In this article we shall look at what happens after filing the income tax return. Every system, right from the school requires assessment and verification. So does the Income tax. Every person/firm/HUF is required to file a Return of Income if his total Gross income(without deductions) exceeds the exemption limits. The tax is determined as per Taxation laws existing in that particular Assessment Year. As we know after the end of the financial year every person who is required to file income tax return, should file his return of income or ITR. ITR under normal course should be filed under Sectuin 139(1). The normal time limit of filing the ITR – which for non-audit cases is July 31 of the Assessment year, and for audit cases September 30 of the Assessment year. Thus, an assessee himself calculates the tax and income, pays tax if due, files his return of income. This process of self-calculation of income and tax is therefore called Self-assessment. There are different methods of filing Income tax return, let’s look at those.

Table of Contents

Different methods of filing Income tax return

There are four ways to file income tax returns. Some can choose the method of filing but for some like people earning more than 10 Lakh in FY 2011-12 (AY 2012-13) e-filing was compulsory.

- E-Filing With Digital Signature – This option requires one to use a digital signature to sign the e-form. It is the most time saving method as it ensures you don’t have to visit any department office again.

- E-Filing Without Digital Signature – If you don’t have a digital signature, you will need to print out the single page receipt cum verification form, called as ITR-V, after completing the e-filing process. The Form ITR-V has to sent to the CPC Centre, either through ordinary or speed post, within 120 days of uploading the electronically filed return.

- Manual Filing – People who are not comfortable with the online system may choose to use the traditional paper form option.

- E-Return Intermediary – An e-return intermediary (PDF file that opens in a new window) is an agent, chartered accountant or firm that completes the e-filing process for you and submits the receipt cum verification form to the correct income tax counter.

Efiling was introduced in 2006-2007. In first year 3.63 lakh tax payers used this facility. In 2010-2011 number grew to 92 lakhs.

Types of Income Tax Returns

In income tax Act there are various types of income tax returns such as Regular Return, Loss Return, Belated Return, Revised Return, and Defective Return. Lets go through it.

Regular Return: Regular return is the income tax return filed by assessee on or before the due date it is covered under section 139(1) of the income tax Act. Thus, if an assessee submits his return of income before due date of filing of return of income, then the return of income is called Regular return.

Loss Return: A return filed by an assessee indicating the amount of loss incurred is called Loss return. It is covered under section 139(3) of the income Tax Act. Thus, if an assessee submits his return of income in which assessee declares the loss incurred by him during the previous year, and then the return of income is called Loss return. It important to note here, that if the loss return is submitted before the before due date of filing of return of income, then only the loss can be carried forward. Remember that the losses can be carried forward up to 8 years if the return of income is filed before due date. If loss return is not filed on or before due date then the losses incurred cannot be carried forward for set-off in coming year.

Belated Return: Belated return is the return filed by the assessee after the due date. it is covered under section 139(4) of the income tax Act. Thus, if an assessee submits his return of income after the due date of filing of return of income, then the return of income is called Belated return.

Revised Return: Revised return is a new return filed by income tax assessee which corrects the information filed earlier in the regular return. It is covered under section 139(5). A return can be revised any number of times by an assessee. A belated return however, cannot be revised. Time period for revising a return and for filing a belated return is the earlier of the following two dates: End of one year from the end of relevant Assessment year or Date of Completion of Assessment.

SimpleTaxIndia:PENALTY ON LATE FILING OF INCOME TAX RETURN AY 2012-13 talks about consequences if returns are not filed on time.

Need for Verification of Income Tax Return

Legally one should return only that much income which one earns. But there are mal-practices such as showing less income so as to pay less tax or some people file ITR in name of their children or wife or other relatives. Often, such malpractice of returning less income is deliberate. But sometimes, it can even be due to ignorance of law or mis-application of law. So there is a need to process and verify these income tax returns.

Quoting from Question Bank of Incometaxindia

What is the mechanism by which the department checks the correctness of my return of income? Would I be given an opportunity to present my views during the course of such verification?

Based on information available with the department a small percentage of returns are picked up for verification. This process is called scrutiny. You will be given full opportunity to put forth views and evidences to support your claims.

Some cases are selected for scrutiny, called as regular assessment, on certain criteria. The selection criteria is fixed differently every year. Quoting from incometaxindia.gov.in:Broad criteria for scrutiny

Cases are selected for scrutiny based on risk-analysis conducted through computer- assisted programme(CASS) and also manually with reference to broad parameters decided every year for the entire tax-payer population, inter-alia, considering factors like gross income, deductions and exemptions claimed, legal issues involved in litigation, quantum and nature of specific transactions, status of assessees, etc

Example of criteria for scrutiny from SimpleTaxIndia:Criteria for selection of cases under scrutiny F.Y. 2011-12

The Income Tax Department has earlier released a good press note that tax returns filed by senior citizens above 60 years and small taxpayers with gross total income of less than Rs. 10 lakh will not be scrutinised in a routine manner.The Criteria for selection of cases under scrutiny in other cases is given under For Financial Year 2011-12 :

- Where value of international transaction as defined u/s. 92B exceeds Rs.15 Crore.

