Every employee needs to submit a declaration, Form 11 when he takes up new employment in an organization which is registered under the EPF Scheme of 1952. This form, EPF Form 11, contains basic information regarding the employee and it is mandatory for an employee to fill it upon joining an organization. EPF Form 11 is a self-declaration by the new joinee about his status whether he is a member or non member of EPF / EPS in earlier employments and opt out of EPF. Can one opt out of EPF scheme on joining an organization? This article explains what is EPF Form 11, goes through contents of EPF Form 11 and instructions on how to fill it.

if a fresher joins his first organization with Basic + DA above Rs. 15,000, he can opt out of the PF scheme when he fills Form 11 on joining an organization. Such an employee is called as an excluded employee. However, he has an option to join the PF Scheme in his future organizations.

Update on 20 Sep 2017:The EPFO has introduced the composite declaration form 11 will replace Form No 13 in all cases of auto transfer. This means that now EPF transfers will be done automatically. Earlier On changing job or joining a new job employee was required to file Form 11 for giving details to the New employer and Form-13 for EPF transfer.

Table of Contents

EPF Form 11

What is EPF Form 11?

Form 11 is a self-declaration by new joinee about his status whether he is a member or non-member of EPF / EPS in earlier employments. This form is to be filled in by every employee at the time of joining the PF covered establishment. From this form the establishment and the authority ascertain the eligibility criteria of the employee as member of EPF / EPS. The purpose of form 11 is to make sure either of two things,

- (1) if the new employee was earlier a member of PF then he has to continue being a member of EPF. A new PF number or Member ID will be allotted by the new organization. It will be tied to UAN number provided by the new employee. More details on FAQ on UAN number and Change of Job

- (2) if the new employee was not a member of PF in the past, or he was not in employment earlier and his salary is more than Rs 15,000 p.m. in the new employment, he can opt NOT to contribute for EPF / EPS. Such an employee is called as an excluded employee. A person receiving PF pension or persons who have withdrawn the PF are also excluded employees.

Form 11 is an important declaration form which enables the provident fund department to maintain records of employees, helping them during inspections and cross checking of facts. It also provides invaluable information about an employee to an employer.

On 23 Sep 2016 EPFO issued a new EPF Form 11. The new Form 11 is a one page declaration form and a simplified version of the existing Form 11. The New Form . 11 will also replace Form No. 13 when existing EPF member makes a request for transfer of his fund availing the facility of UAN (Universal Account Number).

Is Joining EPS compulsory? Can one just join EPF?

The members who join the EPF after 1971 have to became a member of EPS when they join EPF. The Family Pension Scheme came in to force in 1971, at that time option was given to then existing members whether to go for this new scheme or not. Many then members opted not to go for it. The Family Pension Scheme was converted to EPS in 1995

Can one opt out of EPF?

Once a person is enrolled under PF Scheme, irrespective of his salary increments in consecutive jobs, he does not have an option of exemption from the scheme, unless the company is not registered under the EPF act.Such companies are usually startup or company which has less than 20 employees

But if a fresher joins his first organization with Basic + DA above Rs. 15,000, he can opt out of the PF scheme. However, he has an option to join the PF Scheme in his future organisations.

Revised EPF Form 11

In Jan 2015, New Form 11 was issued by EPFO to replace existing Form 11. The Declaration Form, , Form No. 11(New), also replaces Form 13 for existing member of the Provident Fund for transfer of his fund if he has UAN. The members who have been allotted UAN and where KYC details have been digitally verified by the previous employ are not required to file separate Form No.-13. Rest of the employees will continue to fill Form-13 along with Form No.11 (New) or transfer their EPF online.

On 23 Sep 2016 EPFO issued a new EPF Form 11. The new Form 11 is a one-page declaration form and a simplified version of the existing Form 11. The New Form 11 will also replace Form No. 13 when existing EPF member makes a request for transfer of his fund availing the facility of UAN (Universal Account Number). Till Sep 2016 when you are joining a new employer, and if you have contributed to EPF in your previous employment then you have to submit both Form No. 11(Declaration form) and Form No. 13 (for PF transfer from old EPF account to you new EPF account).

