Many of us take a life insurance policy because it offers guaranteed returns. Some part of the returns comes from bonuses declared by the insurance companies. This article explains What is the bonus?Who gets the bonus? What are different types of bonus?How are they generated? When is bonus paid? What happens to bonus if I surrender my policy or make it paid up?How to find about bonus for my policy?

Table of Contents

What is Bonus?

When Life Insurance companies make profits and share the profits with their policyholders they do so by calling it a Bonus.

Does every policy holder of life insurance gets bonus ?

Typically No. Bonus is not shared with every customer or every policyholder. It is only paid to customers who have bought a Participating Insurance Policy such as traditional insurance policies like the endowment policy, whole life insurance policy and money back plan. Each type of Traditional Policy has 2 versions, namely the Participating Insurance Policy and Non-participating Insurance Policy.

The key features of Participating policies are:

- It will participate in the profits of the insurance company i.e It pays bonus to policy holders

- The percentage of bonus that is paid to the policyholder is not fixed.

- The premiums for participating policy are higher than the non-participating policy for a similar coverage and same customer criteria

What are the different types of bonuses given out ?

Most popular are the Reversionary bonuses. Features of these bonuses are :

- They are declared as a percentage rate, which applies to the sum assured of the policy, in respect of the basic policy benefit.

- Once declared, they form a part of the guaranteed benefits of the policy.

- These are and paid at the end of maturity period only or on death, whichever is earlier.

Reversionary bonus are of following kinds:

- Simple reversionary bonus

- Compound reversionary bonus

- Special reversionary bonus

Other kinds of bonus are :

Terminal bonus or Final additional bonus : Terminal bonus is paid at maturity or at the time of claim. After declaring reversionary bonuses if there are still residual profits available in the policy, they are declared as terminal bonus.

Loyalty addition (LA) :This is one time payment which will be given only after completion of certain period

Guaranteed Addition (GA)-In few plans bonus is guaranteed where life insurance company is obliged to pay fixed amount of bonus till the agreed period, called as Guaranteed Addition. Ex LIC’s Komal Jeevan and Jeevan Shree-1.

What is Simple reversionary bonus ?

Simple reversionary bonus is a with profits life assurance bonus, normally declared annually, which is based on the profits of the life company’s investment and is payable at the maturity of the policy or prior death. Simple reversionary bonuses are declared as a percentage rate, calculated on the sum assured. For example if you hold a policy of Rs 10,00,000 Sum assured and the simple reversionary bonus for the year declared is Rs 60 per thousand sum assured, then your bonus amount is Rs 60 * 10,00,000/1,000 which is Rs 60,000 for this year, but you will only get it at maturity or on death.

What is Compound reversionary bonus? How is it different from simple reversionary bonus?

Compound reversionary bonuses also declared as a percentage rate like simple reversionary bonus but they are applied to sum assured and to the reversionary bonuses already attached to the policy. The difference is in the way the bonuses are accrued. For example a compound reversionary bonus of 4% for a sum assured of Rs 1 lakh cumulative accumulated bonus amount over a 15 year term will be

| Year | Sum Assured (SA) | Cumulative SA incl. bonus accumulation | Bonus amount (Rs) for the year | Bonus amount forSimple | Cummlative SA incl. bonusfor simple reversionary bonus |

| Year 1 | 100,000 | 1,00,000 | 4,000 | 4,000 | 100,000 |

| Year 2 | 100,000 | 1,04,000 | 4,160 | 4,000 | 104,000 |

| Year 3 | 100,000 | 1,08,160 | 4,326 | 4,000 | 108,000 |

| Year 4 | 100,000 | 1,12,486 | 4,499 | 4,000 | 112,000 |

| Year 5 | 100,000 | 1,16,986 | 4,679 | 4,000 | 116,000 |

| Year 10 | 100,000 | 1,42,331 | 5,693 | 4,000 | 140,000 |

| Year 15 | 100,000 | 1,73,168 | 6,927 | 4,000 | 160,000 |

What is Special reversionary bonus or One time bonus?

