Saayam works in a private company in Delhi. His company provides him with house rent allowance orHRA. But he lives with his parents instead. Can he claim HRA while living with parents? he asked us. Simple answer is YES he can. Long answer to Can he claim HRA while living with his parents is explained in article below.

Table of Contents

Overview of HRA

Employees generally receive a house rent allowance (HRA) from their employers. House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. Our article HRA Exemption,Calculation,Tax and Income Tax Return talks about it in detail.

- When you are claiming HRA exemption it is assumed that you are also staying at same place. An employee can claim exemption on his HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer. If you stay in your own house, or in a house where you don’t pay rent, you cannot claim the exemption.

- There must be a rent agreement. Office needs the agreement, the rent receipts. Now Even Income Tax Department has standardized the way of declaring HRA by introducing Form 12BB. Failure to have a rent agreement signed by both the parties will lead to legal inefficiencies in the case of a dispute.

- You should be able to prove that you have paid the rent every month. That is why employer needs rent receipts. You transfer money to landlord every month through cheque or bank transfer, so that it is easy to prove, if required.

- Landlord’s PAN is mandatory if you want to avail HRA exemption and you pay rent of over Rs 1 lakh a year or rent is more than Rs 8,333 per month. Landlords without a PAN must be willing to give you a declaration.

- If you pay rent to your spouse, this does not qualify for HRA exemption, because as per income tax department you are supposed to stay with your spouse!

- You can claim exemption on rent paid to others including parents, brother, sister in-laws etc.

- Tax benefits for home loans and HRA are two separate aspects. So if you’re a home-owner and you are paying back your home loan, you can also claim HRA if you live in a rented property

- When you are calculating HRA for tax exemption, you take into consideration four aspects, which are

- Basic Salary

- HRA allowed

- Actual rent paid

- Place of residence i.e where you reside, a metro or non-metro city. Tax exemption for HRA for a metro city(Mumbai, Kolkata, Delhi or Chennai) is 50% of the basic salary, while that for non-metro cities is 40% of the basic salary.

- Rental Income is taxable. The owner(s) has to show the rent received as rental income in their income tax returns. If the house is let out i.e given on rent or is vacant ,which is considered as deemed to be let out. Our article Tax and Income from Let out House Property discusses it in detail with examples While calculating the taxable value of rental income, various deductions are available. It includes:

- Standard deduction , a flat 30% of the annual rent as deduction is for maintenance expenses such as repairs, insurance, etc., irrespective of the level of actual incurred expenditure.

- Municipal taxes paid to the local authority

- Interest paid on a loan taken for construction, repairs, acquisition, or renewal of the property

- Pre-construction period interest deduction (available as deduction in five instalments from year subsequent to construction completion year).

- Additionally, any repayment of principal amount against housing loan taken for such property is also eligible for deduction under section 80C (maximuum deduction under this section is Rs.1.5 lakh)

Claim HRA while living with parents

Saayam or you can pay rent to his parents and claim the HRA but there are some things he need to consider. As rental income is taxable for his parents , one needs to consider Income Tax Slab of parents. One needs to sit down and workout whether paying rent to parents will actually help to save tax or not on net basis. You should save tax through transparent way. Any discrepancy in tax details may invite heavy penalty from income tax department. It is always advisable to consult tax consultant before claiming any tax exemption. Things that one has to consider while claiming HRA while living with parents are as follows:

- You must live in a rented accommodation.

- Parents must be the owners of the house. You can save tax only if you are paying rent to parent or parents who is owner of the property. If the property is jointly held by father and mother then rent should be paid to both of them.

- Documentation should be clear.You must have a rent agreement.

- Rent receipts: pay rent for the same through cheque/bank transfer. Get the Rent Receipts signed by your parents.

- Rental Income is taxable : They must show the rent received as rental income in their income tax returns.

The same rules are applicable if you pay rent to any other family member except wife, such brother, sister in-laws etc

Are you saving tax as a family when you claim HRA while living with your parents?

