Buying a house is a very important financial decision. Real estate is by far the biggest investment that the average person takes up. Note that Banks do not fund the entire cost of the property. They finance only up to 70-80 percent of the total cost. And buying house means getting a home loan, arranging for down payment, servicing EMI, pay for registration and wood work, moving to your home. This article lists the various expenses associated with having your own house.

Table of Contents

Overview of Cost Involved in Buying a House

Real estate is by far the biggest investment that the average person takes up. Banks do not fund the entire cost of the property. They finance only up to 70-80 percent of the total cost. You can get an approval from the bank in advance for your home loan eligibility, depending on your income, credit worthiness, credit score, nature of employment etc. The bank will confirm the maximum amount of loan it is ready to offer at what price. The balance needs to be raised by you from your own resources. This 20-30 percent has to be generated from your own savings, short term plan or by liquidating some investments. You also need funds to pay the stamp duty and registration fee. In addition, funds may also be required for ancillary expenses such as renovating the house, shifting to the new house, purchase of fixtures and fittings and so on.

After 1 Jul 2017, Service Tax and VAT will be replaced by Central GST and State GST whereas stamp duty stays unchanged as it is out of the purview of GST.

Example: Assume you decide to buy a home. The negotiated price with the seller is Rs.80 lakhs.

- Purchase price of property: Rs.80 lakhs

- Registration and stamp duty: Rs.4.80 lakhs

- Interiors: Rs.6 lakhs

- Shifting Rs.20,000

- Total Funds required: Rs.91 lakhs

Finance

- Home Loan : 70% of cost ( Rs.80 lakhs) : Rs.56 lakhs

- Funds to be put in by buyer: 91-56 = Rs.35 lakhs

The detailed breakup of the cost of buying a 2 BHK flat of 1000 sq. ft. saleable area with Rs.5, 500 per sq. feet

| Basic Cost | 55,00,000 |

| Car Parking | 2,00,000 |

| Preferred Location Charge | 1,50,000 |

| Agreement Value | 58,50,000 |

| Infrastructure(Gas, Electricity) | 1,00,000 |

| Total Cost | 59,50,000 |

| Stamp Duty @5% | 2,97,500 |

| Registration Charges | 30,000 |

| Service Tax 3.09% of Basic Cost including car parking | 1,76,130 |

| Service Tax 12.36% on other charges | 12,360 |

| VAT 1% of Agreement Value | 58,500 |

| Total Cost | 65,24,490 |

Down payment

In India, Banks are authorized by the Reserve Bank of India to lend only up to 80% of the purchase price of a property. The balance 20% has to be arranged by the borrower. It is called down payment.

The requirement has been stipulated by RBI with a view to regulate real estate lending and impose a check on banks financing for homes without any limit.

For the lender, this payment provides assurance about the borrower’s financial commitment and strength. When a borrower invests his own personal funds, he is likely to be more committed to meet his loan obligations than otherwise.

Planning for buying a home must start much before you actually decide to buy it.

For an average home buyer belonging to the working class, arranging for the down payment amount may not be easy. To begin with, it would take at least a few years to set aside and accumulate enough funds for this purpose. The number of years for which you may have to save will depend upon your salary, the amount of money you can put away each month and the price of the property you wish to buy. For example, your goal is to collect Rs.10 lakhs, by saving Rs.5000 every month you will be able to achieve your goal at the end of 12 years and 2 months. Here we have assumed that earn interest @ 5%.

An ideal situation would be one in which you decide to buy a house after saving enough to fund the down payment entirely on your own. However, in reality, this may not always be possible. Under such circumstances what are some of the sources from which you can raise the down payment: Loan from Employees Provident fund, Borrow from friends or relatives, Loan from the employer, pledging shares, securities, insurance policies or personal loan.

Parking space, maintenance deposit

Many builders charge an additional upfront payment for exclusive parking spaces in large residential complexes. This amount could vary from 2 lakhs to 5 lakhs depending on the type of property, locality, and type of parking space being provided.

Builders charge an advance maintenance or maintenance deposit of up to 2 years; this usually comes under common amenities, parks, and lightings. In existing buildings, it is charged as a deposit by society members in case of any damages that occur in the future.

Brokerage is the fee charged by the broker – the person who is the middleman between the buyer and the seller. Most brokers charge a fee of 1-2% of the total house cost; however, some are expensive and may charge a higher fee

Preferential Location/Locality Charge (PLC) is the extra charge paid to book a unit which is in a better location within a particular layout or complex. For example, higher floor and flats with gardens or a lake view have very high PLCs. Unlike stamp duty and registration charges, service tax or VAT, this cost is not fixed and varies from builder to builder and also from time to time.

Interiors cost

After acquiring a property one has to invariably spend some amount in getting the interiors done up as per individual preferences and requirements. This expenditure can cost quite a fortune depending on the exact nature of interior work being undertaken. However, on an average, it can be safely assumed to be a minimum of 1% of the entire cost of the property.

Taxes on buying a house

There are four types of taxes and duties that are levied on the purchase of homes – stamp duty, value-added tax (VAT), service tax (ST) and registration charges. The rate or amount of stamp duty, VAT and registration charges, may vary from state to state, whereas service tax comes under the central government.