During the term of the policy, if there are some profits arising due to a one-off reason, and the same profits are not expected to repeat again, this profit is passed on to policyholders as a one-time bonus which is called as special reversionary bonus. This bonus is declared immediately but paid at the time of claim or maturity.

For example to coincide with its fiftieth anniversary, the insurance mammoth, Life Insurance Corporation of India (LIC) announced a special bonus for its policyholders on September 2005. Apart from the special bonus, the corporation announced a final additional bonus for its policyholders. Ref: Policyhaat

What is terminal bonus or Final addition bonus ?

The terminal bonus is given at the end of the life of traditional policies. Its value is not guaranteed and it is different from the reversionary bonus, which is paid out annually by insurers. After declaring reversionary bonuses if there are still residual profits available in the policy, they are declared as terminal bonus.

What is Loyalty addition?

Loyalty addition is the incentives given by an insurer as an additional benefit to the insured for keeping the policy in full force throughout the term of the contract.Rates are determined by the insurer on the basis of its performance.

What is Guaranteed Addition?

Insurer is obliged to pay fixed amount of bonus till the agreed period, called as Guaranteed Addition. This assured bonus will be given to the policyholder whatever be the performance of the corporation for the period in questionat the end of the term of the policy or in case of the early death of the policyholder. Ex of sunch a plan are LIC’s Komal Jeevan and Jeevan Shree-1. For example in LIC Komal Jeevan

The policy provides for the Guaranteed Additions at the rate of Rs.75 per thousand Sum Assured for each completed year. The Guaranteed Additions are payable at the end of the term of the policy or earlier death of the Life Assured.

For example for a policy taken for child at Age at entry: 0 years, with Premium Paying Term: 18 Years ,Annual Premium: Rs. 7281, Policy Term: 26 Years,Sum Assured: Rs. 1,00,000 Guaranteed additions are shown below

| Year | Total premiums paid till end of year | Benefit on Death during the year (Rs.) | ||||

| Guaranteed | Variable | Total | ||||

| Scenario 1 | Scenario 2 | Scenario 1 | Scenario 2 | |||

| 1 | 7281 | 7281 | 0 | 0 | 7281 | 7281 |

| 2 | 14562 | 14562 | 0 | 0 | 14562 | 14562 |

| 3 | 21843 | 21843 | 0 | 0 | 21843 | 21843 |

| 4 | 29124 | 29124 | 0 | 0 | 29124 | 29124 |

How does a Life Insurance company have surplus?

A life insurance company can declare bonus only out of the surplus (similar to profit) determined at the end of each year. Life fund is a pool of money held by a Life Insurance Company into which all life assurance policy holders premiums are paid and all claims are made from. The life fund can only be invested in fixed return guarantee products like the bank fixed deposits, etc. where the money can be withdrawn irrespective of the market performance. A surplus can happen in the Life Fund under the following circumstances:

- Favourable Investment experience – If invests earn a higher rate of return than expected to the life insurance company

- Favourable Mortality experience – if less number of people die within a specific period than calculated by the life insurance company

- Ceding bonus – Bonus received by the life insurance company from the re-insurers

From the surplus liabilities of the life insurance company are deducted. The liability under a policy is defined as the discounted value, as on March 31, of contractual benefits + discretionary benefits + expected expenses in future minus future premium income. The sum assured and bonuses already declared are known as contractual benefits. All types of bonuses expected to be declared in future are known as discretionary benefits. The bonus for the current year has to be declared out of the surplus that emerges.

However, the entire surplus cannot be distributed as current year’s bonus. The company has to first pay tax on the surplus that emerges. From the balance surplus, it has to be pay to the shareholder (LIC pays 10% to the Government) as its share of the surplus. The surplus thus gets depleted before it can be distributed to the policyholders.

Minimum 90% of the profits earned by the life insurance company has to be distributed to the policy holders The insurance company can retain maximum 10% of the life fund’s surplus. The percentage of bonus that is paid to the policyholder depends upon the surplus of the life fund.

For example quoting from Press release in Economic Times LIC has paid Rs 1,137.99 cr to the Government of India as dividend for 2010-11.

