Banks and institutions that provide loans always come up with new ways and forms that help meet the needs of several home buyers. However, before you apply for a home loan, you should have an understanding of the most important aspect of the loan – the Equated Monthly Instalments (EMIs). You need to calculate your EMI beforehand in order to prepare yourself for the future.

What is an EMI?

In simple financial terms, EMI is the money paid by a borrower, every month to a lender in order to clear off the outstanding debt. It also means that a certain sum of money would be deducted every month from your account. However, since the borrower is aware of the amount that needs to be paid every month, it makes personal budgeting easier for them.

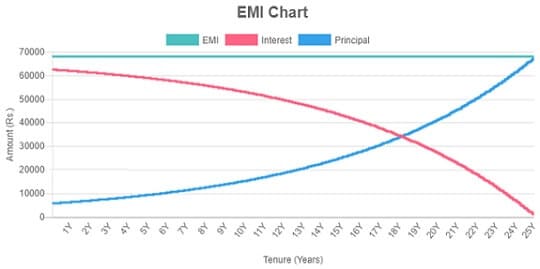

Understanding EMI Break-up

When it comes to calculating the sum that is payable, your EMI is deducted based on a combination of the principal and interest amount that is unequal. So, in the initial years, a major part of your EMI will comprise of the interest that is payable. However, once the loan matures and as you gradually pay off the interest, the outstanding loan amount will reduce. Therefore, the interest becomes lower than your principal amount till finally, it becomes minimal. The EMI however, remains constant.

The EMI however, will remain constant each month except in cases like

You pay a lump sum amount of the loan. In this case, the amount will get adjusted against your remaining balance, reducing your EMI. However, you will get an option to either maintain the EMI amount, while you reduce the loan tenure. But, if you have opted for the floating rate of interest, then, in this case, the EMI will vary according to market conditions.

Three Major Factors that Determine Your EMI

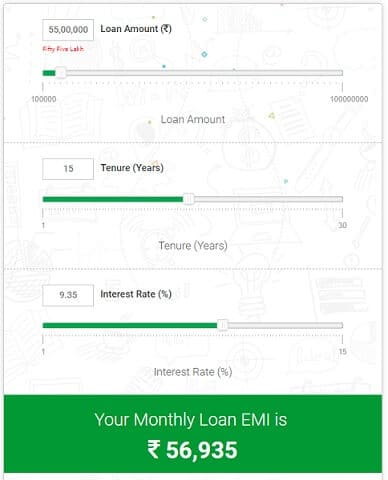

There are three major factors that would determine your EMI. They are as follows:

Principal Amount: The principal amount is one of the major factors that determine the EMI that you have to pay towards your loan. It refers to the actual sum of money that you have borrowed.

Rate of Interest: The rate of interest is another major factor when it comes to your EMI. It is the rate at which you have borrowed the money from a bank or organization. It’s important to keep in mind that the higher the interest rate, greater will be the EMI that you have to pay. Hence, it is always advisable to do your research of the rates offered by different lending organizations before you chose one.

Loan Tenure: This refers to the duration or time period for which the loan is taken. So, if the duration period is longer, the monthly EMI will be less.

Ways to Calculate EMI

The different ways to calculate EMI plays a very crucial role when it comes to determining the EMI you have to pay. The various ways and methods used are as follows:

Annual Reducing Method: In this method, the principal amount and the interest rate is calculated at the end of the year, even though you pay the EMI at the end of every month. This kind of EMI calculation is a big disadvantage, as you still continue to pay the interest on a part of the principal amount that has already been paid.

Monthly Reducing Loans: This is one of the most common as well as an easy method to calculate your EMIs. In this method, there will be a reduction in the principal amount when you pay the EMI every month. Also, the interest will be calculated on the outstanding balance.

Daily Reducing Loans: This method is not a very feasible and popular option. In this method, the principal amount reduces every day when you make repayments daily. Here, the interest is charged on your outstanding balance.

Related Articles:

- Home Loan Transfer : Should I Switch My Home Loan?

- Terms associated with Home Loan

- How EMI Calculators Help You save Money

Hence, EMI calculation plays a very important role when it comes to planning your finances. You can also make use of a home loan EMI calculator which is easily available on many websites to get a better understanding of EMIs and the best way to calculate, before signing up for it.