So you want to invest in stocks and so you want to open a Demat account in India. Choosing a Demat account is based on many factors like product & services offered by broker, Brokerage charges, Trading platform, Tools, and customer service. It is always beneficial to compare brokers before opening an account. This article talks about How to choose a stock broker? Where to open Demat Account? What are the questions you need to answer before opening a Demat account? What are Discount brokers and Full-Service brokers? What is the difference between a discount broker and a Full-Service broker, Comparison of Top Stock Brokers of India

Table of Contents

Questions to ask before opening a Demat account

Before opening a Demat account in India you need to answer the following questions

- Other than stocks, Do you also need to buy Mutual Funds, do you need to buy Gold?

- Do you need just a platform to do stock trading or you need services, research reports also?

- Do you need Trade in Futures and Options?

- Are you buying stocks for trading or investing?

- Do you need higher margins for derivatives?

For Investing in the US stock market one needs to read, Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

Investment Products

Different brokers offer different investment products such as stocks, mutual funds, ETFs, future and options(F&O), currency, commodity. Because there are different exchanges to avail of these. Check what products do you want to invest in? Explanation about terms, futures and options, currency, commodity, is given below in the article.

If you are just starting then we would suggest you start with a platform that offers both Mutual Funds and delivery of Stocks. Investing in Equities: Stocks vs Mutual Funds explains about Investing in Stocks and Mutual Funds.

Brokerage Charges

It is necessary to understand the brokerage charges for the transaction to buy or sell orders in Stocks, Commodities, and Currency, and F&O. Many brokers like Zerodha, Upstox offer Rs.0 brokerage charges for equity cash delivery.

In delivery trades, the stocks you buy are added to your Demat account. You own them till you decide to sell, which can be in days, weeks, months, or years. Intraday trades involve buying and selling a stock within a trading session, i.e. on the same day.

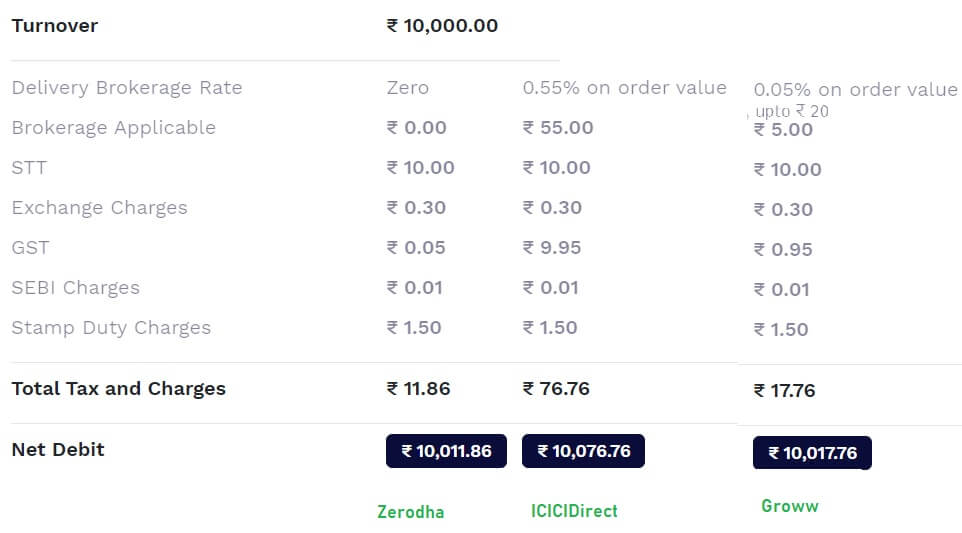

The image below shows the brokerage charged by Zerodha, ICICIdirect, Groww on delivery of stocks worth Rs 10,000. As you can see other than brokerage are other charges like STT, Exchange Charges, SEBI Charges, Stamp Duty Charges which are similar. GST depends on brokerage and hence varies. And hence total brokerage charges vary. More details in our article Transaction costs while buying or selling shares or stocks

Trading Portals & Tools

Does the broker offer web-based trading portals or Mobile app? What are the features provided by Trading Applications?

Does it provide research reports, stock recommendations? Our article Top Websites for Indian Stocks Market Investors, Stock selection, gives a list of websites that a person investing in stocks should look at for stock selection, Stock news.

For a technical analysis of stock charts trading tools are very important. Does the platform offer it?

Does it offer SIP in Stocks, Set order at a predetermined price that can be triggered (For example GTT orders in Zerodha, doing SIP in stocks in Zerodha, ICICIdirect)?

