In May 2019, EPF Member Website for employees allows one to submit the Form 15G for EPF Withdrawal online to avoid TDS. This article explains Rules of TDS on EPF Withdrawal, How to submit Form 15G, How To fill Form 15G.

Table of Contents

Overview of Form 15G and EPW Withdrawal

Now you can submit Form 15G online while submitting your EPF Withdrawal request.

- Login to UAN member website https://unifiedportal-mem.epfindia.gov.in/memberinterface/

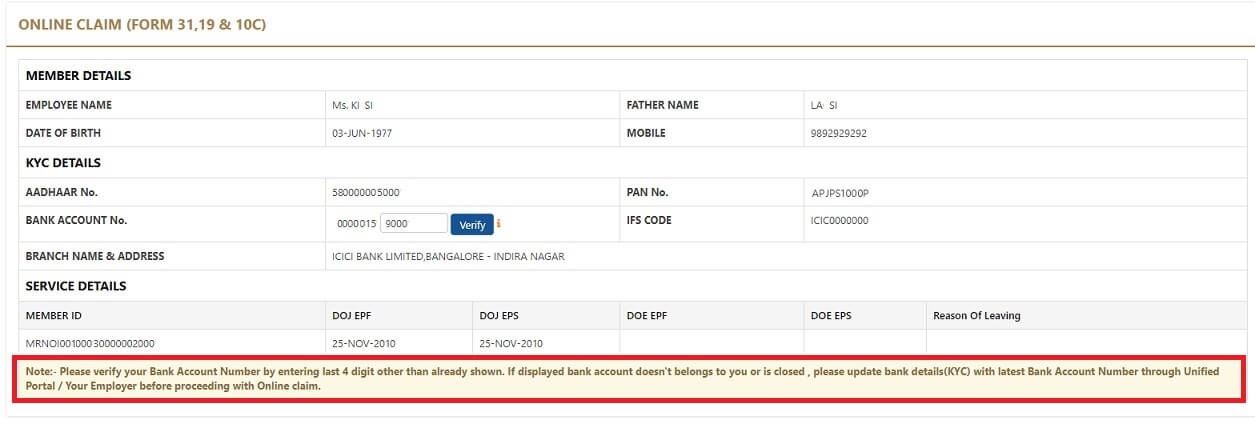

- Click on Online Services->Claim (Form 31, 19, 10C)

- Verify last 4 digits of your bank account as shown in the images below

- You will see the EPF Withdrawal form

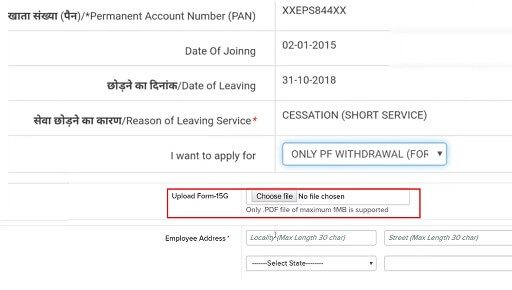

- Below I want to apply for , you will see Upload Form 15G as shown in the image above.

- Download the form 15G from here in pdf format

- Fill in Part I (You don’t have to fill Part II). Upload the Form in PDF format (if you have image, steps to convert image to pdf are given below)

- Enter other details and follow the process as explained in Online EPF Withdrawal: How to do Full or Partial EPF

TDS on EPF Withdrawal and Form 15G

EPF Withdrawal

The rules are that an employee should not be in employment for two months after resigning if he has to withdraw his Provident Fund amount.

Earlier one could withdraw EPF from one job even after joining another job as EPFO could not track if one is working or had a PF account. But now with UAN number, EPFO can find out whether you are employed or not and hence EPFO can theoretically reject your application.

On 1 May 2017, EPFO announced that all EPF Member’s who have activated their UAN and seeded their KYC (Aadhaar) with EPFO will be able to apply for PF Final Settlement (Form19), Pension Withdrawal Benefit (Form10-C) and PF Part Withdrawal (Form31) from the UAN Interface directly. If you meet these requirements then you can withdraw online. Our article How to do Full or Partial EPF Withdrawal Online explains it in detail with images and video.

