One has to transfer the old PF account to the new account. Only then will you be able to withdraw from both accounts online. Linking of PF account with UAN is not sufficient. EPFO plans to merge the PF accounts automatically when one changes the job but it has been in pipeline for some time so till then do an employee has to do it manually. This article talks about Why should one transfer an old EPF account to a new employer and what happens if you do not transfer!

Table of Contents

What happens If you don’t transfer your PF account from the old to the new employer?

Then you would have two separate EPF accounts.

If you leave 2nd organization and withdraw then you will be able to withdraw from only the last employer. To withdraw from the first employer you would have to approach the first employer and do it offline. This becomes time-consuming.

The old EPF account will be considered inactive. It will earn interest but you will have to pay tax on it. It will also show in Form 26AS.

Shouldn’t I withdraw from my old PF account rather than transfer?

You can only do this before joining a new job. Once your New employer EPF is linked you will not be able to do it.

- PF is for your retirement. Let compounding increase your PF amount.

- Your Service Period includes both old and new service periods.

- This helps to decide if the contribution to EPF is less than 5 years or not. EPF withdrawal after 5 years is tax-free.

- Helps in Pension calculation as Pension depends on the number of years you have worked.

- Your PF accounts get merged. So when you finally want to withdraw, you need to submit only one EPF withdrawal requests, for all the EPF accounts, to your last employer. Else you cannot withdraw from an old EPF account online. You would do it offline and need to visit the EPFO office

What is a PF account?

Employer submits the EPF(Employee Provident Fund) money to the EPFO (Employee Provident Fund Office) on behalf of the employee. This includes both the employee contribution, employer contribution, Employee Pension Scheme. Member Id or Member Identification Numbers or PF account number is the number given by EPFO to allow the employer to submit EPF and EPS contributions for the employee. It’s like an Employer opens an EPF account for its employee and contributes to that account every month.

What is UAN?

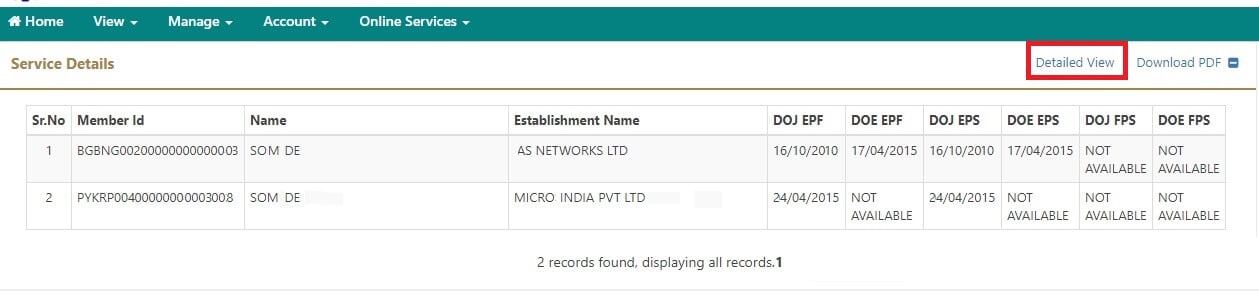

UAN is a Universal Account Number. The UAN is a 12-digit number allotted to an employee who is contributing to EPF. An employee should have only one UAN or Universal Account number. All your Provident Funds or your Member Ids would be tied to your UAN. It will maintain all your Member Ids. It’s like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number as shown in the image below from our article How to check Member Ids or PF accounts linked to UAN

When you change the job?

When the employee changes the job then the new employer will open a new account number for its employee in EPFO. So a new account will be opened, a new Member ID will be allotted to the employee. Member ID is the same as PF number earlier. So you would have as many Member ID as the number of employers who contributed to EPFO on your behalf.

So if you have worked in 2 different organizations then for EPFO it’s like you have 2 separate accounts. The last PF account is the current account and all withdrawals, advance happens based on the amount on that account.

How to transfer EPF account from old to new employer

How to Transfer EPF Online on changing jobs explains the process of transferring EPF online. It is a simple process

- Go to the EPFO members’ portal and log in using your UAN and password.

- Verify that all your details are populated in the UAN portal. No missing or incorrect information.

- Verify that your KYC is approved.

- Please check that your Bank Account Number, IFSC code is correct.

- Click on Online Services->One Member One EPF (Transfer Request).

- The Employee has to get his claim attested by the current or the previous employer.

- A PIN will be generated and sent to the registered mobile number.

- Submit the claim form to the selected employer.

- The employer should approve the request.

- You can check the status of your EPF transfer claim by clicking on Online Services->Track Claim Status. You will also receive regular updates.

- After submitting the form within 2-3 weeks your EPF account will be transferred.

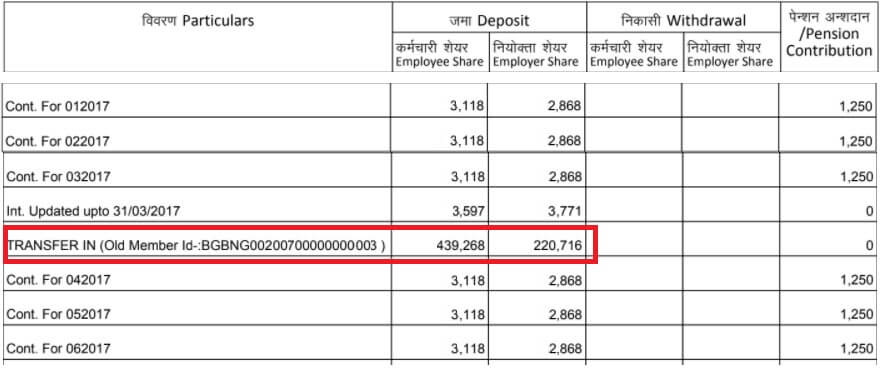

- After the successful claim, UAN passbook of the old and new employer will reflect the transfer as shown here.

- There is no information about EPS transfer. Your EPS pension is dependant on the number of years you contributed to EPS. So View->Service Details on UAN site is sufficient but you can get Annexure K for your own record by raising EPF grievance.

Related Articles:

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- UAN or Universal Account Number and Registration of UAN

Hi, its nice piece of writing regarding media print, we all be aware of

media is a fantastic source of information.

Hello Sir,

I had worked for 2 companies. I didn’t transfer my old pf amount to new pf amount. Without transferring i settled the new amount. so old amount was left there only. so now i am unable withdraw that old amount.

Then i transferred the old amount to new amount. but i am unable withdraw . it says that claim has already settled and my request getting rejected.

now what should i do?? Please give me solution.

Thanks in advance.

hai sir,

same problem currently i am facing, are you get solution. kindly reply me. thankyou

Hi

UAN NUMBER: 100480404920

I have applied for PF withdrawal it’s been 20 days. Still its showing under process kindly confirm still how many days required. I trying to reach epf Office banglore on 08022279130 it’s just ringing call is being answered.