Aiming for prompt and proficient management or resolution of complaints, Income Tax Department has launched e-Nivaran, a unified grievance handling mechanism. This article discusses what is e-Nivaran, how you can raise Grievance with e-Nivaran and track any problem online with e-Nivaran.

Table of Contents

Overview of e-Nivaran

What is e-Nivaran?

Nivaran , in Hindi means Redressal. E-Nivaran is a dedicated one stop electronic grievance redressal that operates under the supervision of an assessment officer. Through e-Nivaran taxpayers can submit grievance in respect to Assessing Officer, NSDL, UTISL, CPC-ITR, E-filing Website team, CPC-TDS, Directorate of Systems, and SBI-Refund Banker. e-Nivaran to address all the grievances received through various channels under single window. Income tax e-Filing portal has been enabled to receive and address all the grievances. E-Nivaran was launched on 17 June 2016 by the Government of India.

This system also assimilates offline and online complaints. Offline complaints are the ones are that registered by being physically present at the income tax department while online complaints are filed via internet. E-nivaran can be used by the staff and tax-payers to view, file and resolve disputes using internet.

How to use e-Nivaran?

Steps to register a complaint on e-Nivaran are as follows:

- Go to https://incometaxindiaefiling.gov.in/

- Login using your income tax PAN number and password and Use eNivaran tab. You can also submit Grievance without logging in.

- Submit your Grievance.

- Track your Grievance by viewing your Grievance Status.

Sample Grievance is shown in image below. Process is explained in detail with images later in article.

How much time e-Nivaran will take to resolve a complaint?

CDBT aims to provide a satisfactory solution to every problem within a maximum period of 30 days of filing a dispute . With online redressal of complaints, the process will be is convenient. But with crores of tax payers and even more disputes getting resolutions from the income tax department will surely take some time but will probably reduce as time passes and efficiency of the departments increases.

What types of complaints can be filed on e-Nivaran?

Assessing officer

|

CPC for ITR- V:

|

CPC: For Processing of ITR

|

CPC for Refund of ITR

|

CPC for Rectification:

|

CPC for Demand

(Read: Income Tax Notice :Sections,What to check,How to reply) |

SBI Refund Banker:

|

CPC TDS on the matters related to:

|

e-Filing portal, you can seek resolution on

|

How to use e-Nivaran?

Using e-Nivaran after logging in to Income Tax efiling website

Go to https://incometaxindiaefiling.gov.in/

- Go to https://incometaxindiaefiling.gov.in/

- If you have PAN and Income Tax login details . Click on registered user and fill in your credentials.

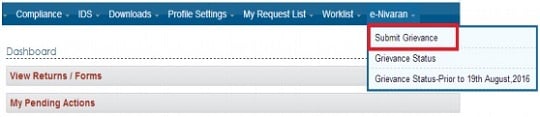

- Once you are logged in, click on e-Nivaran in Menu, as shown in image below.

Using e-Nivaran on Income Tax efiling website without PAN/TAN

If you have no PAN or TAN you can still file Income Tax Griveance without logging in.

Go to https://incometaxindiaefiling.gov.in/

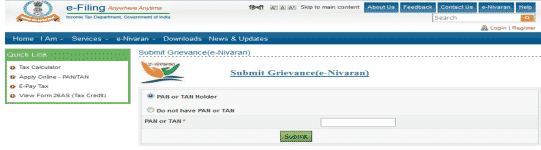

Click on e-Nivaran tab on the top right corner of Income tax portal (as shown in image below).

Click on select Submit Grievance.

You will get two options namely; PAN or TAN holder, Do not have PAN or TAN.

Click on PAN or TAN holder and enter your details. (If PAN is registered on e-filing page, your will be redirected to the login page. If not, you can register your PAN with e-filing or even continue without registering if you desire. We recommend creating a PAN account with e-filing.)