On 20 Sep 2017 EPFO issued a new Composite EPF Form 11 to be used by a new employee in the company. The Composite Declaration Form replaces Form No. 13 in all cases of auto transfer. This means Once the old EPF account details are provided in F-11 form, the funds will be automatically transferred by the EPFO to new EPF account. Auto transfer of previous PF account would be possible in respect of Aadhar verified employees only. Other employees are requested to file the physical claim (Form-13) for transfer of account from the previous establishment.

Contents of Form 11

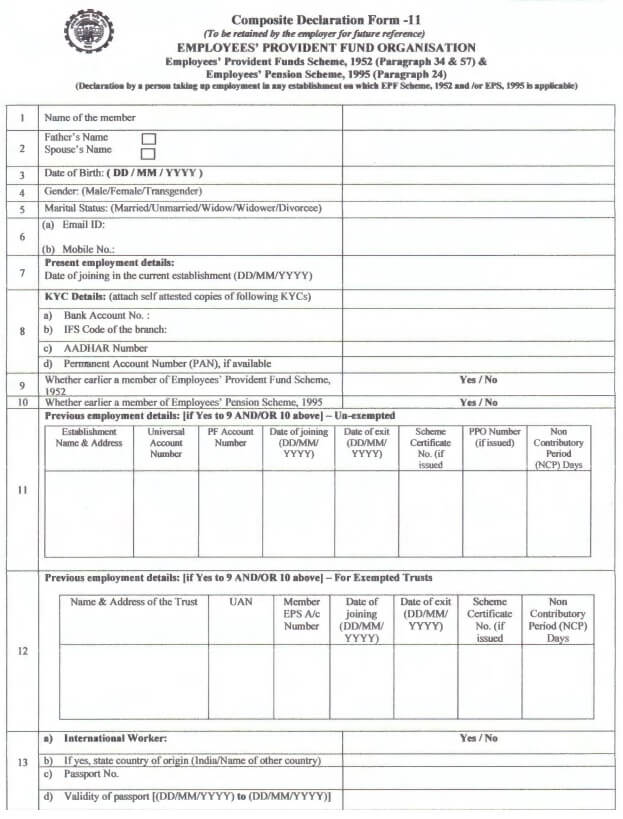

EPF Composite Form 11 is a new 2 Page Form. The image below shows the form

The revised structure of EPF Form 11 requires employees to fill in the following information which includes Personal Information, Details of Previous Employment, Details of International Employee. You can download the new EPF Form 11(post 23-Sep-2016) from here(pdf format). The image below shows the form.

Personal Information in EPF Form 11

Personal Information as shown in the image below.

- Name of employee

- Father’s/Husband’s name

- Date of Birth of employee

- Gender

- Mobile number

- Email ID

- Marital status

Instructions for filling the information is

- Please tick the Title (Mr/Ms/Mrs) and write full name in the form in Item No 1.

- Please tick the relevant box in item no 2 and provide Father’s / Husband’s Name in full in the form.

- Please provide Date of Birth in the form (DD/MM/YYYY) in Item No 3

- Please Tick the relevant Gender in Item No 4.

- Please provide e-mail id on which formal communication can be established and necessary information can be provided through e-mails.

- Please provide your mobile number on which formal communication can be established and necessary information can be provided through SMS.

Previous Employee Details in EPF Form 11

If you have contributed to EPF before then you need to give details of your EPF account as shown in the image below. This is very important and should be entered with utmost care as a number of services including tagging of various member IDs with UAN and its portability is dependent on these details.

- 9. Please tick ‘YES’ if you were a member of the Employees’ Provident Fund Scheme, 1952 otherwise ‘NO’ .

- 10. Please tick ‘YES’ if you f you were a member of the Employees’ Pension Scheme, 1995 otherwise ‘NO’.

- If you have ticked ‘YES’ in any or both of (7) & (8) above, please follow points 9 to fill up the previous employment details at Item Numbers 10,11 &12, otherwise follow 13 onwards

- Please fill Universal Account Number (UAN). UAN is 12 digit number which has been allotted by EPFO and provided to the EPF member through the employer. To check whether you have been allotted UAN against your PF member ID, please go to the UAN Member e-sewa on EPFO website www.epfindia.gov.in and click on Know your UAN status

- Previous employment P.F. member ID

- Date of Exit (i.e. Date on which member has ceased to work in the previous establishment) for the previous employment.

