Bharat bond ETF is an exchange-traded mutual fund that will invest in bonds issued by public sector companies. It will also be available in Mutual Fund format as Fund of Funds. The bond ETF will be open for subscription from December 12-20. Is it a good product for investors seeking low risk, predictable return and a reasonable level of liquidity?

Table of Contents

Features of Bharat Bond ETF

In Budget 2019, the government had announced plans for debt ETFs of public sector bonds after the equity ETFs like CPSE ETF and Bharat-22. The Bharat Bond will have a fixed maturity period and the units will be listed on stock exchanges. Edelweiss Mutual Fund will be managing it. The Govt plans to raise around Rs 7,000 crore through the issue and additional Rs 8,000 crore

- Bharat bond ETF is an exchange-traded fund(ETF) that will invest your money in AAA-rated bonds issued by public sector companies such as Nabard, Hudco, NHAI, PFC, REC, MRPL, Gail, PGCIL and IRFC. (Constituents later in the article)

- Bharat bond ETF is available in 2 maturity series –3 years(mature on Apr 2023) and 10 years(matures on Apr 2030). It will follow the index NIFTY Bharat Bond Index – April 2023 and NIFTY Bharat Bond Index – April 2030.

- The returns are not guaranteed but would be around 6.69% for 3 years and 7.58% for 10 years.

- It will be handled by Edelweiss Mutual Fund company and has the lowest expense ratio of 0.0005%. It is the cheapest mutual fund product in India and one of the cheapest debt fund products in the world, claims Edelweiss Mutual Fund

- For those who do not have a demat and trading account, Edelweiss AMC has launched fund-of-funds (FoF) so it can be purchased and sold like a regular mutual fund. You can also do a systematic investment plan (SIP) in the FoF.

- The unit value of the Bharat Bond ETF is at Rs 1,000.

- ETFs will also be launched in succeeding years giving investors access to different tenors.

- ETFs will be listed on NSE and BSE exchange, where one can buy and sell these. But how liquid will be they be is to be seen.

- Tax: It will be taxed like Debt funds which are taxed at slab rate for holding periods of less than three years and at 20% with indexation for longer holding periods. This is a major advantage of ETF compared to fixed deposits in banks

- A Bharat Bond ETF is similar to a fixed maturity plan (FMP) but with the liquidity of an open-ended fund. It will hold bonds to maturity and hence yield will be locked in at the time of investment.

- Bharat Bond ETF is safe as underlying bonds are issued by Central Public Sector Enterprises(CPSE) and other government-owned entities but major are in the power sector. As public sector companies so no credit risk as to the debt in the ETF is issued by public sector companies.

Cons of Investing in Bharat Bond ETF

Before investing in Bharat Bond ETF be careful about:

- Interest rates in India are close to a multi-year bottom (the RBI’s repo rate is at a nine-year low) and hence locking yourself in at these levels may not be very rewarding.

- Liquidity can only be known once the ETF actually starts trading.

- Government’s disinvestment needs mean that some of these companies may not remain PSUs in the future. The consequent rebalancing will raise costs and affect returns in the ETF. If you are really keen on investing, spread out your money via SIPs.

Comparison of Bharat Bond ETF with other debt options

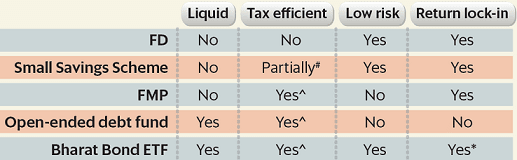

The image below compares Bharat Bond ETF with other debt investment options like Fixed Deposit, Post Small Saving Schemes, Open ended Debt Fund. Interest Rates of Post office Small Savings Schemes shows interest rate on Post office small saving schemes.

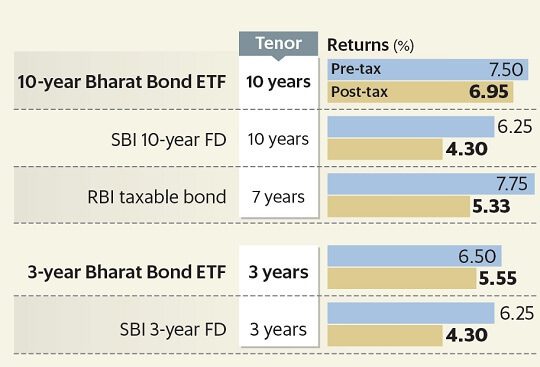

The image below shows the returns comparison of Bharat Bond ETF with Fixed Deposit

Why Govt came up with the Bharat Bonds?

