House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. To claim HRA you need to submit PAN number of your house owner, Lease agreement and receipts to your landlord. This article talks about How to claim HRA from the employer. Can you claim HRA by paying rent to parents, wife/spouse, brother, sister, or sister-in-law? What is rental agreement, should you get the rental agreement made, notarized, registered. What is the format of rent receipt, how many rent receipts to submit? Do you need to get revenue stamp?

Table of Contents

How to claim HRA from your employer?

House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. Our article HRA Exemption,Calculation,Tax and Income Tax Return talks about it in detail. Income Tax Department has standardized the way of declaring HRA by introducing Form 12BB. Your TDS shall be adjusted so you don’t have to pay tax on HRA and your final tax liability will be calculated accordingly. To claim HRA from your employer you need to provide following details to your employer.

- Live physically: You must physically reside in the house mentioned by you while claiming HRA exemption. In case your parents are landlord, make sure that they include the rental income too while filing their returns.

- PAN number of landlord:

- If the annual rent paid by you is more than Rs 1,00,000, it is mandatory to obtain PAN of the landlord and report it to the employer to claim HRA exemption.

- In case PAN is not available, then your landlord must be willing to give you a declaration to this effect. Along with the declaration, you also need to obtain ‘Form 60’ dully filled by your landlord, in case PAN is not available.

- If your landlord is not giving you PAN number maximum HRA that you can claim is Rs 8,333.

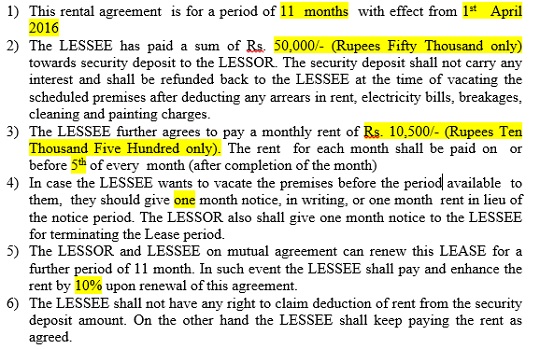

- Lease or rental agreement: You must sign up a valid agreement with the landlord. This agreement will have details of the accommodation on lease, period the of lease and rent agreed. In case of a shared accommodation, then along with the above mentioned details in the rent agreement, it should also mention number of tenants co-sharing the flat, ratio in which rent and how utility bills are to be divided. This document may be asked by your employer.

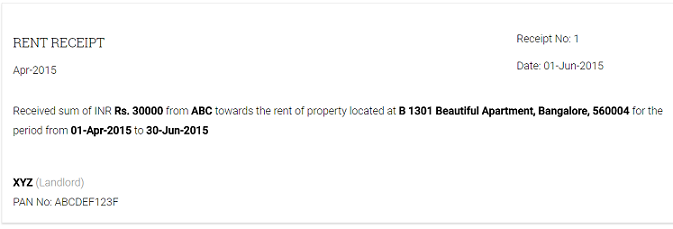

- Rent receipts: To allow you the exemption on HRA, it is mandatory for the employer to collect proof of rent payment. The employer will give you the exemption on HRA based on these rent receipts.

- It is mandatory to furnish rent receipts to the employer for claiming HRA exemption for the monthly rent paid more than Rs. 3000 per month.

- Tax exemption will be calculated only on the basis of rent receipt furnished by employee mentioning the amount paid. Any amount paid over and above the rent receipt shall not be considered for the purpose of exemption by employer.

- Usually, employers need receipts for 3 months or so.

- Rent Payments: Make your rent payments preferably via banking channels instead of cash. Using banking channels helps to provide an electronic trail of money for the transactions occurred.

- TDS:

- Tenants paying rent to NRI landlords must remember to deduct TDS of 30% before making the payment towards rent.

