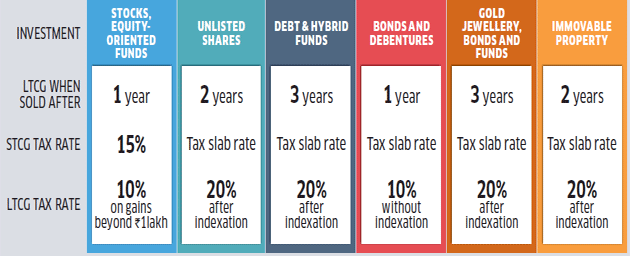

Capital Gain Tax rules differ based on asset and holding period. Capital Gain calculator from FY 2017-18 or AY 2018-19 for calculating Long Tem Capital Gain (LTCG) and Short Term Capital Gains(STCG) with CII from 2001-2002. It is a generalized Capital Gain Tax calculator which calculates Long Term and Short Term Capital Gain based on the time of holding ( purchase date and sale date), on the type of assets such as property or Gold or stocks or equity Mutual Funds. Generally, the rules for classifying short and long-term capital gains are as follows. The image below shows the Short and Long Terms for different types of assets and the table explains it in detail.

Cost Inflation Index for FY 2022-23 relevant to AY 2023-24 is 331.

Cost Inflation Index or CII for the Financial Year 2021-22 is notified as 317.

CII was 301 in the FY 2020-21

Following posts would be helpful in understanding the concepts.

- Basics of Capital Gain, Cost Inflation Index, Indexation, and Long Term Capital Gains

- How to Calculate Capital gain on Sale of House? discusses specifically the capital gain on sale of a house or property.

- Fair Market Value: For properties purchased before 1 Apr 2001, the latest cost inflation numbers start from 1 Apr 2001, one needs to first arrive at what is commonly known as Fair Market Value (FMV) of the property as of April 1st, 2001. Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 explains it in detail.

- If Tax on Long Term Capital Gain/Short Term Capital Gain is more than 10,000 in the financial year, one needs to pay Advance Tax using Challan 280. If you don’t pay Advance Tax you would pay a penalty. Our article Advance Tax: Details-What, How, Why explains it in detail.

- One needs to pay all due taxes before filing Income Tax Return. Our article How to file ITR Income Tax Return, Process, Income Tax Notices explains it in detail

- Cost Inflation Index for all the years can be found at Cost Inflation Index Up to FY 2016-17 and New Cost Inflation Index from FY 2017-18 and is also given below, here, for reference.

- An example of Capital Gain on Sale of Property is shown here

Table of Contents

Capital Gain Calculator from FY 2017-18

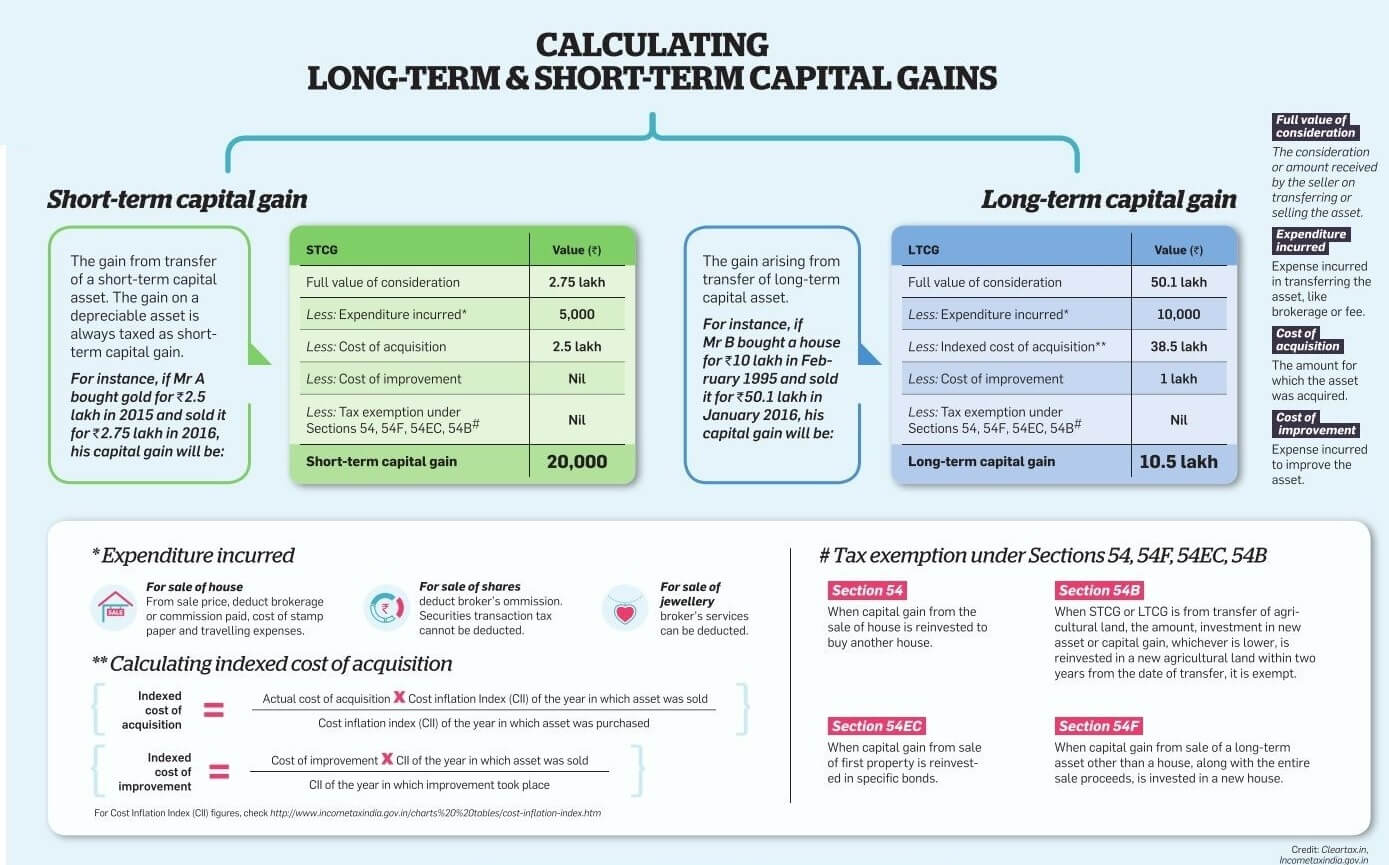

How to calculate Short Term & Long Term Capital Gains

The following image shows How to calculate Short Term & Long Term Capital Gains

Example of Long Term Capital Gain on Property

I sold some property and know that the transaction will invite capital gains tax liability. My query is, when and how much should I pay as tax? Following are the details of the property:

- Bought in 2009-10 for Rs 20.50 lakh (including brokerage and stamp duty)

- Sold in June 2017 for Rs 42 lakh with Rs 85,000 as brokerage.

How much would be the tax liability?

If I want to purchase capital gains bonds, when should I do so? How much time do I have to buy them so that I can avoid paying fines and charges, as well as legal and tax-related issues later on?

The gain arising from the transfer of property attracts capital gains tax. Since you have held this property for more than 24 months, the resultant gain is taxable at the rate of 20.60% (plus applicable surcharge) as a long-term capital gain (LTCG).

The tax liability will be calculated as follows:

- Step 1: Calculating the cost of acquisition (Rs20.5 lakh).

- Step 2: Calculating the indexed cost of acquisition, which is the cost of acquisition * cost inflation index (CII) in the year of sale / CII in the year of acquisition (Rs20.5 lakh *272/148 = Rs37,67,568).

- Step 3: Calculating the LTCG [Rs41,15,000 (net of brokerage expenses)– Rs37,67,568 = Rs3,47,432)].

- Step 4: Calculating the tax on LTCG with cess (Rs3,47,432 * 20.60% = Rs71,571).

- Step 5: Applying the applicable surcharge depending on your total income for FY2017-18.

Long-Term Capital Tax to be paid is Rs 71,571

The resultant LTCG could be claimed exempt from tax if the gain is re-invested in a specified manner. One such reinvestment that qualifies for the exemption is the purchase of government-notified bonds (to the extent of the LTCG) within 6 months from the sale of the property). You need to buy Capital Bonds worth the Long-term capital Gain ie 3,47,432.

The other alternative available for claiming exemption from long-term gains tax is by reinvesting the sale proceeds in another property within prescribed timelines. If such reinvestment is not made, the LTCG or part thereof would be taxable.

Overview of Capital Gains

Any profit or gain that arises from the sale of a ‘capital asset’ is a capital gain. This gain or profit is charged to tax in the year in which the transfer of the capital asset takes place.