Submitting Grievance on E-Nivaran

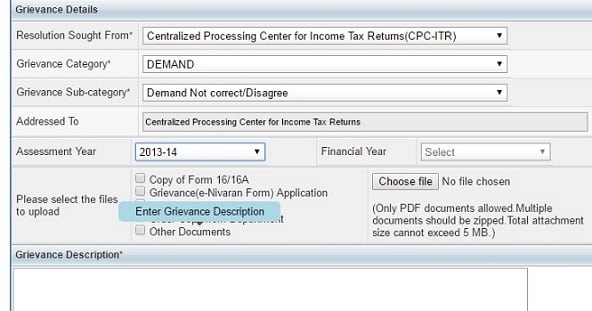

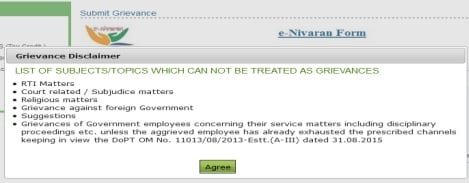

On Clicking on Submit Grievance, a Grievance Disclaimer pop-up will be displayed which lists topics for which one cannot submit Grievance, as shown in image below. One has to click on Agree and proceed forward to raise grievance

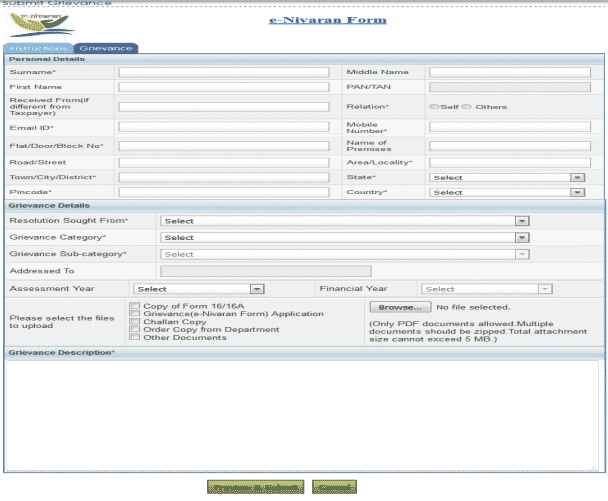

Fill all the necessary details like personal and address information(will be prefilled if logged in), grievance details and click on submit.

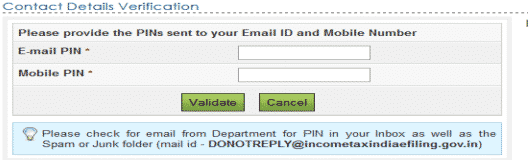

When you click on Submit, to validate the authenticity of your request, an OTP will be sent to your registered mobile number and Email Id. Authorise the grievance by entering the necessary details and click on Validate.

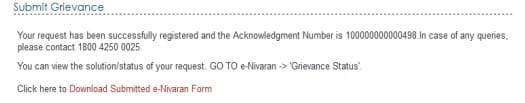

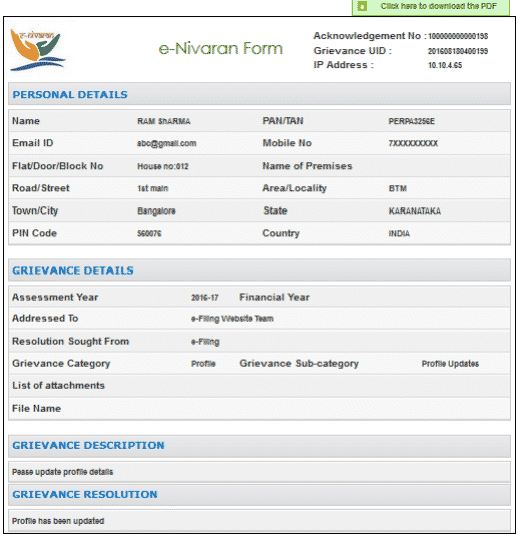

Clicking on Validate will lead to successful online submission of your complaint and you will be given an Acknowledgement Number. You also have an option to download a PDF copy of this grievance by clicking on Download Submitted e-Nivaran form.

How to Track Grievance status on e-Nivaran?

One of the crucial reasons e-Nivaran was launched is to keep a track or record of the complaint filed. You can also check the status of your grievance submitted. There are two ways by which you can check your grievance status without Logging in to Income Tax eFiling website and after logging in to Income Tax Efiling website.