TDS on EPF Withdrawal

If you are withdrawing EPF after 5 years of service then no tax or TDS should be deducted.

5 years mean 5 years of contribution to EPF, it may be in multiple companies and may have breaks. Say you worked in 1 organization for 3 years. Then you joined another organization and transferred your EPF from organization 1 to new employer. Once you work in the organization for at least 2 years then your total number of years will be counted as 5 years.

Provident fund withdrawal before five years of completion of service attracts TDS(tax deducted at source) effective from 1 Jun 2015.

- TDS on EPF is deducted if withdrawal is more than Rs 50,000. This is applicable from June 2016. Earlier this limit was Rs 30,000.

- TDS is deducted at 10 % provided PAN is submitted. Otherwise, TDS is deducted at the rate of 34.608 % if PAN is not submitted.

- If you withdraw offline you can submit form 15G/15H to avoid TDS. This form can now be submitted online while doing EPF Withdrawal.

Form No. 15G or 15H are self-declaration forms that can be furnished by individuals to state that their income is below the taxable limit and hence no TDS should be deducted. The final tax on his estimated total income computed as per the provisions of the Income Tax Act should be nil

Please note that if you withdraw your PF balance before the expiry of five years of contribution, then it is taxable in the year in which you withdrew whether TDs is deducted or not.

- Your employer’s contributions along with the accumulated interest amount will be taxed as “profits in lieu of salary” under the head Salary. However, relief under Section 89 will be available.

- Interest accumulated on your (employee) contributions will be taxed under the head “Income from other sources”.

- The tax deductions claimed on your contributions to EPF will be revoked or rolled back, and shall be liable to tax.

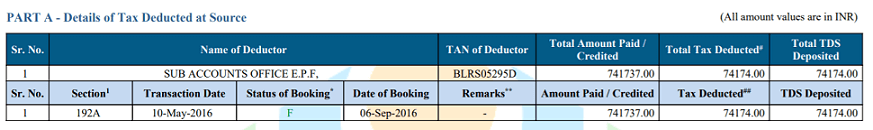

TDS deducted for EPF in Form 26AS

Just in case TDS is deducted and your PAN is registered, TDS will show up in Form 26AS as shown in the image below.

You need to account for it in ITR.

How to Fill Form 15G for EPF Withdrawal

- Download the form 15G from here in pdf format

- Fill in Part I.

- You don’t have to fill Part II.

- Scan it and save it as PDF. Make sure that size of pdf if less than 1 MB.

- If you save it as the image in jpg format then you can use sites like https://jpg2pdf.com/ to convert it to pdf.

- Login to UAN website with your UAN and password.

- Click on Online Services, Claim Form 31, 19 and 10C.

- Choose Form 19.

