This article explores how we make decisions? Are our decisions based only on reason, facts or Are our decisions a blend of both feeling and reason, and the precise mix depends on the situation. What is behavioral finance?

Table of Contents

Human beings are rational. Are they?

Of course human beings are rational, but under certain circumstances(often when tired, or drunk, or in the grip of rage) people’s decisions and thought processes can be very irrational indeed. But when under quite ordinary circumstances where fatigue, drugs and strong emotions are not factors, people reason and make judgements in ways that systematically violate familiar canons of rationality on a wide array of problems.Let’s see some examples.

- Suppose I offered you a choice between a free 1000 Rupees gift certificate and a 2000 Rs. gift certificate for Rs. 700. Which would you take? Most of the people take FREE certificate. But look again, a Rs. 2000 gift certificate for Rs. 700 actual value is Rs 1300, That clearly better,300 Rs better, than getting a Rs 1000 certificate free whose actual value is Rs. 1000. Can you see the irrational behaviour in action ?

- If a doctor tells you that a procedure is 95 percent effective, you are probably inclined to go forward with it. However, if he tells you that out of every 100 procedures, five patients die, you might have second thoughts. How you frame a consumer decision can affect one’s choice!

- Suppose you are offered a choice:

- Flip a coin to win 1000 for heads and nothing for tails or skip the toss and Guaranteed win of Rs 500. What would you take? Most people, researchers have found, will take Rs 500. Now change the scenario

- You can flip a coin to loose Rs. 1000 for heads and nothing for tails, or they can skip the toss and pay Rs 500 which is Guaranteed loss. Most people will take the gamble.

- To the rational man, the two games are similar or mirror images; the choice to gamble or not should be the same in both. But in real life we feel differently about loss than gain, hence two games are very different. The outcomes are different.

Stock market are efficient. Are they?

Efficient market theory says, prices fully reflect available information and that any new information relevant to a company’s value is quickly priced. That is, in an efficient market you can’t beat the market unless you have inside information. It has been the driver of trillions of investing dollars, the inspiration for index funds and vast new derivatives markets. Economic bubbles are an obvious anomaly, in that the market often appears to be driven by buyers operating on escalating market sentiment/ irrational exuberance, who take little notice of underlying value. These bubbles are typically followed by an overreaction of frantic selling. Rational investors have difficulty profiting by shorting irrational bubbles because, as John Maynard Keynes commented, Markets can stay irrational longer than you can stay solvent.

So how do we make decision? What is Behavior Finance?

So how does the humans make decisions? Are our decisions based only on reason, facts or Are our decisions a blend of both feeling and reason, and the precise mix depends on the situation. How can we make those decisions better? Study which which draws on insights from both psychology and economics is called as Behavioural finance. It explores Why people make irrational decisions? Why and how their behavior does not follow the predictions of economic models. If we all make systematic mistakes in our decisions, then why not develop new strategies, tools, and methods to help us make better decisions and improve our overall well-being?

Is behavioral finance different from behavioral economics?

Difference is same as in economics and finance. Investopedia explains the Difference Between Finance And Economics in detail.

- Economics is a broader field, a social science that studies the production, consumption and distribution of goods and services, with an aim of explaining how economies work and how their agents interact.

- Finance generally focuses on the study of prices, interest rates, money flows and the financial markets i.e it seems to be most concerned with notions like the time value of money, rates of return, cost of capital, optimal financial structures and the quantification of risk.

In many respects, economics is BIG picture (how a country/region/market is doing) and concerned about public policy, while finance is more company/industry-specific and concerned about how companies and investors evaluate and price risk and return. Historically, economics has been more theoretical and finance more practical,

So how does Behavior Finance affect us in our daily life?

Behavior Finance is not only for academic purposes. It plays an important role in our daily life, such as

- People talk about how bad a person. Then they come to know he is suffering from a life threatening disease and needs a major operation. People then repent their stand and pray for his early recovery.

- Gamblers are willing to keep betting even while expecting to lose.

- People say they want to save for retirement, eat better, start exercising, quit smoking—and they mean it—but they do no such things. Victims who feel they’ve been treated poorly exact their revenge, though doing so hurts their own interests.

- Products succeed in the marketplace largely based on a healthy level of competition and consumers’ response to the quality of the marketing mix. At least that is what classic economic theory and traditional marketing principles would have us believe. Behavioral economics,however, reveals that the context and situation surrounding product choice, decision heuristics and how consumers react to risk can sometimes trump the marketing mix. For example, playing slow vs. fast background music in a grocery store will increase the time spent in the store shopping.

Is Behavior Finance something new?

- Adam Smith saw psychology as a part of decision-making, and said in The Wealth of Nations in 1759

- In 1955s, Herbert Simon of Carnegie Mellon University puts forward the concept of bounded rationality, arguing that rational thought alone did not explain human decision-making. Traditional economists disliked or ignored Simon’s research, but he went to won the Nobel Prize in 1978

- In 1979, psychologists Daniel Kahneman of Princeton and Amos Tversky of Stanford published Prospect Theory: An Analysis of Decision under Risk, a breakthrough paper on how people handle uncertain rewards and risks. In the ensuing decades, it became one of the most widely cited papers in economics. The authors argued that the ways in which alternatives are framed—not simply their relative value—heavily influence the decisions people make.

- In 1985 Werner F. M. De Bondt and Richard Thaler published Does the stock market overreact? in the The Journal of Finance

- In 2008, Cass Sunstein and Richard Thaler built ideas from Kahneman and Tversky in Nudge: Improving Decisions About Health, Wealth, and Happiness , to design noncoercive policies that encourage people to save more, eat better, and become smarter investors.

Infographic Timeline of behavior economics shows how behavioral economics has evolved.