LIC had declared a valuation surplus of Rs 22,752.71 crore for the financial year ending 2011. For the 2010-11, LIC had received a total premium income of Rs 2,03,358 crore as against Rs 1,85,986 crore in the previous showing a growth rate of 9.34 per cent. The total life fund of LIC stood at Rs 11,51,200.58 crore as against Rs 9,99,517.59 crore in the previous year. The total assets of the company rose to Rs 13,17,416 crore from Rs 11,52,057.21 crore in the previous year.During 2010-11, LIC settled more than 1.89 crore claims for an aggregate amount of over Rs 57,557 crore. Life Insurance Corporation of India (LIC) has paid Rs 1,137.99 cr to the Government of India as dividend for 2010-11.

How is the bonus rate decided?

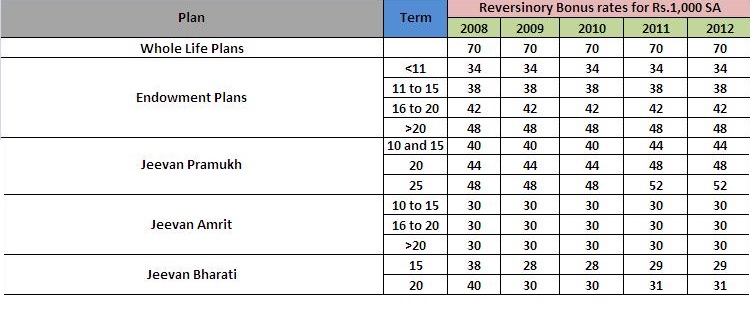

The amount of bonuses declared annually depends on the amount of surpluses in the Life Fund. This, in turn, depends on economic conditions and equity markets. If life insurance companies experiences good surpluses year on year, it could pay a high level of bonuses. If, however, economic conditions are poor and less surpluses are expected, Insurance companies could reduce the bonus rate to reflect the actual investment returns in the Life Fund. The bonus rate is decided after considering a variety of factors such as the return on the underlying assets, the level of bonuses declared in previous years and other actuarial assumptions (especially future liabilities and anticipated investment returns), as well as marketing considerations. Bonus rates of LIC for some of the policies for different years are shown below , for most of policies it is constant but for some like Jeevan Pramuk bonus rates has increased and for Jeevan Bharti bonus rates decreased and then increased.

Are bonuses guaranteed?

Once bonuses are declared, they are guaranteed. However, the bonus rates of all life insurers are not guaranteed.

Do bonuses affect the benefits in my policy?

Yes. Bonuses, once declared, will increase the value of your policy. Sometimes this may become more than the maturity sum assured. For example a person has taken a

- policy having maturity amount of rupees 5,00,000 for a term of 20 years.

- if the bonus is calculated at an average of rupees 42 per thousand sum assured

- Then the total bonus amount accrued for him at the end of 20 years would be 20 x 500 x 42 = 420000 which is just 80,000 short from the maturity amount. So the total amount received by the policy holder will be 5,00,000 + 4,20,000 = 9,20,000.

When do I get the bonus?

Suppose Mr.Sharma take insurance policy at the age of 30 yrs. Term of the Plan is 25 yrs and Sum Assured opted is Rs 10,00,000. So from start to maturity period he is entitled for the bonus which insurance company declares. It will get paid on maturity. If something happens to him during the period of policy term then his nominee will receive Sum Assured+Accumulated bonus till that period.

Will I get bonus if I surrender?

As bonuses are paid at the end of the policy, if you surrender your policy then you will not get the actual accrued bonus. Calculation of bonus amount is based on future value as it is supposed to paid in future. For example

Let’s say Mr Ram had bought a policy with sum assured of Rs. 5 Lakhs. It had a tenure of 10 years, and he paid premiums for 5 years. The accrued bonus is Rs. 1,00,000.And surrender value factor is 0.3. In this case, if he surrenders the policy he would get:

=Original sum assured * (Number of premiums paid / Total number of premiums that were required to be paid) + Accrued bonuses * Surrender value factor

= Rs. 5,00,000 * (5 / 10) + (Rs. 1,00,000 * 0.3)

= Rs. 2,50,000 + Rs. 30,000 = Rs. 2,80,000

Will I get bonus if I make my policy paid-up?

