When you are in your 20s, you are high on energy, as you have just started earning. This is the time when you become financially independent and it is an opportunity to take advantage of investing early. There are numerous investment options for you to choose from. Here is a list of the best investment options in India for those in their 20s.

- 1. Stocks

Stocks are the equity shares in a company. When you buy a stock, you are acquiring a share in the company. The value of stocks depends on the market movement and they are more volatile than bonds.

- 2. Mutual funds

The market of mutual funds has evolved significantly over the years. Mutual funds carry flexibility, as you can choose the type of fund you want to invest in. They give returns higher than the interest on fixed deposit. Moreover, you can choose a Systematic Investment Plan (SIP) to make your investment.

- 3. Bonds

There are two types of bonds-corporate and government. A bond is a loan you give to the government or to an organization and they pay you back with interest after a specific period. They are less risky and you have an option to invest in tax-free bonds.

- 4. Company fixed deposits (FDs)

Company FDs are similar to bank FDs but they give a higher interest rate. However, you cannot withdraw money before the maturity date and it is ideal for those who can tolerate some amount of risk.

- 5. Public Provident Fund (PPF)

This is a traditional investment option, which is not taxable by the government. The amount invested in PPF is tax-free up to INR 1.5 lakh under Section 80C and you earn interest on the investment. It is a risk-free investment product.

- 6. Post office monthly income scheme

This is an investment option, which will generate regular income. It generates decent and has minimal risk involved.

- 7. Unit-Linked Insurance Plans (ULIPs)

ULIP is an insurance product that provides an insurance cover in addition to an investment option. It invests in debt and equity and the fluctuation is counted by its Net Asset Value (NAV).

- 8. Real estate

Real estate is a promising investment avenue and it could give you huge returns in the long term. If you have enough savings, invest in real estate for the future and let your money grow.

- 9. Insurance

A life insurance policy provides financial protection to your loved ones in case of an untoward incident. You need to understand what a term plan is and make an investment. The premium amount paid by you will be deductible under Section 80C of the Income Tax Act. You can buy term insurance online after comparing different plans.

- 10. Startups

If you have knowledge about the market and are a risk-taker, you can invest in startups. However, you need to have an eye to spot promising startups.

- 11. Commodities

If you are a beginner, the easiest way to invest in a commodity is through a futures contract, which is an agreement to buy or sell the commodity at a specific date and price in the future.

- 12 Cryptocurrencies

The demand for Cryptocurrencies such as Bitcoin is increasing across the globe and it has become a digital currency, which is claiming the interest of investors. Please note RBI prohibits all regulated entities from providing services to crypto businesses. While the Indian government is working on drafting the legal framework specifically for cryptocurrency.

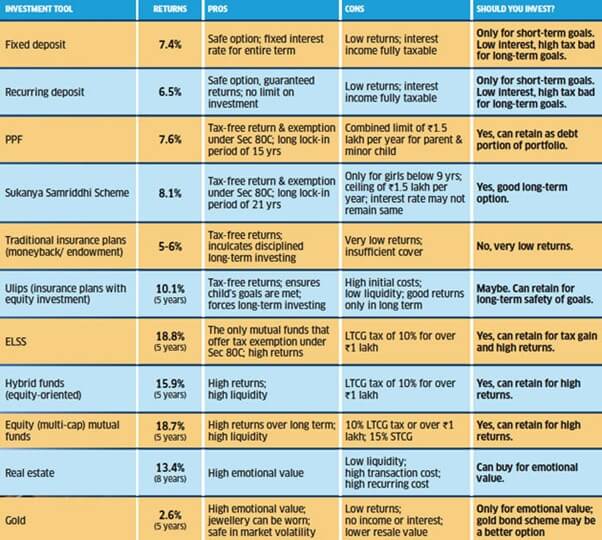

The image below compares various investment options. Understand these options and your risk taking capability.

Consider your investment purpose, risk appetite, and tenure when making an investment.

One response to “Best Investment Options in India for Everyone in Their 20s”

I found your article very informative and you had great use of facts throughout the article.

Thanks for sharing this valuable information with us, it is really helpful article!