Gains, which arise from the transfer of capital assets, are subject to tax under the Income-tax Act. If one sells an asset such as bonds, shares, mutual fund units, property etc, one must pay tax on the profit earned from it. This profit is called Capital Gains. The tax paid on this amount of capital gains is called Capital Gains Tax. Conversely, if you make a loss on sale of assets, you incur a Capital Loss. This post explains about the Capital Gains, type of assets, time of holding assets, Cost of acquisition, Cost of improvements, Expenditure incurred exclusively in connection with the transfer. Exemptions allowed under the income Tax Act, Capital Loss.

Table of Contents

Income Tax and Capital Gains

For the purpose of Income Tax, Under Section 14 income is classified under the following heads:

-

-

-

-

- Salaries.

- Income from house property.

- Profits and gains of business or profession.

- Capital gains.

- Income from other sources.

-

-

-

Our post Income tax overview deals in detail on calculation of Income tax.

Type of Assets

Capital asset means property of any kind held by an assessee whether or not connected with his business or profession. Assets which are considered for computation of capital gains can be classified as:

- Debt Mutual Fund

- Equity Mutual Funds with Securities Transaction Tax (STT) paid

- Stocks with Securities Transaction Tax (STT) paid

- Fixed Maturity Plan(FMP)

- Real Estate, Gold etc.

Securities Transaction Tax: Securities Transaction Tax (STT) has been applied on all stock market transactions since October 2004 but does not apply to off-market transactions and company buybacks.As per Section 10(38) of Income Tax Act, 1961 long term capital gains on shares or securities or mutual funds on which STT has been deducted and paid, no tax is payable.

Classification of Mutual Funds: The Mutual Funds where equity holding is more than 65% of the total portfolio will be categorized as Equity Funds. Other Mutual Funds come under Debt category Examples:

- Fund of Funds (mutual funds which invests in other funds)

- International funds (funds which have more than 35% exposure to international equities)

Exchange Traded Funds (ETF) ETF will be treated as equity or non equity fund depending upon the underlying security. If it invests in domestic equity it will be equity fund, otherwise non equity.

Capital Assets does not include the following:

- Stock in trade, consumable stores or raw materials held for the purpose of business or profession.

- Personal effects, being moveable property (excluding Jewellery, archaeological collections, drawings, paintings, sculptures or any other work of art) held for personal use.

- Agricultural land, except land situated within or in area upto 8 kms, from a municipality, municipal corporation, notified area committee, town committee or a cantonment board with population of at least 10,000.

- Six and half percent Gold Bonds, National Defence Gold Bonds and Special Bearer Bonds.

- Gold Deposit Bonds under Gold Deposit Scheme, 1999 notified by the Central Govt.

Transfer of Asset

If you carefully look at the definition of Capital Gains it says Gains, which arise from the transfer of capital assets, are subject to tax under the Income-tax Act. The word transfer has been given a very wide definition but in simple terms transfer includes

- Sale of asset

- Exchange of asset

- Relinquishment of any right in the asset

- Extinguishment of any right in the asset

- Compulsory acquisition of an asset under the law

For ex: if an insured asset such as property is destroyed and insurance compensation is received, no capital gains is leviable as there is no transfer of asset or right of asset to insurance company.

Certain transactions are not regarded as transfers and hence, the profits and gains arising from such transfer are not taxable under the head Capital Gains such as

- Under section 46,Distribution of assets in kind by a company to its shareholders on its liquidation.

- Under section 47(i) ,Distribution of capital assets in kind by a Hindu undivided family to its members at the time of total or partial partition.

- Under section 47(iii) , Any transfer of a capital asset under a gift or will or an irrevocable trust.

- Under section 47(viii), Any transfer of agricultural land in India effected before the 1st day of March, 1970

finance.indiamart.com:Tax upon Income from Capital Gains gives an overview of the transactions are not regarded as transfers.