- Remember to deduct tax at source (TDS) @ 5%, from the rent paid to your landlord if you are paying rent above Rs. 50,000 per month. Interest at 1% per month is levied in case you forgot to deduct it and 1.5% per month where TDS is deducted but not deposited. It would also attract the penalty of Rs 200 per day for the period of delay

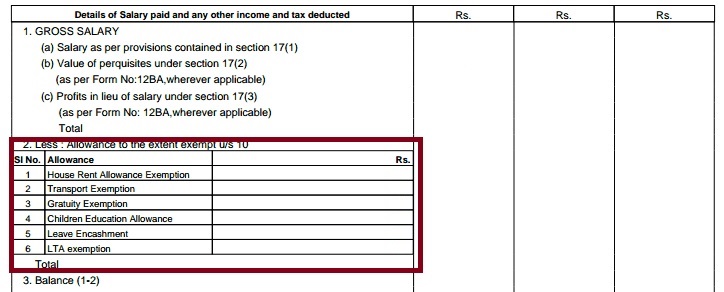

- Form 16, shows the HRA exemption as shown in the image below. House Rent Allowance (HRA) Exemption would be calculated by your employer and shown in Form 16 if rent receipts, lease agreement were submitted on time.

- You would have to show HRA in the calculation of Income from Salary in ITR.

Can I claim HRA exemption paying rent to my wife/spouse: No! If you pay rent to your spouse, this does not qualify for HRA exemption, because as per income tax department you are supposed to stay with your spouse!

Can I claim HRA exemption paying rent to my parents/brother/sister-in-law ?: Yes, You can claim exemption on rent paid to others including parents, brother, sister-in-laws etc.

Can I claim Rent for Part of the Year: Yes.You can still claim HRA for the months you were living on rent. For the remaining month tax shall be deducted on your HRA part of you salary.

Can I claim HRA while filing ITR if I cannot submit proof to the employer on time: Yes you can

While Income Tax Act does not restrict the employee from claiming tax exemption for HRA while filing returns but there will be mismatch in the salary income reported in the Form 26AS by your employer vis-à-vis that reported by you in your return. This may prompt the department to send a communication seeking response regarding the mis-match

If you have not been able to claim HRA exemption from your employer you can claim it directly. This exempt amount has to be reduced from your total taxable salary. The net amount is shown as your ‘income from salary’ in your income tax return. Our article How to Claim Deductions Not Accounted by the Employer explains it in detail. If you claim HRA exemption in your tax return, you must still maintain rent receipts and lease agreement safely in your records, in case the assessing officer asks for them later.

Can I claim HRA if it is not part of my salary? Yes If you are making payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence, but do not receive HRA from your employer, you can claim deduction under section 80GG.

Rental Agreement

A rental agreement is a legal document that binds the owner of the property and tenant and safeguards the interest of both the parties. The landlord must either be the owner of the property or a person having an attorney from the owner. It is important as it protects the rights of a landlord as well as the tenant. It prevents the unnecessary hikes and eviction without prior notice of minimum one month. Rent Agreement can be done online through legaldesk.com,edrafter.in, nobroker.in.

The standard rent agreement is made only for eleven months. Because as per the Registration Act, 1908, clause (d) of sub-section (1), registration of the property that is on lease for one year or more than a year is compulsory Renewable/extendable agreements for three to five years can also be made and registered. However, the stamp duty and registration charges for longer duration may differ.

What should a Rental agreement contain?

A rent agreement includes the terms and conditions under which the property is given on rent. It specifies basically the following conditions. However, if the parties involved have more clauses, they are free to add clauses of their choice as long as both parties consent to it. As soon as you draft your rental agreement, make sure that it is reviewed by both parties.

- Name, address, father’s/husband’s name of both the tenant and the landlord should be clearly mentioned.

- Rent value and the tenure for which the agreement is made. The tenure of a rent agreement is usually 11 months unless otherwise specified in the contract. If it’s for more than a year, it’s mandatory for the owner to get the document registered

- the security amount that is deposited with the landlord by the tenant.

- the day before which the rent is expected to be paid. If the tenant fails to pay the rent before the predetermined period, the penal charges that he would be liable to pay should also be defined in the agreement.

- The rent agreement could also mention the facilities, such as parking space or the usage of society’s gym, included with the property.

- There could also be additional monthly charges, such as the society maintenance charge and club fee. It’s best if the additional charges for using such facilities are clearly spelt out, along with the person who is supposed to bear them.