The government has a threefold objective behind launching this product.

- To deepen the liquidity of the Indian debt markets and provide a gateway for easy retail participation.

- To solve investors’ dilemma of picking premium bonds

- To help the underlying government-owned companies raise funding for their operations.

Investment strategy of Bharat Bond ETF

- ETF will invest only in AAA-rated bonds issued by public sector companies maturing on or before the maturity of the ETF.

- ETF will hold bonds till their maturity and coupons received will be reinvested.

- Weight allocation of the company in Bharat Bond ETF will be based on outstanding debt amount of the issuer in the particular period.

- Issuer weights to be capped at 15 percent at the time of rebalancing.

- Index to follow a buy and hold strategy where existing bonds are held till maturity.

- Any issuer that ceases to be a CPSE, CPFI or Statutory body or the rating is downgraded below AAA, shall be removed from the index on the next rebalancing date.

Constituents of Bharat Bond ETF

The image below shows the constituents of Bharat Bond ETF

How to Buy Bharat Bond?

Bharat Bond ETF is available both as Fund of Funds and ETF.

- One option is to buy from your broker, the image below shows ICICIDirect.com interface where you can buy Fund of Funds or ETF.

- Another option is to buy from bharatbond.in.

Buy Bharat Bonds from ICICIDIRECT

On the left-hand side, Go to Mutual Funds and then Buy ETF/Buy NFO/FMP. You can see option for ETF and FOF for both 10 years and 3 years bonds.

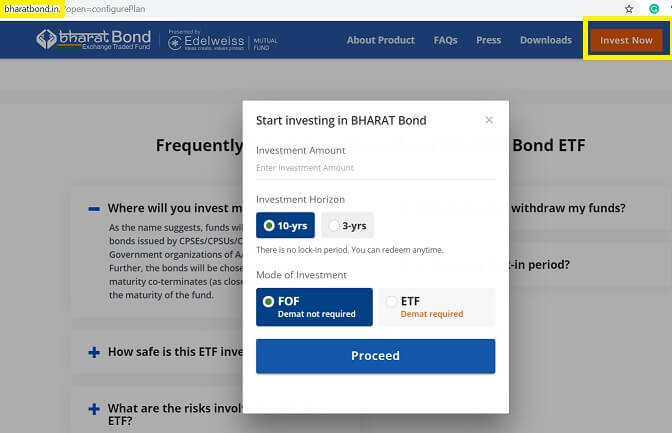

Buy Bharat Bonds from bharatbond.in

Edelweiss has launched a website bharatbond.in. Click on Invest Now and a dialogue box will come where you can buy either Fund of Fund or ETF. You need to provide your PAN, contact details and follow the process.