Computation of Capital Gains

Computation of capital gains depends upon following things:

- The nature of capital asset that is transferred ex: Mutual Fund, Stocks, Property, Gold

- Time for which asset was owned based on the type of asset. Ex: If Shares, Equity Mutual Funds are for which Securities Transaction Tax(STT) has been paid, are transferred after being held for an year it class as Long Term Capital Gain. If Period of holding is less than 1 year it classifies as Short Term Capital Gain.

- Cost of acquisition, Cost of improvements, Expenditure incurred exclusively in connection with the transfer.

- Exemptions allowed under the income Tax Act.

Period or Time of Holding

The period for which an asset has been held by the person prior to its transfer is also relevant in determining the quantum of capital gains. For example a person might not have himself acquired the property, but might have become the owner of the property due to say:

- Distribution of assets on the total or partial partition of a Hindu Undivided family.

- Under a gift or will

- By succession, inheritance or devolution

- Distribution of assets on the liquidation of a company.

In such situations in computing the period for which asset was held, the period for which asset was held by previous owner should also be included. In such cases the purchase/cost price would be the cost to the previous owner. For example:

Mr Sharma receives a house property as gift on 14-2-2012. If the donor has originally acquired the property on say 11-1-2009 and person decides to sell the property on 18-2-1993( i.e 5 days after receiving the gift) the period for which the property was held will be worked out as follows:

- Period for which previous owner held the asset (11-1-2009 to 13-2-2012): 37 months and 3 days

- Period for which Mr Sharma held the asset (14-2-2012 to 18-2-2012): 5 days

Total period of holding: 37 months and 8 days. Hence house property will be treated as a long term capital asset for capital gain purposes.

Net Consideration, Cost of Acquisition, Cost of Improvement

Some of the technical terms involved in acquiring and selling of the capital asset are given below.

Full value of consideration : Price received from the sale of the capital asset without any deduction whatsoever.

Net Consideration: From the Full value of consideration deduct the Expenditure incurred wholly and exclusively in connection with such transfer by the transferor. Expenditure incurred should have a direct connection to transfer e.g. stamp duty, registration etc.

Cost of Acquisition: Value for which asset was acquired. As mentioned above in situations where a person might not have himself acquired the asset then the cost would be the cost to the previous owner. Expenses of capital nature for completing or acquiring the title to the property may be included in the cost of acquisition.

Cost of improvement: It refers to all expenditure of a capital nature that is incurred in making any additions or alterations to the capital asset by the current owner or the previous owner. The expenditure must go to appreciate the value of the asset, like making structural additions/alterations to a house property. Revenue expenditure such as Property taxes, Routine repairs and maintenance expenses, estate duty if paid on inherited property cannot be treated as Cost if Improvement. Year considered for improvement is the year in which improvement took place, irrespective of the year of payment of such costs.

Indexation and Cost inflation index

Indexation allows the taxpayer to factor in the impact of inflation on cost. It helps to counter the erosion in the value of the asset over a period of time. Using the Cost inflation index, the purchase price of the asset gets increased hence the capital gains and so may get reduced. For Ex:

- If a property is purchased in Financial year 1995-96 for Rs 20 lakh.

- It is sold in Financial year(FY) 2011 -12 for Rs 80 lakh.

- Gain would be = Rs 80 lakh – 20 lakh = Rs 60 lakh.

But if CII is considered then we need to calculate cost of 20 lakh of 1995-96 in the year 2011-2012. The Inflation index in year 1995-96 was 281 and year 2011-2012 is 785.

So Indexed cost of Rs 20 lakh in the year 2011-2012 is = 20 * (785/281) = 55.871. So Long term capital gain = 80-55.871 = 24.128 lakh instead of Rs 60 lakh

Cost of improvement can also be indexed. In indexation and capital gain parlance, the purchase price with indexation is called indexed cost of acquisition, cost of improvement if indexation is applied will be indexed cost of improvement. Our post Cost Inflation Index,Indexation and Long Term Capital Gains deals with Cost Inflation Indexation in details including details on when the indexation might not be beneficial.