Capital gains are not applicable when an asset is inherited because there is no sale, only a transfer. However, if this asset is sold by the person who inherits it, capital gains tax will be applicable but purchase date would be of original buyer not date of Transfer. The Income Tax Act has specifically exempted assets received as gifts by way of an inheritance or will.

| Type of Asset | Short Term Capital Gain | Long Term Capital Gain | Tax on Short Term CG | Tax on Long Term CG | |

| Debt Mutual Fund | Before Aug 2014:Selling before 1 year

After Aug 2014: Selling before 3 years |

Before Aug 2014:Selling after 1 year

After Aug 2014:Selling after 3 year |

Added to income and taxed as per tax slab. | Before Aug 2014 If indexation used 20%, Without indexation 10%After Aug 2014 If indexation used 20% | |

| Equity Mutual Funds with STT paid | Selling before 1-year | Selling after 1 year | Taxed at 15%. | NIL | |

| Stocks with STT paid | Selling before 1-year | Selling after 1 year | Taxed at 15%. | NIL | |

| Fixed Maturity Plan(FMP) | Selling before 3 year |

|

Added to income and taxed as per tax slab. | Before Aug 2014 If indexation used 20%, Without indexation 10%After Aug 2014 If indexation used 20% | |

| Real Estate, | From FY 2017-18 selling before 2 years

Before FY 2017-18 Selling before 3 years |

From FY 2017-18 selling after 2 years

Before FY 2017-18 Selling after 3 years |

Part of total income and normal tax rates are applicable. | Indexation benefit is available and tax rate is 20% | |

| Gold & Others | Selling before 3 years | Selling after 3 years | Part of total income and normal tax rates are applicable. | Indexation benefit is available and tax rate is 20% |

How can you save the Long-term Capital Gain Tax on Property under section 54

You can save long-term capital gain tax on the sale of property by claiming Exemption under Section 54. Requirements for saving the tax are as follows

- To claim the full exemption only the capital gains have to be invested.

- In case entire capital gains are not invested – the amount not invested is charged to tax as long-term capital gains.

- A new residential house property must be purchased or constructed to claim the exemption.

- The property must only be bought in the name of the seller of property and not on anybody else’s name.

- Only ONE house property can be purchased or constructed.

- Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption will not be available for properties bought or constructed outside India.

- The new residential property must be purchased

- either 1 year before the sale or

- 2 years after the sale of the property/asset.

- Or the new residential house property must be constructed within 3 years of sale of the property

- If you do not want to buy another property then you can save capital gain tax by investing in Capital Gains Account Scheme, 1988 before the date of tax filing or 1 year from the date of sale, whichever is earlier.

How to save the LTCG on Asset other than property by buying property?

You can save long-term capital gain tax on sale of any asset other than a House Property by claiming Exemption under Section 54F. Requirements for saving the tax are as follows

- To claim the full exemption the entire sale receipts have to be invested.

- In case entire sale receipts are not invested, the exemption is allowed proportionately. [Exemption = Cost the new house x Capital Gains/Sale Receipts]

- The property must only be bought in the name of the seller of asset and not on anybody else’s name.

- A new residential house property must be purchased or constructed to claim the exemption.

- Only ONE house property can be purchased or constructed.

- Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption will not be available for properties bought or constructed outside India.

- The new residential property must be purchased

- either 1 year before the sale or

- 2 years after the sale of the property/asset.

- Or the new residential house property must be constructed within 3 years of sale of the property

- If you do not want to buy another property then you can save capital gain tax by investing in Capital Gains Account Scheme, 1988 before the date of tax filing or 1 year from the date of sale, whichever is earlier.

Cost Inflation Index to be used from FY 2017-18

The CBDT has notified the Cost Inflation Index Applicable from FY/ PY 2017-18 (AY 2018-19) onwards, with Base Year shifted to 2001-02.

| SI. No. | Financial Year(FY) | Assessment Year(AY) | Cost Inflation Index |

| 1 | 2001-02 | 2002-03 | 100 |

| 2 | 2002-03 | 2003-04 | 105 |

| 3 | 2003-04 | 2004-05 | 109 |

| 4 | 2004-05 | 2005-06 | 113 |

| 5 | 2005-06 | 2006-07 | 117 |

| 6 | 2006-07 | 2007-08 | 122 |

| 7 | 2007-08 | 2008-09 | 129 |

| 8 | 2008-09 | 2009-10 | 137 |

| 9 | 2009-10 | 2010-11 | 148 |

| 10 | 2010-11 | 2011-12 | 167 |

| 11 | 2011-12 | 2012-13 | 184 |

| 12 | 2012-13 | 2013-14 | 200 |

| 13 | 2013-14 | 2014-15 | 220 |

| 14 | 2014-15 | 2015-16 | 240 |

| 15 | 2015-16 | 2016-17 | 254 |

| 16 | 2016-17 | 2017-18 | 264 |

| 17 | 2017-18 | 2018-19 | 272 |

| 18 | 2018-19 | 2019-2020 | 280 |

| 19 | 2019-20 | 2020-2021 | 289 |

| 20 | 2020-21 | 2021-2022 | 301 |

| 21 | 2021-22 | 2022-2023 | 317 |

| 22 | 2022023 | 2023-2024 | 331 |

Related Articles

Understand Income Tax: What is Income Tax,TDS, Form 16, Challan 280

How to file ITR Income Tax Return, Process, Income Tax Notices

- Basics of Capital Gain, Cost Inflation Index, Indexation and Long Term Capital Gains

- How to Calculate Capital gain on Sale of House?

- Fair Market Value: Calculating Capital Gain for property purchased before 2001

- Advance Tax: Details-What, How, Why

- Cost Inflation Index Up to FY 2016-17 and New Cost Inflation Index from FY 2017-18

- How to show Long Term Capital Gains on sale of House in ITR

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Budget 2018: Long Term Capital Gain on Stocks & Equity Mutual Funds

117 responses to “Capital Gain Calculator on Sale on Property, Mutual Funds, Gold, Stocks”

[…] you can use CII of the FY 2006-07. Then your calculations are correct. You can verify it using our Capital Gain Calculator So you have a capital loss if there is a net loss under the head Capital Gains for an assessment […]

Hi

My father had brought a land in Kanyakumari in Mar-1982 at Rs 1400 (agreement value). Build a 3 Flr building with 9 flats. the construction was completed 1992 (Building cost-23 lacs). We gave 8 flats for rent. We have sold it at 86 lacs in Oct 21. What will be capital gain tax on this transaction

For properties purchased before 1 Apr 2001, the latest cost inflation numbers start from 1 Apr 2001, one needs to first arrive at what is commonly known as Fair Market Value (FMV) of the property as of April 1st, 2001. Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 explains it in detail.

Market value is the price that a willing purchaser would pay to a willing seller for a property, having due regard to its existing conditions, with all its existing advantages and its potential possibilities when laid out in its most advantageous manner.

According to the Income-tax Act, 1961, FMV shall be the higher of the cost of acquisition of the property or the price that the property shall ordinarily sell for if sold in the open market.

Recommended way

Take the help of a registered valuer.

Government-approved valuers follow a standard process for the valuation and provide a detailed report.

In return for a nominal fee, they estimate the real worth of the property. They usually consider factors like dimensions of the property, freehold/leasehold, restrictive covenants (if any), whether insured or not.

In case of any inquiry, the income tax department will consider the value stated in the valuation report from a registered valuer

Fair Market Value is the estimated price which any asset in the opinion of Valuation officer would fetch if sold in the open market on the valuation date.

Thanks for sharing Article. Please visit https://stockoption.co.in/ for Open Free Demat Account.

I sold my flat on 16-08-2020

Purchase Date-24-02-1992

purchase price-269000/-

Sold price -3000000/-

Construction cost- Till date spend- 560000/-

What is the capital gain?

how much i have to pay tax on it?

A house purchase by my real Uncle in November 1977 for Rs.15000/-. In December 2019 they donate the said house to me taking with out any cost. Am I eligible any type of tax liability under Income tax Rules. Property situated in M. P.

I sold my flat on 6-11-2019

Purchase Date-24-02-2011

purchase price-1200000/-

Sold price -2000000/-

What is the capital gain?

how much i have to pay tax on it?

If you enter the values in the Calculator then the Purchase Indexed Cost is 2076646.71

So you have a capital loss.

CII of the Purchase Year: 2011 month: Feb : 167

CII of the Sale Year: 2019 month: Nov : 289

Purchase Indexed Cost:2076646.71

Difference between sale and indexed purchase price: -76646.71

From our article Capital Loss on Sale of House

In case of Loss also Income Tax Act allows one to set off loss(es) and/or carry forward of income under sections 70-80. The process of setting of loss on income (on any kind of income – income from other sources, real estate) and their carry forward is covered in the following steps:

Step 1 Inter source adjustment under the same head of income.

Step 2 If Loss cannot be offset under Step 1.Inter head adjustment in the same Assessment Year.

Step 3 If Loss cannot be offset under Step 1 and 2, Carry forward of a loss.

I have booked under construction Flat in April 2018 – only 30 % amt paid. Next installment paid in Oct 2017 and balance in Feb’2020 .