When you make a policy paid up, you don’t have to pay any more premiums. However, your insurance cover reduces and for the reduced amount continues till the maturity of the policy. Reduced cover is called the paid up value, and is in proportion to the number of premiums paid.

Paid up value = Original sum assured * (Number of premiums paid / Total number of premiums that were required to be paid)

Although the insurance cover continues, you would not be eligible for any future bonuses declared by the insurance company. However, you would retain any bonuses paid out before you made the policy “paid-up”. You do not get any amount when you convert a policy to “paid up”. Instead, you get an amount equal to the paid up value plus any bonuses accrued before you made the policy “paid-up” at the time of maturity, or in case of early demise.

For example Mr Sharma has a policy with Sum assured of Rs. 5 Lakhs, tenure of 10 years, and premiums paid for 4 years. The accrued bonus is Rs. 1,00,000. If he makes the policy paid up, the new sum assured would be:

Rs. 5,00,000 * (4 / 10)= Rs. 2,00,000

Thus, a cover of Rs. 2,00,000 would be available to him till the policy matures for another 6 years or till his death. On maturity at the end of 6 years or in case of untimely death, proceeds from insurance policy would be Rs. 2,00,000 + Rs. 1,00,000 = Rs. 3,00,000.

Does my insurance policy qualify for bonus payouts?

To find out if your insurance policy is a ‘with-profits’ policy, you can check your policy document or contact your insurance adviser.

How do I find out the bonus rates for my policy?

Insurance companies declare bonus rates and information is available on their websites , for example bonus rates of LIC, bonus rates of ICICIPruLife. To find how much bonus your policy has collected you can register your policy online and check details or contact the insurance adviser or insurance company with your policy details. Sometime back LIC provided facility to get details through SMS, asklic <PolicyNumber> <premium/loan/bonus/revival/nom> and sms to 56677 ex: asklic <PolicyNumber> <loan>, but it’s not working now.

Related Articles:

- Checklist for buying Life Insurance Policy

- Insurance : Surrender or Make policy paid up or Continue

- Mixing Insurance with Investment

- Basics of Insurance

In this article we have explained about bonus of life insurance policies? Have you take a life insurance policy with bonus? Is it from LIC or private insurance companies? What made you choose the policy?

39 responses to “Bonus of Life Insurance Policies”

I have just this problem today. I received a phone call from the LIC head office in Delhi a few days ago. I had taken a policy 25 yrs ago I think for Rs25000. But after a few years I made the policy ‘Paid Up’ and collected about Rs.8000. But I completely forgot about the bonus that was being accumulated. Now after 27 yrs LIC told me that the royalty bonus had grown to more one lac! But they cannot give me the money because there was the Agent code attached to it. In order to deactivate the agent code I had give the LIC a security deposit of Rs20,000. I told them I will not pay any money. After all the royalty bonus was my money. Can anyone show me how to recover my money? I have the File Code with me which the Assistant Manager in the claims department gave me.

Thank you.

Mr. Sunder Venkataraman. Looks like this could be a bogus call. Please do not entertain such calls. LIC never asks for any security deposit. I would suggest you contact your agent who sold the policy to you, or LIC customer care directly or any LIC branch.

But the bonus is real. Those fellows gave me details that no one else is likely to know. Like I was to go abroad. I have to find a way to get this money. Maybe I will contact the LIC fellows directly. Thanks.

Hi venkat….I received a similar call today…can I please let me know what happened once you contacted lic?..

Hi,

Your article is really helpful in understanding insurance policy structure. I noticed that in the bonus rates table, announced by SBI Life insurance, there are 3 columns. Reversionary bonus rate, interim bonus rate and terminal bonus rate. I understand Reversionary and terminal bonus rates. Could you please explain what is interim rates. Should I add Interim rates with Reversionary rate. Thank you!

Every conventional With-Profits policy issued by SBI Life has a guaranteed basic sum assured. This is fixed at the time the policy is issued and will not be reduced as long as you continue to pay the agreed level of premiums on or before due dates or within grace period, as specified in the policy document.