- Click on Choose File. Upload the pdf

How to Fill Form 15G for EPF Withdrawal

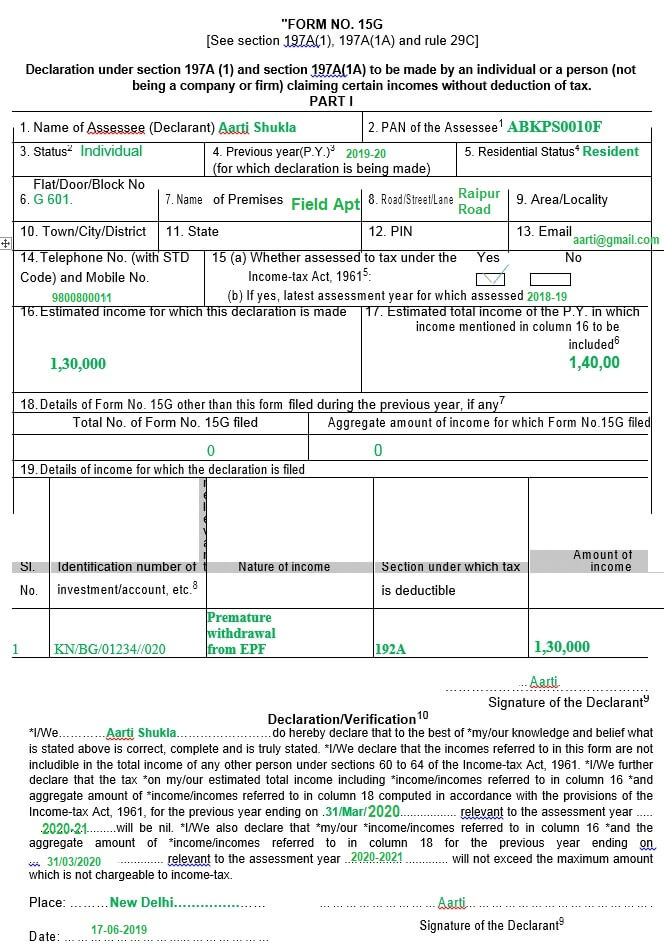

- Field 1, Name: write name as per your PAN.

- Field 2, PAN: write your PAN number.

- Field 3, Status: Usually Individual (Your income tax status which can be Individual/ Hindu Undivided Family(HUF)/ AOP as applicable to you.)

- Field 4, Previous Year: the year in which you will earn your income for which you want to avoid TDS. So it is the current financial year for which you are filing up the form. If you fill the form between 1 Apr 2019 to 31 Mar 2020 then you have to fill 2019-20.

The calendar year starts on January 1 and ends on December 31 but a Financial year (FY) is from April 1 to March 31. As per the Income Tax Act, income earned in a financial year (FY) is taxed in the next Financial Year. FY to which the income belongs is called the Previous year (PY) and the FY in which the income is taxed is called the Assessment year (AY). Ex: The income earned from 1st Apr 2019 to 31 Mar 2020, during FY 2019-20 will be assessed for tax in 2020-21 after you file tax. Here, FY 2019-20 is called Previous Year and FY 2020-21 is called Assessment Year or AY. Our article Income Tax Overview explains terms associated with Income Tax.- Our article Difference between Assessment Year and Financial Year, Previous Year, Fiscal Year in World explains the What is the difference between the Financial Year and Assessment Year? What is Previous Year?

- Field 5, Residential Status: to be entered ex: Resident.

- As Form 15G or 15H can be filled only by Resident hence if one satisfies the condition one needs to mention Resident.

- For income tax purpose residential status of an assessee is classified into, Resident (ordinarily), Resident (not ordinarily), Non-resident. Under the Income-tax Law, an individual will be treated as a resident in India for a year if he satisfies any of the following conditions (i.e. may satisfy any one or may satisfy both the conditions):

- One is in India for a period of 182 days or more in that year; or

- One is in India for a period of 60 days or more in the year and for a period of 365 days or more in 4 years immediately preceding the relevant year.

- Field 6,7,8,9,10,11,12, Current Address details.

- Field 13, Email Id, your email ID

- Field 14, Telephone number, Phone number both LandLine number with STD code and Mobile No. If you don’t have a Landline just fill Mobile Number.

- Field 15 (a), Whether assessed to tax under the Income-tax Act, 1961. Yes, or No, Check the appropriate Box. Mention Yes if assessed to tax under the provisions of Income-tax Act, 1961 for any of the assessment years out of 6 assessment years preceding the year in which the declaration is filed.

- Field 15 (b), If yes, the latest assessment year for which assessed, Mention the last Assessment Year, the year in which you filed Income Tax return. For example, if you filed ITR till Mar 2019 for FY 2017-18, then enter the Assessment Year FY 2018-19

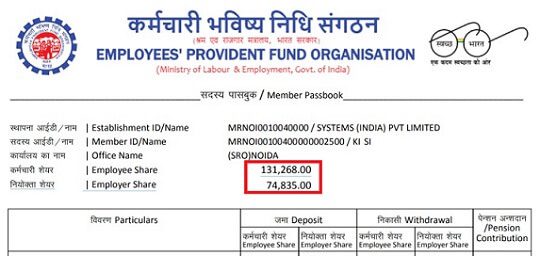

- Field 16, Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For EPF Withdrawal Enter the EPF amount you will get. This includes only Employee and Employer contribution. This should not include EPS or Pension. Verify from your EPF passbook or give a missed call to 011 229 01 406 and you will get SMS if your UAN is registered.

