It is important for you to know answers to a few crucial questions before buying an insurance policy. This not only helps in understanding the policy better, but also ensures peace of mind during the entire policy term and afterwards. In this article we shall cover what questions to ask one self before buying a life-insurance policy, understanding the policy, terms and conditions.

Table of Contents

What you would like your life insurance policy to achieve?

Ask yourself what it is you want the insurance to do. For example, do you want to have coverage that will:

- Pay the outstanding balance owing on a mortgage and other debts?

- Offset the loss of your income? For how long?

- Contribute to the future education of your children?

- A combination of all or part of the above?

Knowing what you would like to accomplish with your life insurance policy will help you determine how much life insurance you need to buy. If you have insurance before then what is the purpose of the new policy? What value will it add to existing policy? Why are you buying the policy?

Who would you like to insure?

Most life insurance companies offer a variety of products to suit your lifestyle and family. You can get a life insurance policy

- On your own life, or

- You can get one policy for both you and your spouse (called a joint life insurance policy) or

- For your child.

Remember that the purpose of insurance is not to soothe us emotionally, but rather to mitigate the financial losses we might suffer if some unfortunate event happens. Identify the potential events that would be catastrophic in a household. This means events that would cause a family to suffer serious financial losses and that would cause its members to substantially change their lifestyle and goals. These are risks crying out for cover, such as the death, serious illness, or disablement of the bread-earner(s). Although the death of the breadwinner(s) is catastrophic from a financial point of view, the death of a child, though awful, is not likely to be.

Child Plans

Biggest advantage of child insurance plan is the benefit of premium waiver.In case of child plans, if the proposer, usually the parent, dies then the future premiums of life insurance policy are waived off for the child’s benefit. These types of plans are double benefit plans. At the time of death of the life insured, the sum assured would be paid to the family to meet the immediate expenses but the policy continues. The future premiums are waived off from the policyholder, but the insurer continues to pay the premiums on behalf of the life insured, so that the maturity benefit is secured for the child’s future. For more details you can refer to EconomicTimes’s Pick your child’s insurance plan carefully

But usually child plan is an endowment policy, which could either be a ULIP or a conventional plan. You need to think whether the same can be achieved in other ways at lesser cost. For example term policy of working parent(s) will take care of the child’s financial needs in case of untimely death of any of the working parents. And investment in various savings instruments available like PPF, MFs, shares, gold, real estate etc. Our article Mixing Insurance with Investment shows how to calculate returns on the policy and why it make sense to keep insurance and investment separate.

Joint life insurance policies

Joint Life insurance policies are designed to enable two people, typically spouses or business partner, to share in one life insurance plan. It covers two individuals(spouse,business partners) under same policy i.e jointly. Since the probability of claim is twice than of individual life insurance plan, the premium is bit higher than single individual life insurance plan. Also if claim is made, the policy gets terminated after the pay out. However joint insurance policy is cheaper than buying two individual term insurance policies. Joint Life Insurance could be endowment or term plan; If the policy is a joint endowment policy, the cover amount (sum assured) is payable on the first death and again on the death of the survivor during the period of the policy. If one or both partners owning the joint policy survive to the maturity date, the cover amount and the vested bonuses are payable on the maturity date. The premiums payable cease on the first death or on the expiry of the selected term, whichever is earlier.

How long will you need life insurance?

No, this doesn’t mean consulting a psychic. What this means is estimating the timing of your life insurance needs.

- When will your home loan be paid off? The loan period of your home-loan will often determine how long your life insurance policy should be.

- When will your children be not dependent on you?

- When are you planning to retire?

Say you are 25 years old and buy a policy of tenure 15 years i.e insurance will end when you are 40 years old. Typically at 40 the life insurance requirements are highest- kids are studying, one needs to plan for their higher education, marriage, need to take care of parents, your own retirement. You would still require insurance. Buying insurance at 40 would involve higher premiums. A 40-year-old breadwinner with young children, for example, might decide on a 15- or 20-year term to ensure that the kids’ expenses are covered until they’re financially independent. While some one in 30’s should look for a policy of tenure 25-30 years.

