How do I buy the stock? asked my reader after opening a demat account. One should invest in equities as money grows in the stock market, we hear. With offers of account and seeing peers investing in the stock market, you decide to invest in the stock market. After your research (the fundamental analysis, technical analysis), You have zeroed on the stock/scrip to buy. Now comes the process of actually buying the stock. How do you go about buying a stock? Earlier you could call a broker with instructions but now with online demat account opening and easy to use platforms online, everything is just a click away. In this article, we shall focus on owning the stocks which would be deposited or delivered to your Demat Account, so you can hold them for as long as you want.

- When can one buy the stocks i.e. what are the stock market timings?

- What kind of stock buying to do: Delivery, Intraday Trading, Short Sell, Buy Today Sell Tomorrow (BTST), Sell Today Buy Tomorrow (STBT) etc.

- Which Exchange(BSE, NSE) to buy/sell from?

- What kind of order to give: Limit Order, Market Order, Stop-Loss Order

Table of Contents

Stock Market Timings

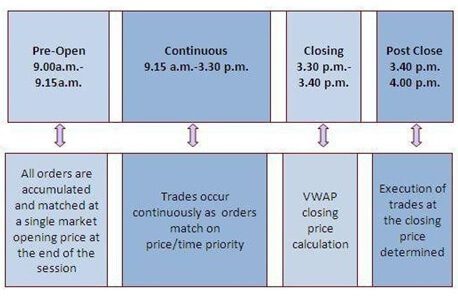

The first thing one needs to understand is the stock market timings. The stock market is open from 9:15 am to 3:30 PM from Monday to Friday with no tea/lunch break. The timings of the Indian stock market are divided into the following sessions as shown in the image below

- Pre-opening session: 9 to 9:15 am

- Normal session (also called continuous session): 9:15 am to 3:30 pm

- Closing Session: 3:30 pm to 3:40 pm

- Post-closing session: 3:40 p.m. to 4 pm

The Indian stock market is closed on Saturday and Sunday as well as on National Holidays and other Holidays. These holidays are declared at the beginning of the year.

The Indian stock market also opens a special trading session, called Muhurat Trading, during Diwali, the festival of light.

Buy Stock: Delivery or Intraday

Trading strategies are methods that traders use to determine when to buy and sell stocks in the financial markets. Strategies may be based on technical analysis, fundamental analysis, quantitative methods, or a combination of decision factors.

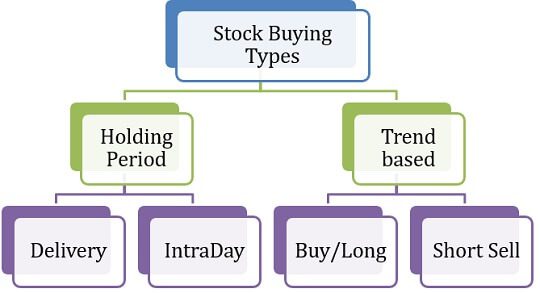

There are various ways of buying stocks such as Delivery, Intraday Trading, Short sell, Buy Today Sell Tomorrow (BTST), Sell Today Buy Tomorrow (STBT). The style can be broadly classified into many categories such as Holding period – Delivery/Intra Day or Trends:

In Delivery, one gets stocks delivered in the demat account. Buyer can hold the stocks for as long as he wants. Say, Samay buys shares today and he wants to sell them after some time (which can be 1 day or 1 week or 1 month or 1 year or 10 years). This type of trading is called delivery trading or positional trading or swing trading. For delivery, the product type that you to need to use while placing the order is called Cash & Carry or CNC

Intraday: Every day the price of a stock, fluctuates. To capitalize on short-term price fluctuations often people buy or sell the same stock in the same day i.e. intraday. In such situations, the stocks never come into the demat account as they are settled during the day. A Transaction is initiated and reversed during the day so that there is no outstanding of any kind for the next day, this is called Intraday trading.

Which Exchange to buy stock in BSE/NSE?

Some shares are not listed on both the exchanges BSE and NSE. For example, SpiceJet is listed only on BSE. For such stock then you can buy them only from the exchange where it is traded. To get listed on an exchange, the stock during IPO needs to pay listing fees. Most of the stocks are listed on both the exchanges.