Stamp Duty and Registration costs on buying house

The agreement executed between the buyer and seller (owner/developer) of a house property, should compulsorily be registered, as per the Registration Act. If the agreement is not registered, it is not admissible as evidence in a court of law.

Stamp duty is payable to the state government. Payment of this duty denotes the legal status of the transaction. A sale agreement that is not appropriately stamped, is not acceptable as confirmation in the court of law.

The registration cost forms a substantial amount depending on the total worth of the property. In most states, the entire legal charges in terms of stamp duty and registration fees add up about 7% to 10% of the property cost. Typically, the stamp duty is about 5% to 7% which means that if one has to buy a property worth Rs 50 lakh, then stamp paper worth Rs.3, 60,000 has to be purchased for typing the sale deed on it. In addition to this expenditure, there is a registration fees payable to the court which amounts to 1% to 2% of the property cost. Moreover, there are several miscellaneous expenses like the fees of the notary and lawyers who get the job done in the court.

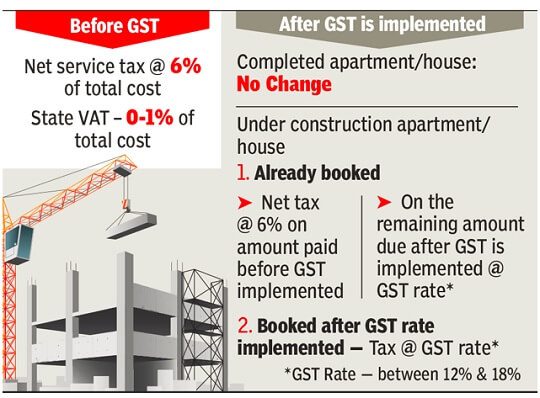

Service tax and VAT for Under Construction Property before 1 Jul 2017

Before 1 July 2017, Service tax and VAT were applicable, only on properties that are booked at under-construction stages. So, both these taxes cannot be levied on properties that are purchased, after the builder has obtained its completion certificate. There is no service tax or VAT for completed properties that are purchased in resale.

Service tax is payable to the central government. This tax is levied at every stage of the construction. The calculation of service tax is quite complex. Service tax is charged at a specific rate on the basic cost of the property (cost of land and construction) and at a different rate on other cost items, such as preferential location charges, floor rise charges, initial maintenance charges, club house, etc. Service tax is payable only on construction component and not on the value of land. The cost of the property includes the cost of land and cost of construction. Since in most cases, it is difficult to ascertain the cost of land and construction cost separately, the government has come up with the abatement or relief scheme. Under this, abatement (relief) is given for 75% of the value of the property and service tax is levied only on the balance 25

A tax of 15% is levied on 25% of the property value. So, a buyer pays 3.75% as service tax on the total value of the apartment.

VAT is typically levied on the sale of goods and is applicable for house property, as it involves the transfer of ownership rights from the seller to the buyer. If you are purchasing an under-construction property, you will have to pay additional VAT in some states such as Karnataka, Haryana and Maharashtra. Developers charge this value added tax and deposit it with state government. There are many states such as UP who do not charge VAT. Also unlike service tax there is no uniform way of computing VAT across states. E.g. in Maharashtra under composition scheme VAT is charged as 1% of agreement value whereas in Haryana the same proposal was passed but not yet agreed by developers. In Karnataka VAT is charged at 5% of agreement value of a unit.

GST for Under Construction Property after 1 Jul 2017

Goods and Services Tax (GST) is introduced from 1 July 2017. The GST Council has brought the real estate sector under the GST ambit partially through works contracts. These will be taxed at 12 percent under the GST regime

Under the new regime, all the other indirect taxes will be subsumed and a buyer will have to pay a uniform 12 per cent tax on the purchase of real estate, except stamp duty. This is true for under construction properties but not on completed, ready-to-move-in apartments.

A roof over the head is extremely important but you must put in a lot of efforts in planning your home purchase. A lot of planning should be done before you actually take the plunge. Knowing what you have to pay is an important step in buying a house.

Related Articles:

- Buying a House,Renting,Home Loan,Tax,Selling,Capital Gain

- Process of Buying a house and Getting Home Loan

- Buying the house: Right time to buy,what should one consider before buying

- Terms associated with Home Loan

- Switch from Base rate to MCLR for Home Loans

We don’t want to shatter your dreams to own a house. We just want you to take a reality check.

4 responses to “Costs involved in buying a house:”

Excellent post. This is very helpful to calculate the pricing includes when buying a property in India

Hi,

Thanks for the detailed article. There is also an another way to fund your down payment needs – through home down payment assistance program launched by a company called HomeCapital. Came to know about it online and thought to share the info here for the benefit of the readers. You can visit their site – https://homecapital.in/ for more information in case you are interested.

Thanks for explaining various cost heads.

Pl. provide detailed breakup of the cost of buying a 2 BHK flat of 1000 sq. ft. saleable area with Rs.5, 500 per sq. feet with 12% GST.

Thanks for the detailed article .