- Field 17, the Estimated total income of the P.Y. in which income mentioned in column 16 to be included, Please mention the total income for this financial year including the EPF withdrawal amount.

- Field 18, Details of Form No. 15G other than this form filed during the previous year, if any, In case any declaration(s) in Form No. 15G is filed before filing this declaration during the previous year, mention the total number of such Form No. 15G filed along with the total amount of income for which said declaration(s) have been filed. Typically people submit form 15G/15H to banks and post offices for not deducting TDS on Fixed Deposits.

- Total No. of Form No. 15G filed, How many Forms 15G have been submitted other than this form 15G in the current Financial year or Previous Year.

- Total amount of income for which Form No.15G filed, Total amount of income for which Form 15G has been filled in this year. Say you have submitted 1 Form 15G for interest income of Rs 50,000 from FD. Then you need to show the 50,000.

- Field 19. Details of income for which the declaration is filed,

- For Identification Number Mention the Provident Fund Number,

- For Nature of Income: TDS on EPF Withdrawal

- For Section: 192A

- For Amount: Mention your EPF amount(Employer + Employee)

Example of Filled Form 15G for EPF Withdrawal

Sample filled form 15G for Aarti Shukla, who withdrew EPF Rs 1,30,00 on 17 Jun 2019 and has other income as 10,000 Rs is shown below. She has last filed her ITR for FY 2017-18 or AY 2018-19 on 3 Jul 2018.

- If you have filed the return for FY 2018-19 or AY 2019-20 the last date for which is 31 Aug 2019 mention AY 2019-20

- Else mention the last Assessment Year in which your ITR was submitted. For example, if You filed the return for FY 2017-18 or AY 2018-19 then mention AY 2018-19.

- In the declaration, part Assessment Year would be 2020-21

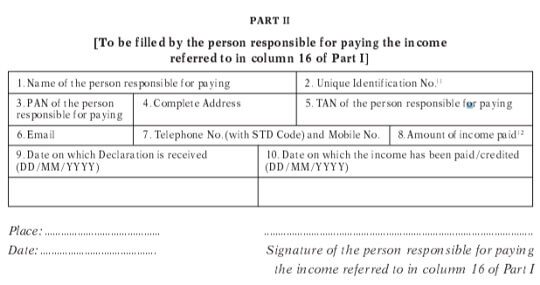

Part II of Form 15G doesn’t have to filled by you.

Difference between Form 15G and 15H

Our article What is Form 15G? What is Form 15H? explains the Forms 15G/15H in detail.

- Form 15G can be submitted by individual below the Age of 60 Years who has taxable income as Zero. The maximum limit permitted for the Financial year 2019-20 is Rs 2,50,000

- Form 15H can be submitted by a senior citizen who has crossed the age of 60 if he satisfies the income tax criteria

- The maximum limit permitted for the Senior Citizen for the Financial year 2019-20 is Rs 3,00,000. For Senior Citizen who have attained and crossed the age 80 years, the tax free income slab is Rs 5,00,000.

- Also, exemption from tax on interest from fixed deposits and post office deposits have been revised to Rs 50,000 from Rs 10,000 for senior citizens for the FY 2018-19.

