This article explains about the electronic filing of income tax return, also known as e-filing of ITR. It explains in Question and Answer form and pictures, What is e-filing of Income Tax Return? Who is e-Return Intermediary? Advantages of e-Filing? How to efile on income tax department website i,e incometaxindiaefiling.gov.in with Video? How is it different from filing through tax filing sites like taxshax, taxspanner etc? What is digital signature? What is XML? What is ITR-V? Statistics of efiling.

Table of Contents

Income Tax Return

What is a income tax return ?

It is a prescribed form through which the particulars of income earned by a person through various sources(like salary, business, professional fees, interest, capital gains, etc.) in a financial year and taxes paid on such income is communicated to the Income tax department after the end of the Financial year, called as income tax return or ITR. It is like your report card in school but instead of marks you have income and taxes. It is the constitutional obligation of every person earning income to compute his income and pay taxes correctly. Different forms are prescribed for filing of returns for different Status and Nature of income . Forms for Financial Year 2012-13 or Assessment Year are now available and can be downloaded from the incometaxindia.gov.in webpage download-forms.

Some terms associated with filing of income tax return.

Financial Year (FY) (or fiscal year) is a period used for calculating annual or yearly financial statements in businesses and other organizations such as government.In India, the financial year runs from 1 April to 31 March Example 1 April 2015 to 31 March 2016 for the current financial year (2015–16)

Previous year(PY) means the financial year in which the individual has actually earned the income (2015–16)

Assessment year (AY) is the year when that income is assessed (currently AY 2016-2017). Income is assessed in the next financial year.

Due Date : The lastdates for filing income tax return for an Assessment Year is called due date. For individuals it is usually 31st July of the Assessment Year.

- Individuals 31st July

- Companies & their Directors 3oth September ,

- Other business entities, other than companies, if their accounts are auditable & their working partners 3oth September

For AY 2016-17 (FY 2015-16) last date for filing return For individuals is 31st July 2016. You need not wait till end of July Once you get Form 16 (usually around min May) you can file the return.

E-Filing of Income Tax Return

What is efiling of income tax return?

The process of electronically filing Income tax returns through the internet is known as e-filing. One can file directly(incometax website) or through an e-Return Intermediary such as Taxsmile,Taxspanner. While the I-T department lets you file your returns online for free, most other portals charge a fee.

Who is e-Return Intermediary?

An intermediary (or go-between) is a third party that offers intermediation services between two parties which in case of Income tax return is income tax department and tax-payer. Income tax department (ITD) allows authorised intermediaries to electronically file returns on behalf of taxpayers. It is allowed under scheme titled Electronic Furnishing of Return of Income Scheme, 2007 to improve interface. TIN NSDL website has more information about e-Return Intermediary

What is physical filing of income tax return?

In case of physical filing the return, an individual needs to fill the printed form or the hard copy and submit it to the nearest Income Tax Office (ITO) and get an acknowledgement.

What are advantages of e-Filing?

- Anywhere, Anytime files, 24 x7 x 365 service.

- Easy, fast,free and secure

- Faster processing and quicker refunds.

- Value added services like viewing Form 26AS, tracking of refunds,email, SMS alerts regarding status of processing and refunds.

- And now it is also compulsory for most.

Is E-filing of Income tax Return compulsory?

E-Filing Returns is compulsory for:

- Individuals earning over Rs 5 lakh a year. They are required to file their tax returns in the electronic format from AY 2013-14 (FY 2012-13) and subsequent assessment years.

- Individual/HUF, having total Income of Rupees 10 lakhs. It was made mandatory from AY 2012-2013((FY 2011-12) and subsequent assessment years.

- Individual/HUF /Firm auditable under section 44B of the IT Act, 1961. It was made mandatory for AY 2012-2013 and subsequent assessment years.

- All Companies

How to efile on incometaxindiaefiling.gov.in?

To file on incometax department efiling website incometaxindiaefiling.gov.in steps are ”

- Fill the form for which there are two options

- File return offline : means you can download the form, fill it without being connected to internet and submit the form online.

- File return online (which currently shows for filing only ITR 1) : means that you need to be connected to internet for filling the form as well as submitting it.