I sold my flat in May 2018 and capital gain proceeds deposited in the capital gain account in a bank

I want to use this proceeds for my last payment in Feb’2020. under a capital gain exemption under section 54 .

Pl clarify the eligibility of exception for the above transaction under scetion 54

You bought an undercontruction flat in Apr 2018 and sold in May 2018.

As it is less than 2 years the gain would be short term capital gain and you cannot use exemption under section 54

I have sold off my ancestral property ( inheritance) in Goa for ₹ 70,00,000, sale deed will be executed shortly as full payment is yet to be received (is balance ₹ 70,000). When do I invest in GOI bonds and what would be the approximate tax leviable

i have purchased flat thru bank loan in july 2016 possession of which is expected in may 2019. Now i propose to sale my existing residential house. Can i use the LTCG for repayment of housing loan to avoid tax

No, Sorry you can’t.

As explained in the article Can Capital Gains on Sale of House be used to pay Home Loan

Home loan and Capital Gains Exemption are two separate things. You can claim the Capital gain exemption only if you use the money from the sale of the property to buy another house. The purchase of new house has to be done one year before the sale of the house or 2 years after the sale of the house. The property should be bought in the name of the seller. Income tax department is not concerned if you used the sale money for repaying the home loan or not.

Hi

In Feb. 2019 I have sold a flat purchased through home loan. Details are as under-

i. While purchasing the flat, sale Agt. was signed with builder on 28/11/05 indicating cost of flat as Rs. 16 lac.

ii. Me and my son were joint owners.

iii.Paid Rs. 1,60,000/- to builder on 25/11/05

iv Paid from loan disbursement of HDFC as under- Jan& Feb 06- Rs.5.34 lac, and from May 06 to July 06- – Rs. 9.06 lac. i. e. Rs. 14. 40 lac. Loan repayment amount with interest- Rs. 24.33 lac

v. Paid other charges to Builder- Rs. 1.85 lac

vi. Travel expenses and Stamp duty etc. for Flat registration on 4/3/11- Rs. 1.30 lac

vii. Property sold in Feb 2019 with payment received for Rs. 55.75 lac. Brokerage 0.75 lac., Travel expenses Rs. 34000/-

What will be Capital Gain tax and by what date it should be deposited. Pl advise.

Two children inherited a flat in Delhi-parents passed away in 2012 and the mutation to both children joint names was completed in 2018. I bought the 50% share from my sibling through a Release Deed with consideration (about 35 lakhs). I have renovated the flat and would like to sell now.

How do I calculate LTCG in this case?

Original Acquisition price in 1989-90 = 2.8 lakhs plus renovation costs + will preparation etc.

50% share bought at 35 lakhs

There is also cost of transferring/mutation etc.

Also renovation costs incurred by me after 50% share purchase.

Please help with the above.

thanks

hii sir,

i sold my ancestral land,which happened to be a commercial one, and put all the money in capital gain account. By mistake, i brought a new residential home in name of my wife.

now i have two question:

1st- after i filed itr, my itr for that finacial year has not been processed and its been two years now. What should i do?

2nd- i have researched and have found cases where court has admitted the even if person has brought property on others name, if the money used is same of from capital gain account then that person will get excemption. how much m i right?

I purchased a Property in 1995 – 1000 sq yard with ground floor 2512 sft.

for Rs.10 lakhs as per sale deed. plus reg. charges Rs.85000/-

First floor constructed year 2000 2512 sft Rs. 20 lakhs

Property sold July 2018 for Rs 3.3 CR, New property purchased for Rs.

90 lakhs regn before March 2019.(Additional Chargers for interior &

electrical etc )

We have a valuation report dtd 25-02-2012 as followes

For constructed area less dep Rs.25.79 Lac

Land 1000 Sq Yards @ Rs.5500 = Rs.55Lacs

Total Rs.80.79 Lacs.

Please give basis for calculating capital gains and balance amount to

be invested in capital gains exemption bonds.

I have purchased site and constructed my house(ground. floor) in the year 1972 forRs. 25000, first floor in the year 1987 for Rs.100000 and commercial shops in the year 2012 for Rs.7.50 lakhs. in Pozhichalur village in Pammal SRO limits.

I intend selling the same and as per the guidelines the tentative market value comes to Rs.80 lakhs. I will be happy if the capital gains to be taxed or claimed for exemption may kindly be worked out and informed to me.

Hi,

My mom registered a flat in 1990 at Rupees 75,000/-, now we have sold it for 20,00,000/- (Twenty Lakhs) in Dec’2018. She is now 80 years and she receives only family pension. We have made some expenses on modifying and other repair works. please tell me what would the capital gain tax.

Sir it would be difficult to calculate Capital Gain Tax based on the information provided.

Steps to calculate Capital Gain Tax on the property are given below

If the property is purchased before 1 Apr 2001 then the fair market value of the property as on 1 April 2001 will be considered as the cost of acquisition. For ascertaining the Fair market value, it is best to engage the services of a registered valuer. Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 covers it in detail

House improvement cost and transfer cost: While computing the cost of acquisition one can also add the costs incurred with respect to procedures associated with house improvement or transfer cost such as the will and inheritance, obtaining succession certificate, costs of the executor, property valuer etc.

Find the indexation purchase cost: The long-term capital gain(LTCG) shall be computed as the difference between net sale proceeds and indexed cost of purchase. For indexation, the cost of acquisition should be adjusted by applying the cost inflation index (CII).

In case of long-term capital gain, capital gain = final sale price – (transfer cost + indexed acquisition cost + indexed house improvement cost).

My son purchased a Flat in FY 2009-10 for 17 lk and now sell for 37.5 lk. Apart from Regn Fee, Stamp duty, Insurance, Valuation Fee around 2 lks spent (with Vouchers) and brokerage + renovation around 2 laks w/o vouchers.

Similarly while selling around Rs. 1.5 lak be paid as brokerage without Receipt.

How these are accounted on LTCG

At present he is an NRI

Sir,

I purchased house in oct 2012 for Rs 2100000 (As per agreement).

Took bank loan for Rs 1600000

sale deed value is Rs 840500. (in sale deed it is mentioned semi furnished house).

what is my purchase value?

I sold house in sep 2018 for Rs 3800000.

Registration charge for purchage Rs 84000

brokerage for selling Rs 70000 (given to agent through cheque no receipt)

how much i have to Pay as capital gain tax.

If property purchased in FY 2008-2009 and sold in 2017-18, how capital gain be calculated?

I invested in a upcoming project in Bangalore with the first payment made in Jan 2014. The total cost of the flat was 48 Lacs and this was funded with my personal funds and well as loans with nationalized banks.

Regular payments were made to the bulider based on their demands as per the construction progress.There was a considerable delay in construction and the property was not ready for possession before 2018. Meanwhile I found it difficult to pay loans and decided to dispose the property. I found a buyer willing to pay 60 lacs and since the property was not registered in my name I executed a assignment deed with the builder and buyer thereby transferring the rights to the property.

I paid off the loans that were outstanding and wanted to check on what would be the capital gains tax on this transaction.

I paid over 11 lacs in interest to the bank for the loan and was unable to claim and tax rebates.

Please advise on the capital gains calculation. Specific questions I need answers for is

1. Will the interest paid for the loan qualify as cost for acquiring the flat

2. I sold the property in 2018 however the payments to the builder were spread between 2014 and 2018. Would this have an impact on calculating capital gains

3. How much capital gains tax would I need to pay.

1. In case you don’t receive possession within three years of taking the loan, you can only claim a deduction of Rs 30,000 each year

2. For under construction property date of allotment is considered as the purchase date irrespective of when you did the payment

2b. Purchase price would be Total Agreement Value of the Flat not the amount you paid.

3 Assuming Purchase price to be 48 lakhs in Jan 2014 and selling price to be 60 lakhs after Apr 2018.

CII of the Purchase Year: 2014 month: Jan : 220

CII of the Sale Year: 2018 month: Apr : 280

Purchase Indexed Cost:6109090.91

So you have a capital loss of 1,09,090.91.

I purchased in 2008 a house for Rs 20.0 lakh and sold it in Aug 2018 for 60.0 lakh. Purchasers valuer valued it at 45 lakhs. can I use that figure? what will be my tax liability.

Hello,

I am a senior citizen retired from SBI. My annual pension is Rs. 5,00,000 per annum and have interest income of Rs. 6,00,000 per annum. I am depositing Rs. 1,50,000 in PPF annually.

I purchased a flat in 1993 for Rs. 1,75,000 and paid RS 25,000 as registration fees. Now I am going to sell the flat for Rs. 25,00,000. Kindly, intimate me the capital gain tax to be paid because of selling of this flat.

For properties purchased before 1 Apr 2001, the latest cost inflation numbers start from 1 Apr 2001, one needs to first arrive at what is commonly known as Fair Market Value (FMV) of the property as on April 1st, 2001. Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 explains it in detail.