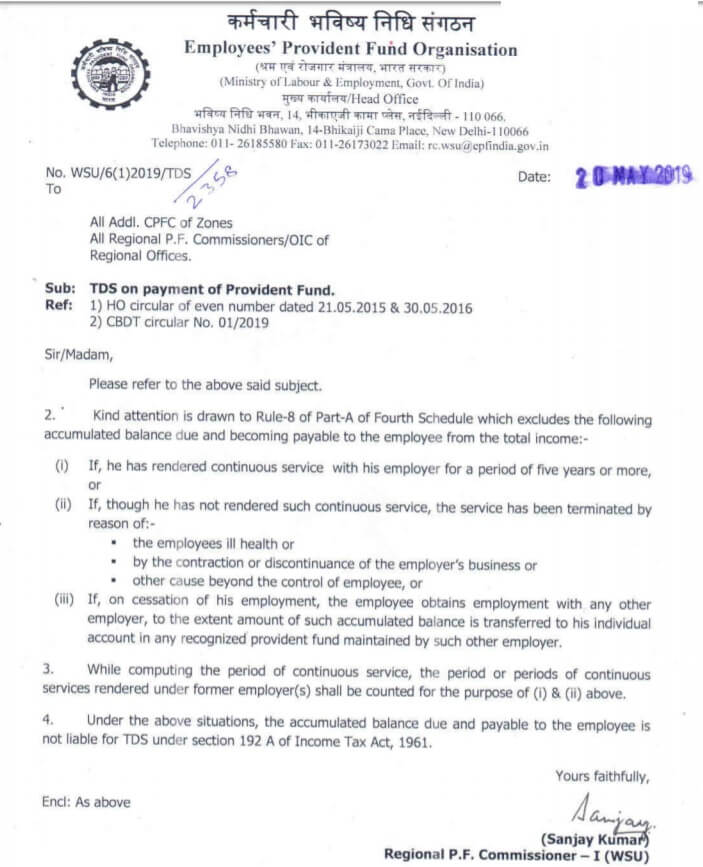

Notice from the EPFO for no TDs on EPF Withdrawal

Related Articles:

- EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

- How to do Full or Partial EPF Withdrawal Online

- How to Fill Form 15G? How to Fill Form 15H?

- Difference between Assessment Year and Financial Year, Previous Year, Fiscal Year in World

When I am filling Form 15G for PF withdraw, what amount to be mentioned in point no. 16. I don’t know the interest amount for 2020-21. Shall I leave the place blank ?

You can but it might get rejected.

You can Calculate EPF interest using the formula,

Check EPF calculator http://bemoneyaware.com/calculators-quiz/epf-calculator-methodi/

or put an approximate amount which is higher than last year!

You can add both amount employee and employer share total amount..

Hello Team,

I need to withdraw complete PF amount.I resigned job in 2019 and moved to aboroad and not filed my tax since FY-2020-21. I had been working in my last company more than 10year.

Now I wanted to withdraw the amout.

1. Do I need to pay tax for that?

2. How to fill Form 15g for withdraw full amout.

Appriciate your help.

Regards,

SD

In Umang application it is showing like if the amount is greater than 50000 and worked less than 5 years form 15G do not required. Kindly clarify.

Theoretically, it is not required but practically EPFO rejects the claim if the form is submitted.

I have applied for pf withdrawal online,I have uploaded form 15 g and cheque photo but after submitting the claim I found that form 15 g is not showing though my file size was less than 1 mb.

Sad to hear.

You can

a) wait for the claim to be accepted or rejected

b) file the complaint at EPF and upload Form 15G/H as explained at http://bemoneyaware.com/epf-grievance-complaint-online/. There is no guarantee that this might work

Hello Subir,

I have also moved to abroad in 2019 and I have filed my tax return for FY-2020-21 but now I want to withdraw my full PF amount.

Have you done yours? any advises for me?

Thank you and appreciate your help.

Hello there,

I’ve been unemployed for more than 4 months now. I’m trying to withdraw the PF money but the different terminologies used in the form and the articles available online just confuse me. For instance, a few articles mention that in #17 of Form 15G the user should mention ‘Total income – PF Withdrawal Amount (#16)’ while you mention that #17 should include ‘Total Income + PF Withdrawl Amount’.

This is my last tax slip, can you please tell me what amount should I fill in #17 of Form 15G? https://www.screencast.com/t/zByDi1pO

The PF amount is:400000

Thank you so much for your help!

Best,

Amjath

Hello Amjath,

Don’t get bogged down by details.

Fill the amount that you are comfortable with.

Form 15G/H is simply a declaration

PF amount refers to the total EPF contribution that you have made in all the years, you would get this from passbook.

Your total income would be the sum of all the incomes you have earned this year. Your salary income + Income from Interest in FD+ Interest in Bank account + Capital gain etc.