- Choose whether you want to use digital signature while filing. A digital signature authenticates electronic documents in a similar manner a handwritten signature authenticates printed documents. This signature cannot be forged.

- If you do not use digital signature the Income Tax receipt, called as ITR-V, needs to be printed and sent to Central Processing Unit (CPC) Banaglore within 120 days of filing return.

These steps are explained in video by Income Tax Department on YouTube given below.

What are the steps to file returns offline at incometaxindiaefiling.gov.in?

Steps to file returns offline are :

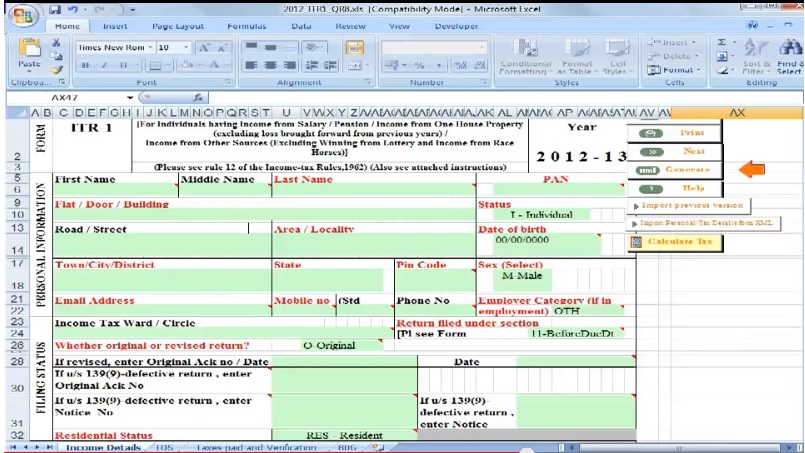

- Download the applicable ITR form which is zip file which has Microsoft excel file also called as Return Preparation Software

- Fill it offline

- Generate a XML file and save it to your computer.

- Logon to incometaxindiaefiling.gov.in (If you don’t have the Login you need to register )

- Go to e-File->Income Tax Return and Upload your XML file (saved in step 3)

- Choose whether you want to use Digital Signature or not

- On successful upload acknowledgement details would be displayed.

- If you did not use digital signature the Income Tax receipt, ITR-V, needs to be printed out and sent to Central Processing Unit (CPC) Banaglore within 120 days of filing return.

Form to fill in offline mode is an excel file shown in picture below :

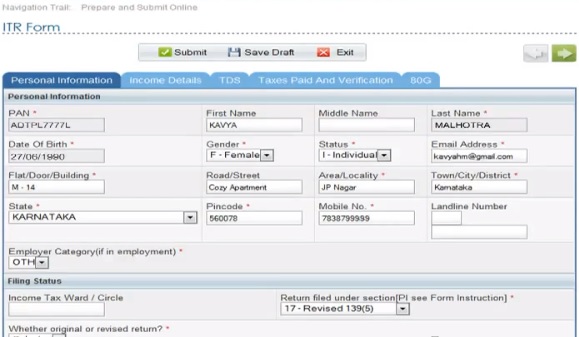

What are the steps to file returns online at incometaxindiaefiling.gov.in?

Steps to file returns online are :

- Logon to incometaxindiaefiling.gov.in (If you don’t have the Login you need to register )

- Choose the Form and Assessment Year. Note: Currently only ITR 1 form can be filled and Assesment Year shows as only AY 2012-13.

- Choose whether you want to use Digital Signature or not

- Fill the form

- Submit the form.

- On successful submission acknowledgement is generated.

- If you did not use digital signature the Income Tax receipt, ITR-V, needs to be printed out and sent to Central Processing Unit (CPC) Banaglore within 120 days of filing return.

