Which is the best credit card? With a number of credit cards available, offering a variety of benefits which credit card is best for you is difficult to decide. You need to consider the Annual Fees, the credit card charges on not paying in full or APR, where your major spending pattern lies. This article explains golden rules of using credit cards, Factors to consider while choosing a credit card, explains What are Credit Card Reward Points and Cashback, different types of cards like those which provide Airport Lounge Access

Table of Contents

Two golden rules of using credit cards are

- Do not buy things that you cannot afford, even though you have easy access to credit.

- Always pay your credit card bills in full and on time. Paying Minimum due is the shortest way to huge debt. It is easy to get into credit card debt and difficult to come out. Secondly, it affects your Credit score. Every single late, missed or incomplete payment is reported by your credit card provider to the credit bureaus.

Paying interest on a credit card is the worst kind of debt because it can easily snowball into a much larger number, and is generally spent on stuff that you can easily avoid

Our article Credit Card and Debt explains Credit card debt in detail

Factors to consider while choosing a credit card

When you start researching on the credit card you need to take care of following charges:

Annual Fee of credit card

A yearly fee charged for the convenience of having the credit card. Some credit cards waive the annual fee the in the first year. Some credit cards waive off the annual fees depending on the amount you spend. At times you can ask your credit card company to waive the fee.

Annual percentage rate (APR)

The annual percentage rate (APR) is the yearly interest rate applied to a balance carried beyond the grace period i.e it is the borrowing interest rate for when you don’t pay your bill or pay the minimum amount. We shall how these are used later. Credit card companies usually advertise interest rates on a monthly basis (e.g. 2% per month). For example, a credit card company might charge 1% a month, but the APR is 1% x 12 months = 12%. Credit cards (also personal loans) are the most expensive loan that you can take with annual interest above 36% or 2% per month. If you are paying your credit card bill in full then you do not need to worry about Annual percentage rates. APR of credit cards is around 40%

Our article Credit Card Fees and Charges cover credit card charges in detail.

Joining perks

Many credit card companies offer an incentive when you get their new credit card. This gift can be in the form of bonus points, gift vouchers, discounts, etc. Remember it is one time only. So it should be the last factor that affects your decision in going for a new credit card. The welcome gift differs depending on the card and the bank.

Incentives and Rewards on using Cards.

Some credit cards offer rewards and incentives for using their credit card. Rewards come in several different forms: cash back, reward points, and discounts.

For instance,

- There are cards that offer air miles based on the amount you spend on your card.

- Or you can opt for fuel cards that waive the surcharge on fuel. Such cards are called Fuel Waiver Credit Cards

- Some cards offer discounts on shopping or restaurants or movie tickets, online shopping. Such cards are called lifestyle/Entertainment/Shopping cards.

What are Credit Card Reward Points?

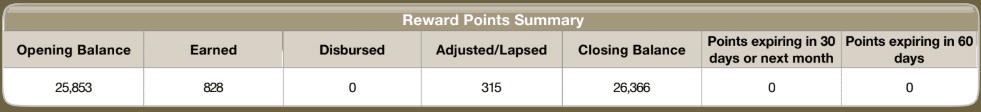

As part of a rewards program, you can earn points on every purchase. The total points earned on a transaction may vary on the basis of its monetary value as well as the expenditure category such as shopping, dining, fuel etc. Depending on the card issuer, you can earn between 1-5 reward points for every Rs. 100-Rs. 150 spent on your card. Some credit cards also provide options to earn bonus reward points as part of festive season campaigns, if the card is used to make a purchase at a specific store. The credit card reward points summary is shown in the image below. 828 points were earned on spending 38,054.00 Rs.

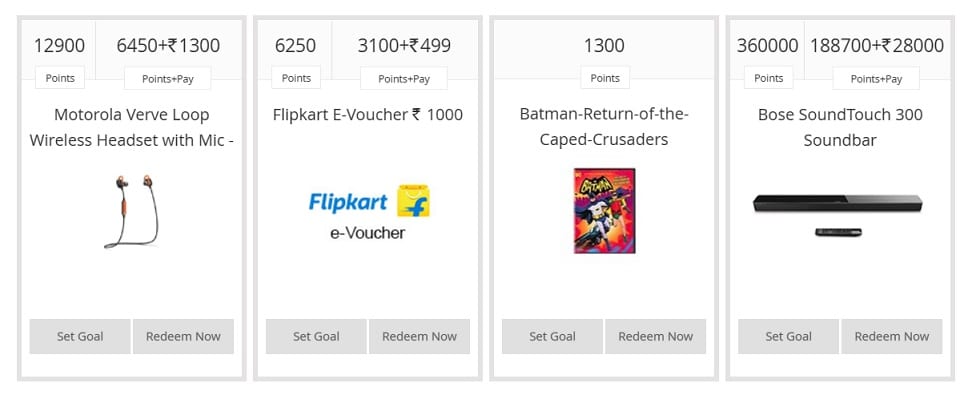

Every card issuer has its own point redemption system. There are often extensive online catalogues that list the rewards you can qualify for as well as the number of points required to avail a specific reward.

