On November 8, 2016 India witnessed one of the most significant revolutions,Demonetization. PM Narendra Modi debarred the legal acceptance of 500 and 1000 rupee notes to blow the black money market, beat corruption . Entire nation is struggling to exchange currency or make payments. With the crunch in notes circulation and acceptance of only lower denominations of 10, 50 and 100 rupees this move has been a boon for digital payment system. With a chunk of population left to adapt to the new-age payment process due to innumerable setbacks, it is time for the people to go cashless and make hassle free payments. This article talks about how to go cashless, various digital options available like Debit and Credit cards,Digital Wallets, NEFT, IMPS, UPIthe way they work and how you can use them to make purchases or to transfer money without having real cash.

Table of Contents

Comparing CashLess Options

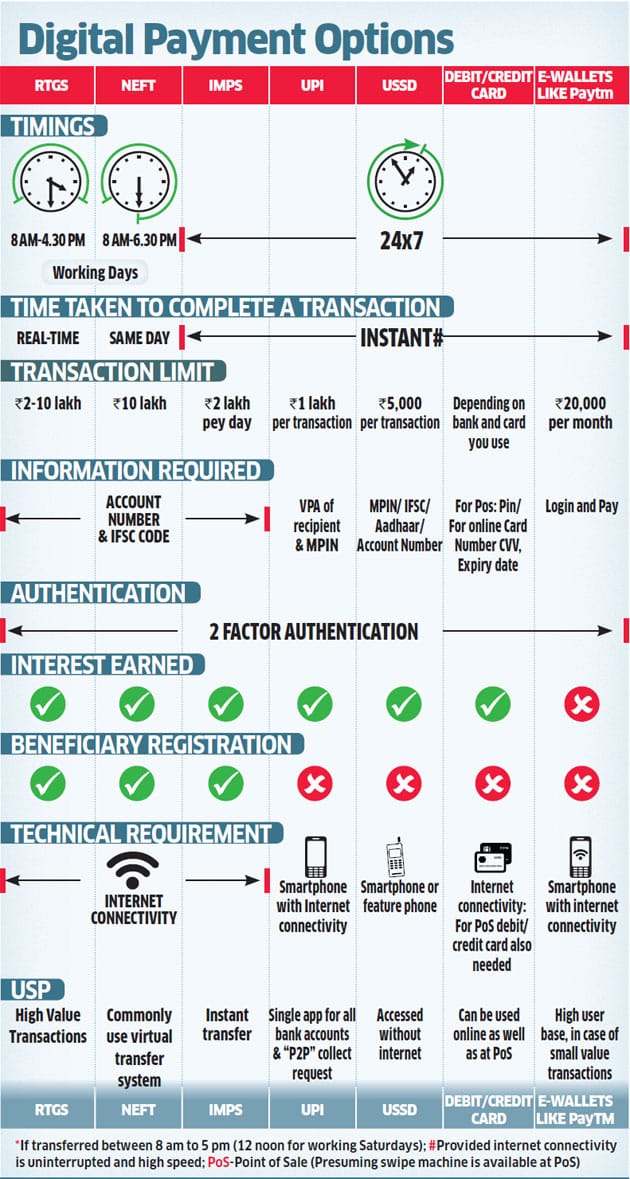

Currently available cashless payment systems include credit/debit cards, e-wallets such as Paytm, Unified Payment Interface (UPI), IMPS, USSD, RTGS, and NEFT. There is no single ‘best’ payment option for everyone and all transactions. However, you could try to pick a payment option suitable for your purpose. You can compare Cashless options on basis of

- Time taken to complete a transfer/payment

- The maximum amount you can transfer

- The financial details/information (e.g. account number etc) that you need to complete the transfer

- How is the transaction validated/authenticated

- Whether you will earn interest on the money kept in reserve in the payment system?

- Whether you need to specify who the money is being transferred to in advance i.e. register the beneficiary (recipient) of the money (beneficiary registration);

- What infrastructure/technical support is a must for the transfer to happen.