- Rent revision terms (if going for long duration)

- Notice period, Lease Termination & Extension

- In case the flat is furnished, a list of fittings and fixtures should be made and the penalty for damage decided in advance. The landlord should also check plumbing, electrical, sanitary fittings, etc, and mention their condition in the agreement. Details of the condition of walls, ceilings, and rooftop should also be mentioned so that there is no dispute over damage to the house if there is any.

- The purpose of tenancy should be clearly written- whether it will be used for the commercial or residential purpose.

Sample Terms and conditions are given below. You can download sample rental agreement (doc) from here

Rental agreement and Notary

Under 11 months, both registration and notarization can be overlooked. Do not confuse registration with notarization as both are two different actions.

Notarization generally refers to verification and giving a seal of authenticity to a document. This is performed by a Notary who is appointed under the Notaries Act. Registration on the other hand in registering the document with a local Sub-Registrar office. The procedures for both are governed by different Acts and can therefore, be considered as two entirely different procedures.

In India, it is not mandatory to notarize a rental agreement. As long as it is printed on Stamp paper and is signed by both parties and by two witnesses, it is considered binding. However, if you wish to notarize it, you may do so. The job of the notary is to verify everything in the document and attest the document once everything is found to be genuine about the document as well as the deponent. A Notary public is someone appointed by the State/ Central Govt. and his/her primary duty is to deter frauds and forgeries by overseeing/witnessing document signing and authenticity verification. Apart from this Notary Public also performs duties such as oath administration, affidavit signing, record maintenance and performing marriage ceremonies.

However, if you still wish to get your deed notarized, here’s the procedure for it. It is fairly simple, so it should take you very little time.

- Visit a court/ Sub-Registrar office

- Approach a Notary Public

- Present your documents and explain the need to them

- Get the deed notarized

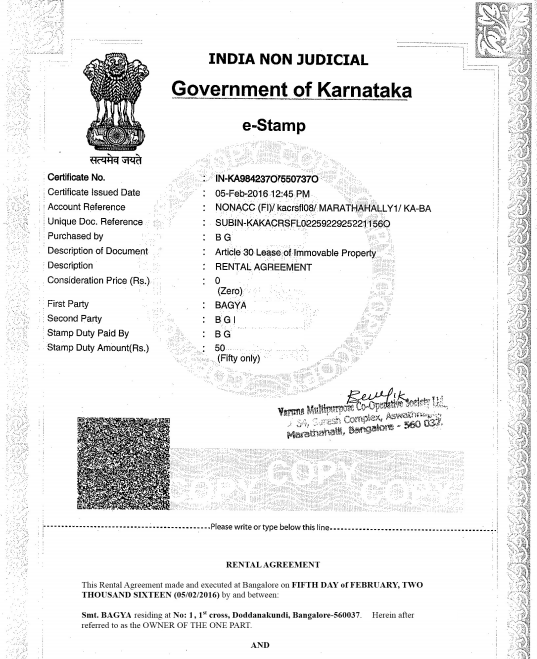

Rental agreement and Stamp Paper

As per the Law when one does some transactions such as buying and selling real estate, business agreements, leasing property, one needs to make pay Stamp Duty to Central/State Govt. The duty to be paid varies from state to state and if a state does not have its own Stamp Act, it will be overseen by the Indian Stamp Act. Stamp papers are proof that the required Stamp Duty has been paid to the Govt., much like receipts.

The Stamp Paper value (Stamp Duty) depends upon State to State. For example in Delhi, the Stamp Paper amount provided by Government for Agreement is Rs. 50 where as in Bangalore Rs. 20. The Stamp Paper value of Rent Agreement is not decided on the amount of rent fixed between parties but is decided as per the stamp duty fixed by the State Government. The range of Stamp Duty for rental agreement is mostly Rs 20, rs 50 and rs 100. You verify with your employer if there is some limit on stamp paper.

As of now, Indian Govt. permits payment of Stamp Duty in more than one ways. They are:

- Through e-Stamping

- Through papers bearing impressed Stamps which would be the non-judicial Stamp paper

- Using a Franking machine

- Adhesive stamps, paying at the registrar office etc.

