Stock market has different Indices to measure the performance of the companies. India popular indices are Sensex and Nifty 50. The popular US Indices are DOW, S&P 500 and NASDAQ. It is important to learn about the differences in US Market indices if you are investing in the US. This article explains the difference between Popular US Indices Dow Jones, S&P 500 & NASDAQ. They differ in what companies are in the index and in what proportion.

Table of Contents

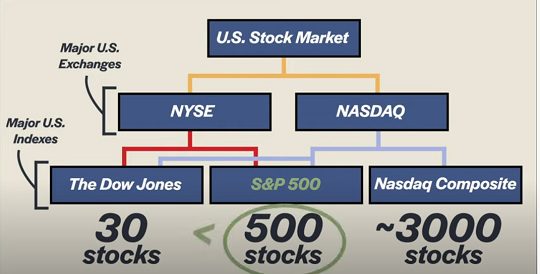

Popular US Stock Market Indices

An index provides a summary of the market by tracking some top stocks in that market. It tries to provide a snapshot of where the overall market is headed. Companies can be in more than one index, For example, some of the largest companies like Amazon, Microsoft are in the S&P 500 and Dow & NASDAQ.

- DOW (Dow Jones Industrial Average): The Dow represents 30 large-cap stocks as determined by the Wall Street Journal.

- S&P 500 (Standard and Poor’s 500 Index): S&P 500 includes the top 500 companies by market capitalization listed on the New York Stock Exchange

- NASDAQ (National Association of Securities Dealers Automated Quotations): it’s commonly accepted as an indicator of how tech-sector and innovative companies, big and small, are faring

- Wilshire 5000 This index represents up to 5,000 companies of all shapes and sizes, from gigantic corporations to the smallest of small companies. The Wilshire 5000 is often called the “total market index”

- Russell 2000 follows 2,000 of the smallest players in the market

The Dow, of course, is the primary index used in the news and by most public market commentators. It’s the oldest, it’s the best known, and it’s good enough to serve in that role. But always keep in the back of your mind that it has just 30 stocks and it’s calculated with that price-weighted system.

S&P 500 Index is the 500 component stocks weighted by market cap and it the best representation of the broad market movements.

If you’re interested in tech, then you may have more interest in the Nasdaq. Remember that you’re not looking at the market in a broad sense with that index, you’re looking disproportionately at the tech segment.

Our article What is Market Capitalisation? What are Large Cap, Mid Cap and Small Cap Companies? talks about How is Market Capitalization calculated? Why is it important to know about Market Capitalization?

Our article What is the difference between Sensex and Nifty? covers the difference between the Indian stock market indices Sensex and Nifty 50.

What is DOW?

DOW (Dow Jones Industrial Average or DJIA): The Dow represents 30 large-cap stocks as determined by the Wall Street Journal.

- It is the oldest index, dating back to May 26, 1896.

- It was created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow and his business associates, statistician Edward Jones.

- The name “Industrial” is largely historical, as most stocks in this index are not from manufacturing industries, but rather from all the major sectors except utilities and transportation. They include household names such as Johnson & Johnson, Coca Cola, and McDonald’s.

- How is it constructed: weighting for each component in the Dow Jones Industrial Average is ranked by share price, and then a divisor applied to create the final value. S&P 500 and Nasdaq 100 use market-capitalization-weighted method for constructing the index

Companies in DOW

| Company | Exchange | Industry | Date Added | Index Weighting (Apr 30, 2020) |

|---|---|---|---|---|

| Apple Inc. | NASDAQ | Information technology | 2015-03-19 | 8.01% |

| UnitedHealth Group | NYSE | Managed health care | 2012-09-24 | 8.01% |

| The Home Depot | NYSE | Retailing | 1999-11-01 | 6.17% |

| Goldman Sachs | NYSE | Financial services | 2013-09-20 | 5.29% |

| McDonald’s | NYSE | Food industry | 1985-10-30 | 5.23% |

| Visa Inc. | NYSE | Financial services | 2013-09-20 | 5.06% |

| Microsoft | NASDAQ | Information technology | 1999-11-01 | 4.94% |

| 3M | NYSE | Conglomerate | 1976-08-09 | 4.35% |

| Johnson & Johnson | NYSE | Pharmaceutical industry | 1997-03-17 | 4.18% |

| Boeing | NYSE | Aerospace and defense | 1987-03-12 | 3.87% |

| IBM | NYSE | Information technology | 1979-06-29 | 3.58% |

| Walmart | NYSE | Retailing | 1997-03-17 | 3.44% |

| Caterpillar Inc. | NYSE | Construction and Mining | 1991-05-06 | 3.34% |

| Procter & Gamble | NYSE | Fast-moving consumer goods | 1932-05-26 | 3.26% |

| The Walt Disney Company | NYSE | Broadcasting and entertainment | 1991-05-06 | 3.12% |