- What are the costs involved.

Below is an overview of the comparison analysis.

Why go CashLess?

There are a lot of benefits to using digital wallets and electronic cash instead of paper money , it helps cut out the large costs involved in printing and transporting huge amounts of paper money, simplifies logistics, along with protection from theft and counterfeiting and accounting of money. 90 % Retail consumer transactions atleast in Top 10 cities of India can go cashless. An avg. Indian working middle class performs 45-60 financial transactions in a month and Large part of is done via cash. But many of these expenses can be done using digital means.

- House Needs:Grocery,Salon, Parlours

- Helpers: Maid, Laundryman, Iron Man,Milk, Newspaper

- Transport: Public Transport or Petrol if you have your own vehicle.

- Utilities: Recharges like Telecom and DTH, Bill payments like Electricity, Gas, Internet ,Society maintenance and payments,Municipal tax payments

- Small amounts :Office canteen, office expenses like birthday and other celebrations, road side food

- School fees of kids and stationary

- Investments

People who have gone cashless

David Wolman began his journey by deciding to shun cash for an entire year—a surprisingly successful experiment (with a couple of notable exceptions). He then ventured forth to find people and technologies that illuminate the road ahead. All this is captured in his book Book The End of Money: Counterfeiters, Preachers, Techies, Dreamers–and the Coming Cashless Society by David Wolman

In India , Abhishant Pant, a 35-year-old fintech professional shows how to live cashless. . Pant has a whole host of apps that he uses to pay during transit, at grocery shops/restaurants/street food stalls. The motive is : Living without cash. “A cashless/cashfree is seen as a key to Prime Minister’s vision of black money-free India. It took me three months to convince my domestic help to receive direct credit into her bank account, but now she thanks me as it has helped her in building a savings habit.” You can read about his experiments on LinkedIn or listen to him on YouTube

How to go cashless?

E-wallets or Digital Wallets

Electronic wallet in reality is virtual cash. E-wallets can be loaded with money using your debit/credit card or net banking. This money can then be used to make purchases at a vendor (if they accept that mode of payment), to recharge you mobile/dth, to pay mobile/gas/electricity bills, book flight/railway tickets or even order food! Generally e-wallets like Paytm, Freecharge and Mobikwik have great promotional offers everyday especially on making utility payments. By using these wallets you can actually save a lot of money. Each offer has a coupon code that needs to be applied before making payment and cash back will be credited in your e-wallet. These mobile wallets have also extended their tie-ups to offline vendors.

How to use mobile wallets?

Our article Paytm: How to Use Paytm,Open Paytm account,Pay using Paytm covers Paytm in detail.

Register for Mobile Wallets

- You have two options to use the mobile wallets: Download app or make payment using the browser.

- Download the app you want to make payment from, from Google Playstore or OS.

- Register using Facebook/email id.

- Verify mobile number.

Add Money

- Select add money option.

- Enter the amount you want to add

- Now select an option to add money: Debit card( Requires card details with CVV and will be authenticated with OTP/3D pin), Credit card, Net Banking(Requires login & transaction Id and password)

- Once the money is added, it can be used across platforms where it is accepted or to dispense bill payments directly from the app.

Use Wallet to pay

- To make payment, Select type of transaction- bill payment/pay to vendor.

- Authorize the transaction with OTP sent to registered mobile number and payment will be done without any trouble.

- In case of any cancelled or returned orders, money is reversed back into the account.

Transfer back to Bank Account: Money in these mobile wallets can also be transferred back into the bank account if required.