You bought your flat in 1993 for around 2 lakh

Assuming 2 lakh as cost price LTCG comes up to 3.88 lakhs

CII of the Purchase Year: 2001 month: Apr : 100

CII of the Sale Year: 2018 month: Oct : 280

Purchase Indexed Cost:560000

Difference between sale and indexed purchase price: 1940000

Long Term Capital Gain Tax with indexation (at 20%):388000

Assuming For FMV of Rs 4 lakh

Purchase Indexed Cost:1120000

Long Term Capital Gain Tax with indexation (at 20%):276000 or 2.76 lakh.

Saving Long Term Capital Gain: If there are any long-term capital gains, one may have to either

pay tax on it at the rate of 20% or

Buy a new property

either 1 year before the sale OR

2 years after the sale of the property/asset OR

The new residential house property must be constructed within 3 years of the sale of the property.

Save capital gains tax by buying specified bonds u/s 54EC

Our article How to Calculate Capital gain Tax on Sale of House or property? explains it in detail

I purchased 100 shares of a company at 88.40 per share. Purchase date is 16-dec-2018

I sold the 100 shares at 15.80 on 5-jun-2018

What will be my LTCG ? I presume I can claim a loss.

I entered the figure in the Capital Gains Calculator. The calculation is not correct.

The Difference between the sale and purchase price is calculated as 149156.

Your purchase date mentioned is 16-Dec-2018 and sale date as 5 Jun 2018.

When did you buy the shares?

Hello,

Your blog has explained the Capital Gains concept nicely.

I have a question for you; can you please help?

My parents had a flat in Mumbai in their name. The said flat was purchased in year 1995 for INR 2,35,000 (Two Lakhs Thirty Five Thousand only). After the unfortunate death of my parents the flat was legally transferred to my name in 2018 (50% of the flat-shares were gifted to me by my sister). Now I want to sell the flat for INR 40,00,000 (Forty Lacs Only). How should I calculate the capital gains on this sell of property? Also should I deposit the entire 40 Lakhs in the Capital Gains Account or only the Capital gains?

Thanks,

Abhishek.

I bought a built house on 2012 august for 31,60,000 but registered that as a plot for 7 lakhs just to save stamp duty( for a built house it is higher and for a land plot it is low).I received LIC housing loan for 18,90,000. Now in 2018 I am selling that flat for 28,00,000. How much LTCG should i pay ?My doubts are below :

1. What proof should i submit to IT to also consider the construction cost of the property(7,06,000 + 24,54,000 = 31,60,000) and to completely avoild LTCG ?

Sir,

I have recently sold my property. Details are below.

Purchase Date : 20-11-2002

Purchase Price : Rs.3,00,000 /-

Sale Date : 21-05-2018

Sale Price : Rs.26,50,000/-

Market Price : Rs. 32,00,000

What will be my capital Gains and corresponding Tax to it. I am planning to invest the capital gains. Advise what amount I should invest? (Should I invest all my sale proceeds or only capital gain)

How do you define Market Price?

Why is your Sale price less that Market price?

What is the sale price on registration.

Coming to Capital Gains

Purchase Indexed Cost:800000(300000* 280/105)

Difference between sale and indexed purchase price: 18,50,000

Long Term Capital Gain Tax with indexation (at 20%):3,70,000

You can save long-term capital gain on Sale of property in the following ways

Exemption under Section 54 : Entire capital gains (ie 3,70,000) in your case have to be invested.

Save capital gains tax by buying specified bonds u/s 54EC from NHAI and Rural Electrification Corporation Limited within six months of selling the house. Again only capital gains have to be invested not full amount.

(1)Exemption under Section 54

A new residential house property must be purchased or constructed to claim the exemption

The new residential property must be purchased either 1 year before the sale or 2 years after the sale of the property/asset.

Or the new residential house property must be constructed within 3 years of sale of the property/asset

If you are not able to invest the specified amount in the manner stated above before the date of tax filing or 1 year from the date of sale, whichever is earlier, deposit the specified amount in a public sector bank (or other banks as per the Capital Gains Account Scheme, 1988).

Only ONE house property can be purchased or constructed.

Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption shall not be available for properties bought or constructed outside India to claim this exemption.

Bought a residential site on Hosur Road on 8-7-1999 for Rs. 60,150/- including stamp duty for registration. Now, planning to sell the same in Sept. 2018 for Rs. 8,40,000/-. I am a lady senior citizen. What would be the LTCG and how I can save tax on it. If I have to pay tax, how much it would be?

You sold a plot

Cost price was Rs 60,150 but in 1999. Typically Fair Market Value should be found as on 1 Apr 2001.

Using our calculator:

Indexed cost is 1,69,400( 60,150 X 280/100)

Difference between Sale price and Indexed Price is 670600

Long term capital gain on sale of property is 20% which is 1,34,120

What if you don’t want to pay LTCG tax at all?

You can make use of Section 54 F to save on your long term capital gains by selling your plot of land.

You can sell your plot of land for a long term capital gain and invest the gain (profits) in a residential house/apartment.

You can claim a tax exemption under Section 54 F on your LTCG obtained on the sale of a long term asset other than residential house/property say a plot of land.The LTCG is exempt if invested in :

The purchase of a residential house/property within 1 year before or within two years of the sale of the plot of land.

You construct a new residential house within a time period of 3 years after selling the plot of land.

How much of LTCG can you save by using Section 54 F?

If the LTCG you get from the sale of your plot of land is equal to or less than the cost of the new house/apartment purchased then the entire capital gain is exempt from tax.

If the LTCG obtained from the sale of your plot of land is greater than the cost of the new house purchased then the amount up to the cost of the new house is allowed as a tax exemption. The amount which exceeds the cost of the house is taxed at 20% with an indexation benefit.

You have to invest your LTCG in a single residential house/apartment only within India no matter how high the capital gain.

What if you already own a house or an apartment?

You can still avail the benefits of Section 54 F on the LTCG you make on selling your plot of land if you already own a residential flat or a house.

You should not own more than a single house/apartment (other than the house/apartment you would buy on the sale of the plot of land).

Don’t want to invest in a new house immediately

You can deposit your LTCG in a capital gains account scheme before the due date of filing your income tax returns.

You can withdraw this money and then invest in the residential house/apartment within the time specified (3 years).

If you do not buy/construct a new house within the specified time period (3 years) the money not used (invested in the capital gains account scheme), will be taxed as an LTCG in the financial year which is 3 years after the sale of the plot of land.What if you sell your new house/apartment bought with the LTCG of your plot of land within 3 years of its purchase?If you sell your new house/apartment in a time period less than 3 years from the date of acquisition (Date you purchased the new house) then the LTCG you enjoy under Section 54 F is reversed (taken back) and the LTCG will be taxable in the year of transfer of the new house.

Use tax saving bonds to save on your LTCG taxes

You can claim a tax exemption under Section 54 EC on the long term capital gains obtained on the sale of the plot of land provided you invest the capital gains within a period of 6 months of the sale in certain specific long term bonds such as the REC and the NHAI bonds.

These bonds have to be held for at least 3 years (lock in of 3 years) and the interest earned on these bonds is taxed.

You are exempted only INR 50 Lakhs in tax saving bonds even if investments are made over two financial years.

Hi,

I have recently sold my property. Details are below.

Purchase Date : 25-11-2005

Purchase Price : Rs.272,250 /-

Sale Date : 09-08-2018

Sale Price : Rs.3,066,525/-

What will be my capital Gains and corresponding Tax to it. I am planning to invest the capital gains. Advise what amount I should invest? (Should I invest all my sale proceeds or only capital gain)

Helmet Heroes http://helmetheroes.games is a an enormously multiplayer function playing video game in which you could team up with your online friends and discover regions and fight against adversaries.

It showcases virtually 40 adversaries, thousands of various tools, helmets, shield, and also devices. You could choose between being a warrior, archer, wizard, or cowboy. Or if you ‘d like, you could incorporate classes and also develop you have mix. You can additionally dual wield weapons as well as utilize shields. There are a lot of special skills to pick from along with the ability to release significant earth trembling energy degrees to thrill other players and also aid you pound via waves of adversaries. In your downtime from combating, you could fish for over 40 different fish, or you can slice down trees to acquire wood to craft new tools. You could likewise purchase family pets which will certainly help you battle enemies and also you can even ride them!

land purchases a.y. 2004-05 Rs. 2082453/- area 535.21 after we given to Development in f.y. 2014-15 ( 40 – 60% ratio ) our share 40% when that time market value 45000/-

after we sold our share rs. 19400000/- on F.y. 2017-18.

how can we calculate longtime capital gain….

plz give some reply……….

Purchased land and constructed property in – 1981.

Sold property on March 28 2018.

Time elapsed from 2001 :17 years

Difference betweem sale and purchase price: 2743000

CII of the Purchase Year: 2001 month: Apr : 100

CII of the Sale Year: 2018 month: Mar : 272

Purchase Indexed Cost:1243040

:Long Term Capital Gain 1956960

Long Term Capital Gain

Tax with indexation (at 20%):391392

1. Is the above calculation correct?

2. How much amount has to be deposited into capital gains account? Only long term capital amount -1956960

or entire sale proceeds – 3200000 ??