Exemptions on Income Tax for capital Gains

Income tax act grants exemptions from capital gain tax, either totally or partially, if certain conditions are satisfied. The exemptions mentioned Section 45 are as follows: References to specific sections are from VakilNo1: Income Tax Law

| Section | Description |

| 54 | Profit on sale of property used for Residence. |

| 54B | Capital gain on transfer of land used for agricultural purposes not to be charged in certain cases. |

| 54D | Capital gain on compulsory acquisition of lands and buildings not to be charged in certain cases. |

| 54E | Capital gain on transfer of capital assets not to be charged in certain cases |

| 54EC | Capital gains – Not to be charged on investment in certain bonds |

| 54F | Capital gain on transfer of certain capital assets not to be charged in case of investment in residential house |

| 54G | Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area |

| 54H | Extension of time for acquiring new asset or depositing or investing amount of capital gain. |

| 115F | Capital gains on transfer of foreign exchange assets not to be charged in certain cases |

Please check the current tax law before deducting the exemption as the exemptions keep on changing. Some sections might become outdated. For example Section 54EA, Section 54EB were replaced by Section 54EC from Apr 2001.Ref:Outlookmoney:Touch And Go!(Sep 2000). Some of the exemptions that became outdated are given below

| 54EA | apital gain on transfer of long-term capital assets not to be charged in the case of investment in44[specified securities]. | Apr 2001 |

| 54EB | Capital gain on transfer of long-term capital assets not to be charged in certain cases: | Apr 2001 |

| 54ED | Capital gain on transfer of certain listed securities or unit, not to be charged in certain cases. | 2006 |

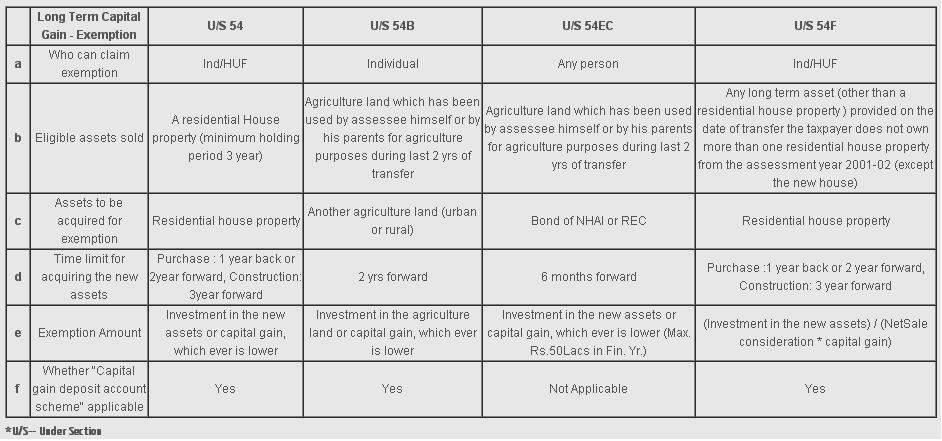

Some of the exemptions for Long Term Capital Gains are given below:

Long Term Capital Gain Exemption

Calculation of Capital Gains

Calculation of Capital Gains consists of following steps:

- Finding out type of asset.

- Find out time of holding of asset(including that of previous owner) the Financial Year in which the asset was acquired and sold. Remember for the Tax purposes Financial Year is considered.

- Find out the net value of consideration after deducting expenditure incurred wholly and exclusively in connection with such transfer.

- Finding out Cost of acquisition.

- Finding out Cost of improvement.

- Based on the type of asset and time period of holding applying the indexation or not

- Finding out if any exemption is available.