SBI Life adds declared reversionary bonuses to the guaranteed basic sum assured. Once bonus has been added to the policy it becomes part of the guaranteed basic policy benefit and cannot be taken away. It may however be reduced if the policy is made paid-up or surrendered.

In addition, Interim bonuses and Terminal bonuses as declared by the company also added to the policy benefits.

The reversionary bonuses are declared as a percentage of the basic sum assured.

For products where basic sum assured is increased with a certain percentage after specified period, the reversionary bonuses are declared as a percentage of the effective sum assured (i.e. increased sum assured).

The reversionary bonuses are declared on annual basis for each policy year during the term of the product, provided the policy is in-force as on the date of bonus declaration (i.e. all due premiums have been paid).

Reversionary bonuses once declared and allocated are guaranteed. The future bonuses are however not guaranteed and will depend on future experience.

If a policy is made paid-up (in other words if you stop paying premiums) then the annual bonus added to date remain credited to that policy, but the policy will receive no further bonus additions.

Interim bonuses are declared every year as a percentage of the basic sum assured or increased sum assured added to policies becoming claims before declaration of the next reversionary bonus.

Terminal bonuses would normally be declared every year as a percentage of the total bonuses already attached to the policy. Terminal bonuses are declared for policies becoming claims during the year. They are paid in respect of

the policy claims by death or maturity and may also apply to surrender.

Hello sir, I had taken a Jeevan Anand policy (149) in Mar-2013 with a term of 29 years. I have already paid my annual premium for 3 years.

This policy is split into 25 policies whose premium sums upto 56140 Rs. So, my yearly premium for all 25 policies together is 56140 Rs. Sum assured is 100000 for each of the 25 policies.

I now regret going for this policy, as I am not able to pay huge premium each year.

I want to surrender my policy. So, I want to know how much I will get back if I am surrendering. How should I calculate the bonuses accumulated ?

Is this the right time to surrender or should I pay my premium for few more years and surrender to get the maximum return ? When is the best time to surrender ?

If I am making this as paid up how much will I get in return ?

What do you suggest, sir ? Should I surrender or make it as paid up ?

Thanks a lot in advance.

Sir you can download

the Insurance Policy Surrender Value & Paid-up Value Calculator and then play around with numbers

I had taken a policy table817 for the term 20 year with single premier ass amount is1500000 how much will I get after 20 years

Hi Kirti,

Hope you are doing good. I came across this article when I was searching for LIC paid up options. You have provided good suggestions to people here and I am also expecting the same. My case might be a bit different to answer but request you to pls provide your honest suggestion.

I am 32 yrs now. My agent (family friend) had given me a combination of LIC plans. I have total 14 policies taken on 25 Jan 2009 (yearly premium – Rs. 86000). (12 Emdowment and 2 money Back) total coverage 20 Lakh (with diff terms starting from 20 to 35 yrs). I have paid full 4 yr premiums (around 3.5 Lakh). I have decided to make all the policies PAID UP.

Now here comes my question and your honest suggestion:

On 31 Dec 2012, I undergone an Open Heart Sergery. I have paid full 4 years of premium. My agent is suggesting me to pay 1 more premium (around 23K) for 2 money back policies this year (5th year) so that I get 70K back in Jan 2014. Also he is saying that you wont get any bonus if you surrender/ make policy paid up before 5 years.

My questions:

1. I feel to make the policies Paid up as I wont loose my money invested also I get min coverage till either my death/ policy maturity. But as I have paid 4 premiums and making the policies paid up before 5 years, Will I get the Bonus ?

2. Shall I surrender the policies and forget my loss & bonus?

3. Shall I pay 1 more premium for 2 money back policies and get 70 K in next 6 months?

4. Shall I pay 1 more premium for all 14 policies so that I am eligible to get bonus in case I surrender / make the Policies Paid up?

5. Can/ Cant I get a new Term policy at normal premium rates (due to Open Heart sergery) ?

Please suggest soon as I need to take the decision till next week to avoid my policy getting lapsed / getting into documentation after completing 6 months for late payment.