Help here please

Please get the Fair Market Value of the property as it was bought in 1981 and now the base year is 2001.

Based on that only can one calculate the Long Term capital gain.

As explained in our article Capital Gains Account Scheme and Sale of property

If one invests the capital gain(not the difference between cost and sale price) within 1 year of sale or 2 years of the transaction, under section 54, 54F/FC, the capital gain is not charged for tax. However, in many cases, the due date for filing income tax returns for the year in which the capital gains arises is before the expiry of the specified period. If a person is unable to utilize the capital gain or invest the same in another property or bond before the tax filing due date which is usually 31 Jul, then he can invest capital gain with Capital Gains Account Scheme (CAGS) to buy more time. He can easily withdraw at the time of investment in the specified instrument.

In Mar 2017, Rahul sold a residential property after 5 years of acquisition. On sale, he made a capital gain of 10 lakhs (10,00,000). As this property was held for more than 3 years(after Apr 2017 it is 2 years), its long term capital g

I purchased plot on 2.2.2012 for Rs 4 lakh and sold the same for Rs 4 lakh on 6.5.2018. Am i required to pay capital gains tax? Am I required to mention these details in the IT returns?

Dr Vennam upender

Madurai

As you sold the plot in May 2018 details of this does not have to reported for ITR filed in ITR of FY 2017-18 or AY 2018-19 due date of which is 31 July 2018.

As it is for income earned between 1 Apr 2017 to 31 Mar 2018.

For next financial year ie for FY 2018-19 or AY 2019-20 yes you have would have to report it as it is a capital loss.

As Indexed cost of plot for FY 2011-12 is 608696 and selling price is 40000. So you have a loss of 208696 which you can carry forward for next 8 years.

I have a query on Section 54. I have sold out a property on Dec 2017 which was purchased on June 2006. I received Long Term Capital Gain (LTCG) from the sell. The money received from LTCG I used to repay the home loan on Jan 2018 for a home purchased in Apr 2011.

Since this new residential property is purchased 1 year before the sale. Can a claim for tax exception on LTCG ?

From what we understood

The new residential property is purchased in Apr 2011 and the loan prepaid was in Jan 2018.

Our article Can Capital Gains on Sale of House be used to pay Home Loan discusses it in detail.

Hi,

My name is Bharath I need clarification on long term capital gain for below scenario.

My father has purchased residential plot in 29th Jan 1997 for 48000. He is no more now I am legal hear for that property now I am going to sell this property for 12 lacks asper Govt guidance value. do I need pay long term capital gain?

If I need to pay how much I need to pay?

Regards,

Bharath

Sad to know about your father. Our condolences.

Please get the market value done as the base year is moved to 2001.

Indexed cost of land price assuming 48,000 is 1,34,400 (48000 *280/100)

Long term capital gain =10,65,600 (12,00,000 – 1,34,400)

LTCG are taxed at 20% which in your case turn out to be 2,13,120

Exemption from Long term capital gains on sale of Land comes under section 54F(on sale of house comes under section 54)

You can save long-term capital gain tax on sale of any asset other than a House Property by claiming Exemption under Section 54F. Requirements for saving the tax are as follows

To claim the full exemption the entire sale receipts have to be invested.

In case entire sale receipts are not invested, the exemption is allowed proportionately. [Exemption = Cost the new house x Capital Gains/Sale Receipts]

The property must only be bought in the name of the seller of asset and not on anybody else’s name.

A new residential house property must be purchased or constructed to claim the exemption.

Only ONE house property can be purchased or constructed.

Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption will not be available for properties bought or constructed outside India.

The new residential property must be purchased

either 1 year before the sale or

2 years after the sale of the property/asset.

Or the new residential house property must be constructed within 3 years of sale of the property

If you do not want to buy another property then you can save capital gain tax by investing in Capital Gains Account Scheme, 1988 before the date of tax filing or 1 year from the date of sale, whichever is earlier.

Sir,

I have sold four SBI shares on NSE/ BSE in Feb 2018, which I bought in Nov 2014 and the money I received was rs

The details are as follows

bought SBI shares on Nov 2014 @307 per share

Sold four shares in March 2018 @ 298 per share.

The amt I received was around rs 1163/- after all the STT etc

1) My question is can I file ITR 1 sahaj for the AY 2018-2019.

2) Can I show this rs 1163/- against the 10(38) exemption in ITR 1 sahaj form.

3) Also I had received unclaimed dividend income of Rs 20000/- for the last 5 yrs, in March 2018. So can I show the this as exemption under 10(34) section of ITR 1 sahaj?

Thanks

Sir, Can you pls confirm on the above query please? Thanks

You can report exempt LTCG in ITR 1 provided it is exempt under Section 10(38) which is true in your case.

Regarding unclaimed dividend income of Rs 20000 can you throw more light on it

-was it from mutual funds/stocks?

Sir,

It was shares/ stocks unclaimed dividend around rs 20000/ from 2012 onwards to 2018 transferred by the registrar and the transfer agents of the company shares I hold. For 2017-2018, the dividend income was around 7000/- only. The remaining 13000/- were unclaimed dividend from 2012 onwards. It was directly credited into my bank account. 1) Pls confirm is it fine to show the entire 20000/- dividend transferred in ITR1 Sahaj, exempt income 10(34) section for FY 2017-2018 returns.

2) Also, just for information , can you also pls confirm if it is fine if amount of income earned from long term capital gains is less than 1 lakh by selling shares can be shown under exempt income 10(38) in ITR 1 sahaj form ?.

Thanks.

Request you to pls provide advice for the above queries? Thanks

Sir,

Request you to pls reply on the above two queries ( Also my total income for FY 2017-2018 is less than rs 5 lakhs).

Thanks

Can Capital gains be used to settle / repay Bank Educational Loans, without paying capital gain tax???

Seller and repayer both are same person

No, capital gain can be used for speicified purpose to claim exemption.

1. Either to purchase / construct new property in india

2. Deposit in specified Bonds

no other usage is specified in tax law.

I have bought an Apartment Costing Rs.38.7Lac on April-2017 (Bank Loan-30 lacs and 8.7lac own money) and have another apartment on Feb-18 @ Rs.23.5Lac which was purchase by me in Aug-2012 @ Rs.12 lac.

Please advice impact of reinvestment within 1 year of sale of old property and applicability of LTCG.

Thanks

A new residential house property must be purchased or constructed to claim the exemption.

So you sold a property bought in Aug 2012 at 12 lakh for R 23.5 in Feb 18

CII of the Purchase Year: 2012 month: Aug : 200

CII of the Sale Year: 2018 month: Feb : 272

Purchase Indexed Cost:1632000

Difference between sale and indexed purchase price: 718000

Long Term Capital Gain Tax with indexation (at 20%):143600

You can use the entire Long Term Capital Gain proceeds on sale of a residential house to buy another house property (residential property) to save Capital Gains tax. Below conditions need to be satisfied though;

The new house has to be bought one year before (under-construction property) the transfer of the first house or within two years after the sale. (For an Under construction property or flat , the construction has to be completed within three years of the transfer of the first property.)

The deduction allowed is equal to the actual investment or the capital gain, whichever is lower.

If you plan to use the gain to build a house, it has to be done within three years of the sale of the property. Do note that ‘cost of land’ can be included in the construction cost.

As you bought a new house (in your name, we assume) within 1 year of sale of house i.e in Apr 2017 which 1 year from Feb 18 you can claim deduction under section 54 equal to the actual investment or the capital gain, whichever is lower.

Lower of 38.7 lakh and 143600 is 1.43 lakh which you can claim as the deduction.

Fantastic! Thank you.

I have a questions about residential plot with house purchased in 1969. Since then a new house was constructed on same property in 1978. Several improvements and repairs have been done at various times, prior to 2001 and after.

Now if that property is sold in 2018, how would you calculate LTCG.

Regards

Sir,

My elder brother purchase a tenament in 1974 at Rs. 36000/- and sold on 23-04-2018 at Rs. 1672000/- what is the long capital gain tax and what is CII

Pl. reply

My brother’s age is above 60 years.

Thanks

Pradip Chavan

I HAVE PURCHASE PLOT IN 1DEC,1990 FOR RS.2,51,000 & CONSTRUCTED HOUSE ON IT IN 1DEC 1991, COST OF CONSTRUCTION WAS 4,00,000. HENCE TOTAL COST WAS 6,51,000 IN 1992. NOW IF I SELL IN 1 APR 2018, AT RS. 1,00,00,000. WHAT IS MT CAPITAL GAIN TAX

sir we purchased aflat in february 2015 for 30laks. we sold it on24.4.2018 for42lakhs.please let me know how much i have to invest in bonds to avoid paying incometax.iam a senior citizen reply

Hello,

As you sold on 24 Apr 2018, CII of FY 2018-19 should be used. Which is not available so using the value of last year your long term capital gain is 8 lakh.