Capital Gain = Net Consideration – Cost of Acquisition- Cost of Improvement – Exemption

Table below lists the Capital gain tax based on Type of assets and Time of holding, indexation used or not

| Type of Asset | Short Term Capital Gain | Long Term Capital Gain | Tax on Short Term CG | Tax on Long Term CG | |

| Debt Mutual Fund | Selling before 3 year | Before Aug 2014:Selling after 1 yearAfter Aug 2014:Selling after 3 year | Added to income and taxed as per tax slab. | Before Aug 2014 If indexation used 20%, Without indexation 10%After Aug 2014 If indexation used 20% | |

| Equity Mutual Funds with STT paid | Selling before 1 year | Selling after 1 year | Taxed at 15%. | the new LTCG tax of 10% would be levied only on LTCG of an individual exceeding Rs 1 lakh in one fiscal or financial year.

(before 1 Apr 2018 LTCG was NIL) |

|

| Stocks with STT paid | Selling before 1 year | Selling after 1 year | Taxed at 15%. | the new LTCG tax of 10% would be levied only on LTCG of an individual exceeding Rs 1 lakh in one fiscal or financial year.

(before 1 Apr 2018 LTCG was NIL) |

|

| Fixed Maturity Plan(FMP) | Selling before 3 year |

|

Added to income and taxed as per tax slab. | Before Aug 2014 If indexation used 20%, Without indexation 10%After Aug 2014 If indexation used 20% | |

| Real Estate, Gold & Others | Selling before 3 years | Selling after 3 years | Part of total income and normal tax rates are applicable. | Indexation benefit is available and tax rate is 20% |

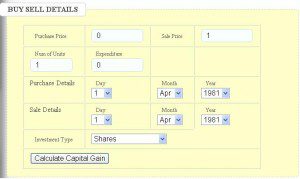

If you are interested in finding the Capital gains etc, you can try Capital Gain Calculator shown below.

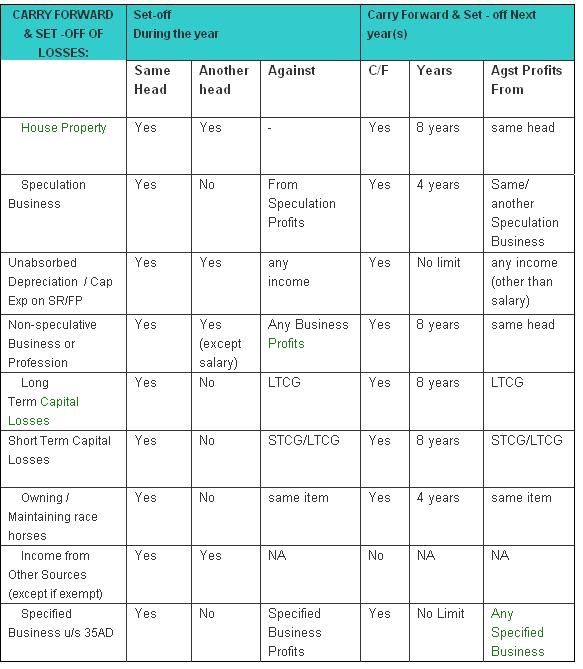

Capital Losses

Cases may arise when there is a capital loss i.e consideration for transfer is less than the cost of acquisition and improvement. Such loss, whether it relates to a short-term capital asset or a long term capital asset cannot be set off against positive income under any head. It can be carried forward to the next year and can be set off only against Capital gains but under specific categories. Morever, the law allows for any unabsorbed loss to be carried forward for 8 years. However the taxpayer has to file a loss return, failing which the unabsorbed loss will not be allowed for set-off. The table from itaxindia.org:SET OFF CARRY FORWARD OF LOSSES INCOME TAX INDIA given below tries to explain which capital loss can be offset or carried forward under which head.

Related Articles:

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- How to Calculate Capital gain Tax on Sale of House or property?

- Buying a House,Renting,Home Loan,Tax,Selling,Capital Gain

- RSU of MNC, perquisite, tax , Capital gains, eTrade

Hope our post helped you in explaining about the Capital Gains, type of assets, time of holding assets, Cost of acquisition, Cost of improvements, Expenditure incurred exclusively in connection with the transfer. Exemptions allowed under the income Tax Act, Capital Loss. Apologies upfront for any mistakes. Please let us know and we will correct. If we missed out anything please let us know. If you liked it please let us know too!