Sorry to hear about your Open heart surgery. hope you are well now.

You can also ask the questions at jagoinvestor forum to get answers from multiple people.

Without knowing your complete financial situation it would be difficult for us to answer the questions.

Can/ Cant I get a new Term policy at normal premium rates (due to Open Heart surgery) ?

No you cannot get the term policy at normal premium rates. Simply because yours is a high risk case compared to others.

You should not hide your details as then insurance company can reject your claim

Regarding surrender/paid up.

Can you ask your agent for how much would you get in each case for each of the policy?

Then arrange them in order of maximum returns and then least premium paid.

You can also ask the agent how much would a new Term policy cost?

Get these details which might give clue on how to proceed further.

Take care

Hi Kirti,

Hope you are doing good. I came across this article when I was searching for LIC paid up options. You have provided good suggestions to people here and I am also expecting the same. My case might be a bit different to answer but request you to pls provide your honest suggestion.

I am 32 yrs now. My agent (family friend) had given me a combination of LIC plans. I have total 14 policies taken on 25 Jan 2009 (yearly premium – Rs. 86000). (12 Emdowment and 2 money Back) total coverage 20 Lakh (with diff terms starting from 20 to 35 yrs). I have paid full 4 yr premiums (around 3.5 Lakh). I have decided to make all the policies PAID UP.

Now here comes my question and your honest suggestion:

On 31 Dec 2012, I undergone an Open Heart Sergery. I have paid full 4 years of premium. My agent is suggesting me to pay 1 more premium (around 23K) for 2 money back policies this year (5th year) so that I get 70K back in Jan 2014. Also he is saying that you wont get any bonus if you surrender/ make policy paid up before 5 years.

My questions:

1. I feel to make the policies Paid up as I wont loose my money invested also I get min coverage till either my death/ policy maturity. But as I have paid 4 premiums and making the policies paid up before 5 years, Will I get the Bonus ?

2. Shall I surrender the policies and forget my loss & bonus?

3. Shall I pay 1 more premium for 2 money back policies and get 70 K in next 6 months?

4. Shall I pay 1 more premium for all 14 policies so that I am eligible to get bonus in case I surrender / make the Policies Paid up?

5. Can/ Cant I get a new Term policy at normal premium rates (due to Open Heart sergery) ?

Please suggest soon as I need to take the decision till next week to avoid my policy getting lapsed / getting into documentation after completing 6 months for late payment.

Sorry to hear about your Open heart surgery. hope you are well now.

You can also ask the questions at jagoinvestor forum to get answers from multiple people.

Without knowing your complete financial situation it would be difficult for us to answer the questions.

Can/ Cant I get a new Term policy at normal premium rates (due to Open Heart surgery) ?

No you cannot get the term policy at normal premium rates. Simply because yours is a high risk case compared to others.

You should not hide your details as then insurance company can reject your claim

Regarding surrender/paid up.

Can you ask your agent for how much would you get in each case for each of the policy?

Then arrange them in order of maximum returns and then least premium paid.

You can also ask the agent how much would a new Term policy cost?

Get these details which might give clue on how to proceed further.

Take care

I don’t be aware that the way I found themselves below, on the other hand thought the following send was terrific. I wouldn’t fully grasp exactly who you might be but certainly you will a well-known tumblr when you find yourself never witout a doubt. Many thanks!

I don’t be aware that the way I found themselves below, on the other hand thought the following send was terrific. I wouldn’t fully grasp exactly who you might be but certainly you will a well-known tumblr when you find yourself never witout a doubt. Many thanks!

It is a detailed explanation and will help many in getting the idea of bonus in Insurance policies. Keep it up.

Thanks Melvin. People don’t usually worry about bonus in insurance polices till the maturity time

It is a detailed explanation and will help many in getting the idea of bonus in Insurance policies. Keep it up.

Thanks Melvin. People don’t usually worry about bonus in insurance polices till the maturity time

Until I read this post, I had a misconception that all policy holders of an Insurance Company will get bonus. Now I got my doubts cleared. Thanks for sharing.

Thanks Easwar. Actually most of us go for the policy with profits hence your assumption is not misplaced.