Do you understand the plan?

Before you purchase an insurance plan, be very clear about the benefits it offers,its features such as the tenure, payouts, premium amount and surrender rules, and how it fits in with your needs.

Plan Type: Market Linked or Traditional

Traditional plans are like Term Insurance, Endowment Plan, Money Back Plan where kinds of benefits one gets are known before hand. A Ulip is a market-linked instrument where premium is divided into two parts : one part used for insurance coverage and other part for investment in funds which provide returns that are linked to the markets. These funds have assets, which are a combination of debt and equity-linked instruments. Based on the risk profile of the customer, he can decide to invest his policy money in one or more than one of such funds provided in a Ulip. Our article Life Insurance explains different kinds of Life Insurance policies and difference between them.

Premium Mode: Single Premium or Regular Premium and Amount

When you take a policy, you will have to pay the insurance company a fixed amount every year called as premium. In some policies, this can be a one-time payment instead of an recurring payment. These are referred to as single premium policies. Pay the premium once and for all and the policy will stay in force till the end of the coverage period. In other polices one can choose the frequency of payment, for example, annually, monthly, or quarterly. MoneyControl How to decide premium payment frequency? shows through example of how to choose between single premium and regular premium. Premium amount for a single policy will be more for the regular premium. Frequency of payment also affects the Premium amount with annual premium being the lesser than quarterly which is lesser than monthly.

Premium Paying Term and Tenure of the plan

Tenure or Term : The term of the policy is the period for which an insurance policy provides cover or the number of years you choose to insure yourself also called as the Tenure. If you buy it for 10 years, the policy is described as one with a 10-year term.

Premium paying Term – the number of years you pay premium on your policy. Usually the premium paying term is the same as the policy term. However, some policies offer you the option of selecting a premium paying term that is lesser than the policy term ex: whole life policy

Benefit Illustration

When an insurance agent recommends life policy to you, the agent has to give you a benefit illustration. This benefit illustration, as the name suggests, illustrates the benefits of the plan, both guaranteed and non-guaranteed (or variable) for a sample age and term. The illustration assumes two rates of return (6% and 10% p. a.) as prescribed by the Life Insurance Council. The variable benefits depends on the financial institution future investment return, mortality, expenses etc. Remember these are illustrations only and the benefits payable in the future will depend on actual future experience. The main objective of the illustration is that the one understand the features of the product and the flow of benefits in different circumstances with some level of quantification or with numbers.

Benefits and does it match your needs

Insurance plans offer a wide range of benefits. Some give periodic payouts, others give a lump sum on maturity, some allow equity exposure, while others give a dual insurance cover. Some benefits are available during the term of policy and some at maturity. Understand what benefits are available (guaranteed bonus, variable bonus) and when.

Not all benefits are suitable for all investors. For instance, a young person with a steady job and rising income will not benefit much from a money-back plan that gives periodic payouts. A child plan will not be of much help if your son is already in his teens and you need money for his college education 4-5 years later. Similarly, a low-yield endowment plan that offers minimal cover may not suit a person who needs to insure himself for a sizable amount.

Lock-in period and Surrender Charges

Lock-in period is the period during which an investor is restricted from selling a particular investment or will not get any benefit. For example, Ulip policies issued prior to September 1, 2010 have a lock-in period of three years, whereas those issued post-September 1, 2010 have a lock-in period of five years.

Halfway through the policy, you might want to discontinue the policy and take whatever money is due to you. The amount the insurance company then pays is known as surrender value. The policy ceases to exist after this payment has been made. How much is the surrender value? What are the penalty charges? It’s like knowing the exit gates before the start of a airplane flight!