Now I am already having one house. ( EXISTING House) constructed in 1980.

I am getting a new flat in about April 2024 as my share from my ancestral property NEW House).

In anticipation of the new house in April 2024, I want to invest some money in the form of capital investment during Oct-Dec 2023, ie less thann 1 year preceding the accrual of capital gains on the new asset in April 2024,

YOUR CLARIFICATIONS SOUGHT ON THE FOLLOWING 2 ITEMS

1,CAN I GET CAPITAL GAINS TAX EXEMPTION ON THE NEW HOUSE ( 2024 April) TO THE EXTENT OF THE PROPOSED CAPITAL EXPENDITURE ON MY EXISTING HOUSE ( OCT- DEC 22024 EXPENDITURE).

2. WHAT WILL BE THE IMPACT IF THE PROPOSED CAPITAL EXPENDITURE ON MY EXISTING HOUSE IS INCURRED WITH A HOUSING LOAN FROM A BANK.

Hello,

I want certain clarification with regard to UTI-ULIP Plan 1971 (A debt oriented Fund). I joined the scheme on 25.01.1999 with yearly contribution of Rs.7500/- (Insurance premium Rs.510/- + investment amount Rs.6990/- for 10 years. Every year the UTI gave Bonus units also. No one is clarifying the tax details and hence I am still holding the units even after the maturity date.

1. On redemption there will be capital loss on sale of all original units due to indexation benefit.

2. As for the Bonus units are concerned, there is no indexation benefit as the cost is nil and hence the actual redemption amount will be taxed at 20% without indexation.

My question comprises of two things for calculating the Capital gains/ loss:-

a) The NAV data ( fair market value) of Units held by me prior to 01-04-2001 is not available anywhere , even with the UTI Mutual Fund authorities. In its absence can I use the actual NAV data for which those Units were allotted to me?

b)There is no provision to show separately the capital loss on sale of the original units for which indexation benefit is available, and the capital gains on sale of BONUS units for which there is no indexation benefit in schedule CG (part B, Point 7) of ITR-2 .

or

c) Can I show the net figures without separately reporting them? Is it allowed? In my opinion, the effect is the same. I am not hiding anything.The format is not allowing me to report the current year losses separately.

Kindly do help me.

I purchased a flat in the year April 2000 for a sale consideration of Rs: 4.5 Lakhs. I sold the property in the year Jan 2018 for a sale consideration 0f Rs: 23.5 Lakhs . can I am to pay income tax or not. since it is a long term invstement.

Though it is a long-term investment You would have a capital gain tax of around 2 lakhs.

You can claim tax exemption under Section 54 on the long-term capital gain on the sale of a house. To avail of this exemption, you must

Use the entire profit to either buy another house within two years or

Construct one in three years.

If you had already bought a second house within a year before selling the first one, you could still avail of the tax exemption,

But what if you don’t want to buy a property at all with the capital gain (LTCG) amount? You can still get tax exemption. The long-term capital gain tax can also be saved under Section 54EC if the capital gain is invested for three years in bonds of the National Highways Authority of India and Rural Electrification Corporation Limited within six months of selling the house

Please go through our article How to Calculate Capital gain Tax on Sale of House or property? which calculates the capital gain on sale of house.

If the property is purchased before 1 Apr 2001 then the fair market value of the property as on 1 April 2001 can be considered as the cost of acquisition. For ascertaining the Fair market value, it is best to engage the services of a registered valuer. Our article Fair Market Value: Calculating Capital Gain for property purchased before 2001 covers it in detail

Just to get an idea if we assume that the property rate in Apr 2001 was same as Apr 2000 your approximate capital gain Gain Tax with indexation (at 20%) is 225200

Details from calculator are given below.