Form to fill in online mode is shown in picture below :

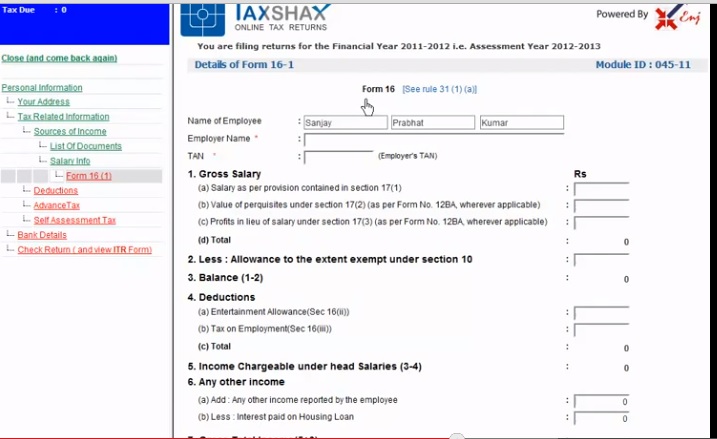

How is to e-file using e-Return Intermediary?

E-return intermediary i.e tax filing sites like Tax-Shax, TaxSmile, TaxSpanner etc provide online software which asks unambiguous, clear-cut questions about the nature and amount of annual income the ‘what’ and the ‘how much’. This way, it systematically draws relevant income tax filing information without requiring to get into the nitty-gritty areas of income tax law interpretation and computations. But that comes at a price as these tax filing utilities charge for using their services. Charges usually start from Rs 250 and depends on what kind of help one needs ex: does the form filled need to be reviewed by the tax expert, need help in sending ITRV etc. A sample of screen from E-return intermediary(Taxshax) website shown in picture below.

Note: We do not use and are not recommending TaxShax. It’s just a representative picture that we are showing to show filing of returns through E-return intermediary.

It becomes convenient for a person

- Who is not comfortable using Excel. Remember that for offline filling of Income tax return downloaded is in Miscrosoft excel format. (Unless

- Is not aware of income tax laws and computation and needs help or hand-holding

What is a Digital Signature?

A digital signature authenticates electronic documents in a similar manner a handwritten signature authenticates printed documents. This signature cannot be forged.

- India is one of the select band of nations that has the Digital Signature Legislation in place. This Act grants digital signatures that have been issued by a licensed Certifying Authority in India the same status as a physical signature.

- The Digital Signature certificates are typically issued with one year validity and two year validity.

- You can get digital signature from Certification Agencies. Certification Agencies are appointed by the office of the Controller of Certification Agencies (CCA) under the provisions of IT Act 2000. There are a total of seven Certification Agencies authorised by the CCA to issue the Digital Signature Certificates.

- Tata Consultancy Services CA

- National Informatics Centre

- Institute for Development & Research in Banking Technology (IDRBT)

- MTNL

- Code Solutions Ltd.

- Safescrypt

- e-Mudhra

What is XML?

XML stands for EXtensible Markup Language it does not DO anything and is used to structure, store, and transport information.

- XML is a markup language much like HTML i.e has tags ex of tag is <body>.

- XML tags are not predefined. You must define your own tags

- XML was designed to carry data, not to display data

The following example of XML file which is to captures sending of note to Tove, from Jani. Tags <note>, <to>,<from> etc are defined by software who will process the information.XML about note has sender and receiver information, it also has a heading and a message body. It depends on how the information stored in XML is used.

What is ITR-V?

ITR-V stands for ‘Income Tax Return – Verification’ form. E-filing without digital signature is not complete till signed ITR-V is sent.

- This form is generated when you e-file without using a digital signature.

- It is sent to the email id registered if filed on incometaxefile.gov.in.

- This form is used by Income Tax Department to verify the authenticity of income tax return when filed online without using a digital signature.

- It is password protected. To open the PDF copy of ITR-V, please enter your PAN in lower case and date of birth in case of the individual tax payers / date of incorporation for non-individual tax payers in DDMMYYYY format without any space between the PAN and date fields.

- You have to take print-out of ITR-V form generated, sign the copy and send sent by Ordinary Post or by Speed Post ONLY within 120 days from the date of e-filing. Or E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- If you don’t e verify you can send ITR-V to Central Processing Unit (CPC) of Income Tax Department in Bangalore which handles e-filing.

Its address is :

Income Tax Department – CPC,

Post Bag No – 1,

Electronic City Post Office,

Bangalore – 560100,

Karnataka – India.

What is status of e-filing of Income Tax Return in India?

