Can the banks in India Fail? Which banks in India have failed? What happens if the bank fails? Are there some too Big to Fail banks?

Table of Contents

Is Indian Financial System crumbling?

Yes Bank, India’s fifth-largest private sector lender, is in the middle of a crisis as the Reserve Bank of India (RBI) placed Yes Bank under a moratorium on 5 Mar 2020, saying it was taking control of it for 30 days. RBI is working on a revival plan. India’s biggest bank SBI has expressed its willingness to make investment in Yes Bank and participate in its reconstruction scheme, RBI said. RBI also named Prashant Kumar, SBI’s former chief financial officer, as Yes’ administrator. The central bank also limited withdrawals to Rs 50,000.

During last few years, huge frauds and financial misdemeanours have been unearthed in public sector banks such as Rs 11,400 crore scam of Punjab National Bank-Nirav Modi and Mehul Choksi cases, ICICI bank fraud of Rs 1,875 crore pertaining to Videocon group involving Chanda Kochhar, former CEO of ICICI, now under the scanner of CBI/ED.

The bust up of Infrastructure Leasing and Financial Services (IL&FS) in 2018 which was a gem among the NBFCs and a darling for the lenders, led to the debacle of the NBFC sector itself due to contagion effect. The group has borrowings of nearly Rs 91,000 crore, out of which bank loans are Rs 57,000 crore – 70% of which from PSU banks.

Next was Dewan Housing Finance Limited (DHFL) from the HFC sector which defaulted on its Rs 1,000 crore payment obligation. DHFL has a housing loan outstanding of over Rs 1 lakh crore, the deposit base of Rs 10,000 crore which is the real concern

There are 9,659 NBFCs registered with the RBI as on March 31, 2019. The NBFC sector’s gross toxic loans have shot up from 5.8% in 2017-18 to 6.6% in 2018-19.

Is the Indian financial system is crumbling? Have public and private sector banks, Non-Banking Financial Companies (NBFCs), Housing Finance Companies (HFCs), Co-operative banks, become prone to disasters?

The Great Indian Banking disaster

Yes Bank had been seeking new capital since 2019, to bolster its ratios and quell questions about its stability due to its exposure to shadow banks entangled in a prolonged crunch in the local credit market.

Yes Bank Crisis

Here’s a look at the events leading up to the Reserve Bank of India‘s move.

-

- Sept. 19, 2018 – RBI refuses to give Chief Executive Officer Rana Kapoor an extension to his term – Kapoor to step down by end of January 2019

- Nov. 27 – Moody’s cuts bank’s foreign currency issuer rating; changes outlook to ‘negative’ from ‘stable’ citing concerns over corporate governance

- Jan. 24, 2019 – Yes Bank hires the head of Deutsche Bank India Ravneet Gill as its new CEO

- Feb. 13 – Yes Bank says RBI observed no divergences from central bank norms in the bank’s asset classification and provisioning

- April 26 – Rising levels of bad loans trigger Yes Bank’s first-ever quarterly loss; Macquarie Research double-downgrades stock to ‘underperform’, stock tanks 30% on next trading day

- May 14 – RBI appoints ex-central bank Deputy Governor R. Gandhi as additional director to Yes Bank’s board – a rare move signaling an increased level of scrutiny on the lender

- July 17 – Yes Bank reports 91% drop in first-quarter profit, as provisions surge and asset quality deteriorates sharply; gross bad loan ratio stood at 5.01%

- Oct. 3 – CEO Gill says bank is in talks with private equity firms, strategic investors and family offices to raise additional capital

- Nov. 1 – Yes Bank reports bigger-than-expected loss for the second quarter, as bad loan ratio deteriorates to 7.39% and provisions swell to 13.36 billion rupees

- Jan. 10, 2020 – Yes Bank rejects Braich’s investment, says will launch a $1.4 billion share sale, after a board member’s resignation casts more doubt on the lender’s future

- Feb. 12 – The lender says it will delay disclosing its October-December earnings by at least a month, and that it was in talks with potential investors for a cash infusion

- Feb. 12 – Bank says it received non-binding expressions of interest from JC Flowers, Tilden Park Capital Management, OHA (UK) and Silver Point Capital.

- Nov. 29 – Yes Bank says it aims to raise up to $2 billion in a massive issue of new shares to institutional investors and family offices; says it is in talks to sell shares worth $1.2 billion to Canadian investor Erwin Singh Braich and Hong Kong-based SPGP Holdings, which he backs

What happens on Failure of Bank? What is Deposit Insurance?

If the banks fail people mostly lose their savings in the bank. They get only deposit insurance which is up to 5 lakh rupees,under the Deposit Insurance and Credit Guarantee Corporation (DICGC). The deposit insurance was raised from 1 lakh rupees on 4 Feb 2020.

Deposit insurance scheme covers bank deposits including savings, fixed and recurring with an insured bank. This deposit guarantee can be released only if the bank gets closed. if the bank is a going through problem customers do not get it.

Our article Deposit insurance on bank failure, Amount, Limit explains it in detail.

Too Big to Fail Banks, Domestic systemically important bank

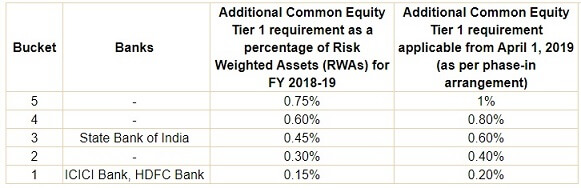

Domestic systemically important bank or D-SIB means that the bank is too big to fail. If a domestic systemically important bank or DSIB fails, there would be significant disruption to the banking system and the overall economy. The concept of D-SIB emerged after the global financial crisis.