Table given below gives an overview of where all Wallets can be Used

| Wallet/ Use | E-commerce | Bookings | Deliveries | Taxi | Offline shops | P2P | Recharges |

| Paytm | Paytm, eBay, Croma | Paytm, IRCTC, BookMyShow, MakeMyTrip, Cleartrip, PVR Cinemas | Swiggy, Zomato Order, Grofers, BigBasket | Uber, Meru | Yes | Yes | Yes |

| FreeCharge | Snapdeal, Jabong | IRCTC, BookMyShow | Swiggy, Zomato Order | Meru | Yes | Yes | Yes |

| MobiKwik | eBay, Jabong, Myntra | MobiKwik, IRCTC, BookMyShow, MakeMyTrip, Cleartrip, PVR Cinemas | Swiggy, Zomato Order, Grofers, BigBasket | Meru | Yes | Yes | Yes |

| Ola Money | eBay, Voonik, HealthKart | BookMyShow, Cleartrip, Oyo Rooms | Box8, Doormint | Ola | Yes | Yes | Yes |

| PayUMoney | eBay, Jabong, Myntra, Croma | MakeMyTrip, BookMyShow, Cleartrip | Zomato Order, Grofers, BigBasket | – | Yes | Yes | Yes |

| ItzCash | Yebhi | BookMyShow, IRCTC, Yatra, Cleartrip, Redbus | – | – | Yes | Yes | Yes |

| Oxigen | eBay, Croma | IRCTC, BookMyShow, PVR Cinemas | – | – | Yes | Yes | Yes |

| Vodafone mPesa | eBay, WalMart India | BookMyShow | – | – | Yes | Yes | Yes |

| Airtel Money | eBay, Myntra | BookMyShow | – | – | Yes | Yes | Yes |

| Jio Money | eBay | BookMyShow | – | – | Yes | Yes | Yes |

Most used mobile wallets for transactions

For utility bill payment/to make online purchase/direct payment to vendors the following apps are extensively accepted. You can also check the links to learn how to add money and make payments.

- Paytm: https://www.youtube.com/watch?v=TS290Go39PI, Our article Paytm: How to Use Paytm,Open Paytm account,Pay using Paytm covers Paytm in detail.

- FreeCharge: https://www.youtube.com/watch?v=IulgH6CXmO4

- Mobikwik: https://www.youtube.com/watch?v=NSCC8Qziimg

- PayUmoney:

For cashless travel:

- Olamoney: https://www.youtube.com/watch?v=8zZLtZSetv0

- For Uber, Paytm can be used.

Bank e-wallets

If you are skeptical to use third party apps, a few banks have launched their in-house e-wallets to cater on the go needs of the masses and to compete with private e-wallet companies. Bank e-wallet works exactly like third party apps, where payment details need to be added before loading money into the wallet. Once money is loaded it can be used to disburse where these payment modes are compatible. For example, Lime is the official e-wallet for Café Coffee Day where for every transaction done you are eligible to earn extra rewards as compared to cash transactions.

Banks that have e-wallet:

- Pockets-ICICI bank: https://www.youtube.com/watch?v=L0w2EwWkicg&index=3&list=PLK7jUbKwQcg_ept1GH4rgkBoEQ3eNCerE

- Chillr- HDFC Bank: https://www.youtube.com/watch?v=xpkG7e6HpAg

- Lime- Axis bank

- SBI- Buddy

- Citi Masterpass- CITI bank

Some bank mobile wallets are also available for download and use even by people who are not account holders of that particular bank.

IMPS/RTGS/NEFT

Available across all banks, IMPS, RTGS, NEFT happen to be trusted and commonly used money-transfer services.

- Immediate Payment Service (IMPS) is an instant inter-bank money transfer service where funds can be transferred effortlessly using internet banking, mobile banking or ATM. This service is available 24×7 throughout the year even on Sundays and public holidays.

- NEFT and RTGS are also options for transferring money online using internet or mobile banking to any bank account holder. But the service is not available on holidays and beyond a certain time range. IMPS has leverage over both the services as it offers instant transfer unlike RTGS and NEFT.

How to IMPS/RTGS/NEFT using mobile banking:

- Register your mobile number for mobile banking with your respective bank.