Efiling started in FY 2003-04,when income tax department made it compulsory for all corporate deductors to file Income tax returns for deduction of tax at source (TDS) only in electronic form.From FY 2004-05, in addition to corporate deductors, filing of TDS returns in electronic form is mandatory for government deductors also. government is making more people to file their returns electronically. The income tax e-filing website shows efiling Statistics. A picture from history of efiling is shown below.

Related Articles :

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- After filing Income Tax Return

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

[poll id=”40″]

How do you file your income tax return – electronically or not? Do you like the e-filing of Income tax returns? What do find difficult in filing income tax return? When do you file your income tax return? Do you file it yourself or you file through Chartered Account? Do you use incometax department website or tax filing sites? If tax filing site which one do you use and why?

46 responses to “E-Filing of Income Tax Return”

The topic is very good. Keep sharing these kind of topics.

Your selection of topic is very good and also well written. Thanks for sharing. I feel like all your ideas are incredible! Great job!!!

Its in my nature to learn from others. I apply a similar learning approach for blogging as well. A few week ago I started a blogging series by writing things that I have learned, Put to action and seen results.

Thanks for sharing another sooper post.

I found your article very informative and I totally love how the concepts are explained in this blog post. Thanks for sharing your insights. It helps a lot.

Appreciate the article. One of the best ways to file ITR is efiling. Electronic filing is the process of submitting tax returns over the Internet using tax preparation software that has been pre-approved by the relevant tax authority, such as the IRS or the Canada Revenue Agency. E-filing has manifold benefits which have made this system of tax preparation increasingly popular in recent years; the taxpayer can file a tax return from the comfort of his or her home, at any convenient time, once the tax agency begins accepting returns. Thanks for the article.

Awesome and much useful information. Nice and detailed explanation.

Thanks for sharing this excellent info and tweeted 🙂

Thanks

For discribe wonderfull blog.

Great point,Very informative…

This website is just awesome. I’ve ask these details a great deal and I realised that is good written, fast to understand.

I congratulate you because of this research that I am going to recommend to prospects friends.

I ask you to go to the gpa-calculator.co page where each scholar or learner can calculate results grade point average rating.

Be great!

Really a useful article for the taxpayers who wants save their money and time while income tax filing.

I watched your blog to be particularly enlightening. I am on an astoundingly manager level vivified by your posts and considering encircling mine now. A dedication of appreciation is in light of current conditions to be a motivation to me as I was other than trying to make propels, in any resistance, was not getting the fitting class.

Incredible post!! Much the same as me, a lot of individuals are getting profited from this post.

I watched your blog to be especially illuminating. I am fundamentally charged by your posts and considering forming mine now. A dedication of appreciation is all together to be an inspiration to me as I was other than attempting to make makes however was not getting the fitting class.

Best post I have perused in quite a while. Extraordinary work and much appreciated.

Very useful article for tax payers. Here people can get proper information for Efiling of Income tax return.

https://www.youtube.com/watch?v=lFphkwTfHmw

Step by Stpe tutorial

Excellent post!! Just like me, plenty of people are getting benefited from this post.

Tax Return Services in Barking

Awesome Article: Think You sharing nice article and helpful

I have a query. What is to be filled in the space after in my capacity as……, right above the signature box.

Best post I have read in a long time. Great work and thanks.

EXCELLENT SITE.I AM FULLY SATISFIED.FOR A VERY LONG TIME I WAS SEARCHING FOR SUCH A SITE.IT IS THE ONLY SITE I HAVE COME ACROSS SO FAR WHICH INVITES QUERIES AND PROVIDES CLEAR ANSWERS.I HAVE SENT ANOTHER RESPONSE REGARDING THE PROBLEMS I FACE WHILE FILLING ITR-2 FORM USING EXCEL UTILLITY AND HOPE THAT I WILL SOON A RECEIVE AN E-MAIL REPLY FROM YOU.SO LONG.WITH BEST REGARDS.