For using e-Stamp paper for your rental agreements, you need to do is verify whether your state facilitates this, by going on to the website of SHCIL and checking if your state is included in the list. Some of the states that allow e-Stamping include Assam, Gujarat, Himachal Pradesh, Karnataka, Maharashtra, Delhi-NCR, Tamil Nadu, Uttarakhand and Uttar Pradesh.

- To get a rental agreement printed on e-Stamp paper, you will first have to purchase an e-Stamp paper from allotted centres in your city as you cannot purchase them online from SHCIL or their distributors!.

- Write/print your rental deed on e-Stamp paper,

- Tenant and the landlord, must place their signatures at designated places along with the signatures of two witnesses.

Rent Receipts

There is no standard format of rent receipts. Rent receipt should contain the landlord’s name, rent amount, address of rented place, landlord’s PAN details and the duration for whicj rent is received( monthly or quarterly). You don’t need the revenue stamp if you are payment of rent is made via cheque or online. Revenue stamp is only needed if payment made in cash per receipt is more than Rs 5,000. An Assessing Officer is free to make such inquiry for the purpose of satisfying himself that the employee has incurred actual expenditure on payment of rent

You can give a monthly receipt for a month in every quarter (Apr-June, Jul to Sep, Oct-Dec, Jan to Mar) or give a quarterly receipt. Please clarify with your employer about frequency/format of receipt.

Note: An employee can be dismissed from service for producing Fake Rent Receipts.

Related articles:

- How to claim LTA

- HRA increased from 24,000 to 60,000 under section 80GG

- How to Claim Deductions Not Accounted by the Employer

- How to show HRA not accounted by the employer in ITR

- If you don’t file the Income Tax Return on time

- Understanding Form 16 – Part 3

Hope this article helped you in understanding how to claim HRA from your employer, rental agreement formar and rent receipt.

Hi Admin, Can I produce only Rental Agreement to Employer without producing Rent Receipts to claim HRA?

Because the landlord doesn’t want to share his PAN Details and he is also refusing to sign any rental receipts. I have made all payments through UPI/Netbanking.

Does the Advance amount paid to Landlord accounts for HRA Exemption?

Sadly no.

You need to give PAN Details of the landlord.

Is Advance amount adjustable to rent? if not then it does not qualify for HRA Exemption

Hello,

Do i need to register or notarize my rental agreement, if the only purpose is for claiming HRA by paying rent to parents?

I stay in Kolkata in a rented apartment and my landlord stays in another state. Can a rent agreement be made on a stamp paper belonging to the state my landlord is in right now?

Typically rent agreement is made in the state where the rented property is!

So get rent agreement made in Kolkata

Hi,

We had a rent agreement with our landlord from 1 June 2019 to June 2020. But due to COVID-19 we verbally agreed with our landlord for two months extension & we paid the rent for those two months. So right now I only have a rent agreement till June 2020 but I have paid rent for July & Aug 2020. What type of proof will my employer need if I don’t have an agreement per se for those two months, will a letter from the landlord suffice?

Letter from Landlord should be good with rent receipts for the months of Jul & Aug 2020.

Verify it with your Payroll/Finance department

Thanks for such a wonderful blog. Truly amazing post. Well described.

Eveyone who would like to calim HRA using rental agrements and receipts should probably read your article. It will be useful for everyone.

Hi,

Is it mandatory for the rent receipt to contain the signature of the landlord? My landlord is suddenly refusing to sign my rent receipts although he has signed in previous years.

I do have landlord PAN details, pan copy, valid rental agreement and proof of rent payments via bank transfers.

Thanks!

Depends on your company.

But try to speak to your landlord as to why is he hesitating.

But your landlord will have to give your details while filing his ITR this year.

This year ITR is asking for details of tenant as explained in our article Income Tax for FY 2019-20 or AY 2020-21

If from April to July I got internship stipend which didn’t have any HRA component and Aug to March I got salary which has HRA, can I claim both 80GG for 4 months and HRA 10(13A) for 8 months? My company has provided me separate form 16 for each.

Great post! it is mandatory for the employer to collect proof of rent payment.

Only Rental Agreement is enough for tax filing, without a rental receipt.

Tax filing does not involve submitting of proof.