- Download the official mobile banking app.

- Register yourself by entering details like mobile number and crate mPin to authorize all transactions.

- Once you register you can select the type of operation you want to do, enter amount, beneficiary details and the amount will be transferred.

Comparison between RTGS, NEFT/IMPS

| RTGS | NEFT | IMPS | |

| Daily transaction limit | Minimum: Rs. 2 Lakh | Minimum: Re. 1

|

Minimum: Re. 1

|

| Maximum: No limit

(Some banks set a maximum limit for single transaction. Eg: HDFC bank has a limit of Rs. 10 Lakhs on single transaction.) |

Maximum: No limit but maximum amount for single transaction is set at Rs. 10 Lakhs. | Maximum: Rs.50000- 2 Lakhs.

(Differs with individual banks.) |

|

| Fees for outward transactions:

|

NA |

Rs 2.50 + Service Tax |

Rs. 5 per transaction+ Service Tax |

|

NA |

Rs 5 + Service Tax |

Rs. 5 per transaction+ Service Tax |

|

|

NA |

Rs 15 + Service Tax |

Rs. 15 per transaction+ Service Tax |

|

|

Rs 25 + Service Tax |

Rs 25 + Service Tax |

NA |

|

|

Rs 50 + Service Tax |

Rs 50 + Service Tax |

NA |

|

|

Days to avail the service |

Monday-Saturday Not available on public holidays & Sunday. |

Monday-Saturday Not available on public holidays & Sunday. |

Monday- Sunday Available on Sunday and any other public holiday. |

|

Time to avail the service |

Monday to Friday: 9AM – 4:30PM

Saturday: 9AM- 1:30PM |

Monday- Friday: 8AM -7pm

Saturday: 8AM – 1PM |

Monday- Sunday :

24 Hours |

| Speed of transfer | Credit to Beneficiary account in time batches, depending on day and time of the week. | Credit to Beneficiary account in time batches, depending on day and time of the week. | Instant. |

| Beneficiary details required | Funds can be transferred to the beneficiary basis their Bank Account No. and IFS Code | Funds can be transferred to the beneficiary basis their Bank Account No. and IFS Code | Funds can be transferred to the beneficiary basis their • Bank Account No. and IFS Code • Mobile No. and MMID (Mobile Money Identifier) |

Unified Payment Interface

UPI is a single payment interface amalgamating all payment systems thus enabling all account holders to send and receive money from their smart phones using either of the identity modes- Aadhar Card Number/Mobile Number/virtual payment address. You can use UPI app to pay for small transactions upto Rs. 1 Lakh.

- To pay or receive money with UPI all you need is a smart phone and a bank account.

- Download the UPI app and link your bank account with the app.

- Every person (payer and payee) will have a unique ID allied with their mobile number. Unique IDs will be virtual say for example, amitshah@axisbank.com or we can use mobile/aadhar number- 1234567890@axisbank.com Unique ID will be available differently for each bank account and option will be given to select the account from which you desire to make the payment.

- Once registered, login with the same credentials and enter the unique ID of the person/entity to whom the payment is to be made and select send. Authenticate the transaction after entering Pin or password.

Plastic Money: Debit and Credit Cards

Debit or credit card is another trouble free option to make payments. There are three types of plastic cards available – Credit card, Debit card and Prepaid card.

- Debit cards are issued by the banks and they are linked to your bank account.

- Credit card are issued by banks and other entities.

- Prepaid card are alternative to cash and cheques and are issued by banks. All you have to do is buy a card and load it with the desired amount and the card is ready for use. One does not require any account to use these cards.

The vendor requires a machine(Point of Sale or POS) where your card will be swiped after entering the eligible amount. You need to authorize the transaction after punching your ATM Pin on the machine and the payment will be easily done. Similarly these cards can be used to make payments directly online without the interference of any wallet or app. But you will have to enter the card details, CVV and authorize the payment with OTP (Sent of registered mobile number)/3D Pin.