- Please provide the details of Scheme Certificate in Item 9 (A) and Pension Payment Order in Item 9(B), if the same have been issuehas the member for the previous membership.

Difference between PF number and UAN

PF number or Member Id or Member Identification Numbers is the number given by EPFO to allow the employer to submit EPF money of employee. It’s like Employer opens an EPF account for its employee and contributes to that account every month. Member ID is the account number of employee in the EPFO. When the employee changes the job then the new employer will open a new account number for its employee in EPFO. So a new Member ID will be allotted to the employee. Member ID is same as PF number earlier. So you would have as many Member ids as the number of employers contributing on your behalf to EPFO. An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. Its like you can have multiple Saving Bank account but all these are tied to your one Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number. Our article FAQ on UAN number and Change of Job discusses it in detail.

International workers information in EPF Form 11

Foreign nationals coming to take employment in India were earlier excluded from the provisions of the EPF Act. The rule, however, was changed in 2008. Now, a qualified international worker has to contribute to the Indian social security. An international worker is a person who can work in an Indian company, where Employee Provident Fund rules apply. Every International Worker, other than an ‘excluded employee’ should become members of the EPF Fund. There is no minimum period of stay in India for activation of Provident Fund compliance. Every eligible international worker has to be registered from the first date of his employment in India.

Social Security Agreement (SSA) is a mutual agreement between two countries to protect the social security interests of an employee in a country from the other country. India has signed this agreement with many countries such as Switzerland, Germany, France, Belgium, and Luxembourg to ensure that Indian workers are treated equally in that country and vice versa. For more details read about International Worker at EPFO website.

An expatriate, working in India, can withdraw his or her provident fund under the following conditions:

- If the international worker is covered under an SSA, the worker can withdraw the provident fund according to the regulations of that particular SSA.

- If the worker is not covered under an SSA, he or she can withdraw the provident fund at the age of 58, which is the age of retirement. However, exceptions are made if he or she has retired because of any incapability to work or is suffering from leprosy, cancer, and tuberculosis.

- An international worker under an SSA can have the provident fund credited to his or her bank account outside India. However, if he or she is not covered under an SSA, the PF would be credited to his bank account in India.

PF for International Workers to be calculated

- on total wages instead of Basic and DA. Total wages means whatever the wages/salary receiving inIndia(includes Basic and all other allowances (HRA, Conveyance, Project Allowance) and the salary/wages receiving in his/her home country. PF to be calculated on 12% as employee contribution. The employee should disclose his home country income to the Indian company for PF calculations

- (b) W.e.f 11-Sep-2010, Pension Fund (8.33%) to be calculated on the Total wages, whereas prior to the amendment it was calculated on Restricted Wages (Rs 6500/)

- The contribution shall be calculated on the basis of monthly pay actually drawn during the whole month whether paid on daily, weekly, fortnightly or monthly basis:

- There is no cap on the salary on which contributions are payable by the employer as well as employee. There is no cap on the salary up to which the employer’s share of contribution has to be diverted to EPS, 1995 and the same is payable on total salary of the employee.

If you are international worker then

- Select Yes in 10(a)

- Please provide country of origin in 10(b),

- Passport Number in 10(c) and

- the validity period of Passport in 10(d).

KYC Details in EPF Form 11

KYC details are required to provide better services to the members. Filling Bank account Number with IFSC. code in 11(a) Provide Aadhar Number in 11(b) and PAN (permanent account number) in 11 (c) if available.