For example SimplySAVE Advantage SBI Credit Card

- Customers can enjoy 10X Reward Points for every Rs.100 that they spend on grocery purchases and in departmental stores. In addition to this, Reward Points can also be availed on movie and dining spends.

- On other purchases, customers can earn 1 Reward Point for every Rs.100 spent. Re.1 is equal to four Reward Points.

Reward Cards Redemption

Please check the Redemption process and Terms and conditions of your credit or the card you are interested in.

At times you need to pay the handling charge for Reward points redemption. For example, Redeeming HDFC credit card reward points Rs 99 will be debited to the card account towards handling charges for all goods and services.

At times reward points expire. For example for HDFC Credit cards Reward points are valid only for 2 years from the date of accumulation.ex:- if you have received reward points in the month of May 2015, the same will expire in May 2017.

Excerpt of the rewards catalogue of SBI is shown below.

What is Credit Card Cashback?

With cash back credit cards, a particular percentage of the amount spent on the card will be returned to you as cash back. Some offer cash back in terms of money

Features and Benefits of Citibank Cashback Credit Card

|

Features and Benefits of HDFC Bank Money Back Credit Card

Fees and Charges

|

Types of Credit Cards

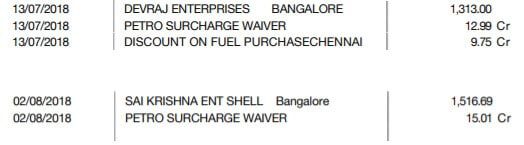

Fuel Surcharge Waiver of Credit Cards

On every card transaction, shopkeepers pay a fee for card transactions called as merchant discount rate. MDR rate: 1% for debit cards and around 2% for credit cards. Every merchant has to pay this fee. Many would remember how shops used to charge 2% on using credit card earlier but now have waived it off .Typical retail transactions for clothes, groceries etc, margins are around 10%-30%. So merchants can absorb the cost of MDR. But fuel is sold at a fixed amount per litre, though in large volumes but margin in less. Hence customer has to pay the fee for using a credit card for filling petrol.

Many banks offer fuel surcharge waiver to credit cardholders when they spend a specific amount of money on fuel every month. This offer is available on fuel transactions made at all Indian petrol bunks. The image below shows the Fuel amount with surcharge and then fuel surcharge waiver and at times discount too!

Our article MDR and Using Debit and Credit Cards at Petrol Pumps explains it in detail.

Example of IndianOil Citi Platinum Card

- Complete waiver of the 1% fuel surcharge at authorised IndianOil outlets

- Annual Fee of 1000. Your annual fee of Rs1000 is waived on making spends of Rs30,000 in a membership year.

- 4 turbo points/150 spent on fuel at authorised IndianOil outlets

- 2 turbo points/150 spent on groceries and at supermarkets

- Up to 71 litres of free fuel annually on redemption of your turbo points for fuel at 1,200+ authorised IndianOil outlets

- No expiry date for turbo points. 1 Turbo point Rs 1

- Up to 15% savings at participating restaurants

Travel Benefits of Credit Cards

Travel benefits include air miles, airport lounge access, travel insurance, airline offers, hotel offers, etc.

Example of Citi PremierMiles Card

-

- 10 miles for every Rs 100 spent on flight tickets and hotel bookings made on the PremierMiles website and with select partners

- Annual Fee: 1st Year – 3,000. 1st-year fee waived for Citi Priority customers. 2nd Year Onwards – 3,000.