According to the July 2016 data available on the website of the Reserve Bank of India (RBI), banks in India had issued 25.9 million credit cards and 697.2 million debit cards as of July-end. According to RBI data, India had a total of 1.44 million POS terminals installed by various banks across locations at the end of July. Besides, there were more than 200,000 ATMs across India. Of the 1.44 million POS terminals, SBI, Axis Bank, HDFC Bank, ICICI Bank and Corporation Bank account for 1.16 million. Four of these five banks are predominantly urban. In the month of July, a total of 881 million transactions across India took place through debit cards at ATMs and POS terminals. About 85% of these transactions were done to withdraw cash at ATMs. In terms of value, 92% of all debit card transactions were at ATMs. This only suggests that debit cards are used less for purchase and more as a means to withdraw cash.

Mobile wallets V/S Bank Mobile wallet V/S UPI

Mobile wallets have just one drawback that they are not centralized for all the merchants. You go to your local shop to purchase a packet of chips, he does not really accept paytm or freecharge of course if he is digitally advanced after the bold demonetization step.

As unlike UPI there is no single platform for all merchants, it is a trouble to keep every e-wallet stacked with money. For example,OLA and UBER. They have an option for paying by cash at the end of the journey, but for if you want to pay by card, you need money in two different wallets. For UBER you need to add cash in your Paytm account, and for OLA you need to add in OLA Money. It is a very tedious procedure to add sufficient money in every wallet.

UPI is be a tough competition to the mobile wallets as the process is faster due to minimal credentials required and is a one-stop platform for all categories of payments and beneficiaries.

Mobile wallets have clout over UPI with their CASHBACKS. By using coupon codes to transact you will be eligible to receive cash back in your wallet. This results in savings and thus mobile wallets and UPI will be thriving hard to slash each other’s throat till the time UPI comes up with cash backs and then mobile wallets might just vanish.

Mobile banking and internet banking has gone down to an extent because there are various hurdles like manually feeding a lot of vital data. Though RTGS,NEFT and IMPS are still done a huge scale.

Which cashless options,mobile wallet do you prefer to use? Or are you stuck with the traditional mobile banking? Vote in the poll below.

[poll id=”99″]

Related articles:

- What are Mobile Wallets or Digital Wallets

- Paytm: How to Use Paytm,Open Paytm account,Pay using Paytm

- Pockets Facebook App by ICICI Bank, Social Banking

- What happens when credit card is swiped?

- What is Unified Payment Interface or UPI?

- Third Party Fund Transfer NEFT RTGS

- IMPS or Immediate Payment Service : Send Money Instantly

- What is Mobile Banking

Digital money and a potential cashless economy is what we are looking forward to. People still do hesitate to transact using the internet for security issues but with no 100 rupees notes left in hands and long ATM queues we only have virtual money to our rescue! Do you use cashless ?

4 responses to “Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards”

Hello Editor, Thanks for sharing this informative blog applying this method anyone can easily grab many discounts while doing recharge and bill payments and I would also like to mention one of the similar kinds of websites which offers one of the Best Recharge And Bill Payment Services In Rajasthan since few months I have been a regular user for them and actually grabbed many discounts on my recharge services, I would like to suggest the same if you want to enjoy discounts and fast recharge services.

Great article. I also want to get a credit card but cibil score scares me. This is because I have heard that non payment in credit cards due to any reason also lowers down your cibil score. Is that true?

I am constantly reading about cibil score because increasing it is has become immensely important for me. I read many blogs and found http://www.loankuber.com/content/cibil-score/a-perfect-credit-score/ to be very beneficial. It has a section just dedicated to cibil score. Thought it would help other people like me too. 🙂

Shopkeepers can’t charge 1-2% extra on Debit Card Payment – RBI.

More info@ https://www.moneydial.com/blogs/shopkeepers-cant-charge-1-2-extra-debit-card-payment-rbi/