will be taxed at 10% if an individual’s total capital gains cross Rs. 1 lakh. Earlier, there was no LTCG tax if one holds the equity mutual fund units for more than a year. All gains up to 31 January 2018 will be grandfathered. Only the Gains that would arise after 31 January 2018 would be considered. Education Cess is also changed to 4%. These changes could lead to increase in the tax liability of investor. In view of the individual circumstances and risk profile, each investor is advised to consult their investment/tax adviser(s) before making a decision to invest/opt for ELSS.

Union Budget 2018 also imposed an 11.648% Dividend Distribution Tax (DDT) on equity oriented schemes.

Our articles discuss details about ELSS funds Understanding ELSS Funds or Equity Linked Saving Schemes, Best ELSS Funds to Invest In 2018 for Tax Savings

Related Articles:

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Choosing Tax Saving options : 80C and Others

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax Overview

- Paper Work A Necessary Headache

2 responses to “ELSS: Save Tax and Create Wealth Infographic”

Great job. Thanks a lot for providing all the information here. Thanks

Thanks Kirti!!!

I believe unless one needs to save taxes under Section 80C, there is no need to invest in ELSS.

Non-ELSS equity funds provide greater flexibility.