Rental agreement, Rental receipts are required if you have income tax notice, scrutiny and Assessing officer wants to verify your claim.

if a person stay in rental house only one day or night in a month then it’s oK

Can rental income be earned by any other member of the family except the owner of the property?

My house property is registered in my father’s and my uncle’s name, can I rent out the property and earn income on my name and make the agreement on my name as well as issue rent receipts to the tenant for him to claim the deduction on the same?

Rental income is in the name of property owner

Hi Sir,

Thanks for all these information. I have started an internship. My stipend is 17500 and my HRA is 9000. But I live with my sister and brother in law in a house whose rent is paid by my brother in law and he claims for it from his employer. But I need to avail that HRA in order to meet my expenses. What can I do? I mean is there any way that I continue with my brother in law and sister but avail that HRA too. Is it necessary to present all agreement paper in order to avail that HRA from my employer?

Yes, now paperwork has to be correct as Income tax department has become very stringent.

ITR also required PAN of owner and PAN of the tenant.

Why are you worried about HRA? Your income is 17500 x 12= 2,10,00 which is below the basic exemption limit of 2.5 lakhs.

You don’t have to pay tax.

Taxation of Stipend Income has been a matter of much debate. In the Income Tax Act from a purely factual standpoint there is no mention of ‘stipend’.

when Stipend is paid to further a person’s education, we need to test whether it qualifies as a Scholarship.

Research fellowships, grants received from universities may all be exempt when their nature is to support further education.

Usually doctors earn stipend as they pursue a higher degree at a hospital. Such work by the doctor is similar in nature to that of a full time employee. The doctor is gaining experience from such work and performing duties like regular doctors – in such cases your Stipend may be taxed.

MBA graduates or engineering graduates receive stipend by pursuing internship at a company – Some companies may even offer accommodation. The Stipend letter may or may not include a break up like a salary letter does. This may or may not be similar to the employment letter offered to a full time employee. However, if this payment is made for you to gather an experience and perform services similar to an employee, such Stipend income shall be taxable.

Is Rent agreement mandatory if my monthly rent is less than Rs. 5000 /-

What documents are mandatory and when. Please help !

Employer usually asks for Rental agreement as a proof even if the rent is less than 8333 Rs.

Rental agreement and Rent receipts are mandatory.

They have to be provided usually from Dec-Feb when employer asks for it to calculate your net tax liability.

Can I show rent receipt for Feb and March in advance if I submit proof during Jan itself.

Yes you can

I am paying rent to parents with out rent agreement. Can i claim for HRA and if yes what kind of document i have to submit to employer

You can claim HRA when staying with your parents.

To claim HRA you need to provide the PAN number of your landlord: If the annual rent paid by you is more than Rs 1,00,000, it is mandatory to obtain PAN of the landlord and report it to the employer to claim HRA exemption. If your landlord is not giving you PAN number maximum HRA that you can claim is Rs 8,333.

Typically you need to provide rental agreement and rent receipts to HR dept.

You can discuss it with your HR/Payroll department what documents they require.

Parents must be the owners of the house. You can save tax only if you are paying rent to parent or parents who is owner of the property. If the property is jointly held by father and mother then rent should be paid to both of them. Rental Income is taxable: They must show the rent received as rental income in their income tax returns.

Our article Claim HRA while living with parents discusses it in detail.

Is notary is mendatory for rental agreement? I m doing agreement with my parents house and I m paying him rent amount.

No, it is not essential to notarize a rental agreement as long as it is printed on stamp paper and is duly signed by both parties and two witnesses.

you can claim, except your wife you can claim with any name or any blood relations, to make agreement give me a call on 8867467154

If there are two tenants in the rental agreement, how do I claim HRA exemption? Should I take the half of rent amount as rent paid?

Can hra exemption be claimed by husband if the rental agreement and rent receipts are in the wife’s name?

Very useful and detailed article.

Is rental (leave and license) agreement on stamp paper must for claiming HRA (license fee) or getting rent receipt would suffice for subsequent years on expiry of original agreement?

I have a leave and licence agreement with my landlord for 11 months signed and notarized in May 2011. We had a clause of auto extension with mutual agreement on increase in rent. No new Leave and license agreement is signed or notarized on expiry of Initial term, but after every 11 months, my landlord increases licence fees between 5-10 percent. I take rent receipt every year with his PAN number mentioned. I have made all payment via Cheque or NEFT.