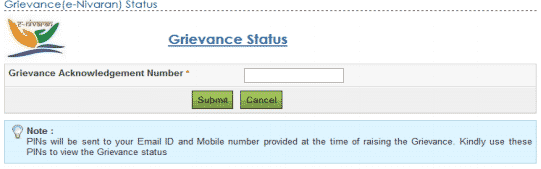

Track Grievance status on e-Nivaranv Without login

This is an option where with only acknowledgement number you can check your complaint status.

- Go to https://incometaxindiaefiling.gov.in/

- In e-Filing Home page click on e-Nivaran tab (Top right end corner).

- Click on View Grievance Status and enter Acknowledgement number.

- Click on submit.

- Click on Submit, you will have to validate with mobile no and email-id pin received to view Grievance Status. You can also download the pdf

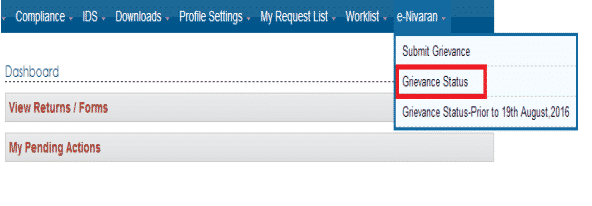

Track Grievance status on e-Nivaran With login

- Log on to https://incometaxindiaefiling.gov.in/

- Click on Registered User and fill in your credentials.

- Once you are logged in, find e-Nivaran .

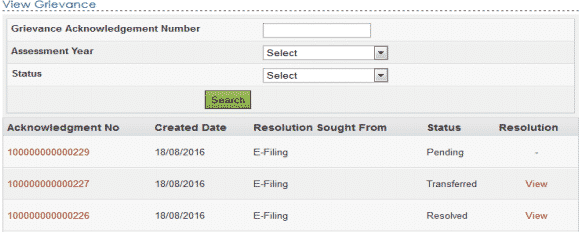

- Click on Grievance status, as shown in image below.

- You can also view previous grievance status raised prior on 19th Aug by clicking on Grievance Status-Prior to 19th Aug 2016 under e-Nivaran.

If you have multiple grievances, you can view all of them under this section with their individual status, resolution and date the request was raised.

View Multiple Grievances Status on e-Nivaran after logging in

If the issue has been updated with a clarification or solution, you can click on View to view the details of grievance along with the response in the form of pdf.

If you click on Acknowledgment number, PDF will get download which contain Grievance request.

Related Articles:

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Income Tax Refund: How to claim Refund,Check Status

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

What do you think of E-Nivaran utility of Income Tax Department? Have you raised grievance related to Income tax issue? How was the experience? Was your grievance resolved?

I’d filed ITR on 28th August 2019. Even after 60 days, I havent’ received the refund… the status states “Successfully e-verified”. So I raised a grievance through e-Nivaran and their response was “Dear Taxpayer, processing of your E-filed return is in progress. Please wait for initmation u/s 143(1) which will be sent to your registered email id once the process is completed.”

Now it’s been 4 months since I had filed the ITR but haven’t received any refund.

How else can be try to get this resolved?

Thanks!

You just have to wait.

Time limit to complete assessment is one year from the end of the Assessment Year.

But practically they do not take so much time, generally speaking, the Income-tax department usually takes 1 to 6 months time

We are entered wrong PAN while payning advance tax, later on on we came to know that PAN is wrong . We send our request through e-nivaran to rectify the PAN and credit the tax amount to our PAN. now the status showong that “transfered”.

What does it mean, that department has solved the issue or we have to do any thing else ?

kindly reply

i have filed a e-nivaran grievance for refund of AY-2011-12 date 12-7-2019 more that 30 days passed no resolution. what is the next step i can do to claim refund which is overdue?? please help

What does the transferred status mean?

I have received a demand notice for AY 2008-09 , which is incorrect. It was observed that CPC has omitted one of the form 16 out of two submitted. I cannot resubmit the returns as AY2008-09 not available on line. My AO is in a different state where I am not able to reach.

Can i upload documents in E-Nirvaran or I have to contact AO only ?

What does your Notice say?

Does it ask you to meet your AO?

What do you do when enivaran does not get any reply after 30 days- what is the next higher escalation contact email address