Please check our article http://bemoneyaware.com/income-tax/#Types_of_Income for more details

Super article and with lots of detailed guidance. Many relevant questions have been answered. Thanks. Definitely recommend to many colleagues

Hi sir,

I need to withdraw complete PF amount.I resigned job in 2018 December and not working for 2 years. Total service in previous company is also 2 years.I have Submitted ITR-1 for Assesment year 2019-2020.

My PF amount I.e(Employer share + employee share) is Rs. 60900

Pension share is Rs. 29332

All my KYC documents are verified.

I am confused what to fill in form 15g clause

No:4 – Previous year for which declaration is made

No:15(a)(b) : whether assesses to tax under the income tax act 1961 (yes or no)

No:16 – Estimated income for which this declaration is made ( I have no income for last year as I was unemployed)

17: Estimated total income of the P.Y. in which income mentioned in column 16 to be included)

Please sir kindly clarify on the above queries ..

Awaiting your reply.

Should i upload 15g form only 1 part or 3 part also .And Pancard is necessary to upload while uploading 15g form . My total employee & employer share will be 65,267 and how can i know my estimated total income of the PY in which income mentioned in column 16 to be included .

Form 15G/H is linked to PAN.

Your PAN should be already linked to UAN and if not please do so

Other than this what else income do you have?

Dear Sir

I retired at the age of 60 and have not withdrawn my EPF amount, it has earned interest over last 3 years. In form 15H, do I fill the total EPF amount balance (employer + employee share) or just the interest earned in last 3 years.

Which amount is taxable, total EPF balance or just the interest earned in last 3 years

If you withdrawing You should enter total EPF amount balance (employer + employee) with interest

If you worked for more than 5 years then the amount is not taxable.

If you withdraw before 5 years of service only then withdrawal amount becomes taxable as explained in the article

http://bemoneyaware.com/epf-withdrawal-before-5-years-tds-form-15g-tax-itr/

Sir am submitted 15g form how many days money credit in my account plz reply me

Hello Sir,

I have worked in an organisation for Six & half years continuously and resigned from there. My EPF is 52500 and EPS is 82500.

Do I need to submit form 15G?

Sir,

Employee contribution – 26k

Employer contribution – 8k

EPS – 17.5k

My query is do I need to submit form 15G or not?

Waiting for your reply

Sir mera pf 35900 hai to15g bharna panega sir ey teeno ka h imploi ka pensan ka imployear ka

Sirf PF not Pension amount

Hi, I have worked around 4 years in company and quit on Jan 2016. So for filling form 15g which year do I need to mention PY and AY. I really confused with many article. Plz guide me.

2. My Pan number is not verified in UAN portal, do I need to visit near by submit Pan and other details or online is fine. Guess my PF linked in Thaane. If submit EPFO office can I submit near by sorroundings which is in chennai.

Or can I get EPFO office mail id.

Thanks in advance for your guidance.

As you have UAN you can do online.

Why is your PAN not verified? Raise complaint at EPF grievance website as explained in the article How to register EPF complaint at EPF Grievance website online

Previous Year: the year in which you will earn your income for which you want to avoid TDS. So it is the current financial year for which you are filing up the form. If you fill the form between 1 Apr 2019 to 31 Mar 2020 then you have to fill 2019-20.

Hello Sir ,

My PF comes to a total of 41,100 should i fill the form 15g

Also if yes What should I mention in Column 17 is it total salary of PY + PF ?

Please Help.

HI sir,

My pf amount is 151000. I have worked in the previous organization for 5 years. Do i need to fill the form 15g and upload online for pf withdrawal?. Will it be taxable?

sir my pf amount is less than 13000 so i shold also fill the 15g form??? and if soo what should i fill in 15,16,17 number box in the form please help

Technically you are not required to fill 15G form.

But to be on safe side fill it.