The too-big-to-fail tag also indicates that in case of distress, the government is expected to support these banks. Due to this perception, these banks enjoy certain advantages in funding. It also means that these banks have a different set of policy measures regarding systemic risks and moral hazard issues.

Which Indian Banks Have Failed?

Between 1947 and 1969, 559 private banks in India failed, with numerous people losing their life’s savings. One of the reasons for the Indian government’s decision to nationalise the biggest banks in India in 1969 was the huge number of instances of private banks going bust.

Our article Nationalisation of banks: When, Why and Impact discusses why the banks were nationalized

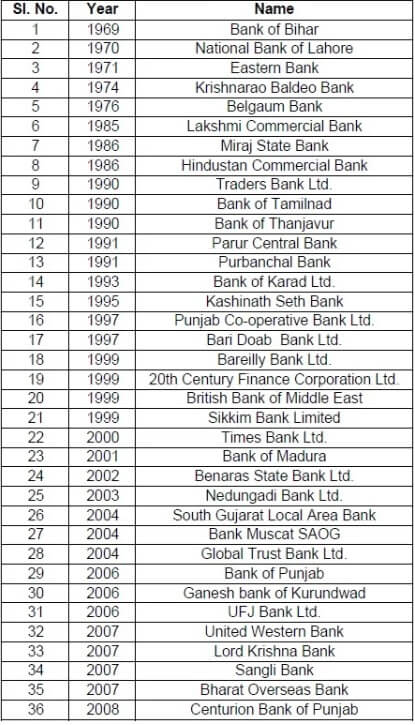

From 1969 onwards, many private banks have been put under moratorium in public interest, due to mismanagement and have gone out of existence. Several of them were merged with healthy Public Sector Banks (PSBs), such as the high-profile case of the Global Trust Bank which was merged with the Oriental Bank of Commerce in 2004. The list of banks which have failed are given below.

Cooperative Bank Failures

Urban cooperative banks failures occur with alarming regularity. Their numbers fell from 1,926 in 2004 to 1,551 in 2018, as per RBI data. The central bank forced 129 mergers and by March 2017, cooperative banks accounted for only 11 per cent of the total assets of scheduled commercial banks (SCBs).

In 2001, Ahmedabad’s Madhavpura Mercantile Cooperative Bank went bust. That landed another 210 urban cooperative banks in trouble and some of them had to be liquidated.

Reasons why cooperative banks fail so often

- RBI’s supervision of cooperative banks is not as stringent as that of commercial banks. Typically, the state government audits cooperative banks while RBI inspects their books once a year.

- The small capital base required to start a bank. For example, urban cooperative banks can start with a capital base of Rs 25 lakh compared to Rs 100 crore for small finance banks.

- Such banks are sometimes hijacked by vested political interests. This could mean appointing political lackeys as senior bank officials and sanction of fraudulent loans which are later written off.

List of Commercial Bank Mergers in India

1. 2017: SBI merged with its Associate Bank & Bhartiya Mahila Bank (BMB): On April 1, 2017, the five-associate bank of SBI and Bhartiya Mahila Bank became the part of the SBI Bank.

- State Bank of Bikaner and Jaipur (SBBJ)

- State Bank of Hyderabad (SBH)

- State Bank of Mysore (SBM)

- State Bank of Patiala (SBP)

- State Bank of Travancore (SBT)

- Bharatiya Mahila Bank (BMB)

2. 2014, ING Vysya Bank merged with Kotak Mahindra Bank

3. 2010, Bank of Rajasthan merged with ICICI Bank

4. 2008, Centurion Bank of Punjab merged with HDFC Bank

5. 2007, Sangli Bank merged with ICICI Bank

6. 2007, Bharat Overseas Bank merged with Indian Overseas Bank

7. 2006, Ganesh Bank of Kurundwad merged with Federal Bank

8. 2006, United Western Bank merged with IDBI

9. 2004, South Gujarat Local Area Bank Ltd merged with Bank of Baroda

10. 2004, Global Trust Bank merged with Oriental Bank of Commerce (OBC) –

11. 2003, Nedungadi Bank Ltd merged with Punjab National Bank

12. 2002, Benares State Bank Ltd merged with Bank of Baroda

13. 2001, Bank of Madura merged with ICICI Bank

14. 2001, Financial Services firm ICICI merged with ICICI Bank

15. 2000, Times Bank Ltd. merged with HDFC Bank

16. 1998, Bareilly Corporation Bank merged with Bank of Baroda

17. 1997, Bari Doab Bank Ltd merged with Oriental Bank of Commerce (OBC)

18. 1997, Punjab Co-operative Bank Ltd merged with Oriental Bank of Commerce (OBC)

19. 1994, Bank of Karad Ltd. (BOK) merged with Bank of India

20. 1993, New Bank of India merged with Punjab National Bank

21. 1985, Lakshmi Commercial Bank merged with Canara Bank

Related Articles:

- Deposit insurance on bank failure, Amount, Limit

- Nationalisation of banks: When, Why and Impact

- Punjab and Maharashtra Co-operative (PMC) Bank

- What are Central Banks,What is RBI? What do they do?

The government can’t afford a bank failure. Yes Bank is likely to be bailed by SBI in the next few weeks. But, here again, the taxpayers’ money is used to bail out a business failure that too on account of serious corporate governance rule violations.

With the impasse at Yes Bank and deposit withdrawal restrictions, the trust deficit that already exists in the system is likely to get widened. The central bank has a lot of explaining to do on prolonging the crisis to this stage.