“Today’s generation of retail investors, life maximizers as we identify them, have expanded the definition of LifeGoals and are looking for investment solutions that are value packed, convenient and backed by reliable investment performance. We are confident that the new product will offer a powerful proposition to new age investors.” said Tarun Chugh, Managing Director and Chief Executive Officer, Bajaj Allianz Life Insurance Company Ltd about Bajaj Allianz Life Goal Assure, the new age ULIP.

Table of Contents

Bajaj Allianz Life Goal Assure

Life Goals are priceless… from earning your first income to buying your dream home, seeing your child graduate from a premier school to entering into your retirement, each of these once in a lifetime experiences are memorable. To achieve these life goals, one needs to be smart with their financial planning. Bajaj Allianz Life Goal Assure, a life goal based investment plan (ULIP) gives you the opportunity to plan your once in a lifetime experiences with zero worries.

Bajaj Allianz Life Goal Assure, the new ULIP brings with it unique benefits that are one-of-their-kinds for a ULIP in India.

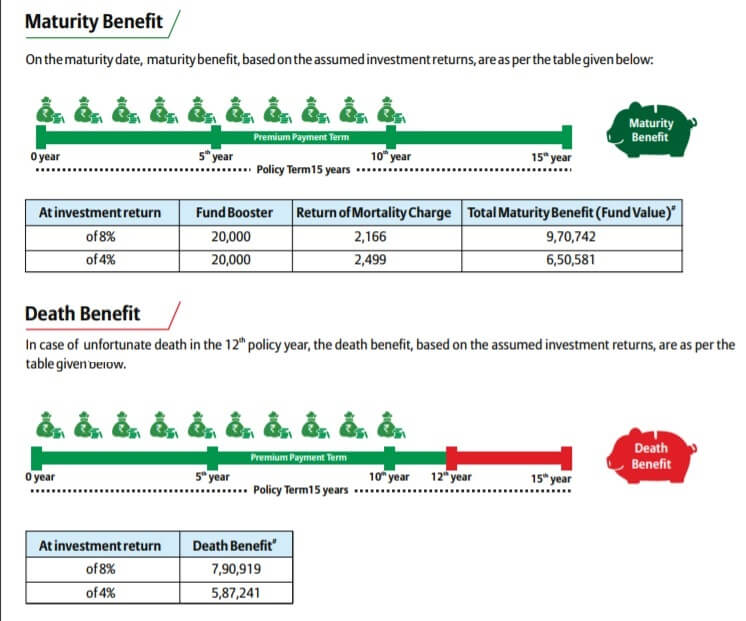

- The Return of Mortality Charges (ROMC): The ROMC feature of Bajaj Allianz Life Goal Assure guarantees that a policyholder will get back the cost of the life cover when the policy matures, thus enhancing the value of their corpus on maturity.

- Return Enhancer: At maturity, the customer who opts to receive the maturity benefit in instalments (and not lump-sum) over a period of five years will receive the benefit of Return Enhancer which is an addition of 0.5% of each due instalment. During this period, the customer’s fund value will continue to participate in the fund(s) of his/her choice.

- Fund Booster: It is an additional amount added to the Fund Value on the date of maturity of the policy.

- Loyalty Additions: An incentive for paying premium regularly and staying invested in the policy. It is applicable for Annualized Premium of INR 5 lakh or more, and for policy terms of 10 years and above.

- Four portfolio strategies: Bajaj Allianz Life Goal Assure provides customers with four portfolio strategies that are designed keeping in mind the different customers’ needs and risk tolerance. The portfolio strategies are:

- Investor Selectable Portfolio Strategy

- Wheel of Life Portfolio Strategy

- Trigger Based Portfolio Strategy

- Auto Transfer Portfolio Strategy

- There are also options to decrease Sum Assured, change Premium Payment Term, and unlimited free switches between funds.

- There are also tax benefits under section 80C and 10(10D).

How Bajaj Allianz helps in achieving Life Goals

Neha is a 35-year-old married woman with a son, Rohan who is 3 years old. Her husband, Ravi runs a business of a retail shop. They have a family income of around INR 10 lacs p.a. Neha and Ravi are worried about the ups & downs of their business and their Life Goal is to build a kitty for their son, Rohan’s education.

Neha starts investing INR 50,000 p.a. in Bajaj Allianz Life Goal Assure with a 15-year time horizon and Sum Assured of INR 5 Lacs.