- Up to 15% savings at participating restaurants

- Complimentary access to select airport lounges across India

- Complimentary air accident insurance coverage up to Rs 1 crore

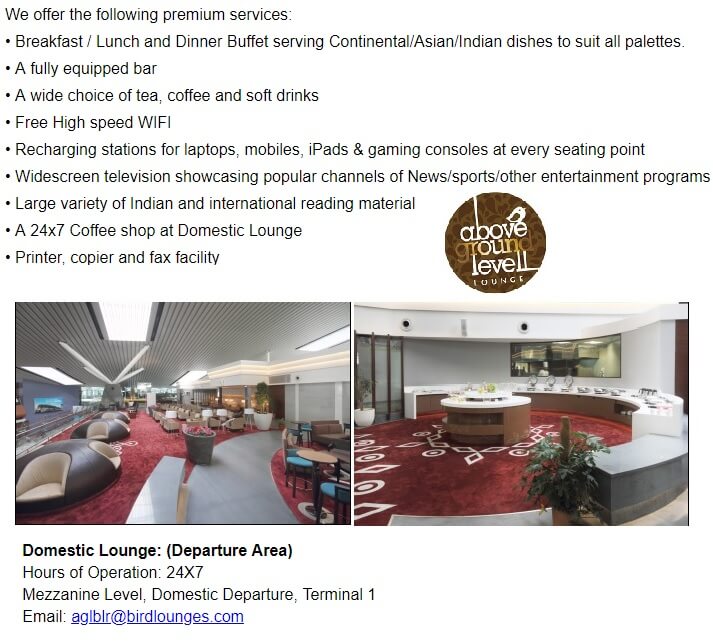

Airport Lounge Access of Credit Cards

Many Airports in the world have areas where passengers can relax or chill out. Those areas are called Airport Lounges. Luxury airport lounges treat you to all-inclusive amenities, comfier seating, complimentary snacks and beverages, televisions, newspapers, magazines and more. Refresh yourself before the next flight at their private bathrooms, showers, and fitness centres. Many of the luxury lounges have stylists, spas, and massage facilities as well.

These lounges are fully equipped to cater to the needs of business travellers and are complete with workstations, photocopiers, fax machines, and faster Wi-Fi.

Some travel credit cards offer complimentary lounge visits at both national and international airports. Cardholders can sit and relax in select airport lounges during flight delays and can enjoy the privileges offered by the lounges at no cost. The offer varies from one bank to another. Some banks put a limit on the number of visits, while some others allow access only to Indian airport lounges.

Example of the facilities offered by Above Ground Level Lounge in Departure Area of Kemepegoda Airport in Bengaluru

Shopping/LifeStyle/Entertainment Credit Cards

The Lifestyle Credit Card enhances the user’s choices with respect to food, dining, shopping, movie ticket bookings and so on. This card provides the users various perks which suit their individual lifestyle requirements.

Example Kotak Delight Platinum Credit Card Features

- Rebates on Dining: You get 10% Cashback on dining spends. Spend a minimum of Rs. 10,000 on categories other than dining and entertainment within the billing cycle to avail 10% cash-back on dining (stand-alone outlets) every month

- Cashback: A maximum Cash-back of Rs. 600 including both Dining & Entertainment transactions will be given in a monthly billing cycle. Dining & Movie Transactions up to Rs. 4000 are eligible for cash-back.

- Rebates on Movies Get 10% Cash-Back on movies by spending a minimum of Rs. 10,000 on categories other than dining and entertainment within the billing cycle. A maximum Cash-back of Rs. 600 including both Dining & Entertainment transactions will be given in a monthly billing cycle. Dining & Movie Transactions up to Rs. 4000 are eligible for cash-back.

- Fuel Surcharge Waiver: Get freedom from paying the surcharge on fuel! Applicable on transactions between Rs. 400 and Rs. 4000.Maximum fuel surcharge waiver allowed in a calendar year is Rs. 4500.

- Railway Surcharge Waiver: Save railway surcharge waiver for transactions on the IRCTC website and for transactions on Indian Railways Booking Counters. Maximum railway surcharge waiver allowed in a calendar year is Rs. 500.

- Milestone rewards: Spend Rs. 1,25,000 every 6 months and get 4 PVR tickets free of cost. Enjoy a maximum of 8 free PVR tickets every year.

Example of SBI Simply CLICK Card

- Annual Fees: Rs. 499 (get reversed after spending 1L rupees )

- Joining perk: Get e-gift voucher worth Rs. 500 from Amazon

- Earn 10X rewards on – Amazon / BookMyShow / Cleartrip / Foodpanda / FabFurnish / Lenskart / OLA / Zoomcar

- Earn 5X rewards on all other online shopping

- Earn 1 reward point per Rs. 100 on all other spends

- 2.5% fuel surcharge waiver (on 500+ transaction amount)

- Cleartrip e-voucher worth Rs.2,000 on annual online spends of Rs. 1 Lakh

Forex Currency Markup on Credit Cards

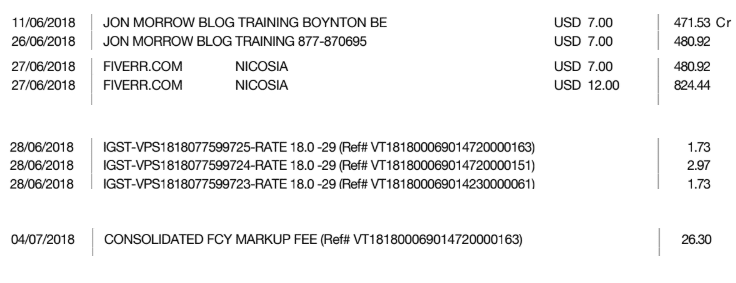

If you do lots of foreign transactions online such as on websites like Fiverr, Upwork, AliExpress you need to pay in USD. So you have to pay currency conversation charge for credit card company paying in non-Indian currency. The image below shows the credit card transactions done and the FCY Mark up fee charged by HDFC Regalia Card. (Thanks to our friend Kavita for giving the details)