As mentioned earlier, Rental Income is taxable. The parent/parents must show the rent received as rental income in their income tax returns. So you would be saving tax as family and complying with tax rules, if you and your parents are in different income tax slab. When they are in a lower income bracket or they don’t have any income. Even when the house is jointly owned by both your parents, you can pay them rent proportionately, that will spread the rental income between them and may turn out to be more beneficial. Your parents can invest this income in can be invested in their name such as the Senior Citizens Saving Scheme, five year bank fixed deposits or tax saving equity mutual funds or other financial investments that can earn them a higher return based on their age.

If your parents are more than 60 years old (and less than 80 years old), they are not required to pay any tax on income up to Rs 2,50,000. And if they are more than 80 years old their income is exempt up to Rs 5,00,000.

Lets take an example.

- Say you are in 30% income tax slab.

- Your parents are retired and have no other source of income.

- They own the house.

- You live in the house.

- You pay Rs 32,000 a month, that is, Rs 3.84 lakh a year,

- Your parents can deduct 30% i.e 1,15,200 and have to pay tax on only Rs 2,68,800.

- For FY 2015-16, the amount that is over and above the basic Rs 2.5 lakh exempt limit so you can invest in their name in tax free scheme such as PPF, tax free bonds, and bring down taxable income to 2.5 lakh.

You get a bigger benefit if the house is co-owned by your parents. Then they can split the earning from rent and show separate tax liability. The best part is you can decide how much rent you will pay to your parents provided rent is justified. It will help to save tax till optimum point. This way Sayaam can give back to his parents, and two, save some taxes.

Rental Agreement and Rent Receipts for claiming HRA

Rental agreement is a legal contract which includes of all the important clauses , protect the interests of both the parties and serves as a collaborative evidence in case of a dispute. Following things should be covered in rent agreement are as below:

- Rent and Deposit

- Maintenance, Electricity and Water Charges

- Damages, Repairs and Alterations

- Tenant’s Responsibilities

- Owner’s Responsibilities

- Lease Termination & Extension

- Miscellaneous clauses

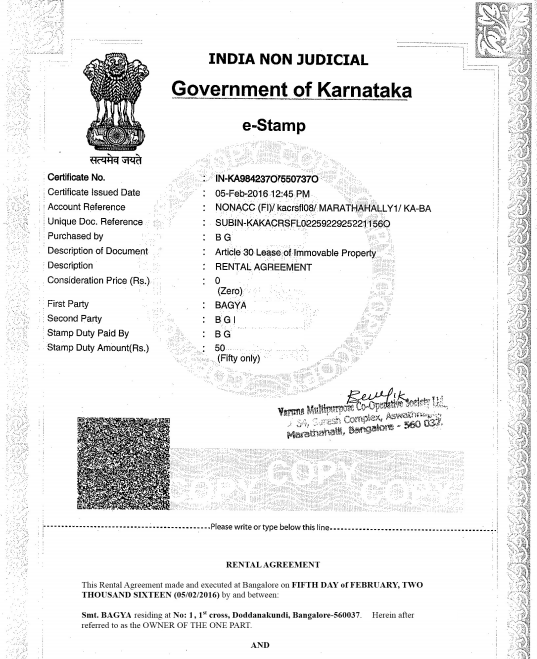

As per the Law when one does some transactions such as buying and selling real estate, business agreements, leasing property , one needs to make pay Stamp Duty to Central/State Govt. The duty to be paid varies from state to state and if a state does not have its own Stamp Act, it will be overseen by the Indian Stamp Act.

As of now, Indian Govt. permits payment of Stamp Duty in more than one ways. They are :

- Through e-Stamping

- Through papers bearing impressed Stamps which would be the non-judicial Stamp paper

- Using a Franking machine

- Adhesive stamps, paying at the registrar office etc.