Thanks for commenting! It’s encouraging

Until I read this post, I had a misconception that all policy holders of an Insurance Company will get bonus. Now I got my doubts cleared. Thanks for sharing.

Thanks Easwar. Actually most of us go for the policy with profits hence your assumption is not misplaced.

Thanks for commenting! It’s encouraging

Good Detailed Info.

Earlier LIC used to give details of Bonus accumulated in online Log in facility but it seems that they have withdrawn it.

If any one is is looking for the bonus declared since inception :

http://www.saving-ideas.com/2012/10/lic-india-bonus-ratesbonus-history-info/

Thanks for appreciation and link. How did you get the historical value? Will use it when I write on bonus rates of LIC.

LIC seems to be going backwards technology wise. SMS not working,bonus not available online..wondering why?

bonus values are sourced from one of the old LIC diary..

LIC withdraw bonus information probably because lower bonus values may have creating some sort of disappointment among policy holders..

But as far technology of online premium collection is concerned ,they are ahead…. they have much superior & smooth online premium payment facility..

Thanks Paresh.

LIC bonus rates have gone down from earlier years but have been consistent since 2005.

Do people really know about bonus rates?

Yes their online premium collection is good but I am having a problem in registering my husband’s old policy.

As far I understand,to register on LIC website policy holder need to have matching policy no & DOB as per LICs record…You should have checked about DOB…

You are true saying that peoples don’t care much about bonus rates..Feeling of safety & savings are enough…

Thanks Paresh. I tried but it still gives Wrong data entered.

Human beings are a rare kind..we believe that nothing bad will happen to us (but may happen to others). And what to take care of, earning,spending, family..time kahen hain sochne ka 🙂

Good Detailed Info.

Earlier LIC used to give details of Bonus accumulated in online Log in facility but it seems that they have withdrawn it.

If any one is is looking for the bonus declared since inception :

http://www.saving-ideas.com/2012/10/lic-india-bonus-ratesbonus-history-info/

Thanks for appreciation and link. How did you get the historical value? Will use it when I write on bonus rates of LIC.

LIC seems to be going backwards technology wise. SMS not working,bonus not available online..wondering why?

bonus values are sourced from one of the old LIC diary..

LIC withdraw bonus information probably because lower bonus values may have creating some sort of disappointment among policy holders..

But as far technology of online premium collection is concerned ,they are ahead…. they have much superior & smooth online premium payment facility..

Thanks Paresh.

LIC bonus rates have gone down from earlier years but have been consistent since 2005.

Do people really know about bonus rates?

Yes their online premium collection is good but I am having a problem in registering my husband’s old policy.

As far I understand,to register on LIC website policy holder need to have matching policy no & DOB as per LICs record…You should have checked about DOB…

You are true saying that peoples don’t care much about bonus rates..Feeling of safety & savings are enough…

Thanks Paresh. I tried but it still gives Wrong data entered.

Human beings are a rare kind..we believe that nothing bad will happen to us (but may happen to others). And what to take care of, earning,spending, family..time kahen hain sochne ka 🙂

awesome detailing of insurance policy !!! I have book marked the site … there are 100s of queries on life insurance which got resolved reading this … All in all what i understand more sugar more sweet .. its only when we invest more can we get back in return in terms of insurance policies too 🙂

Thanks for your say, Mysay. Your cartoons are amazing, would love to see one on how Indians look at money.

Bonus is a tricky topic. It’s not guaranteed so you don’t know whether you will get in or not. But it’s better not to mix investment with insurance.

Get insurance for protection purpose and not for bonus is what I feel.

awesome detailing of insurance policy !!! I have book marked the site … there are 100s of queries on life insurance which got resolved reading this … All in all what i understand more sugar more sweet .. its only when we invest more can we get back in return in terms of insurance policies too 🙂

Thanks for your say, Mysay. Your cartoons are amazing, would love to see one on how Indians look at money.

Bonus is a tricky topic. It’s not guaranteed so you don’t know whether you will get in or not. But it’s better not to mix investment with insurance.

Get insurance for protection purpose and not for bonus is what I feel.