If you discontinue to pay the premiums, but do not withdraw the money from your policy, the policy is referred to as paid up. The sum assured is reduced proportionately, depending on when you exit from the policy. You then get the amount at the end of the term. Our articles Insurance : Surrender or Make policy paid up or Continue , Discontinue Life Insurance Policy: Surrender,Paid Up,Loan discusses it in detail.

Exclusions

What are the exclusions? Every insurance policy is unique, and therefore, it is not necessary that two policies will have the same exclusions. Enquire about the exclusions in the policy while buying it, and read the policy document in detail to have complete clarity. But there are some common exclusions to payout, such as suicide within a year of buying the policy, death during war, death due to drug abuse etc.

Charges

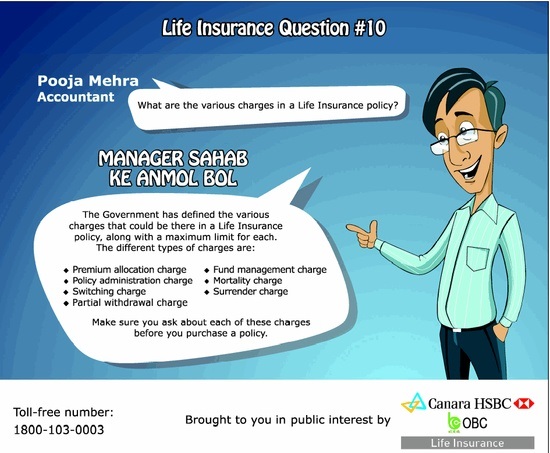

Each insurance company levies some charges on an insurance policy. The four key ones are premium allocation charge, mortality charge, fund management charge (in case of ULIPs) and commission paid to the agent. It is always advisable to understand these as they are deducted from the policy’s account value. While some charges such as fund management charge and policy administration charge are constant, some reduce with tenure. The advertisement of Canara HSBC insurance says it

Tax benefits

If you are taking policy for tax benefits check whether you will be able to claim it or not. Tax benefits on life insurance policies fall under two categories :

- Deductions under 80C section :Insurance products give you deduction of up to Rs 1,50,000 (from FY 2014-15. Earlier it was Rs 1,00,000) from taxable income under 80C. But for policies bought after 1 April 2012 deduction is allowed for only so much of the premium payable as does not exceed 10% of the actual capital sum assured).

- Tax benefit on benefits received under section 10(10D) . Tax treatment of policy on maturity or death of policyholder, on receipt of surrender or paid-up value, is similar. For insurance policies issued on or after April 01 2012, exemption would be available for policies where the premium payable for any of the years during the term of the policy does not exceed 10% of the actual capital sum assured.

To be eligible for these tax benefits, a life insurance policy must offer a cover of at least 10 times the annual premium. If the cover is not big enough, there will be no tax deduction under Section 80C and the maturity amount will also be taxable. This applies only to regular premium policies issued after 1 April 2012 not before it!

Reversal of 80C benefits

If you have claimed 80C benefits by buying life insurance policy then check if those tax savings would be reversed? According to 80C rules, tax savings on traditional life insurance plans will have to be reversed if :

- you do not keep single premium policy in force for two years after the date of commencement of the policy OR

- regular premium policy premiums are not paid for two years.

- For ULIPS time frame is 5 years.

Our article Surrendering Life Insurance Policy discusses it in detail.

Can I get better alternative

After understanding the life insurance policy one needs to ask “Can I get a better alternative at the similar cost”. For instance, say you have an investible surplus of Rs 1 lakh in hand. Before directing it to a single premium plan, you need to figure out whether your resources would be better utilised if you buy a policy with an annual premium of Rs 10,000 and investing the balance Rs 90,000 in other avenues. If you are scouting for avenues to simply park your lump-sum, you can also consider more liquid options like diversified mutual funds or compare it with bank fixed deposits.