If we use the correct value it will be less than 8 lakhs.

Details are given below

Investment Type:Real Estate

Time between :3 years 59 days

Gain Type: Long Term Capital Gain

Difference betweem sale and purchase price: 1200000

CII of the Purchase Year: 2015 month: Feb : 240

CII of the Sale Year: 2018 month: Mar : 272

Purchase Indexed Cost:3400000

Difference betweem sale and indexed purchase price: 800000

Long Term Capital Gain Tax with indexation (at 20%):160000

From 1 Apr 2017 Long term Capital Gain on Real Estate is after 2 years

Sir,

When it comes to capital gains, which date is considered to compute the 3 year period? Allotment/agreement date (OR) registration/possession date?

Also, while computing capital gains, can I subtract the amount paid to the bank in the form of interest for that real-estate asset?

Please let me know. Thanks!

Deduction on home loan interest cannot be claimed when the house is under construction. This pre-construction interest can be claimed only after the construction is finished.

Homeowners can claim the deduction on interest for the home loan only from the year in which the construction of the property is completed

Deductions Allowed under Section 24 for Interest Payments made on Home Loans.

Type of Property Self-Occupied Property Not Self Occupied Property

Completion Status Completed within 3 years Not completed within 3 years Completed within 3 years Not completed within 3 years

Deduction Allowed Rs. 1,50,000 Rs. 30,000 No Limit No Limit

Sir,

I booked an apartment in July 2012 and started paying the installments immediately. The builder delayed the construction a lot and is going to handover the apartment next month (May 2018) only. I am yet to complete the registration and will be doing it this week. I plan on selling the apartment as soon as it’s handed over to me. For the sake of capital gains, will it fall under short-term gain because I register only in April 2018 and sell the apartment in May 2018 or under long-term gain because I got into the agreement with the builder in July 2012 and sell the apartment in May 2018?

The purchase price is 50L and I am going to sell it for 70L. I have already paid 12L to the bank in the form of interest during the wait period. So, will my capital gain be 20L or 8L?

Please let me know

Thanks!

In case, you wish to sell the flat, try to do so before taking possession if the period of 24 months is already over. So don’t register the property.

Capital gains on transfer of property have always been a reason for dispute between taxpayers and authorities. While the Income Tax Act (I-T Act) mentions that the period of holding determines the amount of tax payable, it does not specify from when the period of holding starts. Does it start from the date of allotment or from the day the sale deed is signed or when a property is registered?

The starting date for the holding period also continues to be a matter of litigation because of different rulings from high courts and Income Tax (I-T) tribunals. The most common view, however, is that the date of allotment should be considered for determining the holding period rather than the date of possession.

But the allotment date can come in question, depending on the terms and conditions mentioned in the allotment letter. The seller needs to ensure that the terms of payments and the conditions laid down for sale can help him defend his position in front of tax authorities.

As it is house property you can use indexation to reduce your costs.

As indexation for 2018-19 is not available calculations are based on last year indexation.

Your gain would be more if FY2018-19 indexation will be considered.

The time between purchase and sale is more than 2 years

Gain Type: Long Term Capital Gain

Difference between sale and purchase price: 2000000

CII of the Purchase Year: 2012 month: Jul : 200

CII of the Sale Year: 2017 month: Mar : 264

Purchase Indexed Cost:6600000

Difference between sale and indexed purchase price: 400000( 4 lakhs only)

Long Term Capital Gain Tax with indexation (at 20%):80000

Myself and my wife jointly purchased a site for Rs. 3 Lakhs in the year 2005 and sold the site for 30 Lakhs in October 2017. We divided the sale consideration into 15 Lakhs each.

We both, jointly own one house where we are living now.

My wife wants to construct another house in her name alone in a site given by her grand father. This construction will start in June 2018.

Can she invest her share of 15 Lakhs in the new house and avoid LTCG (we already own one house jointly)?

Can I invest my share of 15 Lakhs also in her new house and avoid LTCG?

Exemptions from your Gains that Save Tax on Sale of Land

Section 54F (applicable in case its a long term capital asset)

If you are using your entire sale proceeds to buy a house property you may end up paying no tax on your gains when – You satisfy all these conditions

(a) You purchase ONE house within 1 yr before the date of transfer or 2 yrs after or construct ONE house within 3 yrs after the date of transfer.

(b) You do not sell this house within 3 yrs of purchase or construction

(c) This new house purchased or constructed must be situated in India

(d) You should not own more than 1 residential house (other than the new one) on the date of transfer

(e) You do not purchase within a period of 2 yrs after such date or construct within a period of 3 years after such date any residential house (other than the new one).

When you satisfy these conditions and invest entire sale proceeds towards the new house – you won’t pay any tax on your gains. However, if you invest a portion of the sale proceeds, the exemption will be the proportion of the invested amount to the sale price or exemption = cost of new house x capital gains/net consideration.

If you want to save your Long Term Capital Gain, you should be co-owner of the house.

Hi Team my father purchased a plot in 1999 at price of 1 lakh Rs and constructed a house in 2011-12 at cost of 12 lakhs.

Now we are planning to sell it at cost of 1 crore . So how much capital gain tax will be applicable.?

Will construction cost included in cost of aquistion? If yes what are all proofs we have to submit for construction cost?

Note: My father also own another property where we are currently living, will this affect us if we plan to purchase another property to save the tax.?

Dear Sir

I am planning to buy a property ( Land) which is planned to be brought at 22.5 lakhs and the seller who is selling it to me brought it for 7.0 lakhs 2 years back. what will be the tax that the seller has to pay as short term capital gain.

From FY 2017-18 onwards ie 1 Apr 2017 The criteria of 36 months has been reduced to 24 months in the case of immovable property being land, building, and house property.

So the seller will have to check long term capital gains and he can use indexation

A small house property sold, and as a legal hair I have received my share of Rs 2.4 lakh in July’17. How to calculate Capital Gain Tax on it, and if I invest this entire amount in another house property in the year 2018-19 can I skip paying capital gain tax in March’18.

Kindly advice.

To find capital gain you need to find the purchase price.

As you have inherited it you will have to use the purchase price of the buyer.

Use that to calculate the capital gains.

The LTCG shall be computed as the difference between net sale proceeds and indexation cost of acquisition. For indexation, the cost of acquisition should be adjusted by applying the cost inflation index (CII). CII for 1981-82 and the financial year in which Shobhana sells the property will be considered.

The year of inheritance has no importance in the calculation of long-term capital gains. You can also add the costs incurred with respect to procedures associated with the will and obtaining succession certificate, costs of executor, property valuer etc. while computing the cost of acquisition.

Cost of the property – The property did not cost anything to the inheritor, but for calculation of capital gain the cost to the previous owner is considered as the cost of acquisition of the Property.

Indexation of cost – Additionally, the year of acquisition of the previous owner is considered for the purpose of indexation of the cost of acquisition.

For example – Mr Arora purchased a property on 1st August 2004 for Rs 75lakhs.

Neha inherited this property from her father in 2012, however she decides to sell this house.

In Jan 2018, Neha sold this house for Rs 1.8 crores.

In this case, cost for calculating Neha’s gain shall be Rs 75lakhs and the cost shall be indexed since it’s a long term capital gain.

For the purpose of indexation, the CII for 2004-05 shall be considered. Therefore cost for calculating capital gains for Neha shall be Rs 75lakhs x CII of 2017-18/CII of 2004-05 = 75lakhs x 272/113 = Rs 18053097.

She sold for 1.8 crore

Therefore net loss for Neha is Rs 53097

If there would have been profit then one may

have to either pay tax on it at the rate of 20%

or save capital gains tax by buying specified bonds u/s 54EC

or buy a new residential house property must be purchased or constructed to claim the exemption.

The property must only be bought in the name of the seller of property and not on anybody else’s name.

Only ONE house property can be purchased or constructed.

Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption will not be available for properties bought or constructed outside India.

The new residential property must be purchased

either 1 year before the sale or

2 years after the sale of the property/asset.

Or the new residential house property must be constructed within 3 years of sale of the property

If you do not want to buy another property then you can save capital gain tax by investing in Capital Gains Account Scheme, 1988 before the date of tax filing or 1 year from the date of sale, whichever is earlier.

Sir,

I had bought a land in May 1994 for 2lakhs

Constructed home on Nov 2001 for 8lakhs

Now sold it for 70lakhs on Mar 2018.

Meanwhile there is a mortgage loan on it for 20lakhs

What will be my LTCG and will 20lakhs be reduced from sale cost.

Please reply.

Thankyou.

Sir,

I had bought a land in May 1994 for 2lakhs

Constructed home on Nov 2001 for 8lakhs

Now planning to sell it for 70lakhs.

Meanwhile there is a mortgage loan on it for 20lakhs

What will be my LTCG and will 20lakhs be reduced from sale cost.

Please reply.

Thankyou.