| The Travelers Companies | NYSE | Financial services | 2009-06-08 | 2.95% |

| JPMorgan Chase | NYSE | Financial services | 1991-05-06 | 2.72% |

| American Express | NYSE | Financial services | 1982-08-30 | 2.68% |

| Chevron Corporation | NYSE | Petroleum industry | 2008-02-19 | 2.63% |

| Nike | NYSE | Apparel | 2013-09-20 | 2.45% |

| Merck & Co. | NYSE | Pharmaceutical industry | 1979-06-29 | 2.25% |

| Raytheon Technologies | NYSE | Aerospace and defense | 1939-03-14 | 1.89% |

| Intel | NASDAQ | Information technology | 1999-11-01 | 1.72% |

| Verizon | NYSE | Telecommunication | 2004-04-08 | 1.62% |

| ExxonMobil | NYSE | Petroleum industry | 1928-10-01 | 1.32% |

| The Coca-Cola Company | NYSE | Food industry | 1987-03-12 | 1.31% |

| Walgreens Boots Alliance | NASDAQ | Retailing | 2018-06-26 | 1.26% |

| Cisco Systems | NASDAQ | Information technology | 2009-06-08 | 1.21% |

| Pfizer | NYSE | Pharmaceutical industry | 2004-04-08 | 1.06% |

| Dow Inc. | NYSE | Chemical industry | 2019-04-02 | 1.04% |

What is S&P 500

S&P 500 (Standard and Poor’s 00 Index): As the name suggests, S&P 500 includes the top 500 companies by market capitalization listed on the NYSE

- The S&P 500, created by Standard & Poor’s in 1962, represents the broadest measure of the U.S. economy.

- Standard & Poor’s Financial Services LLC (S&P) is an American financial services company. S&P is considered one of the Big Three credit-rating agencies, which also include Moody’s Investors Service and Fitch Ratings.

- First calculated in 1923,

- The stocks in this index are from all sectors of the economy and are selected by a committee. To be selected, stocks must have a market cap of $8.2 billion or more (as of 2019), have a public float of at least 50 per cent, have positive earnings for the most recent four quarters, and have adequate liquidity as measured by price and volume.

- The S&P 500 index is a market capitalization-weighted index. The index value is calculated by weighting each company according to its market capitalization and then a divisor, which is set by S&P, is applied to produce the final value

- The 10 largest companies in the index, in order of weights, are Microsoft, Apple Inc., Amazon.com, Facebook, Alphabet A(Google), Alphabet C(Google), Johnson & Johnson, Berkshire Hathaway, Visa Inc., and Procter & Gamble. The performance of the 10 largest companies in the index account for 27% of the Index performance

- For a list of the components of the index, see list of S&P 500 companies

What is the NASDAQ?

NASDAQ (National Association of Securities Dealers Automated Quotations): The Nasdaq is a term that can refer to Exchange and Index

- NASDAQ refers to the exchange, the first electronic exchange. The Nasdaq Stock Market began trading on February 8, 1971. The Nasdaq Stock Market attracted new growth companies, including Microsoft, Apple, Cisco, Oracle and Dell, and it helped modernize the IPO. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind only the New York Stock Exchange.

- The second reference of NASDAQ is to an index. When you hear people say that the “the Nasdaq is up today,” they are referring to the Nasdaq Composite Index, which, like the DJIA, is a statistical measure of a portion of the market

NASDAQ Composite Index is a market-capitalization-weighted index of more than 3000 stocks. The index is closely followed for its representation of technology and high-growth companies.

NASDAQ is different as no other exchange has its own popular index. There is no New York Stock Exchange Composite.

- Started on 5 Feb 1971 with the value of 100.

- Is Owned by NASDAQ OMX Group

- As of March 15, 2020, the industry weights of the Nasdaq Composite Index’s individual securities are as follows: technology at 48.39%, consumer services at 19.43%, health care at 10.21%, financials at 7.21%, industrials at 6.85%, consumer goods at 5.51%, utilities at 0.81%, telecommunications at 0.72%, oil and gas at 0.55% and basic materials at 0.32%. The Top 10 companies in Nasdaq are

- Microsoft

- Apple

- Amazon

- Alphabet (Google)

- Intel

- Cisco Systems

- Comcast

- Pepsi

- Adobe

How have the DOW, S&P 500 & NASDAQ fared

As you can see from the image below, Mostly there is a correlation between the major U.S. indices, but they each have their own ‘personalities’ in how they trade due to the different make-up for each index and importance of certain companies and groups of companies (sectors).

How can Indians Invest in US Stock Market

There are three ways to invest in US stocks,

- You have a brokerage account with Indian Brokers. The Domestic Broker that offer such facilities includes ICICI Securities, Kotak Securities, India Infoline, Reliance Money, and Religare. These Brokers have a tie-up with the foreign brokers that allow the investors to invest in the foreign market.

- You have a brokerage account with Foreign Brokers

- invest in the US focused International mutual funds in India e.g. ICICI, Franklin, etc. or Funds like Parag Parikh Long Term Equity Fund that invests in both the Domestic and International marketplace.

Our article How can Indians Invest in US Stock Market: International Mutual Funds covers it in details

Video on the difference between DOW, NASDAQ and S&P 500

Related Articles:

All About Investing in India: PPF,Fixed Deposits, Mutual Funds, NPS, Stocks

- Stock exchange : What is it, Who owns, controls

- Stock Market Index: The Basics

- Blue Chips Stocks and Penny Stocks

- What is the difference between Sensex and Nifty?

- What is Market Capitalisation? What are Large Cap, Mid Cap and Small Cap Companies?

- Investing in Equities: Stocks vs Mutual Funds

- How to buy Stock: Delivery or Intraday,Market or Limit,T+2

- Difference Between NSE and BSE, Listing of company on Stock Exchange

One response to “Difference between Dow Jones, S&P 500, Nasdaq”

[…] more information on each of the three indices and the differences between them, refer here for a pretty detailed article into each […]