Does it offer to invest through smallcase?

We have given videos of how to use Zerodha and ICICIDirect later in the article.

Customer Care Support

Is your stockbroker offering customer support? Companies like Zerodha do not offer any customer support. Some stockbrokers answer customer queries over phones, E-mails, Live chats.

Complaints against the broker

Check the complaints against the broker. Check the NSE website for complaints on brokers and not social media.

For example, Zerodha many times had to face backlash on social media. the number of tweets were so high that “#zerodha” was among the top trends in Jan 2021, May 2020.

Types of Investment Products: Mutual Funds, Futures and Options, Commodity, Currency

Futures and Options: Derivatives are contracts between two parties willing to buy or sell the underlying asset at a fixed price and fixed time. Derivatives are of 4 types: Forwards, Futures, Options and Swaps. Options are of two types call and put.

Commodity Market is about the trading of metals(like Gold, Silver, Copper), energy, crude oil, spices(Cardamom, Jeera, Pepper, Red Chilli, Turmeric), Pulses(Chana, Masur, Yellow Peas)etc. Currently, the Forward Markets Commission allows futures trading in India of nearly 120 commodities. MCX(Multi Commodity Exchange) is the largest commodity futures exchange in India, with a market share of around 70%. NCDEX( National Commodity & Derivative Exchange) follows with a market share of around 25%, and 5% for NMCE((National Multi Commodity Exchange of India).

Currency trading is buying and selling international currencies. The currency trading (FOREX) market is the biggest and the fastest-growing market in the world economy.Currency futures are traded on platforms offered by exchanges like the NSE, Bombay Stock Exchange (BSE), MCX-SX, and United Stock Exchange (USE). Currency trading hours are between 9.00 am to 5.00 pm.

In currency trading, the trade is always between a pair of currencies. Unlike in equity or stock market where you buy a share of one company, currency trading involves taking a position on a currency pair.

For instance, the EUR/USD rate represents the number of US dollar one Euro can buy. If you think the Euro will increase in value against the US dollar, you buy Euros with US dollars. When the exchange rate rises, you sell the Euros back, and you get profit.

Discount broker and Full-Service broker

Stockbrokers can be classified into 2 types; Discount broker and Full-Service broker.

Discount brokers offer less brokerage. For example, Zerodha charges a brokerage fee of Rs 20 per order on equity intraday whether your trade value is Rs 10,000 or Rs 10 lakhs. And no charges for delivery

Full-service broker is a traditional broker that provides services like research advisory, investment services, wealth management, and Portfolio Management Services to its customers. They have branch offices in their area of operations, offer dedicated Relationship Managers (RM) to customers. The brokerage charged by them is higher than discount share brokers.

Comparing Discount Broker Vs Full-service Broker

| Full-service Broker | Discount Broker | |

| Examples | ICICI Direct, Kotak Securities, Sharekhan, HDFC sec, Axis direct, Edelweiss etc | Zerodha, Upstox, Trade Smart Online, SAS online, Tradejini, etc. |

| Services | Broking Services, Research, Wealth Management, PMS, Depository services etc. | Broking Services with a few brokers offering Mutual Fund services. |

| Brokerage | Generally, charge a percentage of the trade value. Offer low brokerage for high volume traders.Ex:0.25% – 0.75% | Charge a flat fee on each executed order irrespective of trade value.Ex: Generally Rs 10- Rs 20 per order |

| Suitable for | Frequent traders who need research and investment advisory services. | Online savvy traders who want to save on brokerage and have limited trading needs. |

| Physical Presence | Have branch offices in multiple locations. | Zero branch offices. |

| Customer service | Email/Call/Branch Servicing/Doorstep servicing etc.

Generally, offer dedicated RMs for assistance. |

Online services email/chat/phone

No RM services. |

Comparison of Top Stock Brokers of India

| Name of the broker | Type of Broker | Products offered | Account Opening Charges | Account Maintenance Charges | Brokerage Delivery |

Brokerage

Intraday |

| Zerodha | Discount Broker | Equity, Commodity(Gold), Currency, Futures, Options | 300 | 300 | Zero | .03% |

| Upstox | Discount | Equity, Commodity, Currency, Futures, Options | Free | 300 | Zero | .05% |

| ICICIdirect | Full Fledged | Equity, Commodity, Currency, Futures, Options | Free | 700 | .55 | .05% |

| AngelBroking | Full Service | Equity, Commodity, Currency, Futures, Options | Free | 450 | Zero | .05% on order value upto Rs 20 |

| 5 paisa | Discount | Equity, Commodity, Currency, Futures, Options | Free | 45 | 10 | 10 per order |

| Kotak Securities | Full | Equity, Commodity, Currency, Futures, Options | Free | 600 | .39% | .04% |

| Groww | Discount | Equity | Free | Free | .05% order value upto Rs 20 | 05% order value upto Rs 20 |