- Yes First Preferred: Foreign Transaction fee-1.75%; Annual fee-Rs.2500

- HDFC Regalia: Foreign Transaction fee-2%; Annual fee-Rs.2500

Premium credit cards

Premium credit cards are cards which charge an annual fee but offer cardholders a range of exclusive benefits in return. Often viewed as a status symbol, premium cards are only offered to high-earning big spenders. They offer a high credit limit and a number of perks that are difficult, or expensive, to find elsewhere.

Example of Premium Credit Card: YES FIRST Preferred Credit Card

YES FIRST Preferred card is available at an annual fee of Rs. 2,500 and offers lavish privileges to the users on travel, lifestyle, dining, movies and more.

- Annual fee of Rs. 2,500

- The welcome benefit of 15,000 rewards points is offered on making the first transaction on your card within 90 days of card activation. 10,000 bonus reward points will be offered on payment of renewal fee.

- 8 Reward Points on every Rs. 100 spent on the card

- Option to redeem reward points against JP Miles (4 Reward Points = 1 JP Mile)

- Waiver of 3 Green Fees at select golf courses in India along with one complimentary golf lesson every calendar month

- Complimentary Priority Pass Membership that allows 4 lounge visits in a calendar year and 3 free domestic lounge access in a quarter

- Air accident cover of Rs. 1 Crore and medical insurance cover of Rs. 25 Lakhs for emergency hospitalization when travelling to a foreign country

- Exclusive concierge assistance and automobile assistance

- Preferential Foreign Currency Mark-up of 1.75% only

Best Credit Card in India

It is difficult to say one credit card which suits all. One should select a credit card according to his everyday needs and lifestyle requirements.

Best Credit Card with No Annual Fee

HSBC Visa Platinum Card

- APR – 39.6% per annum

- No Joining and No Annual Fees.

- Enjoy the joy of dining with HSBC Dining Privileges with attractive discounts of up to 15% in major cities.

- Fuel privileges where you can have on fuel surcharge by 1% or maximum Rs 250 per calendar month for transactions from Rs 400 to Rs 4000.

- Get 2 points per Rs. 150 spent

- Reward point validity for 3 years.

- Get 5 Times (5X) Rewards on subsequent purchases made after crossing spend an amount of Rs. 400,000 in a year up to a maximum of Rs. 1,000,000 in a year

Standard Chartered Platinum Rewards Card

- Annual Fee: Rs. 250 (Waived off by spending 30,000 rupees on credit card within a year)

- Get additional 1000 rewards points if you transact within 60 days

- Bonus 500 points for registering for online banking

- 20% cashback on Uber rides

- 5 points on spending 150 rupees on dining

- 5 points on spending 150 on fuel

- 2 reward points on spending 150 on any other category

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- Balance Transfer of credit card: What, Why and How

- Paying Credit Card Bill, Understanding statement,Paying Just Minimum

- International Usage of Indian Credit Cards and Debit Cards

- Withdraw money using credit card from ATM: How to, Charges

Which credit card are you using? How did you choose the credit card? what did you consider before getting a credit card?

3 responses to “Choosing the best credit card: Annual Fee, Reward points,Cashback, APR”

[…] Choosing the best credit card: Annual Fee, Reward points,Cashback, APR […]

My UAN number-100061741517

CLAIM ID- GNGGN180650040797

CLAIM RECEIPT DATE – 30/06/2018

CLAIM FORM TYPE – Form-19 (EPF Final Settlement)

PARA DETAILS – Resign

TOTAL AMOUNT APPROVE – N/A

DISPATCH DATE – N/A

CLAIM STATUS – Under Process

REMARKS – Claim Form-19 (EPF Final Settlement)(Resign) Claim id-GNGGN180650040797 Member id-GNGGN00106930000038462 received on this-30-JUN-18 and is under process.

I am processing my claim under online process for pf settlement but till time not get any reply from any side.

I am shearing my claim id and UAN number,please update me the status.

May i know which day is the 40th working day?

Please raise the complaint online.

If you don’t get any update on EPF claim after 3 weeks you can raise EPF grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can raise it with EPFO on their social media platform. We would suggest that you do so after raising the grievance. Social media accounts of EPFO are

twitter.com/socialepfo

facebook.com/socialepfo