Field 15 (b), which year you filed ITR: If yes, the latest assessment year for which assessed, Mention the last Assessment Year, the year in which you filed Income Tax return. For example, if you filed ITR till Mar 2019 for FY 2017-18, then enter the Assessment Year FY 2018-19

Field 16, Estimated income for which this declaration is made, Mention the estimated income for which you are filing the Form. For EPF Withdrawal Enter the EPF amount you will get. This includes only Employee and Employer contribution. This should not include EPS or Pension. Verify from your EPF passbook or give a missed call to 011 229 01 406 and you will get SMS if your UAN is registered.

Field 17, the Estimated total income of the P.Y. in which income mentioned in column 16 to be included, Please mention the total income for this financial year including the EPF withdrawal amount.

Field 18, Details of Form No. 15G other than this form filed during the previous year, if any,

I raised a request for my PF final settlement, in my passbook it shows entries from 2011 to 2019, My total PF amount 3,26,000 Rs. My pan is not approved by my organisation. I didn’t uploaded form 15G while raising for claim.

For my case Form 15G is really required, if yes, how can I update my claim? or guide me the steps please.

9962236441

Sir,

While i am submitting claim online it asked for Form 15G to upload, and in it “Signature of the Declerant who is responsible for paying the income”. Is that means signature of the previous employer? is it really required please help me clarify this sir.

No, it is your signature. You are declaring it.

It is your income

Dear Sir,

I have a problem with my UAN. I have activated the UAN provided to me and I am able to access the account from my mobile too. Now I have resigned 5 months back and I want to close my EPF and pension account and withdraw the full amount. Now, my employer informs me that my UAN has been changed to a new number. Now, I am unable to activate or access that new UAN from my mobile or even from a different mobile. I am also unable to merge the two UANs. My employer is not coming forward to solve the issue. What am I supposed to do now ? Please advise, sir.

hello sir,

I’m nirav patel.

1) My PF is less than 25K and i done my job for 21 months,so for that i need to fill-up form 15G or not?

2) I want PF final settlement, so i claims online in that i need to do all the process twice in that i require to fill-up two different form of 15G, for EPF & EPS?

I am waiting for your positive response.

Thank you

Hi,

I have a query regarding my PF withdrawal.

I started working in July 2010 and worked in 5 different organizations before I moved abroad last year. In all organizations I had got a new PF account number. I got UAN in January 2014 and that was linked to my 4th organization.I transferred all my previous PF accounts to this PF account that was tagged to the UAN. I joined my last organization in May 2017 and worked there until December 2018 (Tenure 1.5 years). This PF account was also linked with UAN so I transferred all my previous PF balance of 4 companies to this account. In the UAN portal , I can only see the summary for only 2 accounts.

Now, I want to withdraw my PF as I no longer work there. My query is:

1). When I try to withdraw my PF online, it only shows tenure of my last organization which is 1.5 years. Now if they confirm my tenure through UAN it’ll still be 4 years 11 months. Does that mean that they’ll deduct TDS?

2). If they look at all closed PF accounts then there won’t be any issue but I am not sure if they do that. How do I avoid TDS in this case?

Would really appreciate your response!

Regards,

Arun

Please check your passbook to see if all transfers have happened.

The new passbook should be updated as shown in the image below

from our article http://bemoneyaware.com/transfer-epf-online-changing-jobs/ which has details.

Are your service details showing all four jobs?

I would recommend you to file a complaint at EPFO grievance site as explained in the article How to register EPF complaint at EPF Grievance website online

Get details about which PF are transferred (were EPF with exempted organizations or Regional EPFO), ask for Annexure K which has details of all your EPF.

Sir, how to withdraw PF for NRI?

Sir, my PF money is 29000 rupees, and it has been 6 years since I left work, so I also have to fill up form 15g ???

Theoretically, it is not required.

Sir,

I have resigned service from Oct 2017. Last Contribution to EPF in Nov 2017 in Thane EPF Off under seperate UAN. Earlier it was contributed from Pune EPF Off from last 22 years under seperate UAN and the last contri to this off was up to Apr 2015. In Mar 2019 Pune UAN A/c transferred to Thane Off. Pune EPF given int up to Mar 2018. Apr 2018 onwards there is no int on epf amt given by Pune Off. also by Thane EPF Off. Shall I get the int from EPF Off. Pl. clear the doubt.