Neha has four investment strategies to choose from. The Maturity and Death benefit based on investment is in the “Pure Stock Fund II”

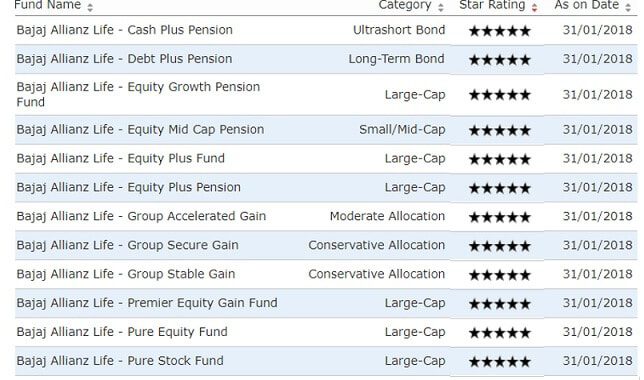

ULIP Ratings

The ULIP Funds of Bajaj Allianz Life Insurance have consistently delivered one of the best CAGR returns, beating the benchmark indices over a longer horizon of three, five and ten years. Further, most of its funds enjoy high ratings from the coveted Morning Star rating agency here.

Should you invest in ULIPs after LTCG on Mutual Funds?

ULIPs have been in the news ever since Finance Minister, Arun Jaitley announced 10 percent Long-Term Capital Gains tax on gains of above Rs. 1 lakh on stocks and equity-oriented mutual funds during Union Budget 2018.

ULIPs provide market-linked returns while a portion of your premium goes into providing life insurance cover also. ULIPs mostly comes with a minimum lock-in period of 5 years. And LTCG does not apply to ULIPs.

ULIP funds allow its customers the benefit of EEE (Exempt-Exempt-Exempt) mode. This means that the customers are eligible for tax deduction during the investment, earnings and withdrawal stage. The premiums paid can be claimed as deductions from the taxable income during the year subject to the provisions of the Income Tax Act. This means that the investment one makes into ULIPs is free of the tax burden.

Life Goals + Plan = Success.

If we talk about ULIP, it is a good product for people who need insurance and investment. Make your goals a reality by investing in Bajaj Allianz life Goal Assure Plan.

12 responses to “Bajaj Allianz Life Goal Assure a new age ULIP”

I have invested in this plan in last 1 year. My total amount’s 80% is on BOND fund , Still my return is -ve. My absolute return is showing -2.00%.

I can’t understand what the Fund manager do about our invested money. They are charging fund allocation/admin charges. How this can be a -ve return if they are expert on investment??????

Are they hiding something from customer end. Can you all share your experience in this plan.

I bought Bajaj allianz Goal assure ULIP policy for Rs. 50000 monthly payment for 5 years and policy term for 10 years. I am planning to build up corpus for my son’s education. I am having a small confusion whether to Stay with this ULIP policy or invest in Mutual funds. Please send your valuable advices

sir in mutual funds, you will not get life cover. also sir, at the time of maturity you will not get any benefit in tax whereas if you keep invested in ulip, then you will get maturity amount free of tax. also sir, risk factor is more in mutual funds because thy invest the money in single fund, whereas in ulip you get the option of 8 funds from which you can choose.

Which is a better policy bajaj future gain or bajaj goal assure

I have already invested 1k monthly premium for around 8 months in future gain.

Should I continue the same policy or should I switch to goal assure n stop future gain.

continue with the same sir as both the plans have almost the same features and there is same kind of return as well on both.

sab moh maya hai Tarun 🙂

Aur sabko maya se moh rehta hain!

I HAVE BOUGHT LIFE GOAL ASSURE PLAN AND I WANT TO KNOW THAT CAN WE CONTINUE PAYING ANNUAL PREMIUM AFTER 5 YEARS (WE HAVE OPTED FOR PAYMENT) UP TO 10 YEARS OR AFTER THAT.

POLICY TERM : 5 YEARS

PREMIUM PAYING TERM :5 YEARS

KINDLY ADVISE US.

REGARDS,

Policy term is the duration of your Insurance period and

Premium Paying Term is the duration of, how many years you have to pay the premium amount.

Please check with your insurance agent.

no sir you cannot because your policy term is of five years only.

Please I want to learn about money

What exactly do you want to learn about money?