- Cases where there was addition of Rs.10 Lacs or more in earlier assessment year and question of law or fact is confirmed in appeal or pending before appellate authority.

- Cases in which addition of Rs.10 Crore or more was made in earlier assessment year on the issue of transfer pricing.

It is also mentioned in this circular that, the criteria for selection of cases is not to be disclosed even under the Right to Information Act.

Assessing Officer and CPC

Processing of income tax returns is done by Assessing Officer or Central Processing Centre (CPC).

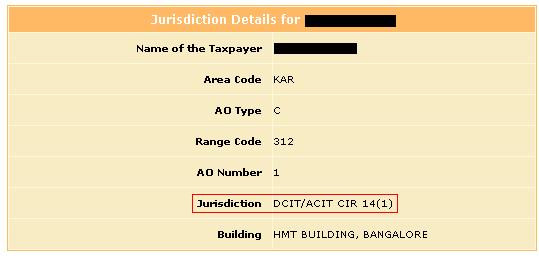

An Assessing Officer is a person who has jurisdiction(means: official power to make tax decisions and judgments for that assessee) to make assessment of an assessee, who is liable to tax under the Act. The designation may vary according to the volume of income/nature of trade as assigned by the Central Board of Direct Taxes(CBDT Board), the department which deals with income tax. He may be an Income-tax Officer, Assistant Commissioner, Deputy Commissioner, Joint Commissioner or an Additional Commissioner. To know more about Assessing Officer one can read incometaxindia.gov.in:Central Board of Direct Taxes Remember we fill the Jurisdiction in our ITR forms which one can find from incometaxindiaefiling.gov.in:Know Your Jurisdictional AO by entering your PAN number. That determines who has official power to make tax decisions and judgments for that particular assessee. For example in the image below Jurisdiction is DCIT/ACIT CIR 14(1) which is in Bangalore.

The Bangalore Centralized processing centre (CPC) was set up for bulk processing of income tax returns. It processses all electronic returns from the entire country and physical returns of Karnataka and Goa regions. At its dedicated call centre, taxpayers can enquire about status of returns and refunds. The Bangalore centre was approved by the Union cabinet at a total cost of Rs 255 crore over a 5-year period. The centre, operated by Infosys Technologies, increased its daily processing capacity from 20,000 to 1.5 lakh returns in 2010-11

Processing of returns by Assessing Officer

For non-scrutiny cases, regular assessment,the Assessing Officer (AO) checks the return of income on the face of it and corrects the mistake, if any on it. If there is any short of tax he will call for it and if there is any excess of tax paid he shall refund the same. Assessing officer in the process of making assessment, may serve a notice under various sections like 142(1), 148(1), 153A(a) or 153C. Returns are required to be furnished within the date specified on the respective notices.

SCRUTINY ASSESSMENT U/S 143(3) On the basis of return of income filed, AO may undertake deep examination of some return of income roughly 2% to 3% of the total returns filed. In scrutiny assessment the AO calls the assessee to furnish the explanations and books of accounts. For undertaking the scrutiny assessment the AO has to issue a notice to the assessee under section 143(2). If Assessee produces the information and explanations required by the Assessing Officer (AO) the AO completes the assessment and determine the Taxable income and income tax liability on the basis of the information and explanations produced before him.

BEST JUDGEMENT ASSESSMENT U/S 144 Best Judgment Assessment, as the name indicates Best Judgment Assessment means the computation of income and tax is undertaken by the AO himself, on the basis of the best of his judgment. The Best judgment Assessment can be made by an AO under the following cases: –

- Assessee does not file his regular return of income u/s 139.

- Assessee does not comply with instructions u/s 142 (1), i.e., notice requiring to file his return of income or 142 (2A), i.e., notice requiring assessee to conduct audit of his accounts.

- Assessee does not comply with instructions u/s 143(2), i.e., notice of scrutiny assessment.

- AO is not satisfied regarding completeness of accounts.

Since in all of the above cases either assess does not cooperate with the Assessing Officer (AO) or does not file return of income or does not have complete accounts. Thus, the assessing officer cannot calculate the income and therefore, he has to judge the income on the basis of his best assumptions/judgments. The AO must give a hearing to the assessee before completing the assessment as per best of his judgment. No refund can be granted under best judgment assessment.

INCOME ESCAPING ASSESSMENT Under Section 147 If AO believes that the income of assessee of any PY has escaped assessment, he can reopen the assessment and complete it as per new information about income or tax. Assessment up to last 6 years can be opened. In order to open an income escaping assessment AO has to issue notice under section 148 to the assessee.

Processing of Returns by CPC

The CPC shall process a valid return of income in the following manner, namely:-

- (a) the sum payable to, or the amount of refund due to, the person shall be determinedafter credit of such Tax collected at Source (TCS), Tax Deducted at Source (TDS) and tax payment claims which can be automatically validated with reference to data uploaded through TDS and TCS statements by the deductors or the collectors, as the case may be, and tax payment challans reported through authorised banks in accordance with the procedures adopted by the Centre in this regard.