SUDHEER AGASHE

Many stock buyers forget that the best way of investing is for income. That is purchasing good quality shares that generate real revenue in the way of a dividends (current or in the future). Locating dividends can be done easily and for many indexes you can employ a lot of free tools such as dividendrocket.com or even finance.google.com to help you locate shares based on criteria that you select. Currently now many of the shares in the UK Index are yielding up to Seven percent and these are all large companies with size over 1 billion pounds http://www.dividendrocket.com/ftse250

Good information . . but i have lot of questions on Income tax

1.my mom is Govt.employee,where TDS is deducted for her income in her department.She forgeted to show Charity receipt(80G Form).Wheather she is eligible for filling e-ITR(income tax return)?

2.In my mom’s Form 26AS statement(IN ALL COLOUMN) it is showing NO TRANSCATION for post 4financial yr (From 2010-11,2011-12,2012-13,2013-14) but each yr Department is deducting TDS as 13000 to 15000 respectively.Where to view her TDS PAID details?

3.I hav income only fom Other sources(like Saving’s Interst,FD).bank is not deducting any TDS (because income is less than 10000) only,but in my SBI net banking it is showing TDS enquiry,if i download it,it is showing a certificate which TAx projected? I cann’t understand what is this?

Thanks Gowtham and asking questions means you are trying to understand so you are welcome.

She forgeted to show Charity receipt(80G Form).

She can claim 80G while filing returns. Our article Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax shows how to claim it

Whether she is eligible for filling e-ITR(income tax return)?

If her income is above 5 lakh this year she needs to e-file. She needs to be careful for selecting the ITR form. If her exempt income (interest from PPF,dividend) etc is above 5,000 she needs to fill ITR2 and not ITR1. Our article Which ITR Form to Fill? explains it in detail.

In my mom’s Form 26AS statement(IN ALL COLOUMN) it is showing NO TRANSCATION

She would have got Form 16. That should be reflected in Form 26AS Part A.

If not ask her to contact her financial department.

I hav income only fom Other sources(like Saving’s Interst,FD).bank is not deducting any TDS (because income is less than 10000) only,but in my SBI net banking it is showing TDS enquiry

I can’t understand your question. Can you elaborate?

Good information . . but i have lot of questions on Income tax

1.my mom is Govt.employee,where TDS is deducted for her income in her department.She forgeted to show Charity receipt(80G Form).Wheather she is eligible for filling e-ITR(income tax return)?

2.In my mom’s Form 26AS statement(IN ALL COLOUMN) it is showing NO TRANSCATION for post 4financial yr (From 2010-11,2011-12,2012-13,2013-14) but each yr Department is deducting TDS as 13000 to 15000 respectively.Where to view her TDS PAID details?

3.I hav income only fom Other sources(like Saving’s Interst,FD).bank is not deducting any TDS (because income is less than 10000) only,but in my SBI net banking it is showing TDS enquiry,if i download it,it is showing a certificate which TAx projected? I cann’t understand what is this?

Thanks Gowtham and asking questions means you are trying to understand so you are welcome.

She forgeted to show Charity receipt(80G Form).

She can claim 80G while filing returns. Our article Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax shows how to claim it

Whether she is eligible for filling e-ITR(income tax return)?

If her income is above 5 lakh this year she needs to e-file. She needs to be careful for selecting the ITR form. If her exempt income (interest from PPF,dividend) etc is above 5,000 she needs to fill ITR2 and not ITR1. Our article Which ITR Form to Fill? explains it in detail.

In my mom’s Form 26AS statement(IN ALL COLOUMN) it is showing NO TRANSCATION

She would have got Form 16. That should be reflected in Form 26AS Part A.

If not ask her to contact her financial department.

I hav income only fom Other sources(like Saving’s Interst,FD).bank is not deducting any TDS (because income is less than 10000) only,but in my SBI net banking it is showing TDS enquiry

I can’t understand your question. Can you elaborate?

dear sir i want itr 4 SUGUMA AND ITR 4 FOR RETURN FILLING WHERE TI WHAT IS THE MENDOTARY IN JAVA AND EXCEL FILE SAVE AND AFTER RELODE THE FORM

Sir your question is not clear to me.

From what I have understood is that you need ITR4 and SUGUM form for AY 2014-15.