If i have purchased a land for 2 lakh in May, 1994 and the construction cost is 8lakh in Nov, 2001. if it is sold for 70lakh in Mar,2018. Then what is the LTCG.

I have an outstanding Mortgage loan of 20Lakh. Will this 20 lakh come under exemption.

Can i use the sale proceeds to pay any personal loan. Will that be reduced from LTCG?

Sir,

Bought property though builder Land plus cost of construction total 10.5 lac. This excludes interest charge paid to bank on Rs 6lakh loan for this. Got possession in 2012-13. Want to sell in 2017-18.Getting price Rs 14.5 lac only. Appears long term capital gain is in minus I. e., loss. Please let me know my tax liability and whether due to this loss my other tax liability gets adjusted by the loss amount. Request your reply at your earliest.

Thanks.

When is your purchase date?

If we put it between 1 Apr 2012-31 Mar 2013 then calculations are as follows

CII of the Purchase Year: 2012 month: Apr : 200

CII of the Sale Year: 2018 month: Mar : 272

Purchase Indexed Cost:1428000

Difference between sale and indexed purchase price: 22000

Long Term Capital Gain Tax with indexation (at 20%):4400

If you have capital loss then

Loss from the transfer of a Long-term Capital Asset can be set off against gain from transfer of any other long-term Capital Asset in the same year.

If there is still loss it can be carried forward for eight assessment years and set off in subsequent years.

Dear Sir,

Thanks for reply. I paid Rs.3.5 lac for land and Rs. 1 lac further to builder in financial year 2011-12 and another Rs.6 lac through Bank loan, this amount paid by Bank in financial year 2012-13.Please let me know my capital gain or loss. Looking forward for your kind reply please. Please additionaly let me know if sale takes place in 2018-19 what is the capital gain / loss. Thanks.

Ashok Johari

Sir awaiting your reply to my previous query.

Regards

Ashok Johari

Assuming you sell in FY 2017-18

Purchase price would include

price of land (registration cost + purchase price). Indexation of the year it happened. So for FY 2011-2012 using indexation of 184 Indexed cost of 4.5 lakhs is 6,65,217

Construction cost – Use indexation of the year the house got completed.

In FY 2012-13 Indexation was 200 so 6 lakhs becomes 816000

Total indexed cost of construction = 1481217

If you sell for more than that it is capital gain else it is a capital loss.

If you sell in FY 2018-19 the indexation cost of purchase would become more.

Dear Sir

Awaiting your kind reply please.

Regards

Ashok Johari

I bought a property in FY 2009-10 for Rs. 10,00,000 and sold it for Rs. 30,00,000 in FY 2017-18. Also, I booked another under construction property for Rs. 35,00,000 in FY 2014-15, but got possession only in FY 2017-18. Is capital gain tax applicable? If yes what would be the amount of tax payable?

I purchased a property for Rs. 10,00,000 in FY 2009-10 and sold it for Rs. 25,00,000 in FY 2016-17. Also, in FY 2014-15 I booked a underconstruction property for Rs. 35,00,000, whose possession I got only in FY 2016-17. What will be amount of LTCG tax applicable to me? Can I claim any exemption?

Plot purchased April 1991 for Rs. 50000 and sold February 2018 for 28.75 lakhs. Please calculate capital gain. I intend to purchase another property but not sure when I may find one, please advice what amount I must invest in Capital gains account scheme immediately to avoid CG tax and whether I can withdraw it for property purchase when necessary.

I bought Resedanancial plot in 1980 by cost 35000/- rs. I sell in 2018 by cost 1400000 . Pls send calculate capital gain

For properties purchased before 1 Apr 2001, the latest cost inflation numbers start from 1 Apr 2001, one needs to first arrive at what is commonly known as Fair Market Value (FMV) of the property as on April 1st, 2001. FMV answers the question as to What would the property purchased in say 1997 be worth on 1 April 2001? Calculating the capital gain based on any arbitrary FMV can land an assessee in trouble if the assessing officer (AO) has a different opinion or doubt over the declared value.

Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 explains Fair Market Value in detail.

I had purchased a Flat in Apr 2016 and now i wanted to sale this property and buy commercial property.

Purchased price 635000 -(Including 20 L Housing Loan)

Selling Price 8000000.

How this can be achieve with minimum tax? How do i get exemption in tax?

I had purchased a new constructed property in July 2016 valued at 60 Lacs.

Later, my old property which was earlier purchased in May 2012 at 17.5 Lacs was sold at 65 Lacs on Nov 2017.

Please help me understand the amount that I need to invest in capital gain bonds. I had planned to repay the home loan on new property.

Please suggest.

CII of the Purchase Year: 2012 month: May : 200

CII of the Sale Year: 2017 month: Nov : 272

Purchase Indexed Cost:2380000

Long Term Capital Gain: 41,20,000

How much is exempt: Investment in the new asset or capital gain whichever is lower or pay tax of 8,24,000.

Long Term Capital Tax with indexation (at 20%):8,24,000

The LTCG could be claimed exempt from tax if the gain(41.2 lakhs) is re-invested the purchase of capital bonds within 6 months from the sale of the property).

So you have to either invest 41.2 lakhs in Capital bonds or pay tax of 8,24,000.

If you would have purchased property within 1 year backward of sale(from Nov 2016) or 2 years forward or constructed one within 3 years then you would not have to pay capital gain.

Paying home loan is not related to capital gain.

Hi –

For RSU which are vested and sold in USD, how do we calculate the purchase price? How to we calculate the correct INR value ?

Its best to ask your employer most of the companies have information about it.

It is considered as perquisite income and will be part of your Form 16, Form 12 BA actually.

The images show a sample image of the purchase value of stocks received in USD and Form 12BA. More details about RSU given below

Form 12BA showing it as perquisite income

Long-term Capital Gain on Unlisted Shares in India/Foreign Company Shares:

In case of unlisted shares/ Foreign company Shares the long term capital gain on sale of share (held for more than 24 months from FY 2016-17) is taxable at the rate of 20%.

On vesting of RSUs, an income equivalent to the difference between the acquisition price and actual price of the shares is deemed to be perquisite income earned by you.

For RSUs, the acquisition price is zero (since RSUs are given for free) and so the entire market value of vested shares is treated as income.

On sale: On sale of the shares, the profit earned is a capital gain , and is therefore taxable as such. For RSUs, the difference between the vesting price and the sale price qualifies as capital gains. For ESOPs, the difference between the market price (not exercise price) at the time of exercise and the sale price qualifies as capital gains. For ESPPs, the difference between the market price (not discounted price) at the time of purchase and the sale price qualifies as capital gains. Depending on the time duration between the acquisition date and the sale date, the profit can either qualify for short-term or long-term capital gains tax. For RSUs, the acquisition date is the vesting date and not the grant date

On vesting: When RSUs, the market value of the shares vested (number of shares vested x current share price) is added to your taxable income as perquisites. This will be declared in your Form 12BA for the year (given along with Form 16). Since there is an income deemed to be earned by you, there will also be a corresponding tax due to you (apart from the tax deducted on your salary).

The broking site where the RSUs are held (such as Etrade in case of foreign shares) will give three options to pay this additional tax due:

a) Sell-to-cover: This is the default option where 33% of the vested shares are sold immediately and the amount is paid to the government as tax. As a result no additional tax is needed to be deducted from your salary income. The remaining 67% of the vested shares remain in your account and you can sell them at a future date when the share price is higher.

b) Same day sale: Here all the vested RSUs are sold immediately. 33% of the sale proceeds are deducted and paid as tax to the government and the rest to you as income from the sale. No shares are left over after this.

c) Cash exercise: Here no shares are sold by the broker. Instead, the company will deduct an additional tax from your salary to account for this extra income, and the same will be part of your total tax deducted for the year and shown in your Form 16.

All vested shares will remain in your account as is. With same-day sale option, you lose out on future share price gains since all shares are sold immediately.

With cash exercise, there is a risk because you pay tax from your pocket based on the market value at the time of grant, but if the share value tanks significantly by the time you sell it, then you may potentially not even recover the amount paid as tax!

Sell-to-cover is therefore the default option and also the safest one, because the tax is settled without you having to pay anything, while the remaining shares remain in your account to be sold at a future date

For foreign shares, if the foreign country where the shares are listed has a Double Taxation Avoidance Agreement (DTAA) with India, then the tax generated from selling the shares abroad will be transferred to the Indian government by the host country. However, for the tax collected by selling foreign shares to be transferred automatically to the Indian government, you will likely need to submit a country-specific declaration to the foreign broker that you are not a resident of that country (in case of US shares, the respective form is W8-BEN ). If this declaration is not submitted, the tax deducted abroad will not be reflected in your Form 16 and you may need to pay the same tax again from your pocket, resulting in double taxation . – On sale: Based on the time duration between vesting and sale, either short-term or long-term capital gain will apply. This capital gain must be declared in Schedule CG of ITR-2 or ITR-4 so that tax may be suitably charged.