If the stock is listed on both the exchanges, then

- In Intraday If you have purchased shares in day trading session, then you have to sell such shares in the stock exchange from where you have purchased.

- But for delivery Once you have the shares in your Demat account, you can sell them on an exchange of your choice. You could have bought your stock on BSE and sell it on NSE or vice versa.

The brokerage charged by the broker, the Securities Transaction Tax are all the same on either of the exchanges.

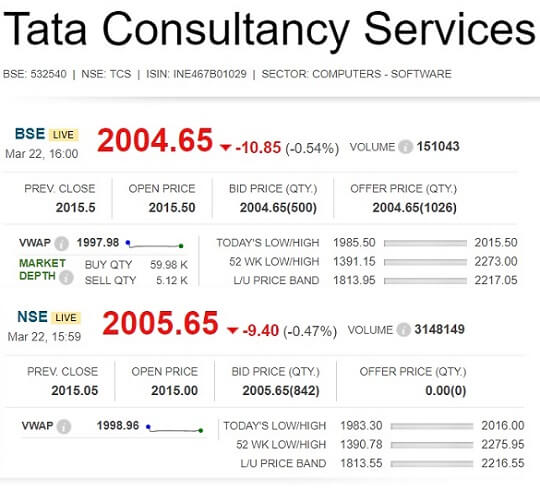

But you may find some price difference between BSE and NSE for the same share, as shown in the image below. It is like two shops selling the same thing, but it may not be at the same price. The price of the same company is different in both BSE and NSE because the supply-demand mechanics of both exchanges are different. The difference in price, however, is not too much. Typically buy from the exchange where it is lesser in cost and sell where is it highest.

The volumes of shares are usually higher on the NSE, so if you have big quantities to sell the NSE could be a better idea.

What type of order to place: Market Order, Limit Order and Stop Order

A stock order is nothing but an instruction to buy or sell shares and are of following types: Market Order, Limit Order and Stop Order.

- Market orders are transactions to be executed as quickly as possible at the present or market price.

- A limit order is the maximum or minimum price at which you are willing to buy or sell.

- Stop-loss is an advance order to sell/buy an asset when it reaches a particular price. It is used to limit loss or gain in a trade. For example, if you have bought 1 share of TCS at Rs. 1,150, and you analysed that stock price of TCS will fall. So, you enterstop-loss order at Rs. 1,120. If TCS share price falls to Rs. 1,120, a sell stop loss order will get triggered, which limits your loss on account of purchase to Rs. 30.

Settlement Cycle

You have bought the shares, but they would be credited into your account 2 days after the trade. Similarly, on selling shares you would get money 2 days after the trade. All equity/stock settlements in India happen on a T+2 basis

- The day you make a transaction, it is called the trade date, represented as ‘T Day’

- The broker is required to issue you a contract note for all the transactions carried out by end of T day

- When you buy a share, the same will be reflected in your DEMAT account by end of T+2 day

- When you sell shares, the shares are blocked immediately, and the sale proceeds credited again on T +2 day

Related Articles:

All About Stocks, Equities, Stock Market, Investing in Stock Market

Hope this article helped you to get an understanding of how to buy a stock? Which was the first stock did you buy? Did you make money on the stock? What should a new investor in stocks be careful about?

5 responses to “How to buy Stock: Delivery or Intraday,Market or Limit,T+2”

This is a very unique blog that provides information on the stock market in India. I am sure your blog will help us to make good investment decisions.

Very Informative.

I have two queries regarding stop loss order.

1. Is stop loss order possible in delivery mode trading?

Example, I have bought 100 Stock of ABC company at the price of Rs. 10 few months back, now price stock price went down to 5 Rs. I will expect price will go high up to 7 Rs in few weeks. To avoid miminum loss, can i place stop loss sell order 7 Rs?

2. How intraday stop loss sell order with a example ? Example im planning to buy some ABC companies stock at 20, and sell by 25, and stop loss sell by 15. How many orders i have to place to this?

Very useful for my kind of beginner in shares.

Informative.