Time between: 16 years 279 days

Gain Type: Long Term Capital Gain

Difference between sale and purchase price: 1900000

CII of the Purchase Year: 2001 month: Apr : 100

CII of the Sale Year: 2018 month: Jan : 272

Purchase Indexed Cost:1224000

Difference between sale and indexed purchase price: 1126000

Long Term Capital Gain Tax with indexation (at 20%):225200

My parents gifted piece of land each of the same plot to us, 3 sisters, value of each being value being Rs.5000/- in 1958.The 3 plots were amalgamated and a buiding was constructed through an agreement with a developer.I got an apartment in Dec, 2010 as per agreement and sold it for Rs. 65/- lakh in may, 2013. How much will be capital gain tax on this sale since there was a value addition to the land but cost was borne by the developer.

Shall be grateful for a reply.

My annual salary is rs 250000, income from other sources is rs 30000 from which Rs 3000 already deducted as TDS, i have made short term loss of rs 8100 from mutual fund during 2015-16. which form i should use? is Rs 8100 can be adjusted against anything? whether any tax refundable? please reply

I am a salaried employee with net capital loss in shares through Demat accnt, which form should I fill?

I also do not want to offset the losses in future also.

I have purchased a flat in 1996 july for 9.90,000/- I sold the flat for 65,00,000/- in the year oct 2013. What is the gain and how much tax haveb I ton pay.

G N Kumar

Sir, usinng our Capital Gains calculator your Long Term Capital Gain Tax with indexation (at 20%):690419.67. It should have been accounted for while filing ITR of FY 2013-14 i.e of AY 2014-15 before 31 Jul 2014.

Detailed calculations are as follows:

Investment Type:Real Estate

Time between :17 years 96 days

Gain Type: Long Term Capital Gain

Difference betweem sale and purchase price: 5510000

CII of the Purchase Year: 1996 month: Jul : 305

CII of the Sale Year: 2013 month: Oct : 939

Purchase Indexed Cost:3047901.64

Difference betweem sale and indexed purchase price: 3452098.36

Long Term Capital Gain Tax with indexation (at 20%):690419.67

Sir, I had booked a flat in Dec 2009 and allotment letter issued in April 2010. Payment was made in instalments. After making final payment in July 2014 possession was handed over in Sept 2014. On sale of this property in April 2016, please clarify whether it will attract Long Term Capital gain OR Short Term capital gain.

My grandfather was a tenant having 1 shop after his death it was transferred to my father and than to mother .in between the shop was under redevelopment in the year 1997 and I got a new shop possession in 2002. Than the agreement was registered in 2012 with zero value and stamp duty was paid 1200.00 now if I am selling the shop what will be my cost of shop for indexation purpose

nil

HELLO,

WE 3 BROTHERS PURCHASED A RESIDENTIAL PLOT IN 2006 FOR RS. 3.5 LACS AND SOLD IT IN 2015 FOR RS. 48 LACS. WE ALL HAD EQUAL SHARE NOW ONE OF US (BROTHER) GOING TO PURCHASE RESIDENTIAL HOUSE IN DIFFERENT STATE, WHAT WILL BE THE TAX LIABILITY AND HOW WE CAN GET EXEMPTION?

THANKING YOU.

Hi,

I bought a property for 35 lakhs during 2011 and sold it for 40 lakhs during 2014. I used your capital gains calculator and my Long Term Capital Gain with indexation comes to a negative value. So, should i be add these details to IT return filing ? If so, how do i fill those details in ITR-1 form ? If it is not filled in ITR-1 form, which form should i fill it into ? Thanks in advance !

Want to add a clarification: One very important question many people have is what is cost of acquisition of shares purchased in secondary market. There are numerous charges one has to pay and not all these charges are allowed to be added as cost of aquisition. The various charges are brokerage, service tax, STT, Stamp duty, transaction charges, ST on transaction charges & SEBI turnover fee (what a loot!) Out of all these only brokerage and service tax on brokerage can be added to the base price to calculate cost of acquisition (before indexation is applied).

Regards,

Thanks a lot Shirish for pointing out. You rightly pointed.out that only brokerage and service tax on brokerage can be added to the base price to calculate cost of acquisition (before indexation is applied).