From middle-class families to higher income ones, Retirement Plans are an integral part of everyone’s financial decisions. It is a way through which every individual secures his/her future from the strides of old age. Pension Plans or Retirement Plans these days come with several schemes and options. However, there are a few factors that you need to consider before choosing the right Retirement Plans for your future.

Table of Contents

Vesting Age

The earlier you choose the Pension Plans the better it is. Decide the age you want to start getting the pension cheques. Experts are of the opinion you should get a pension plan the moment you start earning. As your salary increases, consider increasing the contributions to the plan. The age at which you start getting a pension in a pension plan is known as vesting age.

Importance of Equities

Equities have significance with respect to adding higher value to your portfolio. This is also possible through Unit Linked Insurance Plans (ULIP) which give you a dual benefit – a life insurance risk cover as well as an opportunity to maximize your wealth through investment in various market instruments like stocks, bonds and funds. Hence, go for Retirement Plans which shall yield higher returns in the long term.

Focus on your Financial Portfolio

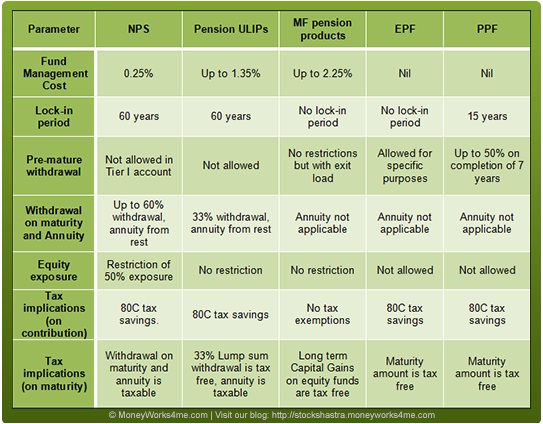

It is true that equities provide comparatively high returns but diversification with respect to Retirement Plans is also important. This is because the Retirement Plan should include fixed deposits, gold and real estate besides equities. Yes, public provident fund (PPF) and employee’s provident fund (EPF) are usually considered as natural Retirement Plans or Pension Plans but sometimes they are not enough. Comparison of the various retirement options is shown in the image below.

Assurance of Invested Money and Assured Returns

In this respect, annuity options are a major determinant. Go for Pension Plans that gives guaranteed annuity for a fixed year whether the policyholder is alive or dead. Hence the spouse is also secured after the death of the policyholder. Another good option to choose from is assured death benefit like complete reimbursement of premium.

ULIP Plans: The New Age Retirement Plan

The insurance and investment industry are not two contradictory financial channels anymore as perceived by many. Both of these complement each other; thanks to Retirement Plans like ULIPs. They are products that reap benefits of both insurance and mutual funds. While one part of your money goes in giving a steady premium to your insurance while the rest of money goes in mutual funds that help grow your money.

So, whichever Retirement Plans you opt for, be it ULIP Plans or otherwise, a long term financial planning is imperative to provide right direction to your hard earned money.