ITR-4S(Sugum) are available in online and offline utility for efiling at https://incometaxindiaefiling.gov.in/e-Filing/.

Thanks for the information.

Is it possible to file the return with a 3rd persons income tax with my login ID.Suppose i want to file the income tax of some of my friends do i need to create a seperate login or is it possible to use my own.

Please advice.

Thanks,

Bipin

User Name for e-filing of returns is individual’s PAN number. As different people have different PAN number hence you cannot use the same PAN.

So you would have to create separate login for each one.

Thanks for the information.

Is it possible to file the return with a 3rd persons income tax with my login ID.Suppose i want to file the income tax of some of my friends do i need to create a seperate login or is it possible to use my own.

Please advice.

Thanks,

Bipin

User Name for e-filing of returns is individual’s PAN number. As different people have different PAN number hence you cannot use the same PAN.

So you would have to create separate login for each one.

Thanks for sharing a really nice information about Income Tax Return. Keep it up.

Thanks for sharing a really nice information about Income Tax Return. Keep it up.

This is very good information. In my company the third party collectors are demanding 200 INR to process the returns. Thank you very much for this post and in btw for the FY 2012-2013 when we have to start filing the returns? Please let us know.

Thanks Kishore. Yes Charges for filing returns are around that only. One can go with the third party collector but make sure that they enter right information or don’t miss out important information.

For ITR1,ITR-4S efiling is open. For others excel utility will be available soon, for manual forms are available. One can file income tax returns from now to 31st Jul 2013.

This is very good information. In my company the third party collectors are demanding 200 INR to process the returns. Thank you very much for this post and in btw for the FY 2012-2013 when we have to start filing the returns? Please let us know.

Thanks Kishore. Yes Charges for filing returns are around that only. One can go with the third party collector but make sure that they enter right information or don’t miss out important information.

For ITR1,ITR-4S efiling is open. For others excel utility will be available soon, for manual forms are available. One can file income tax returns from now to 31st Jul 2013.

Does CPC/IT department send a physical acknowledgement (with the seal) of ITR-V?

Neerav,

No it doesn’t send physical acknowledgment

Upon receipt of ITR-V, CPC Bangalore dispatches an email acknowledgement on receipt of ITR-V. The e-mail from CPC is sent to the email ID mentioned in the ITR. This is your acknowledgement. Your filing is now complete

If you haven’t received the acknowledgement, download the acknowledgement from the income-tax web portal by logging in through your online account. The same will be available under ‘E-filing processing status’ under the tab ‘My Account’.

The receipt can also be checked by adding your PAN and assessment year or by filling the e-filing acknowledgement number on the ‘ITR-V Receipt Status’ tab under ‘Services’ section on the e-fling website.

You can also call the CPC call centre number 1800-4250-0025 (from 9am to 8pm) to enquire about the status of e-filing

Does CPC/IT department send a physical acknowledgement (with the seal) of ITR-V?

Neerav,

No it doesn’t send physical acknowledgment

Upon receipt of ITR-V, CPC Bangalore dispatches an email acknowledgement on receipt of ITR-V. The e-mail from CPC is sent to the email ID mentioned in the ITR. This is your acknowledgement. Your filing is now complete

If you haven’t received the acknowledgement, download the acknowledgement from the income-tax web portal by logging in through your online account. The same will be available under ‘E-filing processing status’ under the tab ‘My Account’.

The receipt can also be checked by adding your PAN and assessment year or by filling the e-filing acknowledgement number on the ‘ITR-V Receipt Status’ tab under ‘Services’ section on the e-fling website.

You can also call the CPC call centre number 1800-4250-0025 (from 9am to 8pm) to enquire about the status of e-filing

Does CPC/IT department sends a physical acknowledgement (with the seal) of ITR-V?

Does CPC/IT department sends a physical acknowledgement (with the seal) of ITR-V?

Very informative post. Thanks for sharing

Very informative post. Thanks for sharing

Thanks for sharing this information….. I find your blog a unique one….. Very informative and the topics you choose are not covered by many bloggers……. Keep blogging………

Thanks for sharing this information….. I find your blog a unique one….. Very informative and the topics you choose are not covered by many bloggers……. Keep blogging………