Example of first page of Rent agreement on e-Stamp Paper is shown in image below. Click on Image to Enlarge

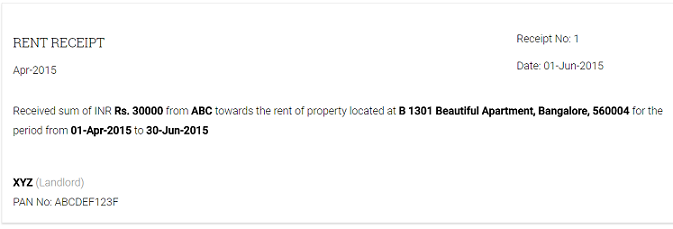

Rent Receipts

To allow you exemption on HRA, it is mandatory for the employer to collect proof of rent payment ie rent receipt. The employer will give you exemption on HRA based on these rent receipts. TDS will be adjusted so you don’t have to pay tax on HRA. Your tax liability will be calculated accordingly. It would be reflected in Form 16.

Usually, employers need receipts for 3 months or so. You can have monthly receipt or quarterly receipt.

A sample rent receipt for quarterly payment of rent is shown in image below. You can generate rent receipts online through www.printrentreceipt.com or ClearTax Generate Rent Receipts

HRA exemption while filing ITR

If you have not been able to claim HRA exemption from your employer you can claim it directly. This exempt amount has to be reduced from your total taxable salary. The net amount is shown as your ‘income from salary’ in your income tax return. Our article How to Claim Deductions Not Accounted by the Employer explains it in detail.

If you claim HRA exemption directly in your tax return, you must still maintain rent receipts and lease agreement safely in your records; in case the assessing officer asks for them later.

Articles that may be useful to you are:

- HRA Exemption,Calculation,Tax and Income Tax Return

- E-filing : Excel File of Income Tax Return

- Which ITR Form to Fill?

- Fill Excel ITR form : Personal Information,Filing Status, Fill Excel ITR1 Form : Income, TDS, Advance Tax

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Tax : Income From House Property , Tax and Income From One Self Occupied property

5 responses to “Claim HRA while living with parents”

Hi,

If I am co-owner with my mother, Can I pay rent to her and claim HRA?

Am I eligible for HRA exception if I am living with my parents in a rented house by government ? My father is govt. employee and we are currently living in govt. quarters. In that case should i include tax benefits under HRA ?

No.

You are not paying rent to your parents.

The house is not owned by your parents.

Parents must be the owners of the house. You can save tax only if you are paying rent to parent or parents who is owner of the property. If the property is jointly held by father and mother then rent should be paid to both of them.

But you can claim the deduction of Rs 60,000 under section 80GG as explained here

Section 80GG provides for Deductions for House Rent paid, provided that a deduction for payment of House Rent has not been claimed under any other section of the income tax act. In other words, if a salaried employee is being given house rent allowance by his employer and he is claiming a deduction from the same, he won’t be eligible to claim deduction under Section 80GG for payment of Rent. All other taxpayers who are neither getting benefit of House Rent Allowance and nor have they claimed the expense for rent paid under any other section of the income tax act, can claim deduction under Section 80GG. HRA limit under section 80GG has been proposed to be increased from 24,000 to 60,000 Rs.

If U are in MAHARASHTRA/MUMBAI PLEASE DO NOT TRANSFER MONEY TO “LEGAL DESK” FOR YOUR RENTAL AGREEMENT…MONEY WILL BE A WASTE…as I experienced it today

Is a RENT AGREEMENT between FATHER(holding VALID PAN and FILING ITR every year (now Retired) and SON to be on a STAMP PAPER or is an ORDINARY PAPER TYPED SHEET is VALID? 02.When is the Agreement Copy to be submitted to the present Employers of son> 03. Is each Rent Receipt to be STAMPED separately or is a consolidated Rent Receipt issued by son to father is good enough and is it to be affixed with STAMPs of the Post Office for submission to his Office?