Hello,

thanks for ur guidance

I worked in an organisation for 4yrs 6months after that i met accident nd was bed ridden for 8months then i joined another company so i do have two uan no. and two salary account one previous nd one present.

Now please guide me how to make the claim and wat to fill in form 15g

thanks in advance

We would recommend you to transfer old PF account to new one.

If you want to withdraw then you cannot do online for old account as you are still working.

You can withdraw it offline

My EPF is below Rs.20k below.Do I need to summit Form 15G ? Kindly,clarify this doubt.

No, you don’t need to submit Form 15G.

Same applies to 23,720 also?i worked for 6 months and quit. The company is sold out. My amount is 23,720 should i fill 15g online and attach to the epf form or not required? Pls help me out

Hello Sir, I have worked for 1

7 months and it’s more than 1.5 year left the job and want to withdraw my EPF amount. My PF amount is less than 20k and my PAN details are also updated. Should in submit 15G form to avoid TDS deduction.

yes

Hello Sir, I have worked for 2 year 1 months and it’s more than 2 years left the job and want to withdraw my EPF and EPS amount. My PF amount as follows

EMPLOYER SHARE = 24230

EMPLOYER SHARE=7408

PENSION CONTRIBUTION=14419

(as per current passbook details,24230+7408+14419=46057)

my pan details are updated Should i submit 15G form to avoid TDS deduction or i can apply without this.

looking forward to valuable response.

regards

rajesh sharma

Field 17, the Estimated total income of the P.Y. in which income mentioned in column 16 to be included

My question is which income should be mention here???

It is my salary amount or which other amount???

It is your total income which includes income from Salary, House Property, Sale of Capital Assets, Interest + FD(Income from other sources) + Income from Business and Profession.

It is Salary + EPF Withdrawal amount(both employer + employee share) + any income mentioned above

Hii Dear

You have not required for form 15G.

You Claim This Amount Without 15G Form.

Hi Sir,

after completion of two years services i have resigned three months back, from last three months i did not join any job and my epf amount is approx 1.5 lac and it can mention in 16th column.

what amount should i give in 17th column?

Shall i produce 15g for epf withdrawal?

Hello Sir, I have worked for 16 months and it’s more than 2 months in left the job and want to withdraw my EPF and EPS amount. My PF amount is less than 20k and my PAN details are also updated. Should in submit 15G form to avoid TDS deduction.

No harm in submitting the Form 15G.

Please note that EPF withdrawal before 5 years is taxable as explained in our article http://bemoneyaware.com/epf-withdrawal-before-5-years-tds-form-15g-tax-itr/

Dear Sir,

I am doing full EPF withdrawal after 7 years of continuous service. I have not joined any other employment after this. Do I still need to attach form 15g at the time of withdrawal?

Not required after completion of 5 years continues service

Can you please explain me the TDS provisions where PF is maintained by Private Trust of the Company and not EPFO.

Whether section 192 or 192A is applicable ?

Who will be liable to deduct tax, whether Company or Trust ?

Whether threshold limit of 50k is available for Trust ?

Thanks in advance.

Thanks a lot for explaining the process in such a good detail. Its very helpful.

hi, I think that the form you have shown is outdated. I just downloaded the latest form from the site.

Hello,

Could you send the latest form to our email id bemoneyaware@gmail.com

Where is the download link for Form15g?

Hi, If PAN aren’t updated in UAN portal , it doesn’t accept 15G too while uploading for online PF claim submission. Kindly guide us, if the total PF amount is below 50k, and if PAN hasn’t been updated and if not working since 4 years, does TDS get deducted from PF amount? If yes, how do we claim from IT and the procedure to follow the same.

Looking forward for your valuable response.

my epf amount is 26000 , and pension con near 8k , is it compulsary to fill form 15g or not. now i m a unemployed.

It helped me a lot and well explained. Thank you for writing.

Thanks a lot for leaving comment.

It is encouraging

Sir,

I am a retired employee and completed 60 years of service. TDS deduction is applicble or not ?

I had PAN but not able to online link with UAN KYC.

To avoid TDS deduction what is to be done?