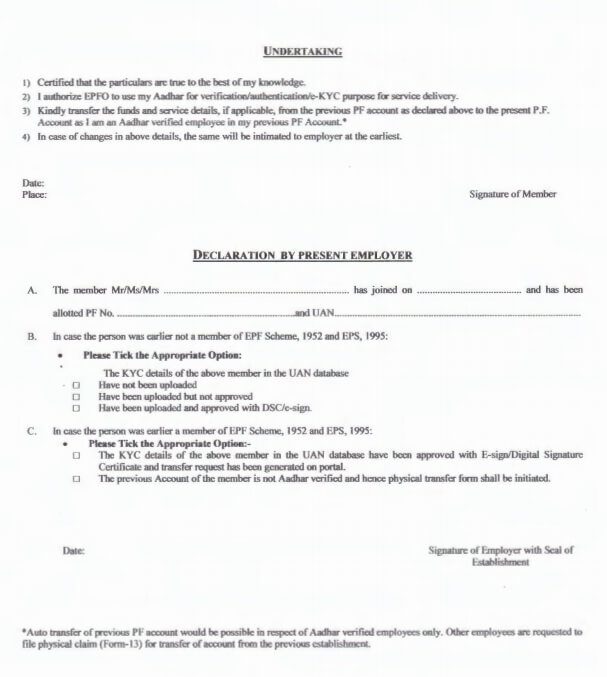

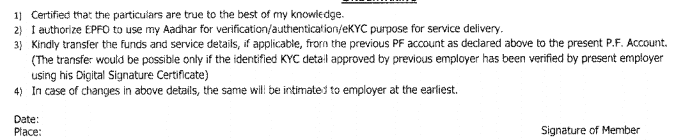

Declaration in EPF Form 11

Please put your signature in the space provided with date and place. Please submit the filled up form to the present employer.

New Present Employer Section in EPF Form 11

The present employer i.e the new organization that you have joined is required to take necessary actions as explained in detail on EPFO website under UAN services and fill up the necessary details with the signature and seal in the space provided. It also has to provide a declaration stating facts regarding the information provided by an employee. This declaration contains the following details.

- Date of employee joining work

- PF ID number/Member ID assigned to employee

- UAN number of employee

- Verification of KYC credentials.

Hope this helped in understanding EPFO Form 11. If you are joining a new company you can opt out of EPF if your Basic + DA is more than 15,000. Else When you join a new organisation, it allows you to submit information about the previous employer to new employer. New Form also starts the EPF transfer.

You can download the new EPF Form 11(post 23-Sep-2016) from here(pdf format)

Related Articles:

List of articles for an Employee:Earning,EPF, UAN,Study

- Withdrawal or Transfer of Employee Provident Fund

- EPF Private Trust, the Exempted EPF Fund

- How much EPS Pension will you get with EPS Pension Calculator

- How EPFO Manages Money, EPFO invesment in Stock Market

- Changing Jobs:Take Care Of Bank Account,Tax Liability

- Changing Jobs and Tax, Form 12B

Sir/Madam

Please tell me how to make correction of name in Scheme Certificate as per Aadhaar card.If it is possible please tell us

Hi

I have query related to form 11 where i want to know that if I opt out from PF contribution with new employer at time of joining and later wish to contribute after few months then is there any provision in EPFO.

Can I approach employer for considering since I opted to be an excluded employee.

Yes, theoretically you can join anytime.

But confirm it with your employer if we allow it.

I have pf account and uan. I left d job. I joined d new job and filled up the form 11 and submitted where I didn’t mention old pf and uan. Thinking that new organization new uan.. now wat I have to do..

if an employee joins his first organization with Basic + DA above Rs. 15,000, he can opt out of the PF scheme when he fills Form 11 on joining an organization. Where to mention the details/ declaration for opting out from PF by the employee?

Are you sure that you don’t want the EPF?

You need to inform your employer.

He will do the needful.

Respected Sir/Madam,

Issue is : By mistake, while joining new organization, I have provided wrong UAN number in Form-11(Declaration form to be submitted to EPFO). As a result of that New PF number got linked with wrong UAN number by EPFO(I guess) because I am not able to see new employer’s PF submission using my correct UAN number ?

Kindly, help and suggest the way to handle this situation.

Thanks,

HI I NEED TO TRANSFER MY PF AMOUNT TO MY NEW MEMBER ID HOW CAN I PROCEED FURTHER AND I HAVE 3 MEMBER ID HOW CAN I GET CONSOLIDATE IT PLS ADVICE

Where to submit this form?? to the previous employer or present employer??

Thank you for this. It is very informative and helpful.

I have previous pf account balance now i hv join new employer i want to transfer my previous pf amount to my present account how can i do it i am unable to do it online it shows no record found when i enter uan or previous member id plz help me

Did you activate your UAN?