Tax on Bharat Bond ETF

The taxation of Debt Fund will apply

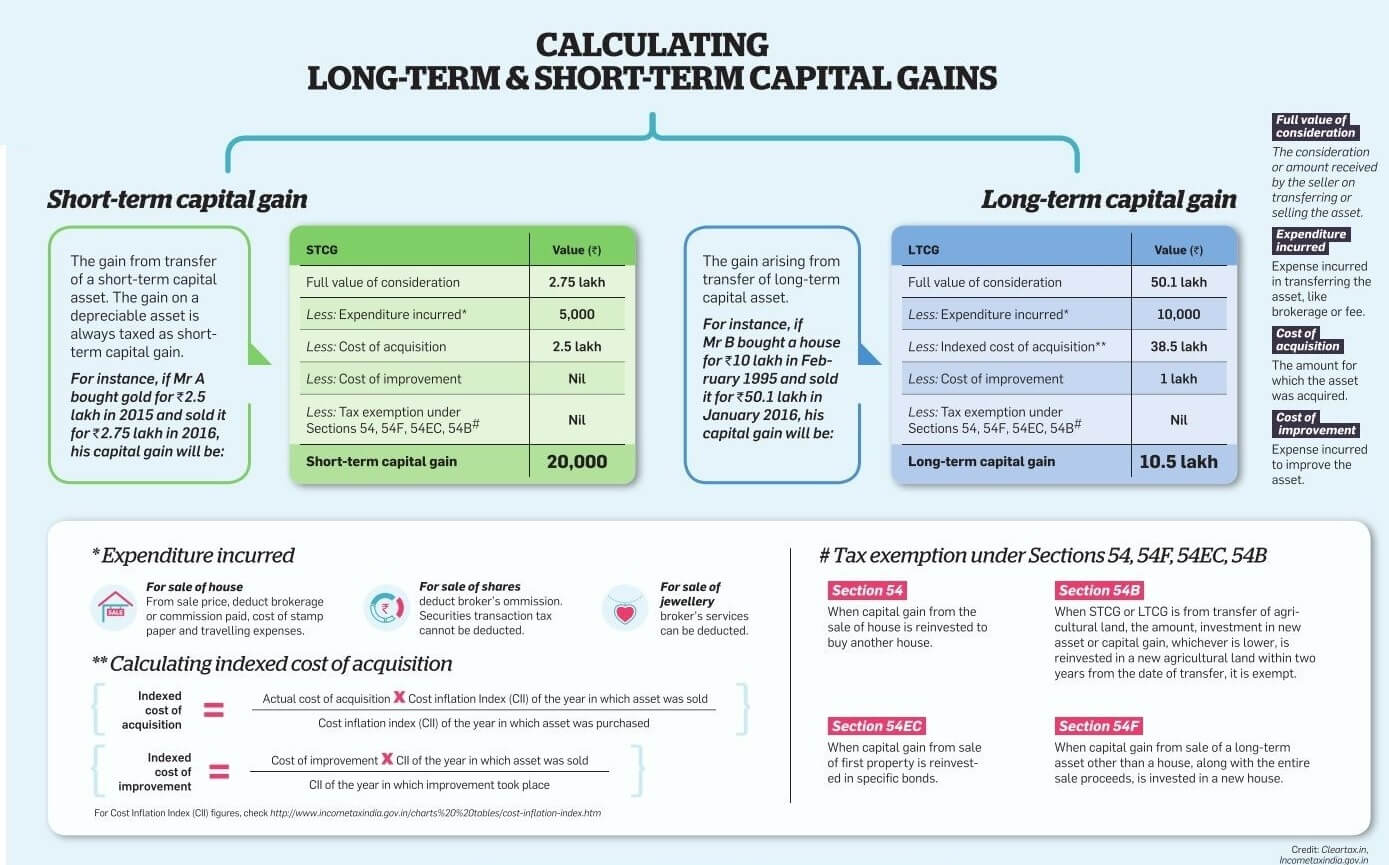

- So if you sell units before 3 years, you will pay Short Term Capital Gain Tax on the gains, which is as per your tax slabs. Our article Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- If you sell after 3 years, Long Term Capital Gain Tax will apply i.e with indexation to take care of inflation and at the rate of 20%. Our article Long term Capital Gains of Debt Mutual Funds: Tax and ITR shows how to report Long term capital gain Tax on Debt Funds in ITR

What is ETF?

An ETF or exchange-traded fund invests in a basket of securities that mostly tracks a certain index. ETFs are similar to mutual funds, but the big difference is that can be bought and sold only through the stock exchanges. Like you would buy stocks, you can buy ETFs through the trading hours from an exchange.

Bond ETF will provide safety as underlying bonds are issued by CPSEs and other government-owned entities. It will have predictable tax-efficient returns due to a target maturity structure. It will also provide access to retail investors to invest in bonds with an amount of as low as Rs 1,000, providing easy and low-cost access to bond markets.

Should one invest in Bharat Bond ETF

The fund is better on taxation when compared to FDs. It is also better on the Liquidity in comparison to PPF & EPF. But Interest rates in India are close to a multi-year bottom (the RBI’s repo rate is at a nine-year low) and hence locking yourself in at these levels may not be very rewarding.

The three-year option is better than the ten-year one.

Related Articles:

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

- Interest Rates of Post office Small Savings Schemes

- Capital Gain Calculator with Indexation