Also instead of quarterly rent receipt a consolidated rent receipt every year is received. Is that a reason to worry?

How do you claim HRA? What do you mean by license fee?

Generally HRA is for claiming House rent from your employer

A rental agreement is a legal document that binds the owner of the property and tenant and safeguards the interest of both the parties. The landlord must either be the owner of the property or a person having attorney from the owner.

Rental agreement is important as it protects the rights of a landlord as well as the tenant. It prevents the unnecessary hikes and eviction without prior notice of minimum one month

One reason stated for 11-month agreement is to skip the registration process. “As per the Registration Act, 1908, clause (d) of sub-section (1), registration of the property that is on lease for one year or more than a year is compulsory.

So yearly rent receipts are fine but you might need a new lease agreement if demanded by Income Tax authorities

Thank you for your prompt attention and reply.

– I submitted rent receipt (= receipt for payment of licence fees, for leave and licence agreement executed in year 2011) and company Human Resource person accepted it for 3 years I was employed with them during 2011-2015 (without asking for renewed Leave and licence agreement, after I explained mutual extension of renewal and payment by cheque/NEFT).

I left that job and worked with other employer but was not receiving HRA for FY 15-16.

For FY 16-17, I am self employed and do share trading activity. So not sure if claiming 5000 rs per month HRA is beneficial or deducting rent from profit gained from equity trading before I file IT return in next few days.

Self-employed professionals cannot be considered for HRA exemption under this act, as they do not earn a salary. However, they can claim benefits on the house rent expenses incurred under section 80GG, which resembles section to 10 (13A) but is subject to certain conditions.

Our article HRA increased from 24,000 to 60,000 under section 80GG covers topic in detail

What are the conditions one has to meet to claim HRA under Section 80GG?

Under section 80GG of income tax act, 1961, a self employed person, businessman and even a salaried person can claim tax deduction for the expenses that they incur towards there house rent.

You are self employed or salaried

You have not received HRA at any time during the year for which you are claiming 80GG. If you are a salary person then you should not be in receipt of house rent allowance

You or your spouse or your minor child or HUF of which you are a member , do not own any residential accommodation at the place where you currently reside, perform duties of office, or employment or carry on business or profession.

You should not own a house in the place in which you live, or work or carry on business

Your spouse, child including minor child, Hindu undivided family (of which you are member )should not own any residential accommodation in that place

You must reside in that house to claim exemption. Any one with you can also stay with you for the purpose of claiming this deduction under section 80GG.

If own any residential property at any place, for which you have income from house property under applicable sections (as a self occupied property), no deduction under section 80GG is allowed.So If you own a house in some other city and use that house for your own resident and have not given for rent then also you can not claim deduction under section 80GG even though you stay in a rented house and pay rent at your work location in a different city.

I watched your blog to be particularly lighting up. I am on an extraordinarily principal level animated by your posts and considering shaping mine now. A commitment of gratefulness is in light of current circumstances to be a motivation to me as I was other than endeavoring to make puts forth, in any defense, was not getting the fitting class.

I am going through a peculiar case. I live in a rented house with my wife and own a flat too (co-owned by my mother). On my CA’s advise, I dont claim HRA and just claim the homeloan components. Now, the query is that though rent agreement is between me and the owner, can my Wife claim for HRA? Her IT team suggests that with new rules (where tenant is supposed to submit Rent Agreement), she can’t. If that’s true – what can I do to have her avail the benefit?

Very useful information – especially I found the general information about stamp paper/notary etc very informative.

Thanks for writing the comment.

We Appreciate it.

Very useful information – especially I found the general information about stamp paper/notary etc very informative.

I am working in a govt bank, my house lease has been sanctioned by the bank for a period of 12 month in june 2017( which expired on may 18) without any auto renewal clause and claimed house rent from bank even after expiry of lease agreement. Please suggest me is this a major issue for me and what to do to rectify this mistake. I am quite worried about this can bank take any dispilinary action against me?

Very Informative. It will help a lot of my friends.