Did you ask your old employer?

HOW I WILL SURRENDER MY EPS CERTIFICATE TO MAKING MY PRAN NO.BY BIHAR GOVT JOB,IS EPS CERTIFICATE AND PRAN IS A SAME THING OR DIFFERENT

EPS is Employee Pension Scheme where one contributes for pension when one has EPF account.

PRAN is Permanent Retirement Account Number and is associated with NPS (National Pension Scheme) which was introduced by Central govt in 2004.

The two are governed by different organizations.

EPF is governed by EPFO

NPS is governed by PFRDA(Pension Fund Regulatory and Development Authority)

What do you have EPS or NPS or both?

Dear sir

I am withdrawal my pf online but not withdrawal my pf Show problem in online my joining date not add in my company so

Plz help me

Maam,

Please login to UAN website and check View->Service History, as shown in the image below, and check that all your details are updated.

If any detail is missing such as DOE EPF you will not be able to withdraw from EPF.

Please send all the picture of your View->service history and answers to the questions to our email id bemoneyaware@gmail.com

Your Member Id or PF account Number

Your name as it appears in the records of EPF for that organization

Name of the company for which you worked.

DOJ EPF: Date of joining Employee Provident Fund. The day from when your EPF contribution started. Should be your date of joining.

DOE EPF: Date of Exit of Employee Provident Fund. The day when your employer stopped contributing to your EPF account. Should be the date of your resignation.

DOJ EPS: Date of joining of Employee Pension Scheme. It would be same as DOJ EPF.

DOE EPF: Date of Exit of Employee Pension Scheme. It would be same as DOE EPF.

Let me explain what I have understood and questions we have.

You are withdrawing your PF online:

Are you still working?

How many PF accounts do you have?

Are they linked to same UAN?

Is your UAN linked to Aadhaar?

My father name missing ha sr. Pizz update sr.

Epfo Me Gender note Avlable he to corection kese kare

I had withdrawn my earlier PF money before joining my current organisation.

My current organisation, which I joined in March-2016, is exempted from PF trust. I am a new EPF member here, there is no contribution to my Employee pension scheme and therefore I do not have UAN created here and also do not have old UAN linked.

In this scenario, how can I become a EPS-member?

Can i request my employer to re-submit Form-11 with corrected old UAN details?

Even exempted organization contributes to EPS.

As discussed in our article EPF Private Trust, the Exempted EPF Fund

EPF Private Trust is a trust authorised by the EPFO to maintain provident fund accounts of employees of a firm or company

Only EPF will be handed by Trusts.

EDLI may be continued with EPFO. If employer provide equal or better benefits, exemption may be granted in lieu of EDLI also.

However, the pension or EPS is payable only by the EPFO. So EPS portion still needs to be submitted to EPFO.

Distribution to EPF,EPS and EDLI remains the same for exempt and unexempt

Scheme Name Employee contribution Employer contribution

Employee provident fund 12% 3.67%

Employees’ Pension scheme 0 8.33%

Employees Deposit linked insurance 0 0.5%

EPF Administrative charges 0 1.1% for Unexempt/0.18% for Exempt

EDLIS Administrative charges 0 0 .01%

Many thanks for such a good article on Form 11.

Hi

Many thanks for such a good article on Form 11.

In the ” What is EPF Form 11?” section, per month salary figure is Rs. 15000. It may be an typo.

Please help to understand what is to be filled in employer part if the employee joining is an excluded one in the present company.

Regards

Puran Dangwal

Sir Actually i m a contractor and if i receive Form 11 Regarding Pf from Labour then Whether i need to cut Pf or not Of Employee, or Give detail any other option to Escape From PF Liabilities

I had pf in my previous company, which was withdrawn and I received the amount as part of the full and final payment. The new company that I joined is now planning to start pf. However I would like to opt out. Can I do that? Which option do I choose on form 11 to opt out?

5353 925422You ought to join in a contest for starters with the highest quality blogs online. I will recommend this page! 14443

how to genrate UAN

how to generate UAN number

i didnt have idea of form-11 ..please mail to my respective maid id form-11

rekha.rkristal@ymail.com