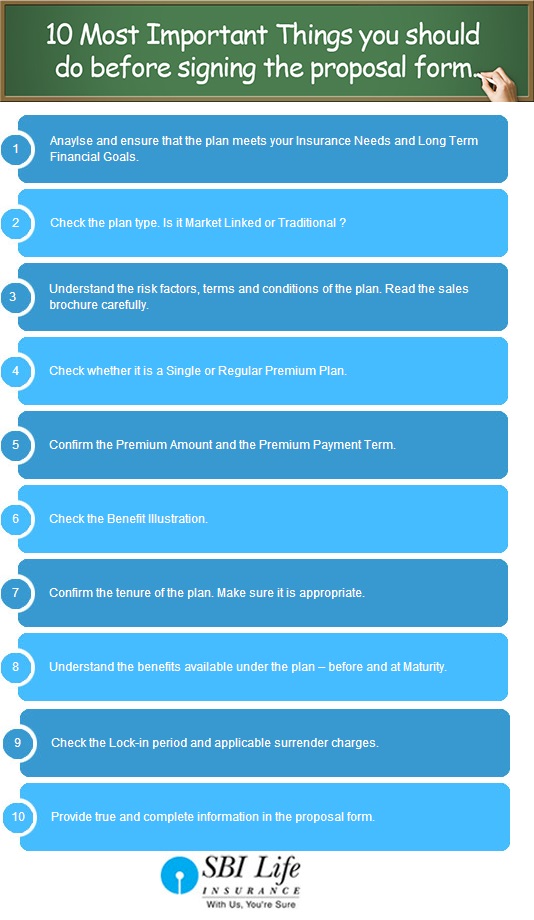

SBI Life Insurance has summarized the important things in picture given below. They have also come up with advertisements on Choti choti cheezon mein itnaa dhyaan toh life insurance lete waqt kyun nahi ? Youtube videos on SBI Life Insurance ads of Man buying razor, Man buying shirt, women ordering kali dal in restaurant , buying movie tickets

Check out SBI Life Insurance’s advertisement on SBI Life 10 Most important things you should do before signing the proposal (Youtube 8:50)

During and after buying the policy

- Fill in the proposal form yourself and provide true information about your health, financial status and occupation.

- Read the policy document carefully and understand the terms and conditions.

- Intimate change in address, contact number, e-mail id and nominee to the company on priority.

- Having all the relevant policy documents in place is extremely critical at the time of claim settlement. Misplacing any of these can lead to claim repudiation. Therefore, in case you lose any of your policy documents, make sure that you immediately apply for duplicates.

Related Articles :

- Insurance : Surrender or Make policy paid up or Continue

- Mis-Selling or Mis-Buying: It’s My Money, My Responsibility

- Personal Finance and Scott Adams,Dilbert

- Mixing Insurance with Investment

Note: We are not affiliated to SBI Life Insurance or Canara HSBC OBC Life Insurance. We have used their advertisements for representative purpose only. (Life Insurance companies are taking steps to make customers aware of it.

Assessing your life insurance needs and life insurance product before will ensure you’re comfortable with the life insurance product you end up purchasing. It would help you not to “miss-buy” the policy and prevent “mis-selling” of policy. What do you consider are the important things before buying insurance policy? Which was the first policy you bought and how did you decide to buy? Have your approach to buying life insurance policy changed? Do you buy insurance for tax purposes?

LIC jeevan anand is the best plan..

Invest 1800/pm for 25 years and get lumpsum of 13,500 after 25 years and 5 lac life cover.

Also Check Kotak Assured life insurance plan here.

http://ifscsearch.in/

Pradhan Mantri Jeevan Jyoti Bima Yojana is beneficial.

Thank you for the information. I subscribed to Pradhan Mantri Jeevan Jyoti Bima Yojana by reading this.

Hey there! This post could not be written any better!

Reading this post reminds me of my good old room mate!

He always kept talking about this. I will forward this post

to him. Fairly certain he will have a good read.

Many thanks for sharing!

I have learn a few excellent stuff here. Certainly

price bookmarking for revisiting. I wonder how much effort you set to create one

of these great informative site.

just excellent

Just encouraging!