- (b) An intimation shall be generated electronically and sent to the person by e-mail specifying the sum determined to be payable by, or the amount of the refund due to, the person; and

- (c) any intimation to the person to pay any sum determined to be payable shall be deemed to be a notice of demand as per the provisions of section 156 of the Act and all other provisions of the Act shall be applicable accordingly.

E-filing Processing Status

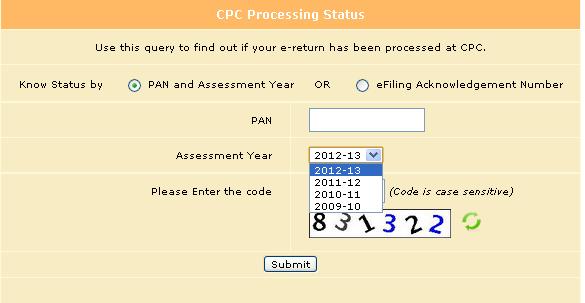

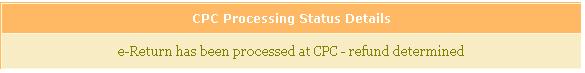

CPC Processing Status for last few years can be checked at incometaxindiaefiling.gov.in: CPC processing status as shown in image below

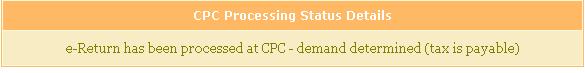

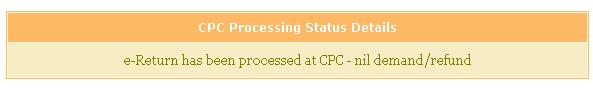

Status can be as follows:

Demand determined: where Income Tax department has demanded for more tax.

Nil Demand/Refund: Assessee has paid all due tax. Income Tax department neither demands more tax nor does have to pay refund to assessee.

Refund determined : Assessee has paid all due tax and more. Income Tax department has to return the extra tax paid which is called as Refund. Refund status can be found at Tax Information Network(TIN) website TIN:RefundStatusLogin. You can also track the status of the income tax refund by contacting the help desk of SBI’s at toll free number: 18004259760 or email them at itro@sbi.co.inor refunds@

In all cases proper intimation is sent to the assessee. The time limit for completion of an assessment or reassessment has been provided in the provisions of section 153 and 153B of the Income Tax Act.

[poll id=”18″]

Related Articles:

Hope this article helped in understanding what happens after filing the return. How has your experience been after filing the income tax return? Do you get refund/ demand for tax/nil-demand/refund?

10 responses to “After filing Income Tax Return”

[…] After filing Income Tax Return […]

[…] After filing Income Tax Return […]

Hello Admin,

I am just writing as all should get aware and I need someone to help with clear information on this.One of my relative is being worked in private concern of cargo transport company and he is a franchisee for his area, he take care of all deliveries and pick ups. Company pay him the service charge only through only bank deposit and all other expenses should borne by him like, office rent, office advance, one 4wheeler,staffs salary, loading,unloading expenses and all others.80% of his service charges received from company is being expensed for his office work.Every year he files and TDS is being taken back as refund, and his records are good.He do only businness and now the problem is Central Excise people always coming and asking the records and he also given all the return filed,income source,bank statement for 5years and expense list for all.Overall Rs.10000-12000 will be his take home and now he face very big problem.Many of them saying in this year budget some 12.36% tax should be paid for this biz category, but only our auditor says and we consult many auditors they dont know and they strongly denies.Now Central Excise people saying that Service tax should be paid for last 3years as 3lakhs and penalty may be 100%-200% and with interest it comes to Rs.8lakhs..Beauty is there are many earning thrice in the company more than what we earn, but Central Excise giving torture only to us.Why this kind,what should get understand to them, how to get relief from this problem.Kindly help by giving a solution by gathering some details to your neighbour chartered accountant auditor.

Thanks Vandana for sharing. Sad to hear about your friend case. My neighbour chartered accountant is unable to offer any help in central excise dept.

I think,this is one of the best article on this site.

Few things come to know for first time.

Thanks for sharing.

Thanks Paresh you words are great encouragement to us. Was looking for information on net to find what happens after filing the income tax returns..and couldn’t find it so searched , read and wrote.

We also came to know of few things during writing the article itself. What did you come to know for first time?

Actually,i was not aware [I am sure a number of readers may not know ]that filed losses are only eligible for off-set in upcoming years or how IT returns are scrutinized by IT department….

Thanks Paresh for sharing your views. Well one crosses the bridge when one comes to it. I also learnt about it when I had loss (in FMP because of indexation benefits ) and was told could carry it forward.

Congratulations for a very enlightening series on e-returns.

May I suggest to complie all these article and publish them in the form of an e-booklet?

Also, having done such an exemplary series of articles, it would be expected of you that whenever and wahtever changes are announced by CBDT every year, you will incorporate the updates in these articles.

This may go a long way to serve the ‘common taxpayers’.

Thanks for your comments. Your idea of making e-book is excellent. Shall try to do so.

Your point about how to write about the changes that CBDT announces is appreciable.

We also discussed about it and decided that we

would have to evaluate the change..minor one can be updated but major ones might call for rewrite.