Hi,

My query about ancestral property to which I’m the only heir. The property deed was registered on June, 1987 with a value Rs 30000/- and is expected to fetch a price more than 1.7 crores. I’m planning to sell it in 2018 and go for my further studies abroad as soon as possible.

I would like to know how to calculate long term capital gains as there is a new set of cii now?

I’m aware that there is an 18% surcharge on LTCG after 1crore. But I don’t know whether it will be for example on 34 lakhs (20 + 14) or only on 14 lakhs (after 1crore). Could you please clarify this?

I guess since I will be leaving the country, I won’t able to get 2 years relaxation on paying the tax. Am I correct?

I will need around 1 crore for my expenses. Is there any smart way to manage my taxes?

I purchased a Plot in the year October, 1985 and I sold in the year August,2017. For the purpose of calculating LTCG of the Plot sold, I intend to take valuation as Fixed by State Govt. for Registration of Plots which will be obtained from the Sub-Registrar’s Office ( for Registration of Lands ) as on 01-04-2001 ( F.Y 2001-02 ). My query is whether the Cost of Registration, stamp duty etc that are payable at the time of Registration ( as the Govt value is excluding the Registration etc Charges ) CAN BE ADDED to the ‘ COST of LAND ‘ as provided by The Sub-Registrar as on 01-04-2001 ie., F.Y 2001-02. Please clarify.

The expenditure incurred on the stamp duty and registration charges form part of the cost of the land.

In case, however, a deduction is claimed under Section 80C of the Act in respect thereof, it may not be possible to get a double deduction.

I have sold a property on Jan 24 2018 for 22,50,000. This was purchased on Aug 18, 2004 for 5,60,000. I spent another 1,50,000 on furnishing in 2004-2005. I incurred about 75,000 as maintenance cost over these year. While I have considered 7,10,000 spent in 2004-2005, how do I incorporate the maintenance cost when calculating the capital gain.

i have sold commercial property recently. can i get an exemption benefit by buying residential property?

The type of property you have transacted into also impact the taxation aspects.

Section 54 provisions apply to the residential property,

section 54F to non-residential and

54EC to all kind of properties

Section 54F: This section is meant for long-term capital gains from sale of property other than Residential. Plot/Land, the commercial property comes under this. As per section 54F, you can save capital gains tax on sale of property (non-residential) using following provisions:

a) You have to invest the complete sale proceeds in a residential property. Unlike as in section 54 where you have to invest only Capital gain amount.

b) If you don’t invest complete proceeds then you will get an exemption on prorate basis, with the calculation as Amount invested*Long term Capital gains/Net consideration

c) You can invest in any manner given below.

a) You can buy the new residential property in next 2 years from the date of sale of existing property.

b) You can construct a new residential house in next 3 years from the date of sale of existing property.

c) You may also buy any residential property even before 1 year from the date of sale of existing property.

d) If you need some time to buy the new house property, then you have to deposit the Capital gain amount into Capital Gain Account Scheme.

Sir, I had purchased a shop in a mall in Rohini NEW Delhi, for a cost of Rs 16 Lacs in FY 2011-12 (AY 2012-13). Recently I have sold the same for Rs 23.50 Lacs.While calculating the Capital Tax Gain for the FY2017-18 (2018-19),after going through various sites on internet, a confusion has arisen if the capital gain has to be invested in 54EC bonds or the entire sale proceeds have to be invested in the said bonds to save tax. Please guide, how I should take action,to save Tax liability.

.

I had purchase property 2007 for 6,25000 and sold jan 2018 for 18,30,000 . hoe capital

gain be calculated?

Sir

Suppose i sell two story house with 9 cent plot which is inherited, for 25 lakhs, what will be the tax i have to pay?

Please help me to calculate the Capital Gain for the residential property purchase for Rs 7764075/- on 29th Dec 2100 and sold on 4th Aug 2017 for Rs 1.56 Cr.

Kindly let me know what wud be the capital gain and what would be the alternative for the taxes.

When did you buy the property 2001 or 2010 or ???

If you bought in 2001 you have a capital loss of 1103656.8.

If you bought in 2010 then details are as follows:

CII of the Purchase Year: 2010 month: Dec : 167

CII of the Sale Year: 2017 month: Aug : 272

Purchase Indexed Cost:12645679.04

Difference between sale and indexed purchase price: 2954320.96

Long Term Capital Gain Tax with indexation (at 20%):590864.19

So you had profit of around 29 lakhs(2954320.96)and long term capital gains is around 6 lakhs(590864.19)

You can save this tax by investing claiming Exemption under Section 54.

Requirements for saving the tax are as follows

A new residential house property must be purchased or constructed to claim the exemption

The new residential property must be purchased either 1 year before the sale or 2 years after the sale of the property/asset.

Or the new residential house property must be constructed within 3 years of sale of the property/asset

If you are not able to invest the specified amount in the manner stated above before the date of tax filing or 1 year from the date of sale, whichever is earlier, deposit the specified amount in a public sector bank (or other banks as per the Capital Gains Account Scheme, 1988).

Only ONE house property can be purchased or constructed.

Starting FY 2014-15 it is mandatory that this new residential property must be situated in India. The exemption shall not be available for properties bought or constructed outside India to claim this exemption.

Thanks for your kind reply. I have purchased the property on 2010.

So it means the capital gain is coming Rs 2954320.96

If I do not purchase the property can i invest in bonds i.e. REC or NHAI whether it would be beneficial what are the terms for the same that is ROI and Locking Period. Please advice or let me know your number ?

Thanks

Kamal Gulati

9718361928

I have a Apartment which I registered in April 2009 and got the possession in Oct 2011, now I am selling the same in Jan 2018, but on that property I’ll get capital gain of 20 Lakhs, in Feb 2015 I registered another Apartment which is still under construction and possession is likely in May 2018, for this new apartment I have a home loan, so my question is that, can I use Capital gain from old property to pay my Home loan of the under construction property registered in Feb 2015. Kindly suggest

I sold my property in Noida in July 2017. If I keep the capital gains amount in Capital Gains Accounts scheme for 2/3 years and am not able to purchase any property during this period what will be my tax liability? Will it be @ 20% or at higher rate and is there any penalty/interest etc payable at the end of the fixed period of 2/3 years. My second question is by which date I am required to deposit the capital gains in the CGAS ? I have already invested Rs.50 lakhs in NHAI bonds . Grateful for your advice.

Thanks.

My Grandfather got a plot in Jammu after partition of India & Pakistan in Jammu & sold in 2015. How I could calculate capital gain.

Thank you for the excellent article.

In case of property, that is booked in May 2007, booking registered in July 2007, construction-linked installments paid till Nov 2011, possession taken in May 2012 and registered in Nov 2012, what is the date of purchase for calculating LTCG ?

Regards

Thank you vry much.Capital Gain/Tax Calculator is vry helpful..But I have a querry- How to Calculate Capital Gains/Tax for AY 2018-19 if a residential Plot is sold in Dec 2017 , which was purchased in Feb 2000..What will be the CII applicable in this case..?

Thanks for the encouraging words.

From 1 Apr 2017 the new CII will be applicable.

For the purposes of calculating capital gains on such properties, you have to know the fair market value (FMV) of a property in 2001.

According to the Income-tax Act, 1961, fair market value is the price that the capital asset would ordinarily sell in the open market on the relevant date.

According to the Income-tax Act, 1961, FMV shall be the higher of

—cost of acquisition of the property, or

—the price that the property shall ordinarily sell for if sold in the open market.

However, “There is no fixed formula to calculate FMV of a property. The technique most widely used to estimate FMV is to look at the sale instances of similar properties in the same neighbourhood. The other option is to look at circle rates

Most experts believe that sellers should take help of a registered property valuer, rather than arbitrarily deciding the FMV of the property. “Assumptions of any type for consideration of value shall not be entertained by the income tax department. In case of any enquiry, the department will consider the value stated in the valuation report from a registered valuer

Government-approved valuers follow a standard process for the valuation and provide a detailed report. In addition to other parameters “to derive at the FMV of a property, a valuer also considers area and dimensions of the property, is it freehold or leasehold, is there any restrictive covenant in regard to use of such property, insurance of the land and property, if the land falls under any development plan of the government

Each valuer is provided with a license from the department to work as a valuer. Fee and charges that a valuer can charge are also prescribed under the Act, and depend on the value of an asset. For instance, for first the Rs5 lakh of asset value, fee would be 0.50% of the value. For next Rs10 lakh, it would be 0.20%, for next Rs40 lakh 0.10% and 0.05% of the value thereafter. “Typically, a valuer takes 3 to 4 days to prepare a valuation report,” said Bansal. In case and AO raises any doubt over the report “it is our (valuer) responsibility to reply, and if needed , the valuer can even visit the AO for clarification on the report,”

An assessee should keep the valuation report along with other documents related to capital gains, for at least 8 years after the relevant assessment year.

If property purchased in FY 1998-1999 and sold in 2017-18, how capital gain be calculated?