So how learning about Behavioral Finance help?

Warren Buffet once said, Success in investing doesn’t correlate with I.Q. once you’re above the level of 25. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing. So If we all know what influences our decisions, what mistakes we can make in our decisions, have strategies, tools, and methods then It will help us make better decisions and improve our overall well-being. In words of Behavioral economist Dan Ariely in Three questions on Behavioral Economics,

It is true that from a behavioral economics perspective we are fallible, easily confused, not that smart, and often irrational. But just like in physical world, We build products that work with our physical limitations. Chairs, shoes, and cars are all designed to complement and enhance our physical capabilities.

If we take some of the same lessons we’ve learned from working with our physical limitations and apply them to things that are affected by our cognitive limitations—insurance policies, retirement plans, and healthcare—we’ll be able to design more effective policies and tools, that are more useful in the world.Once we understand where we are weak or wrong we can try to fix it and build a better world.

What are some of the topics in Behavioral Finance?

Some of the topics in Behavioral Finance are as follows:

- Mental Accounting : We have a tendency to value money differently depending on where it comes from. If you win 5000 in the lottery you are more likely to spend that than the 5000 that you earned on the job.

- Anchoring : Usually, an investor’s mind is fixated on one prominent number that he has been exposed to. Logical reasoning takes a backseat and he takes decisions based on incomplete information. For example, some investors invest in the stocks of companies that have fallen considerably in a very short amount of time. In this case, the investor is anchoring on a recent “high” that the stock has achieved and consequently believes that the drop in price provides an opportunity to buy the stock at a discount

- Loss Aversion: the reluctance to accept a loss, can be deadly People hate losing much more than they enjoy winning. Investors have been shown to be more likely to sell winning stocks in an effort to take some profits, while at the same time not wanting to accept defeat in the case of the losers.

- Herd behavior: Tendency for individuals to mimic the actions (rational or irrational) of a larger group. Individually, however, most people would not necessarily make the same choice.

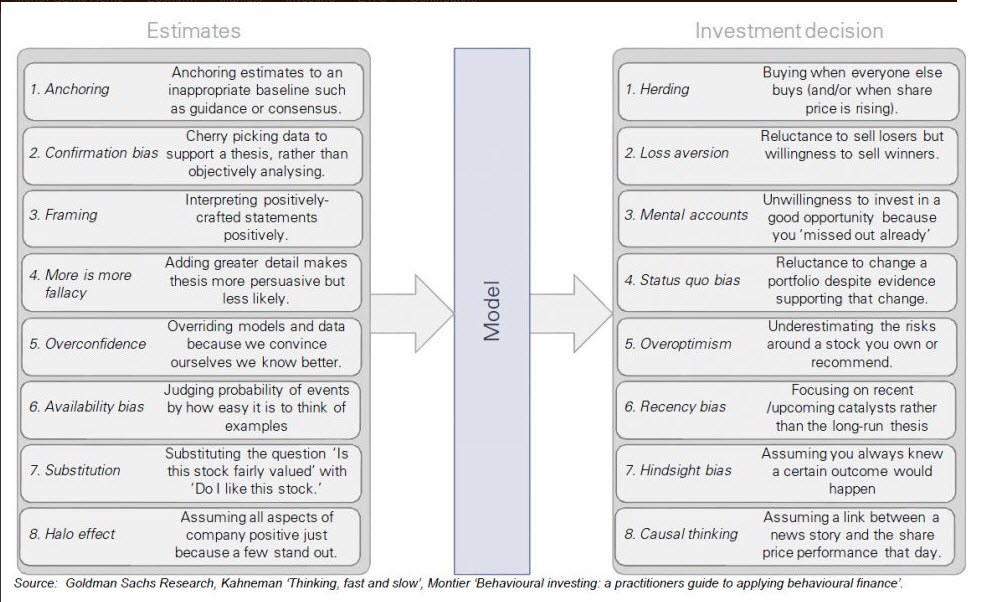

Goldman Sachs distilled the concept into a picture given below (click on image to enlarge)in article on Business Insider GOLDMAN: Behavioral Biases Are Found In Every Aspect Of The Investment Process is given below. Interesting infographic on behavioral economics for marketing, how we process information

Some good books on Behavioral Finance?

Some of the books are (Amazon links)

- The Tipping Point:How Little Things Can Make a Big Difference (2002) and Blink:The Power of Thinking Without Thinking (2007) by Malcolm Gladwell

- Freakonomics by Steven D. Levitt and Stephen J. Dubner (2006)

- Predictably Irrational: The Hidden Forces That Shape Our Decisions by Dan Ariely (2008)

- Nudge:Improving Decisions About Health, Wealth, and Happiness by Richard Thaler and Cass Sunstein (2009)

- Herd by Mark Earls

- Stocks to Riches, Value Investing and Behavioral Finance by Parag Parikh. His blog has excellent information on behavioral finances and tutorials.

Related articles:

- How Gold Ornament is Priced?

- Personal Finance and Scott Adams,Dilbert

- Money Awareness for Beginners

- Books on Money for Children

- Gangnam Style

Behavioral Finance is not a remedy to master the art of stock picking or any other investment. Behavioral Finance only provide us a framework and makes us aware of our emotions as well as those of others and how one can use this information to our advantage. It’s not easy to eliminate biases from our investing psychology, and neither is it possible to do it overnight but being aware of it, working on it would help us in investing better. So what do you think, are we human beings rational, how does emotion play role in decision making? Do you think Behavioral Finance makes sense.

It’s great that you are getting ideas from this article as well as from our argument made at this time.

It’s great that you are getting ideas from this article as well as from our argument made at this time.

good article & something refreshing

good article & something refreshing