Top stock brokers of India

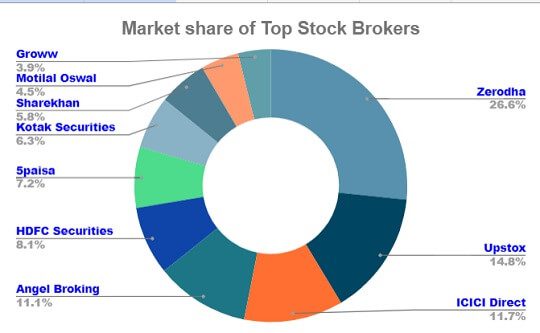

As per the number of Clients on 31 Dec 2020, top stock brokers of India are given below. The Zerodha has been leading stock market broker in India, followed by Upstox and ICICIDirect . Their market share is shown in the image below.

| Zerodha | 2,923,141 |

| Upstox | 1,623,515 |

| ICICI Direct | 1,289,023 |

| Angel Broking | 1,221,008 |

| HDFC Securities | 889,126 |

| 5paisa | 793,518 |

| Kotak Securities | 688,217 |

| Sharekhan | 632,476 |

| Motilal Oswal | 495,271 |

| Groww | 424,845 |

Difference between Trading and Investing

Investing and trading are two very different methods of trying to earn profit in financial markets like stock markets. Explaining it in terms of Cricket, Investing is like a Test Match while trading is like a T20 or a one day match.

The goal of investing is to gradually build wealth over a long period of time through the buying and holding of a portfolio of stocks, baskets of stocks, mutual funds, bonds, and other investment instruments.

Trading involves more frequent transactions, It could be for a day, a week or a month. The length of time between buying and selling a stock, commodities, or other trading instruments(technically called security) is known as the holding period.

Traders are differentiated by their trading style and the time period in which they typically hold their securities:

- Position: A position trader holds securities for months or years.

- Swing: Swing trading involves holding securities for days or weeks.

- Day: A day trader will hold security throughout the day, but not overnight.

- Scalp: Scalp traders hold securities for just seconds or minutes

| Trader (Buy and Sell) | Investor ( Buy and Hold) |

| Wants to buy and sell the stock, looking for short term gains | Wants to buy and hold the stocks. |

| Stocks selection strategy based on technical analysis so uses real-time data and information to take buy and sell calls | Stock selection strategy based on fundamental analysis of a business ; value investing, uses fundamentals information |

| Focuses on the stock price and trade volume. | Bases all decisions on the conviction he has on the company’s growth prospects |

| Tries to time the market. missing the right time to enter or exit may lead to loss | Does not get worried by short-term market volatility. |

| A trader is of an impatient personality like a Rabbit or Hare | An investor is slow and steady in an approach like a tortoise |

Video of using Zerodha

This video showcases buying and selling of shares in Intraday Trading using MIS (Margin Intraday Square off) feature and how to buy and sell shares in Zerodha Kite App using CNC (Cash and Carry) option.

Video of using ICICDirect

This video explains in detail how we can How to buy and sell shares on ICICIdirect.com.

If you are just starting then we would suggest you start with a platform that offers both Mutual Funds and delivery of Stocks.

Related Articles:

All About Stocks, Equities, Stock Market, Investing in Stock Market

- Top Websites for Indian Stocks Market Investors, Stock selection

- UPSTOX:A FAST AND SMART TRADING PLATFORM

- Stock Market Index: The Basics

- Investing in Equities: Stocks vs Mutual Funds

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- Transaction costs while buying or selling shares or stocks

- Why people Lose Money in Stock Market

Before opening a Demat account in India you need to answer the following questions

- Other than stocks, Do you also need to buy Mutual Funds, do you need to buy Gold?

- Do you need just a platform to do stock trading or you need services, research reports also?

- Do you need Trade in Futures and Options?

- Are you buying stocks for trading or investing?

- Do you need higher margins for derivatives?

Where did you open the Demat account? Which Broker did you choose and Why? If we have missed any point do let us know.

One response to “How to choose a stock broker? Where to open Demat Account?”

[…] Source link […]